April 2021 / INVESTMENT INSIGHTS

This Inflationary Heat Wave Should Prove Temporary

Strong growth is unlikely to spark a new inflationary regime.

Key Insights

- My inflation model forecasts a gradual rise in the overall price level through the first quarter of next year.

- While the U.S. economy is poised to enjoy its fastest growth since the 1980s, we still are likely to end 2021 with substantial slack in the labor market.

- In my view, inflation fears are overblown, though we may see a series of pressure points as the vaccinated economy reopens.

According to my latest estimates, I expect inflation to increase gradually over the coming four quarters. A sharp bounce back in energy costs and a more moderate increase in food prices may push headline consumer price inflation to approximately 2.5% in the first quarter of 2022, from an average of around 1.5% in the first quarter of 2021 (March data are not available as of this writing). Core inflation should rise only modestly, however, from around 1.3% to 1.6%.

The confluence of unprecedented peacetime monetary and fiscal policy support and the rollout of highly effective vaccines is underpinning prospects for the strongest year of growth in real (inflation-adjusted) gross domestic product (GDP) since the early 1980s. Some worry that this will result in a “high-pressure” economy that sees demand far outstripping sustainable supply, generating cost- and price-boosting bottlenecks and shortages.

The Federal Reserve’s strategic shift last fall toward permitting greater inflation has also raised concerns that an inflationary regime shift is in the offing.

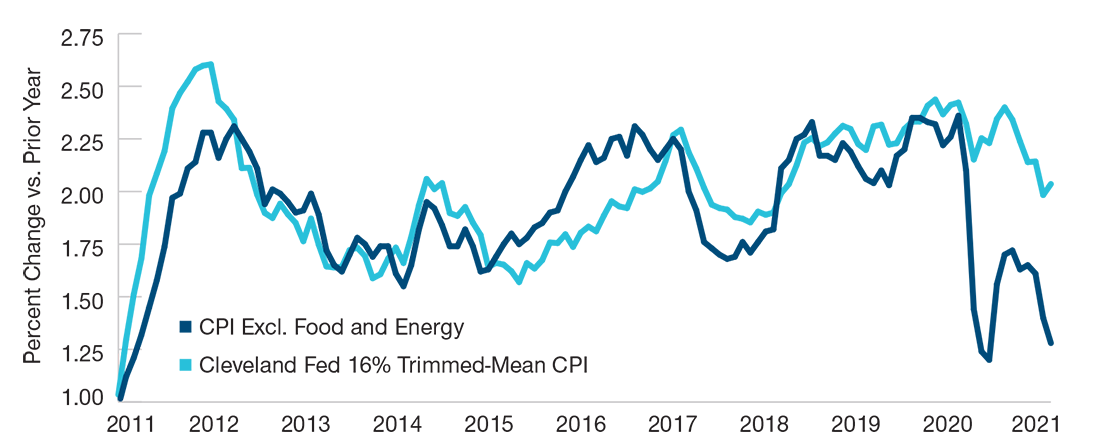

Indeed, pressure points in the economy have already emerged, and reversal of pandemic-induced shifts in relative prices are likely to continue this year. This will likely result in higher inflation figures, including an upward convergence of core consumer price inflation toward the measure of underlying inflation produced by the Cleveland Fed (Figure 1).

Moderate Inflation Likely Ahead

(Fig. 1) Core Consumer Price Index (CPI) vs. Cleveland Fed measure ofunderlying inflation

From January 2011 through February 2021.

Sources: Bureau of Labor Statistics, Federal Reserve Bank of Cleveland, and Haver Analytics.

In my view, however, a self-reinforcing uptrend in the general price level is unlikely to engage until margins of product and labor market slack narrow to levels that prevailed early last year. This is probably a development that will wait until the second half of 2022. In addition, structural disinflationary forces that dampened cyclical inflation pressures before the pandemic appear to remain in place, suggesting that the evolving underlying reflation should be gradual.

Case for Goods Sector Cost Pressures to Moderate

The first phase of price pressures arose as global manufacturing reopened—first in Asia, and later in the U.S.—and businesses scrambled to replenish inventories depleted during last year’s lockdowns. Firms also struggled to keep pace with work-from-home demand for consumer durable goods, as well as the uninterrupted post-lockdown growth in U.S. housing and business equipment investment. China’s industrial cycle drove commodity prices higher, and bottlenecks in domestic supply chains facilitated passthrough of these cost increases to processed inputs.

While it is possible that these cost pressures, if sustained, might eventually pass through to larger increases in consumer prices, history suggests that it will take some time. In addition, reduced congestion at West Coast U.S. ports suggest that supply chain disruptions will soon begin easing. Finally, the emerging peak in China’s credit impulse—the change in the growth rate of aggregate credit as a share of GDP—raises the prospect of a reversal of the underlying upward trend in industrial commodity prices.

