March 2022 / INVESTMENT INSIGHTS

For or Against? The Year in Shareholder Resolutions—2021

With environmental and social proposals in the spotlight, case-by-case insights were key to our decision-making

Key Insights

- Many proposals, particularly those relating to environmental and social issues, demanded a nuanced approach to our voting rationale.

- For environmental proposals, in particular, improving the level and quality of company disclosure remains our primary objective.

- Distinct classifications of proposals provide a useful framework for understanding how we arrived at our voting decisions.

Within the context of growing demands on the private sector to constructively address the world’s environmental, social, and governance (ESG) challenges, shareholder resolutions can be an important tool to persuade companies to increase their focus on key societal challenges. The year 2021 presented a range of themes for consideration, and our approach to each continues to be guided by careful attention to the end result within our well‑tested framework.

The Role of Proxy Voting in Stewardship

We see proxy voting as a crucial link in the chain of stewardship responsibilities that we execute on behalf of our clients. From our perspective, the vote represents both the privileges and the responsibilities that come with owning a company’s equity instruments. We vote our clients’ shares in a thoughtful, investment‑centered way, considering both high‑level principles of corporate governance and company‑specific circumstances. We take an inclusive approach to these decisions, with involvement from our ESG specialists and the investment professionals who follow the companies closely. Our overarching objective is to cast votes in support of the path most likely to foster long‑term, sustainable success for the company and its investors.

Our view is that the proxy vote is an asset belonging to the underlying clients of each T. Rowe Price investment strategy. This means that our portfolio managers are ultimately responsible for making the voting decisions within the strategies they manage. To fulfill this responsibility, they receive recommendations and support from a range of internal and external resources, including:

- The T. Rowe Price ESG Committee

- Our global industry analysts

- Our specialists in corporate governance and responsible investment

- Insights generated from our proprietary Responsible Investing Indicator Model (RIIM)

- Our external proxy advisory firm, Institutional Shareholder Services (ISS)

1 Source: T. Rowe Price, as of December 31, 2021.

Prudent Use of Our Influence

Our proxy voting program is one element of our overall relationship with corporate issuers. We use our voting power in a way that complements the other aspects of our relationship with these companies. For example, other contexts in which we might use our influence include:

- Regular, ongoing investment diligence

- Engagement with management on ESG issues

- Meetings with senior management, offering our candid feedback

- Meetings with members of the Board of Directors

- Decisions to increase or decrease the weight of an investment in a portfolio

- Decisions to initiate or eliminate an investment

- On rare occasions, issuing a public statement about a company—either to support the management team or to encourage it to change course in the long‑term best interests of the company.

However, in an environment where large institutional shareholders are often rated by third parties according to how frequently they vote against Board recommendations, we wish to be clear—it is not our objective to use our vote to create conflict with the companies our clients are invested in. Instead, our objective is to use our influence—through the various avenues listed—to increase the probability that the company will outperform its peers, helping enable our clients to achieve their investment goals.

A proxy vote is an important shareholder right, but its power is limited to the one day per year when a company convenes its annual meeting. Influence—earned over time and applied thoughtfully—is a tool we use every day.

Varying Degrees of Regulation and Qualification

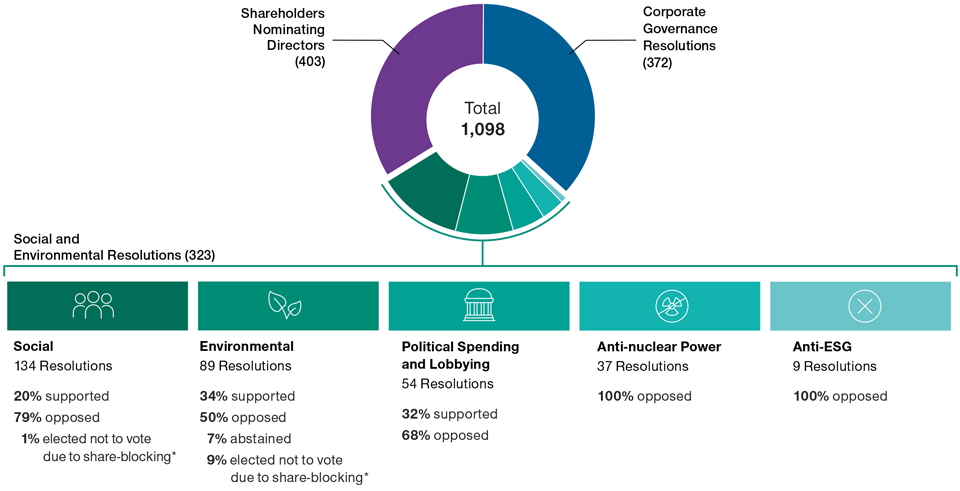

Shareholder Resolutions Voted on in 2021

(Fig. 1) Digging deeper into E&S resolutions

Chart shows the number of shareholder resolutions we voted on in 2021 by proposal topic. For “Social and Environmental Resolutions,” we classify the proposals into 5 distinct categories.

Chart shows the number of shareholder resolutions we voted on in 2021 by proposal topic. For “Social and Environmental Resolutions,” we classify the proposals into 5 distinct categories.

*Share-blocking is a requirement in certain markets that impose liquidity constraints in order to exercise voting rights. We generally do not vote in these markets.

As of December 31, 2021.

Source: T. Rowe Price.

In various markets around the world, company shareholders are afforded the right to present items to be voted upon at the annual general meeting. However, these shareholder proposals are subject to varying degrees of regulation and qualification. In some markets, such as Japan, North America, and the Nordic region, filing requirements are minimal. As a result, it is common to see many resolutions submitted by individual and institutional investors in these markets. In other markets, where sponsors are required to have large, long‑term holdings to be eligible to submit proposals, shareholder resolutions are relatively infrequent.

In 2021, the T. Rowe Price portfolios voted on 1,098 shareholder resolutions across all markets. Of those, 403 were situations where shareholders were nominating directors to a company’s Board. Another 372 were resolutions asking companies to adopt a specific corporate governance practice. Here, we focus on the 323 remaining proposals that specifically addressed environmental and social (E&S) issues. We classify these proposals into five distinct categories, as illustrated in Figure 1.

Voting Framework: Principles‑Based or Case by Case?

When it comes to proxy voting issues, there is some debate as to the best approach: Is it best to look at each issue individually and consider the company’s circumstances or to apply a set of principles evenly across all companies? In our view, the answer is both.

There are many areas within proxy voting where a principles‑based approach can be implemented effectively. For example, our proxy voting guidelines are designed to promote an appropriate level of Board independence, robust shareholder rights, and strong linkage between executives’ compensation and company performance. However, there are other areas where a case‑by‑case approach is necessary in order to achieve full alignment between our guidelines and our voting outcomes. This is very much the case for shareholder resolutions.

The main reason why shareholder resolutions are hard to implement with a principles‑based voting approach is because they are more nuanced than other proxy voting categories. For example, we employ an objective set of indicators to determine a director’s independence. It is a straightforward decision to vote against existing directors and suggest that the company replaces them with independent Board members. In the case of many shareholder proposals, the message to the company is not only does it need to make a change, but also to employ a prescriptive method to do so. We often find ourselves agreeing with a proponent that a company’s E&S disclosure is inadequate. However, we do not always agree with the prescriptive remedy.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.