Five Trends Shaping Markets In 2020 - And How to Respond

Key insights

- The year ahead will likely bring slowing growth, negative interest rates, steep valuations and geopolitical concerns.

- Effective strategies to navigate this environment may include diversifying risk, going long duration, and overweighting emerging markets.

- Other ideas include seeking multiple sources of income and treating market corrections as buying opportunities.

Looking ahead to 2020, investors face a range of challenges as well as opportunities: a slowing global economy in a mature economic cycle, central banks stimulating or preparing for stimulus, low or negative interest rates, steep valuations, and myriad geopolitical concerns, including ongoing technological disruption, shifting demographics and piling global debt. It is easy to get scared.

We have narrowed these down to five key trends that we believe will continue to dominate headlines and drive the performance of financial assets over the short term. For each of these trends, our EMEA Multi‑Asset Solutions team has outlined a range of investment ideas to help investors position their portfolios for the period ahead.

1. Slowing Economic Growth, the End of the Cycle: Finding Growth in a Low‑Growth World

This current expansionary stage of the economic cycle is the longest on record. Mature cycles do not just end because of old age, but rather because one of the following has occurred: significant imbalances in the system, rising inflation and aggressive central banks, or a confidence shock leading to a collapse in demand. While we cannot be certain we have any of the above, predicting the end of cycles and the beginning of recessions are notoriously difficult.

Economies across the globe are slowing down; debt levels are high and rising; inflation remains stubbornly low, although the labour market is tight; short‑term and long‑term interest rates are low or negative; and corporate earnings are losing steam after a roaring 2018. As time goes by, investors are increasingly concerned about an economic contraction.

We have yet to identify any clear signals that a recession is imminent. The cycle could continue for another 12 to 24 months, or perhaps longer with the help of policymakers. Investors who need their portfolio to generate returns must invest—they do not have the privilege of pulling out, risking missing on a potential final upward‑leg in equities, in particular when cash and government bonds offer much lower returns. Nobody wants to be the one who stops dancing before the music stops.

The three investment ideas here are: to maintain diversification, to maintain exposure to defensive investments (because we don’t know when recession hits), and to favour investments offering growth and income potential because they are likely to be attractive in a low‑growth, low‑yield environment.

Investment Trend No. 1: Slowing Economic Growth

2. Monetary Policies: Global Synchronised Stimulus

While the U.S. Federal Reserve (Fed) has cut its policy rates three times, and is on pause, an easing cycle may still ensue, depending on data. Never in modern history has an easing cycle begun with the U.S. 10‑year Treasury yield so low. Meagre inflation, political pressure, and the fear of a recession are all potential reasons for the Fed to ease—no group of Federal Open Market Committee members wants to go down in the history books as the one that derailed the global economy. Meanwhile, across the Atlantic, the European Central Bank (ECB) has not only cut its deposit rate from ‑0.40% to ‑0.50%, but it has also reintroduced its quantitative easing (QE) programme. A lot is at stake.

The situation is different for other major central banks—the Bank of Japan (BoJ), the Bank of England (BoE), and the People’s Bank of China (PBoC). While the PBoC must rebalance a weakening economy with de-risking the financial sector and controlling debt—and so might not offer stimulus at full throttle—many central banks in emerging markets have room to cut rates. They have not had the opportunity to begin a hiking cycle, yet they are already considering easing once again. Just as we thought that markets were beginning to get over their addiction to QE, easy money, and stimulus, they relapse. Policymakers do not want the economic cycle to end under their watch.

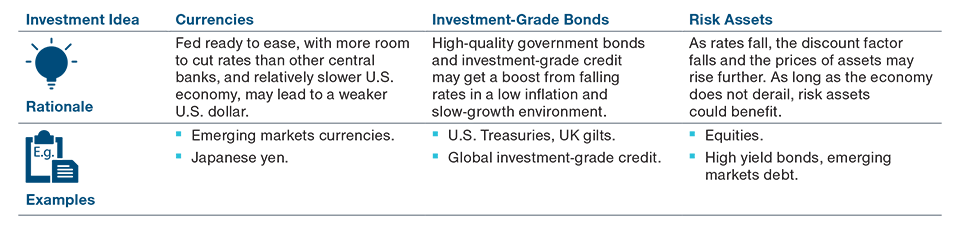

The three investment ideas here focus on currencies, high‑quality fixed income, and risk assets. Global synchronised stimulus may have a profound impact on all these asset classes. The risk is now that the markets expect policymakers to act; if central banks fail to deliver, the disappointment could lead to a sell‑off. In other words, central banks are the knights in shining armour and without them, confidence might be severely dented.

Investment Trend No. 2: Global Monetary Stimulus

3. Fixed Income: The New Abnormal and the Role of Bonds

We are truly in uncharted territory. Not only have some equity markets (once again) reached all‑time highs, but the yields of some government bonds have also (once again) recently reached all‑time lows. The German 10‑year bund yield has reached a level below ‑0.70% for the first time in history. Some investors need safe‑haven assets to hedge liabilities so much that they are willing to pay the German government to keep their cash, instead of earning an interest on it. The yield of French 10‑year government bonds fell below zero for the first time. Now, investors who lend money to the French government get paid back less than they have lent. The yields on 10‑year Greek bonds reached over 25% in the 2011 eurozone debt crisis. Now, the 10‑year Greek yield is lower than the U.S. 10‑year Treasury yield.