The End of Pandemic-Induced Price Shocks Cuts Both Ways

Air fares, hotel rates, motor vehicle insurance, and clothing prices have been hit hard by social distancing requirements and work-from-home arrangements. According to my estimates (using Bureau of Labor Statistics data), a return to February 2020 price levels in these areas over the course of a year could contribute 0.51% to the 12-month rate of CPI inflation. Not all price shocks were negative, however, and a renormalization in prices for major appliances, housekeeping supplies, and used vehicles could trim CPI inflation by 0.27%, offsetting more than half of the upward price corrections.

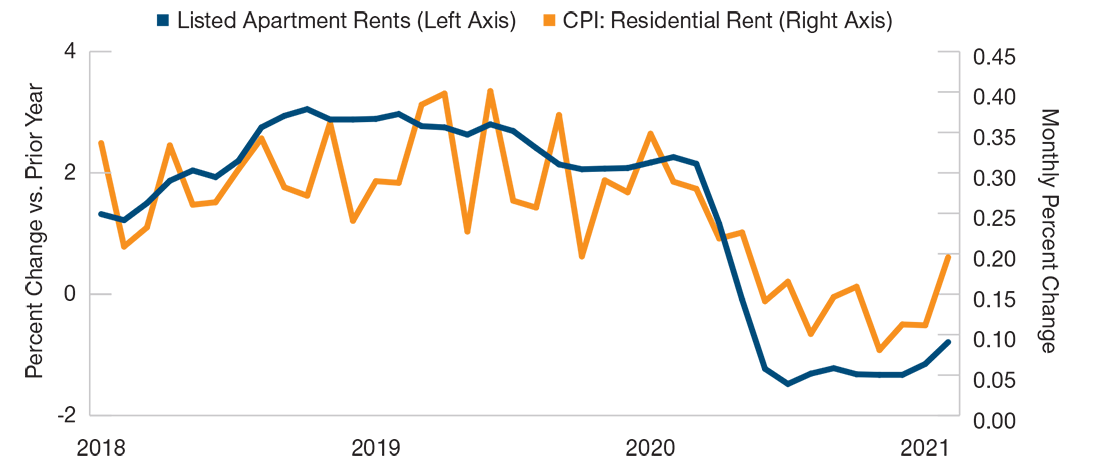

Housing inflation components will require watching. While the CPI’s measures of housing costs continued to grow during the pandemic, rent forbearance and rapidly shifting demand patterns suppressed rent increases. In February, fading forbearance helped push listed apartment rents higher, as well as overall residential and owners’ equivalent rent readings (Figure 2). These two components account for 32% of the all items index, so it will be important to monitor the speed of their potential return to the pre-pandemic trend over the first half of the year (Source: T. Rowe Price analysis of Bureau of Labor Statistics data.)

Housing Inflation Bears Watching

(Fig. 2) Listed apartment rents vs. CPI residential rent

From January 2018 to February 2021.

Sources: Bureau of Labor Statistics, Federal Reserve Bank of Cleveland, and Haver Analytics.

