July 2022 / ASSET ALLOCATION VIEWPOINT

Tech Stock Valuations Have Become Reasonable

Despite the recent rout, tech stocks are still not cheap

Key Insights

- Although technology stocks have sold off steeply year‑to‑date, they are still not cheap when compared to the broader market.

- Our Asset Allocation Committee recently added to growth stocks but remains underweight relative to value.

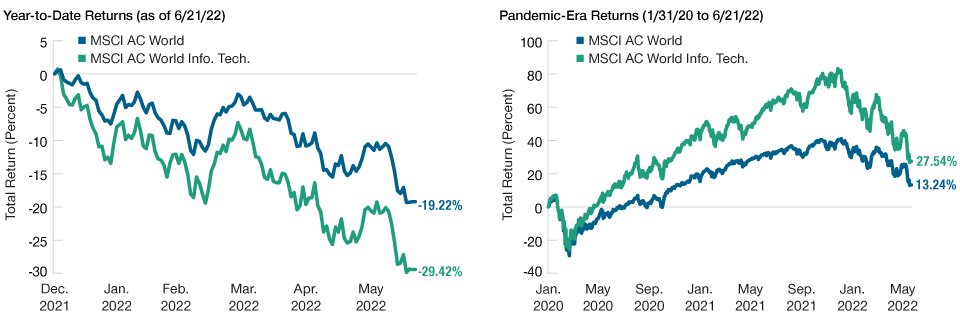

Since the beginning of 2022, stock markets have sold off sharply, with many major indexes recently reaching bear market territory. Notably, technology stocks, in particular, have borne the brunt of the sell-off (Figure 1, left chart).

With many investors wondering if tech stocks have become attractive again, taking a longer‑term perspective could be instructive. An analysis of stock performance during the pandemic era shows that, despite the steep year‑to‑date sell-off, tech stocks have still returned more than twice as much as the broader market (Figure 1, right chart).

Tech Rout Has Been at the Core of the Sell-Off

(Fig. 1) Pandemic‑era returns for the tech sector still exceed the broader market

December 31, 2021, to June 21, 2022 (left chart) and January 31, 2020, to June 21, 2022 (right chart).

Past performance is not a reliable indicator of future performance.

Source: MSCI. T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. See Additional Disclosure.

The earnings for many technology companies surged during the pandemic due to the accelerated adoption of many important technology trends—such as cloud computing, online shopping, and streaming video. While tech stocks gained significantly during this period, their outperformance was partially driven by higher earnings rather than entirely by increases in valuations.

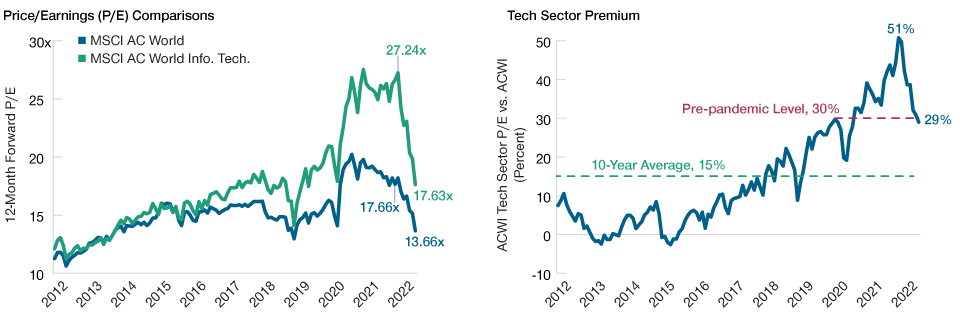

This premise can be tested by comparing the price/earnings (P/E) ratio of the tech sector versus the broader market. As shown in Figure 2, valuations for tech stocks and their valuation premium relative to broader equities became extreme during the pandemic—a “pandemic premium” that has mostly been reversed. Still, it is important to note that the valuation premium for the tech sector remains almost double the 10‑year average premium (Figure 2, right chart).

Have Technology Stocks Become Attractive Again?

(Fig. 2) Sector premium has largely reversed to pre‑pandemic levels but remains elevated

January 2012 to June 2022.

Past performance is not a reliable indicator of future performance.

Source: MSCI. T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. See Additional Disclosure.

Overall, the rout in technology stocks has helped to remove much of the froth, and valuations have become more reasonable since their peak in November 2021. However, these stocks are still not cheap relative to the broader market. Given our continued caution toward this heavily growth‑oriented sector, our Asset Allocation Committee recently added to growth stocks but remains underweight relative to value.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

July 2022 / INVESTMENT INSIGHTS