June 2021 / MIDYEAR MARKET OUTLOOK

China 2021 Market Update

On a steady path to normalization.

KEY INSIGHTS

- 2021 can be viewed as a year of normalization for China’s GDP, earnings growth, financial markets, and policy after the preceding pandemic disruption.

- The U.S.-China relationship remains competitive in nature, though increased dialogue and a more predictable approach may lower tail risk and uncertainty.

- A broader economic recovery is expected to take hold in 2021 that could lead to a divergent sector performance from equities.

China’s economy is on the right track to recovery in 2021. We expect the Chinese consumer to play a bigger role this year thanks to the low base and pent up demand. Successive holidays and festivals have been accompanied by improving consumer confidence. Residential property, one of the first sectors to recover, remains well supported. Sectors exposed to the US/EU economy recovery might also benefit, as well as export manufacturers leveraged to global trade. On the other hand, COVID-19 beneficiaries, including some technology companies as well as companies related to China’s infrastructure spending, such as construction machinery, may face a high comparison base in 2021. After all the coronavirus disruption last year, 2021 can be viewed as a year of normalization for GDP, earnings, markets, and policy. Corporate profits are currently thriving in China’s post-COVID environment.

On the coronavirus front, we believe the vaccination rollout should facilitate a further rebound in those business and consumer services that have been lagging, such as food, hotels, entertainment, and personal services. Though the country’s international borders remain shut, domestic air travel and tourism have rebounded strongly. During the Labor Day holidays in early May the number of domestic tourist trips reached a record 230 million, 3.0% more than in 2019.China’s vaccination rollout in the initial phases was relatively slow, but it has accelerated recently reaching 10 million on May 7. As more types of vaccines get approved and production ramps up, we’d expect the pace to accelerate further as the year progresses. That may give China a more visible path to opening its international borders in 2022.

A Correction and Consolidation in Equities

To understand the market’s behavior in 2021 we need to begin with a quick review of performance in 2020. China’s early and sustained economic recovery May 2021 Wenli Zheng Portfolio Manager China Evolution Equity Strategy China 2021 Market Update On a steady path to normalization. We expect the Chinese consumer to play a bigger role this year thanks to the low base and pent up demand. 2 from the coronavirus was reflected in a strong performance by the CSI 300 large-cap index, which rose 27% in 2020 compared to 16.3% for the S&P 500. The broader A-share market, represented by the Shanghai Composite Index, only rose 13.9%, close to the return of the average developed economy stock market. There was clearly a big gap in 2020 performance between China’s mega-cap growth and internet giants and A-shares generally. And while the A-share market overall still did well, 50% of stocks actually fell last year. There was also a very wide performance gap among sectors. Turning to 2021, Chinese equities corrected from their mid-February peak, taking year-to-date performance into negative territory (as of May 15 2021). Factors cited as contributing to the initial correction were higher U.S. bond yields, risk-off sentiment due to news flow around US – China competition, and renewed travel and quarantine restrictions ahead of Chinese New Year following a wave of coronavirus clusters in January.

However, we believe that the most important reasons for the corrections were: (1) China being the first major economy to normalize monetary and fiscal policy. Given a healthy recovery, liquidity was not as loose as in 2020; (2) the valuation of some market favorite growth stocks, as well as some thematic stocks, had become expensive. After China’s early economic recovery and the outperformance by A-shares in 2020, a correction and period of consolidation ahead of other, lagging markets should not have come as a great surprise and we view the correction as being part of the normalization process that can provide attractive entry points for bottom-up investors.

Shares of leading Chinese internet companies fell as Beijing stepped up regulatory scrutiny of e-commerce platforms like Alibaba, Baidu, and Tencent. Some crowded stocks pulled back while some sectors that lagged in 2020 started to catch up (industrials, small caps, commodities). Tech stocks came under further pressure after the U.S. Securities and Exchange Commission said it would begin to implement legislation to delist U.S.-listed Chinese companies that do not comply with U.S. audit requirements.