Key Elements of Structurally Muted Inflation Regime Seem to Still Be in Place

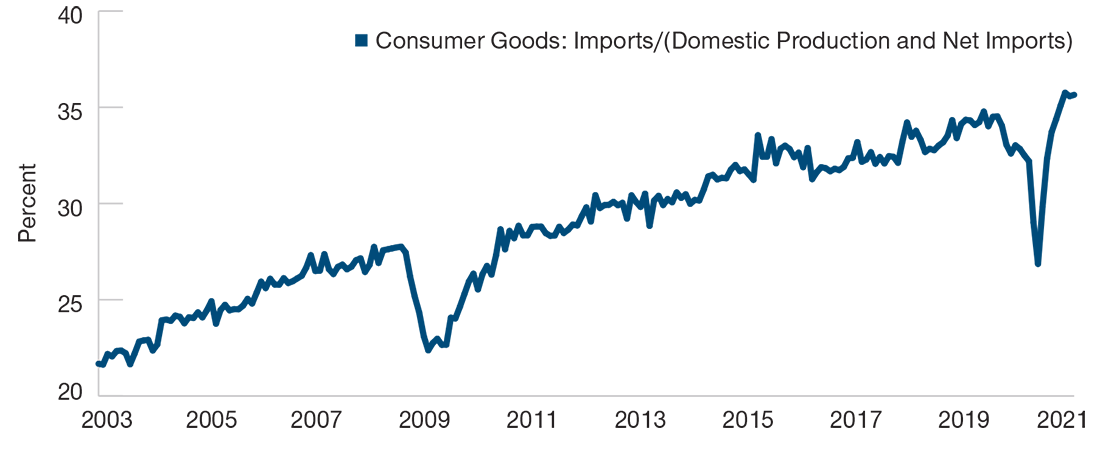

Globalization, while weakened by the pandemic, is likely to remain a disinflationary force. The share of domestic consumption represented by imports fully recovered from its plunge following last spring’s lockdown, and we may even see further inroads for cheaper, foreign-made products (Figure 3). Further, pricing discipline imposed by online shopping likely strengthened as a result of the lockdown, with e-commerce’s share of retail sales rising by 2.65% over the course of last year (Source: Census Bureau, T. Rowe Price analysis.)

Cheap Imports Remain Disinflationary

(Fig. 3) Imports’ share of the economy (gross value of domestic production plusnet imports)

From January 2003 to January 2021.

Sources: Census Bureau, Federal Reserve, Haver Analytics, and T. Rowe Price analysis.

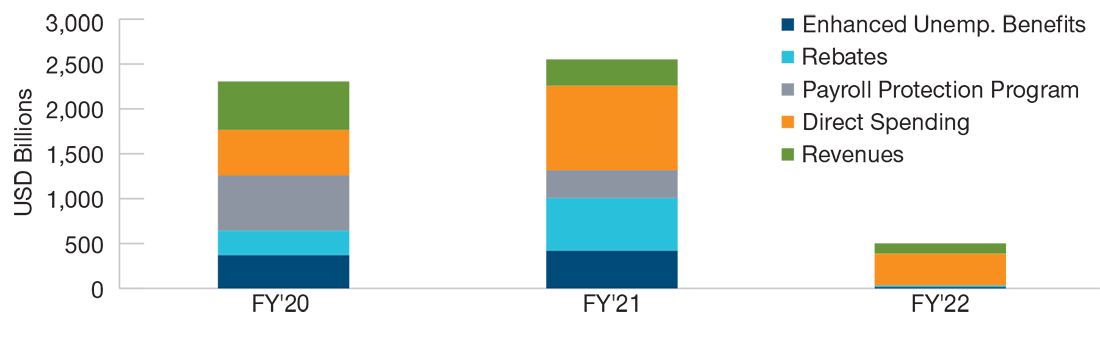

The Fundamental Backdrop: The Tailwind From Fiscal Policy Is Set to Abate Sharply

Figure 4 shows the estimated impact on the federal budget deficit of all legislation enacted to address the coronavirus pandemic, including the American Rescue Plan (ARP) signed into law earlier this month. Largely because of that measure, the thrust of fiscal policy in the current fiscal year (running through September 30) is on par with the support provided through September 30, 2020. By design, however, the ARP is front-loaded—disbursing virtually all its support to households, businesses, and the public health response over the next three to six months.

Fiscal Stimulus Set to Fall Sharply

(Fig. 4) Impact of government programs on federal deficit

As of March 19, 2021. FY = Fiscal Year. FY 2021 and FY 2022 represent projections. Actual future outcomes may differ materially from projections.

Sources: U.S. Congressional Budget Office and T. Rowe Price analysis.

The fiscal tailwind is set to abate sharply in the second half of the year, even if a large, multi-trillion-dollar infrastructure package is enacted in the fourth quarter, as the Biden administration intends. Proposed spending is likely to exceed USD 2 trillion, but those outlays would be spread over a 10-year horizon, with critical mass only accumulating after three to four years. In addition, tax increases under consideration would offset some of the positive economic impact of increased spending.

