December 2022 / INVESTMENT INSIGHTS

2023 Global Market Outlook

The Need for Agility

Key Insights

- Central bank efforts to bring inflation under control have reached a critical point. In 2023, investors will be looking for the peak in interest rates.

- U.S. earnings growth estimates may be too optimistic. But we see relative valuation advantages in some equity sectors and in non‑U.S. markets.

- The worst bond bear market on record pushed yields to some of the most attractive levels since the global financial crisis. Investors appear to have noticed.

- The threat of global economic decoupling has been exaggerated, but big structural changes are in progress. We see opportunities amid the disruptions.

A Time to Be Selectively Contrarian

Heading into 2023, capital markets appear to have priced in a significant global economic slowdown. The key question is whether this deceleration will end in a “soft landing”—with slower but still positive growth—or in a full‑fledged recession that drags down earnings.

Much depends on the U.S. Federal Reserve (Fed) and the world’s other major central banks as they continue efforts to bring inflation under control by hiking interest rates and draining liquidity from the markets.

“History is not on our side,” says Sébastien Page, head of Global Multi‑Asset and chief investment officer (CIO). “Fed hiking cycles don’t generally end well, especially when inflation is running high.”

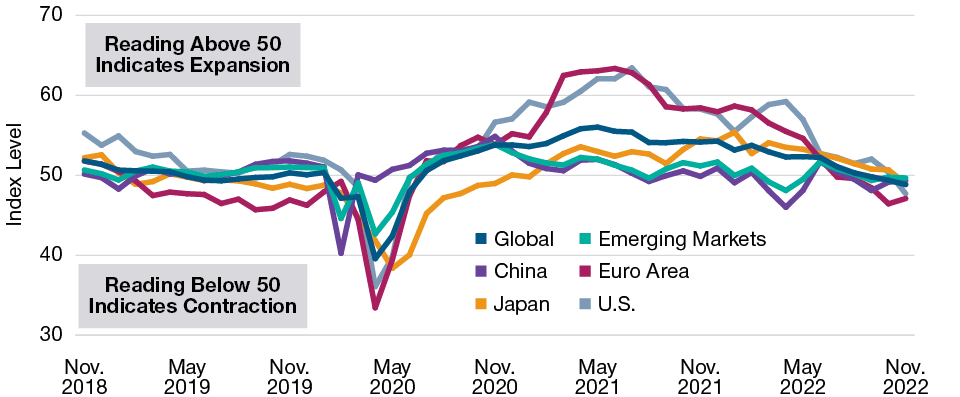

But investors shouldn’t assume a deep downturn is inevitable, Page adds. Although some leading indicators have weakened (Figure 1), U.S. employment was still growing in late 2022. Corporate and household balance sheets appeared strong. And the economic wounds inflicted by the COVID pandemic continued to heal, notes Justin Thomson, head of International Equity and CIO.

Geopolitical risks will remain potential triggers for downside volatility in 2023. Structural factors, such as bank capital requirements that constrain market liquidity, could magnify price movements, both up and down.

With most central banks seeking tighter financial conditions, investors can’t count on them to intervene if markets fall, warns Andrew McCormick, head of Global Fixed Income and CIO.

“We’ve come out of a period where central banks had strong motivation to suppress volatility,” McCormick says. “Now, policy is aimed at tightening financial conditions. So there is no buyer of last resort when markets come unhinged.”

But excessive pessimism and volatility can create value for agile investors, the CIOs note. An attractive point to raise tactical exposure to equities and other risk assets may appear in 2023, Page predicts. However, as of late 2022, it had not yet arrived, in his view.

Until it does, Page favors a “selectively contrarian” approach of tilting toward specific sectors within asset classes— such as small‑cap stocks relative to large‑caps and high yield relative to investment‑grade (IG) bonds.

In difficult markets, security selection will be critical, Page says. “Active management skill is just incredibly important in this environment.”

Leading Indicators of Economic Growth Are Fading

(Fig. 1) Purchasing Managers’ Index Levels for Manufacturing

As of November 2022.

Sources: Institute for Supply Management/Haver Analytics, J.P. Morgan/IHS Markit, Bloomberg

Financial L.P. (see Additional Disclosures). Data analysis by T. Rowe Price.