Looking ahead, we see China’s stock market becoming more earnings-driven this year after a solid post-pandemic economic recovery. Fundamentals and earnings delivery could play a larger role this year. With liquidity no longer lifting all boats, we believe good stock selection will be paramount. Consensus corporate earnings for 2021 are expected to increase 24% for companies in the MSCI China Index and 23% for those in the large-cap CSI 300 A-share Index, with further gains of 14% and 13%, respectively, in 2022, according to analyst estimates compiled by I/B/E/S. Chinese industry is today in a much healthier position than it was one year ago during the coronavirus pandemic. The shift in economic growth drivers in 2021 is expected to drive a rotation in sector performance. While internet, technology, and certain infrastructure-related names face the challenge of a high 2020 base, we think that small caps, global trade-related names, and services businesses should all benefit from the normalization of the economy.

Economic Policy on Hold

China’s leaders announced more prudent monetary and fiscal policies at the annual National People’s Congress (NPC) in March. A conservative GDP growth target of “over 6%” was set for 2021, which should be easily achievable given the low pandemic base. China’s budget deficit was forecast to fall to 3.2% of GDP, reflecting a renewed focus on curbing debt. Beijing believes it has done enough to reflate the economy (Figure 1) and policymakers may adopt a ‘wait-and-see’ approach in the coming quarters. Investors, however, were disappointed by the lack of new stimulus. Some worry that policy might be tightened prematurely, as the government seeks to balance supporting economic recovery with the longer-term need to contain financial risks. The chance of aggressive tightening is quite low, however. China has ample fiscal and monetary space to reverse course quickly should the economy falter. The PBoC, China’s central bank, kept monetary policy broadly neutral during the recovery from the coronavirus, with no change in interest rates for twelve months. It therefore has some policy ammunition in reserve.

China’s Long Term Targets

At the National People’s Congress (NPC) in March more details of the 5-year economic plan for 2021-2026 were unveiled. A key focus of the plan is President Xi’s ‘dual circulation’ theory. This seeks higher-quality growth through supporting domestic markets, innovation, and reform. Beijing views boosting domestic demand, upgrading supply chains, and achieving greater self-sufficiency in key technologies as the best way to hedge against external uncertainties and challenges.

Under dual circulation, China may have better protection against global economic shocks and the international trade cycle. China’s leaders have stressed the need for greater innovation and increased spending on R&D. Beijing still prefers to cooperate with other countries rather than engage in geopolitical rivalry. China will continue to open up its economy to overseas companies while at the same time pursuing economic and financial reform.

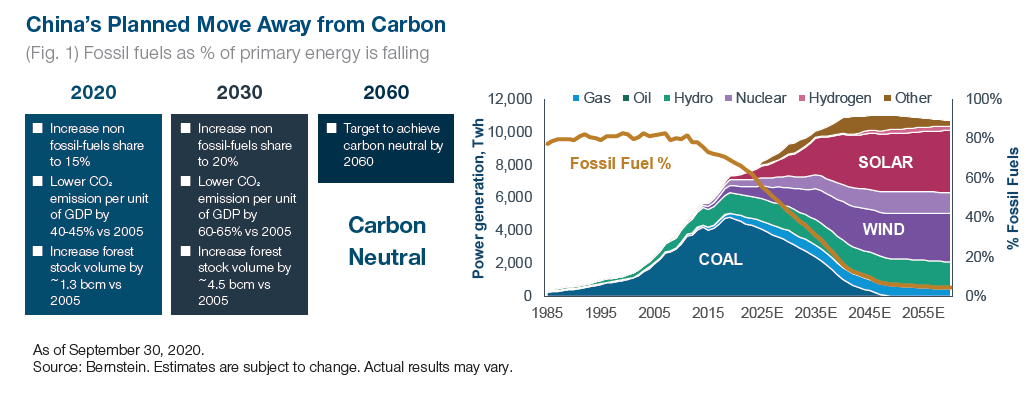

President Xi also announced revised long-term targets for the economy at the NPC, including more details of the plan to transition to clean energy and reduce net carbon emissions to zero by 2060. The focus has firmly shifted to improving China’s emission standards and achieving carbon neutrality by 2060. China accounts for 30% of global industrial output, and its efforts will contribute meaningfully to global carbon reduction, with a sharp focus on renewable sources of energy.