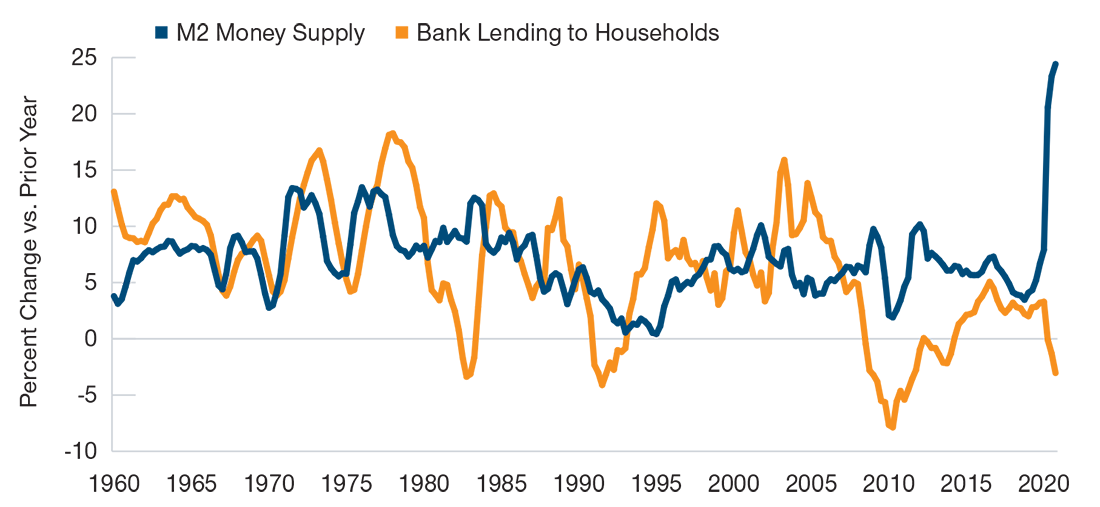

The Recent Acceleration of the Money Supply Does Not Guarantee Inflation

Milton Friedman’s famous quip that “inflation is always and everywhere a monetary phenomenon” still casts a long shadow. The recent rapid increase in the money supply (as measured by M21) has raised worries that inflation will soon follow. It is true that an increase in M2 has occasionally been followed by higher inflation, and the period between 1968 and 1981 shows the highest correlation between the two (it’s probably no accident that Milton Friedman’s quip dates to 1970).

In the 1960s–1970s episode, however, the money supply surge resulted from the Fed’s accommodation of strong private credit demand by providing banks with sufficient reserve deposits to head off any upward pressure on short-term interest rates—at the time, banks were required to hold a backstop of reserve deposits proportional to loans outstanding.

To a large extent, the borrowed funds ended up as M2, which is made up largely of bank liabilities—demand, time, and savings deposits. The echo of money supply growth in household borrowing was readily discernible in the 1960s–1970s. The ensuing credit-financed excess of household demand for goods and services relative to sustainable supply contributed to the prolonged inflationary episode that followed.

Yet inflation and money supply growth have been virtually uncorrelated over the past 20 to 25 years. Indeed, the current episode is notable for the coincidence of a surge in M2 growth and an outright contraction in bank lending to households (Figure 5). Indeed, the elevated 12-month M2 growth rate is due largely to a jump last April, combining rebate checks, portfolio shifts from risky assets to bank deposits, and forced saving due to disruption of consumer services—factors not exactly inflationary in their implications.

Money Supply Diverges From Lending

(Fig. 5) Money stock vs. consumer and mortgage loans

From 1Q1960 through 4Q2020.

Sources: Federal Reserve, Haver Analytics, and T. Rowe Price analysis.

Labor Market to Tighten, But Unlikely Enough to Push Inflation Past 2%

I’m estimating potential growth of 6.5% in real GDP in 2021, as measured by its level in the fourth quarter over the year before. In this scenario, assuming 2% productivity growth, employment could grow to around 4.5%. I further assume that the labor force participation rate can recover two-thirds of the current shortfall relative to its February 2020 level.

If these employment growth and participation forecasts are correct, the unemployment rate is likely to fall from 6.0% in March 2021 to around 4.0% in December, likely keeping it well above the 50-year low of 3.5% in February 2020. The employment/population ratio combines the unemployment and participation rates, making it a more comprehensive measure of labor market slack, in my view. This ratio would potentially end 2021 at around 59.8%, also notably below its February 2020 level.

It is true that, as of February, post-pandemic wage growth has been stronger relative to the employment/population ratio than in the past. That said, measures of wage growth that account for changes in labor force composition are slightly lower than a year ago. Given the large pool of available labor, I expect the wage trend to moderate into better alignment with traditional patterns in the months ahead, with wages potentially growing by roughly 2.5% to 3.0% over the 12 months of 2021.

Given these factors, it appears unlikely that a tighter labor market will bring us into a new inflationary era. Indeed, with a 1.5% underlying productivity trend, hourly wage growth would have to reach 3.5% to generate 2% unit labor cost inflation, which would underpin a similar rate of consumer price inflation.

The Return of the “Old Normal”

Under this growth and inflation scenario, the Fed appears very unlikely to raise rates faster than it has communicated. According to the Summary of Economic Projections released on March 17, 14 of the 18 participants in the Fed’s Open Market Committee meeting expect no rate increases through 2022, while 11 anticipate none in 2023. Indeed, it may well be that investors will have to ratchet down short-term interest rate expectations in the coming months as the pandemic recedes and the “old normal” of structural inflation restraints likely reasserts itself.

Important Information

Where securities arementioned, the specific securities identified and described are for informational purposes only and do not represent recommendations.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guaranteethat any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

April 2021 / MARKETS & ECONOMY

April 2021 / INVESTMENT INSIGHTS