February 2021 / INVESTMENT INSIGHTS

The Challenge of Low but Rising Rates

Searching for Yield Amid Rising Rates.

Key Insights

- With the 10-year U.S. Treasury yield increasing, government bond investors face the dilemma of low but rising interest rates.

- High yield bonds are typically less sensitive to rising interest rates and may offer investors higher current income.

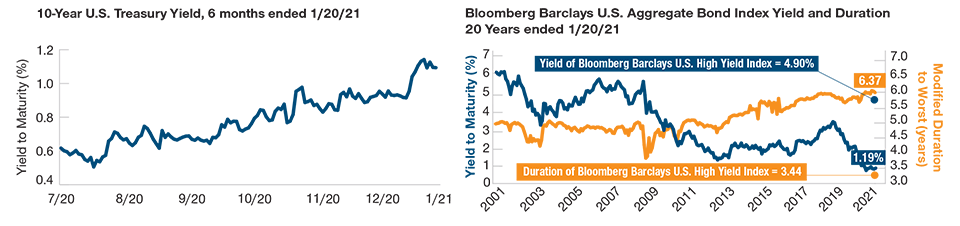

The 10-year U.S. Treasury yield has been on a downward trend for the last decade, reaching a remarkable low of 0.50% on August 4, 2020. However, the yield has been steadily increasing since then. Going forward, government bond investors may be facing the worst of both worlds—the dilemma of low but rising interest rates.

For investors, low rates mean the current expected income from government bonds is limited, while rising rates mean the market value of their investment is decreasing. From an asset allocation perspective, this is particularly troublesome as bonds are important portfolio building blocks for two reasons—income and stability.

To cope with this challenging dynamic, investors could increase their allocation to higher-yielding corporate bonds. The right chart below compares the yield and duration (price sensitivity to rate changes) for both the Bloomberg Barclays U.S. Aggregate Bond Index and the Bloomberg Barclays U.S. High Yield Index. As illustrated, the high yield bonds typically offer higher current income and are also less sensitive to rising rates.

The primary downside to high yield bonds, however, is their higher credit or default risk during times of economic stress relative to investment-grade bonds. While this is a valid concern, the current environment appears favorable for credit risk for the same reason that interest rates are rising—i.e., improving economic growth expectations.

A low but rising interest rate environment can be challenging for bonds, but, fortunately, it typically benefits higher-yielding bonds. For this reason, the T. Rowe Price Asset Allocation Committee favors high yield bonds over investment-grade bonds.

Searching for Yield Amid Rising Rates

High yield versus investment-grade bonds

Past performance is not a reliable indicator of future performance.

Sources: T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. Bloomberg Barclays. See Additional Disclosures.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

February 2021 / INVESTMENT INSIGHTS