November 2021 / VIDEO

Financial Wellness: Redefining the Path to Retirement Success

Financial wellness is now recognized as a critical solution to helping workers and retirees meet their goals. This has accelerated the shift to measuring retirement success holistically and recognizing that competing savings needs and debt are significant barriers to successful retirement outcomes.

There are several reasons why we see financial wellness as one of the critical trends for the retirement industry right now. One is a recognition that the retirement savings gap that plan participants face is unlikely to be erased without simultaneously improving the financial wellness, or the financial resiliency and well-being, of those enrolled in defined contribution plans such as 401(k)s. There’s also a growing recognition of workers’ financial fragility (defined as the inability to come up with $2,000 within 30 days to meet an unexpected expense).6

At the same time, the pandemic has woken up the industry to the importance of financial wellness, demonstrating the direct connection between saving and spending. Those who needed financial help may have tapped in to retirement savings that they may struggle to replace or incurred debts that will impair their ability to save.

Another impact is that employers are struggling to recruit and retain workers who are now emboldened to look for new employment, either due to economic need or opportunity. The competition for labor is intense and will only become more so, at least in the short to intermediate term. This shines a spotlight on the need for more competitive benefits for employers to offer, including those tied to a more comprehensive set of financial wellness solutions.

As a result, there has been an acceleration in the adoption of financial wellness programs to help employees or to provide benefits they have stated they want or need. Indeed, 59% of industry professionals expect the demand for financial wellness programs to grow, according to our research.

The Case for Financial Wellness

The opportunity to tackle financial wellness going forward will be within workplace retirement plans. Indeed, our research shows that 78% of employees rely on their workplace for advice and support on how to achieve lifetime financial goals. Employers will need to decide what role they need to play in the financial lives of their employees. These are not mere philosophical questions.

The case for financial wellness programs is compelling. Each year, T. Rowe Price conducts studies of workers saving for retirement in 401(k) plans and retirees. Our research reveals that about half of workers reported high to moderate levels of financial stress (ranging from 45%–60% of those responding) relating to managing debt and health care expenses, budgeting, saving for retirement and other goals, and managing their investments. Unfortunately, financial stress has real consequences to both the worker who is struggling financially and to their employer.

A study by Willis Towers Watson7 found:

- Workers who are struggling financially lose 44% more work time to absence than peers without financial worries.

- Workers who are struggling financially have lower engagement levels than peers without financial worries (24% versus 46%).

- Of all workers surveyed, 53% indicated that saving for retirement is the area where they most want help from their employer.

Employers say that reducing employee financial stress and improving overall worker satisfaction and retention are the top motivations for investing in financial wellness programs, according to our research.

Nevertheless, our research suggests that many savers not only struggle with achieving financial wellness today, but they may also more fundamentally struggle with connecting the dots between the actions they take today and how those actions will affect their future retirement outcomes. We believe that individuals may not fully appreciate and correctly value the impact of their present actions. One notable observation we’ve seen is that workers’ financial capabilities and progress toward financial goals increase with age, while their optimism about their retirement decreases as retirement approaches.

Employers Can Help

Employers are well positioned to help their workers if they so choose, because workers said they look to the workplace for advice and support about how to achieve their lifetime financial goals. Demand for these services is expected to grow.

The effects of the coronavirus pandemic offer further evidence of the value workers find in these programs and the degree of urgency of need. Our research shows that during the early days of the pandemic, 47% of the workers surveyed said that their level of financial stress increased, with 39% seeing a reduction in pay, 23% missing one or more monthly bill payments, and 23% of savers tapping in to retirement savings to pay for day-to-day expenses.

We see this in the participant behavior in the retirement plans for which T. Rowe Price is a recordkeeper, reflective of workers’ financial fragility. For example, 9% of all participants used at least one of the Coronavirus Aid, Relief, and Economic Security (CARES) Act provisions that allowed workers to withdraw monies from their retirement accounts without penalty. Of those who did so via a coronavirus-related distribution, 23% claimed they would repay the amount withdrawn, as allowed under the CARES Act, but less than 1% had done so by the end of 2020. Most worrisome is the fact that those who withdrew money were between the ages of 40 and 50 and will struggle to make up for lost savings.

Financial stress due to the coronavirus pandemic was also evident in the ways that 401(k) plan participants sought help. Views of digital educational content on financial wellness topics increased from 15% in 1Q20 to 49% to 2Q20 and increased 20% year over year, according to our research. Content on managing debt and emergency savings and tools like financial wellness checklists were of particular interest. While engagement of this content is encouraging, it also highlights the dilemma many workers face. While participants viewed more content on financial wellness, they viewed less content on retirement savings. The assistance workers sought and continue to seek bring into focus the push and pull between present financial needs, short- and long-term financial goals, and how the management of the two affects one’s future.