Explore our four themes:

| Themes | Description | Link |

| An Economic Balancing Act | Central bank efforts to bring inflation under control have reached a critical point. In 2023, investors will be looking for the peak in interest rates. | Click to view |

| Leaning Against the Wind | U.S. earnings growth estimates may be too optimistic. But we see relative valuation advantages in some equity sectors and in non‑U.S. markets. | Click to view |

| The Return of Yield | The worst bond bear market on record pushed yields to some of the most attractive levels since the global financial crisis. Investors appear to have noticed. | Click to view |

| Deglobalization in a Connected World | The threat of global economic decoupling has been exaggerated, but big structural changes are in progress. We see opportunities amid the disruptions. | Click to view |

Summary

Entering 2023, investors stand at a major turning point in capital market history. The global economy has passed from decades of declining interest rates into a new regime marked by persistent inflationary pressures and higher rates.

“The era of cheap money, high valuations, and super‑high asset returns driven by multiple expansion is over,” Thomson warns.

Regime change clearly presents risks. But markets may have overreacted to some of those risks in 2022, creating attractive potential opportunities for investors willing to be selectively contrarian:

- Valuations in most global equity markets have improved markedly, although U.S. equities still appear expensive relative to their own history.

- Fixed income yields have reached attractive levels, given what appears to be a manageable outlook for credit downgrades and defaults.

- Structural challenges could boost capital spending on supply chains and renewable energy development, allowing investors to seek the new winners.

In this environment, McCormick says, investors will need to be able to blend top‑down macroeconomic insights with detailed bottom‑up fundamental research. “You’ll have to be able to judge how the big macro changes are likely to filter through the markets.”

Finally, some investors may need to adjust their tolerance for risk, McCormick concludes. “Many of these issues are just very hard to forecast,” he says. “People will have to expect that their portfolios are going to experience volatility.”

It's Not the Heat, It's the Illiquidity

The potential for market volatility will only increase as the Fed and other central banks raise rates and press ahead with quantitative tightening, Page warns. “The biggest risk right now is liquidity.”

In 2022, Page notes, bear markets unfolded in two stages. The first was a rate shock as the Fed raised rates from zero to 4% over a nine‑month period. This was followed by a growth shock as investors discounted the risk of an earnings downturn.

In 2023, Page warns, investors could face a third bear market stage: a liquidity shock, in which markets decline across the board as leveraged positions are unwound. While painful, such shocks also can create major buying opportunities, he says.

“A liquidity event could mark the kind of capitulation that typically has marked the bottom of a bear market,” Page says. “Those historically have been very strong buy signals.”

Successfully timing a market bottom is notoriously difficult, Page notes. But history suggests investors don’t need to be precise to benefit from temporarily depressed equity valuations.

According to Page, in 17 previous major U.S. bear markets (defined as a decline of 15% or more in the S&P 500 Index), an investor who shifted just 10% of their portfolio from bonds to stocks near a market bottom could have significantly enhanced portfolio returns over the subsequent 12 months—even if their timing was three months early, three months late, or somewhere in between.1

Investors may want to be more cautious now, however, Page says. Historically, he notes, the chances of successfully investing around a market bottom were significantly lower when inflation was high and interest rates were rising.

That’s one reason to take a selectively contrarian approach in 2023, Page says: The Fed is no longer backstopping investors by limiting market volatility, a policy known as the “Fed put.”

“When there is no Fed put,” he says, “you want to be a bit more patient about leaning in.”

2023 Tactical Views

*For pairwise decisions in style and market capitalization, boxes represent positioning in the first asset class relative to the second asset class.

The asset classes across the equity and fixed income markets shown are represented in our multi‑asset portfolios. Certain style and market capitalizationasset classes are represented as pairwise decisions as part of our tactical asset allocation framework.

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particularinvestment action. Information and opinions, including forward looking statements, are derived from proprietary and non‑proprietary sourcesdeemed to be reliable but are not guaranteed as to accuracy.

Additional Disclosures

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2022, J.P. Morgan Chase & Co. All rights reserved.

Copyright © 2022, Markit Economics Limited now part of S&P Global. All rights reserved and all intellectual property rights retained by S&P Global.

“Bloomberg®” and Bloomberg U.S. Investment Grade Corporate Index, Bloomberg EuroAggregate Credit Index, Bloomberg U.S. Aggregate Credit–Corporate High Yield Index, Bloomberg Global High Yield Index, and Bloomberg Emerging Markets USD Aggregate Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend T. Rowe Price products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to T. Rowe Price products.

The “S&P 500 Index” is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”), and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by T. Rowe Price. T. Rowe Price products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.