December 2022 / MARKETS & ECONOMY

Do Not Underestimate the Impact of Quantitative Tightening

It may affect economies more than central banks assume

Key Insights

- Central banks are introducing quantitative tightening (QT) measures but appear to regard them as secondary measures that contribute little to active policy tightening.

- Our analysis suggests that QT measures may have a much bigger impact on yields, output, and inflation than central banks expect.

- This may result in central banks tightening more than necessary in order to bring inflation down, potentially exacerbating any recessionary dynamics.

Many central banks have begun introducing, or are at least discussing, quantitative tightening (QT) measures. Judging from their public communications, central banks intend these policies to run largely in the background and contribute little to active policy tightening. I believe their impact could be much greater than this, however—potentially sharpening bond market volatility and creating the risk that central banks tighten policy more than necessary.

QT is a more limited policy tool than quantitative easing (QE) in that it impacts economies in fewer ways. QE influences markets through six main channels: market stabilization, the reduction of uncertainty, policy signaling, exchange rates, portfolio rebalancing, and bank lending.

How QE and QT Impact Economies

In times of market distress, for example, QE can stabilize bond markets, easing financial conditions. When economic uncertainty is high, the pursuit of QE can signal to the general public that the central bank will do “whatever it takes” to save the macroeconomy. If it is commonly accepted that QE will be unwound ahead of a rise in the interest rate, then implementing QE may signal that the long-term interest rate will stay lower for longer, thereby easing financial conditions.

Like any monetary policy, QE may stimulate the economy by weakening the exchange rate. The portfolio rebalance channel of QE leads to lower bond yields and higher prices of other assets, as investors rebalance their portfolio toward other assets. The bank lending channel implies that the QE-induced rise in bank reserves stimulates lending activity.

QT Impacts Economies in Fewer Ways Than QE

(Fig. 1) It mainly influences exchange rates, asset prices, and bank activity

As of September 30, 2022.

Analysis by T. Rowe Price.

By contrast, QT likely only operates via the portfolio rebalance, exchange rate, and bank lending channels (Figure 1). This is because central banks said that QT will only be implemented during calm market conditions—and gradually. The market stabilizing and confidence/uncertainty channels would likely not operate in this environment. The policy signaling channel is unlikely to operate since QT does not provide any signals about the future path of the policy rate. As such, the QT multiplier we use in our analysis contains only the effects of the portfolio balance, exchange rate, and policy signaling channels.

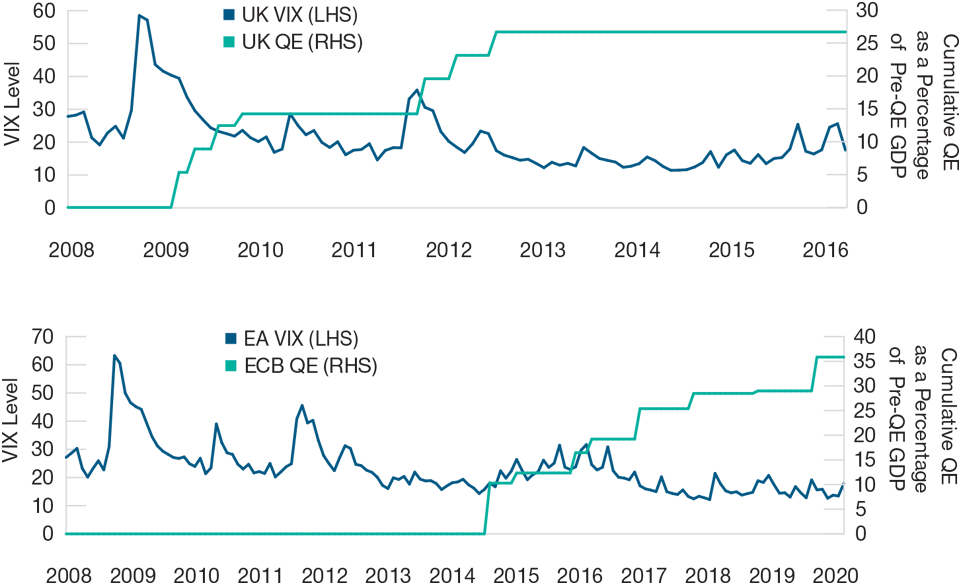

Since QT is only a recent policy, the only way to isolate the effects of the three QT channels is by analyzing differences in pre-pandemic QE multipliers. The effect of the market stabilizing and uncertainty channels can be removed by comparing the European Central Bank’s (ECB’s) with the UK’s QE. In the UK, QE took place mainly during times of high financial market volatility, while the ECB implemented QE during a much calmer period (Figure 2). Consequently, the ECB’s QE multiplier likely doesn’t contain the market stabilizing and uncertainty effects.