The “new normal” for government bonds was supposed to be “lower for longer” rates. Globalisation, technological disruption, debt that “borrows” growth from the future, and demographics can explain a world with modest inflation and modest economic growth, justifying low government bond yields. But negative yields are not a new normal—they are abnormal. With central banks pivoting to easing policy, economic growth slowing down, and inflation remaining low, the negative yields can turn even more negative. The caveat is that if the U.S.-China trade war and Brexit reach a healthy resolution, combined with easier global monetary policy, the economy may improve and rates may move higher, not lower.

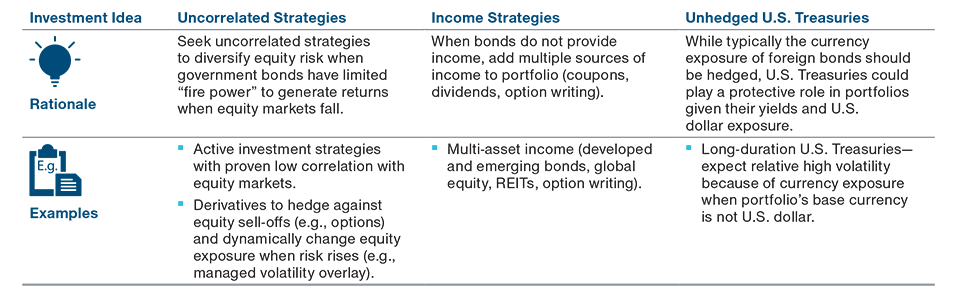

The three investment ideas here focus on the role of high‑quality bonds in multi‑asset portfolios. The traditional roles of bonds were to generate income—which doesn’t work so well with negative rates—and to diversify equity risk. Protection from bonds is limited when rates are low (how much further can they fall?), and it is expensive to pay interest on bonds rather than collect interest from them. Safety has become expensive.

Investment Trend No. 3: Fixed Income

4. Valuations: When Expensive Is Too Expensive

Many financial markets are close to historical extremes—either highs or lows. Years of unconventional monetary policies have pushed interest rates lower and asset prices higher. Valuations mostly matter over the long term—although they can impact short‑term sentiment—and at extremes. Public stocks are arguably not overvalued because earnings have kept up with prices, and they are not as expensive as bonds. However, it is difficult to argue that bonds are not overvalued when rates are so low and spreads are so tight. Higher prices today mean lower returns tomorrow. Excess returns—alpha—from active management could become more precious when market returns are modest.

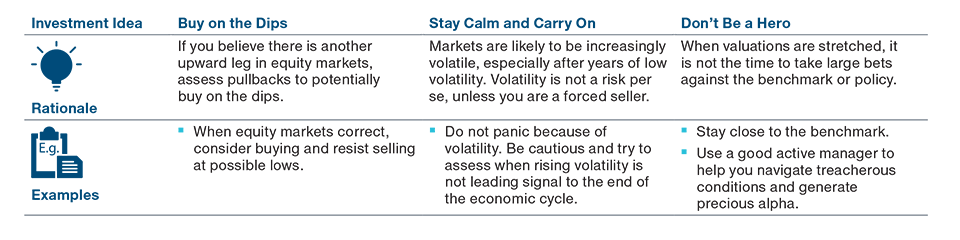

At times like these—with rich valuations, a mature economic cycle and geopolitical uncertainties—investors tend to become increasingly nervous, and investor behaviour can become paramount. Moreover, when the bond market implies one thing—low/negative 10-year bond yields reflect expectations for negative economic growth and/or deflation—and the equity market implies the opposite—swinging from one record-breaking high to another—this is not time to be too brave. Our three investment ideas focus on how investors should behave during these stressing times. Uncertain times require a diligent and clear head, calmness in the face of volatility and the unknown, and not being too brave.

Investment Trend No. 4: Valuations

5. Geopolitics: Politics, Populism and Policy

During normal times, geopolitics can create a lot of noise—but it usually has limited impact on the long‑term performance of financial markets. We are not living in normal times.

We are living through a number of secular shifts in society: a digital revolution, a political revolution, and a demographics revolution. Technology impacts nearly every aspect of our lives—the way we work, shop, bank, commute, communicate, and so on. Populism seems to have changed Western politics and our values. An aging population may mean that the Japanification of Europe will follow. Fiscal policy needed to fund more populist campaign promises will likely contribute to ever-growing debt bubble for many countries. Things are changing, and they are changing fast.

Global trade disputes between the U.S. and China are set to continue impacting the global economy, manufacturing, supply chains, and corporate earnings. With the impeachment process and the 2020 U.S. general election on the horizon, we believe President Trump is likely to try to reach a deal with the Chinese. European politics—Brexit, the need for decisions on fiscal stimulus—are likely to have a major impact. Regardless of how the Brexit saga ends, the mere fact that it ends will remove some uncertainty—and markets hate uncertainty. Another geopolitical risk is an escalation of tensions in the Middle East. Although the oil price is no longer as sensitive to the situation in the Middle East because new technologies offer abundant energy sources in the U.S., a war could still impact oil prices. With the amount of global debt in the system, a spike in inflation due to higher energy prices in a world running on fossil fuel could be damaging.

In this complex environment, our investment themes focus on what can go wrong in case of deterioration and what can go right in case of resolution.

Investment Trend No. 5: Geopolitics

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

201911-1016081