September 2021 / INVESTMENT INSIGHTS

Should Rising Inflation Be a Concern?

Key Insights

- High inflation over an extended period has typically been a headwind for stock and bond investors.

- Although markets appear to assume the current inflation spike will be temporary, durable increases in housing costs and wages could defy those expectations.

Inflation is rising, but the market-implied 10-year-forward inflation expectation for most developed market countries remains relatively muted, reflecting widespread assumptions that the inflation spike may prove temporary (Figure 1).

*Line represents the market-implied inflation expectations for the next 10 years.

Sources: Bloomberg Finance L.P./Haver Analytics. Russell. See Additional Disclosures. T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. See Additional Disclosures.

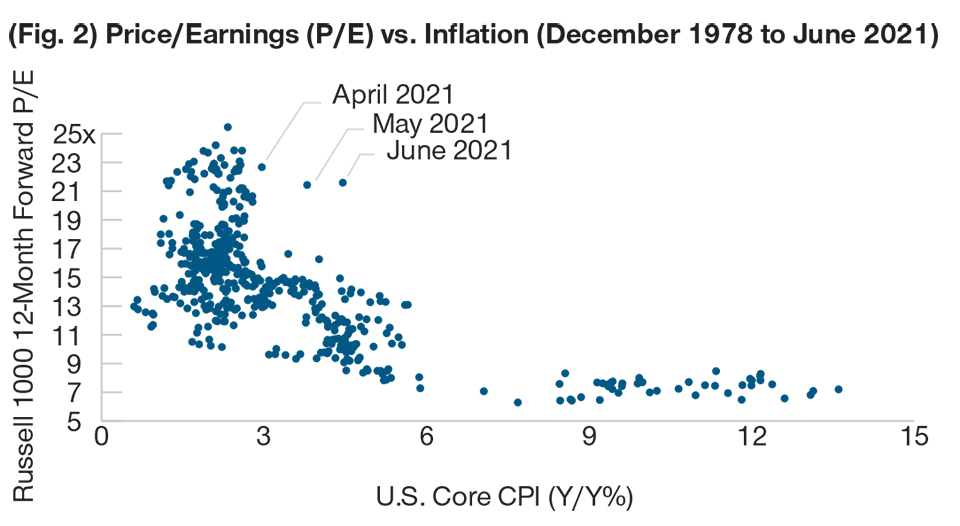

For financial markets, elevated inflation for an extended period could be problematic. Higher inflation typically brings higher interest rates, and, given their sensitivity to rising rates, bond markets would likely sell off. Also, significantly higher inflation historically has depressed equity valuations (Figure 2), a potential headwind for stocks. In such an environment, higher correlation between stocks and bonds could diminish the diversification benefits of a balanced portfolio.

We expect inflation to be higher than it has been over the past decade but not high enough to be a major concern. Recent results have been heavily influenced by extreme price hikes in categories that experienced a sudden stop and restart due to the pandemic, such as used cars and travel. We believe these trends are likely to moderate in the near term. Further, as seen in Figure 2, the recent inflation spike does not appear to have depressed equity valuations, likely reflecting the expectation that it will prove transitory.

Going forward, we are closely monitoring housing costs—a significant component of consumer prices—and wage inflation. Housing costs have been rising steadily for the past decade, a trend heightened by increasing work-from-home arrangements. Meanwhile, higher wages have historically led to price hikes as employers sought to offset rising labor costs. Durable increases in these two components could, in our view, generate more sustained inflation.

IMPORTANT INFORMATION

Where securities are mentioned, the specific securities identified and described are for informational purposes only and do not represent recommendations.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

August 2021 / GLOBAL ASSET ALLOCATION

September 2021 / INVESTMENT INSIGHTS