Balancing all the competing financial needs is a complex challenge that is having a significant impact on the retirement landscape. Savers face a wide variety of stresses, and the way each participant prioritizes these stresses varies as well. Many employees say they are not saving 15% of their wages, according to our research, and provide different reasons. Of those respondents, 31% cite day-to-day living expenses, 14% cite credit card debt, and 11% cite student loan debt. Financial wellness solutions can help address all of these concerns.

Against this backdrop, there is a lot that employers and financial professionals can do. There are multiple avenues to address savers’ needs—be it through plan design, the use of personalized communication and messaging, or simplifying processes and making transactions that will benefit retirement savers less onerous. All these strategies play a part in meeting savers where they are.

Employers and Financial Professionals Can Incorporate Financial Wellness by:

- Choosing plan design features (e.g., auto‑enrollment, auto‑escalation, matching formulas, vesting, employer contributions, etc.) that both nudge and incentivize plan participation and saving among the employee populations least likely to do so.

- Offering programs that help employees assess their point‑intime financial health and set, monitor, and prioritize meaningful financial goals, such as:

- Targeted, personalized communications to engage nonparticipants and participants to inspire them to take financially healthy actions, such as increasing savings or paying down high interest rate debt.

- Educational programs and tools that help employees budget their monthly living expenses to align the income with both debt management and savings goals (e.g., emergency savings, retirement, home purchase, etc.).

- Offering services (e.g., emergency savings, consumer debt management, student loan repayment assistance, and financing, etc.) that help savers overcome the behavioral friction and automate emergency savings and/or debt repayment.

- Delivering services through multiple modes of engagement that span from digital to in‑person so that those who seek counseling or coaching can do so in a manner that best meets their needs.

- Ongoing measurement and assessment tools that reinforce healthy behaviors and highlight the long-term benefits of healthy financial actions taken today and their impact on future outcomes.

Several shifts are occurring already, and more are on the way.

For one thing, there are several bipartisan legislative initiatives that, if passed, may help increase the adoption of programs or plan features related to financial wellness, such as the ability to match student loan payments or create emergency savings accounts.

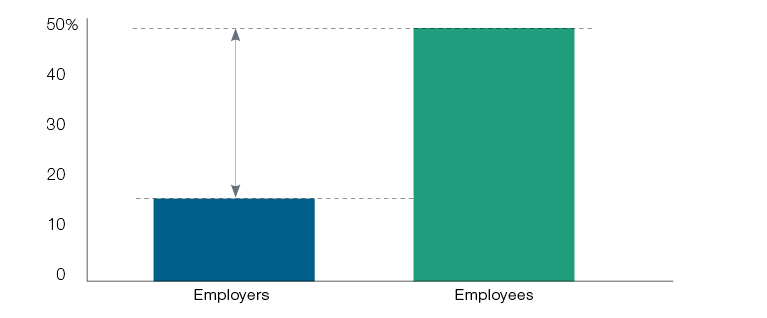

At the same time, plans are starting to increase their financial wellness offerings, recognizing that there appears to be a gap between what employees want and need versus what they are being offered. As one example, just 16% of employers offer student loan evaluation and refinancing tools, according to research from Financial Health Network (FHN), but 49% of employees would use these tools if offered.8 See Figure 1.

A Gap Between What Employers Offer and What Employees Need

(Fig. 1) 16% of employers offer student loan evaluation and refinancing tools; 49% of employees would use the tools if offered

Source: The Case for Employers to Invest in Employee Financial Health, Financial Health Network, 2019.

At T. Rowe Price, we see financial professionals, consultants, and employers who are successfully embracing financial wellness focused on these actions:

- Taking a holistic approach to financial wellness, recognizing the competing priorities to savings, spending, and debt.

- Utilizing or offering integrated education, tools, and advice across both investment guidance and financial wellness with a focus on driving behavioral change. Focusing on ease, automation, and personalization to optimize impact.

- Being nimble. Success is often predicated on putting the right messages in front of the right people at the right time. Being timely with prompts that anticipate and respond to both life and market events will increase engagement.

- Recognizing that financial wellness extends well into retirement. Retirees have a need for financial wellness just as workers do. Consider what needs are common and where their need for guidance and advice may diverge from that of workers.

- Adopting a framework that not only measures retirement outcomes but workers’ ability to manage their day-to-day finances and the progress made toward financial goals that workers set for themselves.

IMPORTANT INFORMATION

This material is provided for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide recommendations concerning investments, investment strategies, or account types; it is not individualized to the needs of any specific investor and not intended to suggest any particular investment action is appropriate for you, nor is it intended to serve as a primary basis for investment decision-making.

The views contained herein are those of the authors as of November 2021 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Investors will need to consider their own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

All investments involve risk. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor, and T. Rowe Price Associates, Inc., investment advisor.

©2021 T. Rowe Price. All rights reserved. T. Rowe Price, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc. RETIRE WITH CONFIDENCE is a trademark of T. Rowe Price Group, Inc.

November 2021 / ENVIRONMENTAL, SOCIAL, AND GOVERNANCE

November 2021 / U.S. FIXED INCOME