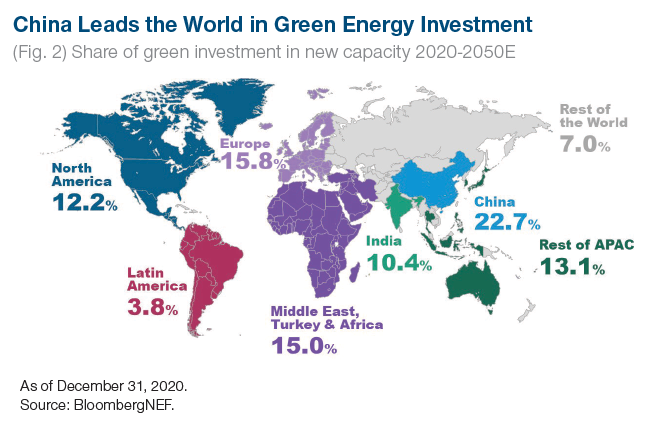

In our view, China is well positioned to be a leader in renewables and green energy. Being an importer of traditional energy today, a future that is sourced by renewable sources of energy will allow China to become more self-sufficient and thus serve an economic goal as well as a social goal – by improving living standards for Chinese people who have been subjected to high levels of pollution in their history. China’s aim to achieve carbon neutrality by 2060 will achieve a key social outcome and allow China to be less dependent on energy imports.

China is taking the lead in the global transition away from carbon, producing 70% of the world’s solar panels, 50% of its electric vehicles and one third of all wind turbines. China has also established a prominent position in the global supply chain for the raw materials essential to electrification, such as rare earths, cobalt, lithium, and copper.

Looking Ahead: China Equity Markets in H2 2021

Chinese equities had a stellar 2020 and given the speed of change and the inefficiencies that present themselves in the market, we believe China remains a stock picker’s paradise. There are pockets of speculative bubbles such as in some thematic stocks, but we are still able to find very attractive opportunities in the supply chains that support these industries. The transition away from a carbon-intensive economy to a more sustainable economy offers a tailwind to industrialization and we find very attractive value in some industrial businesses.

We see consumption as another important pillar of growth from the government’s perspective with a focus on quality growth. We also find very good value in this space. These tend to be companies that offer compounding growth opportunities as well as some companies that are undergoing a positive product cycle. The shift of domestic demand from foreign brands to local brands provides another tailwind. With this favorable backdrop, we believe home-grown businesses can take a step further and expand into global leaders.

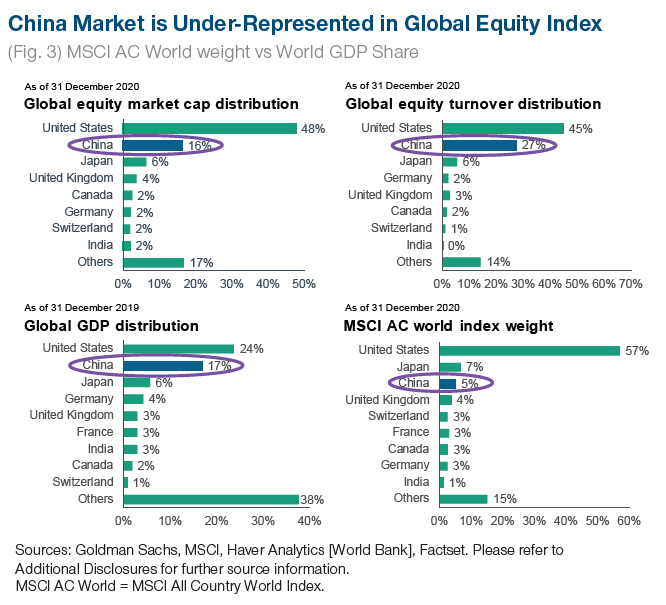

We are of the view that the largest inefficiencies in this vast China universe of more than 5,200 stocks are short-termism and investors’ obsession with mega-cap stocks. Indeed China’s top 100 mega-caps are widely owned by investors over the world (roughly 70% of the MSCI China Index) but only represent around 2% of the universe by name count.¹ There is an abundance of money being left on the table outside of the mega-cap space that can offer a very fertile hunting ground for bottom-up investors. At a time when Chinese authorities are expressing concerns about speculative bubbles and are leaning towards policy tightening, we are of the view that fundamental research that allows for idiosyncratic alpha generation is a favorable strategy for pursuing strong equity returns in China in 2H 2021.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

This material is only for investment professionals that are eligible to access the T. Rowe Price Asia Regional Institutional Website. Not for further distribution.