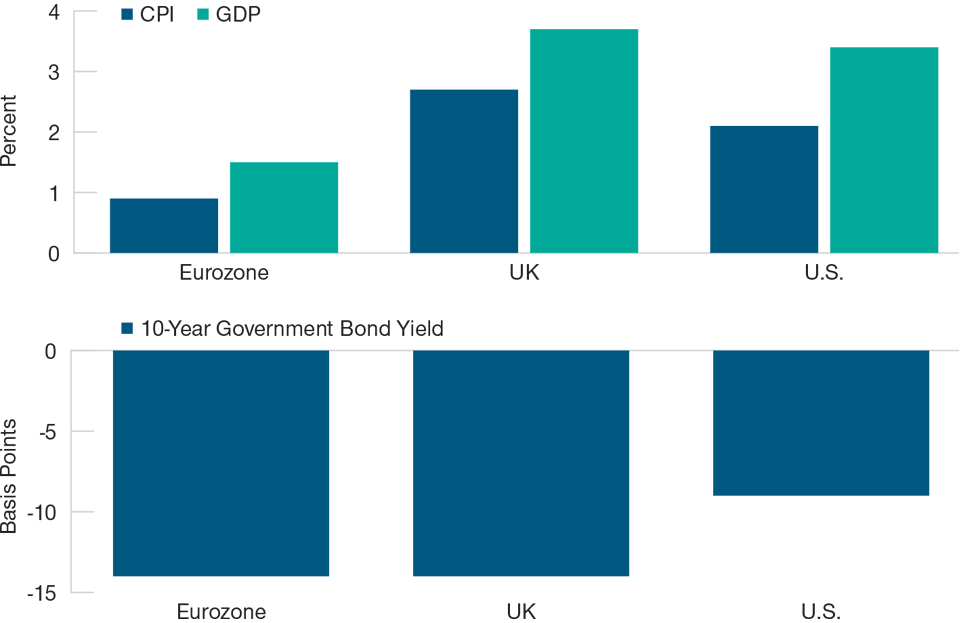

Similarly, while the bond market effects of QE were similar across regions, the ECB’s QE program had much less impact on gross domestic product (GDP) and inflation than the Bank of England’s QE program (Figure 3). Previous research showed that about 40% of the bond market response can be attributed to the signaling channel. Incorporating this finding generates a QT multiplier that is roughly 70% smaller than that of QE.

The Potential Impact of QT Is Not Well Understood

What does this QT multiplier tell us about the effects of QT on the macroeconomy? We expect the Federal Reserve to shrink its balance sheet by USD 900 billion per year. This amount of QT would result in an estimated decline of 0.36% in consumer price index (CPI), 0.6% in GDP and a 30bps rise in the 10-year U.S. Treasury. The Bank of England’s Monetary Policy Committee specified QT of GBP 80 billion will raise gilt yields by around 40bps a year while reducing output and inflation by around 0.55% and 0.4%, respectively. We believe that the ECB’s QT, which is still under discussion, will likely amount to EUR 350 billion per year. This would lead to an implied rise in bund yields of 28bps, a reduction in CPI of 0.17% and GDP of 0.31%. These impacts on output and prices would normally correspond to a policy rate rise of 125bps. These simple calculations therefore suggest that QT is likely to have a bigger effect than commonly assumed.

The UK’s QE Program Was Introduced During Heightened Volatility

(Fig. 2) The ECB’s QE program was launched in a more stable period

Analysis as of September 30, 2022.

Analysis by T. Rowe Price. Sources: Weale and Wieladek (2016), Wieladek and

Garcia-Pascual (2016).

As with any such illustration, these numbers should be treated with some caution and probably represent the upper bound of QT effects. However, even if we assumed that the effects of QT are 90% smaller than QE (rather than the 70% I assumed), this would still be equal to a policy rate rise of 42bps. The key point, therefore, remains that the bond market and macroeconomic implications of QT are likely to be significantly bigger than assumed by central banks.

QE Impacted GDP and Inflation More in the UK Than in the Eurozone

(Fig. 3) The bond market effects were very similar

As of September 30, 2022. The data was collected over the following time periods:

Eurozone: January 2015 to February 2020, UK: March 2009 to March 2016, and U.S.: March 2009 to November 2015.

Sources: Bank of England, European Central Bank, and Bloomberg Finance L.P. Average effects reported in response to a 1% rise in asset purchase as a share of GDP.

This has two important market implications. The first is that as long as central banks continue to shrink their balance sheets, there will be pressure for yield curves to steepen in the medium term, as term premia slowly rebuild. Bond markets are therefore likely to stay volatile for some time to come while they find this new equilibrium. The second implication is that it is plausible that central banks will tighten more than is necessary to bring inflation back to target if they underestimate the consequences of QT for the real economy. This could exacerbate any recessionary dynamics in the affected economies going forward. Central banks should therefore proceed with caution as they will only slowly learn about the effects of QT.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

December 2022 / MARKETS & ECONOMY