March 2021 / INVESTMENT INSIGHTS

Why the Time Is Right to Consider Investing in EM Local Debt

It offers relatively high income potential and the prospect of capital gains

Key Insights

- Reasons for overweighting EM local debt include income, economic advantage, currency valuations, diversification benefits, and active management opportunities.

- EM local debt also offers a universe of issuers with higher ratings on average for environmental, social, and corporate governance (ESG) factors compared with some other EM assets.

- We believe emerging market (EM) local debt offers relatively high expected returns and considerable diversification benefits.

Emerging market local debt is often overlooked in fixed income and multi‑asset portfolios as investors regard it as too risky. However, as the global economy begins to recover from damage inflicted by the coronavirus, we believe that EM local bonds can play an important role in portfolios as an income‑generating growth asset. Below, we offer five reasons why we believe EM local debt is an attractive option for investors with appropriate risk tolerance and well‑diversified portfolios.

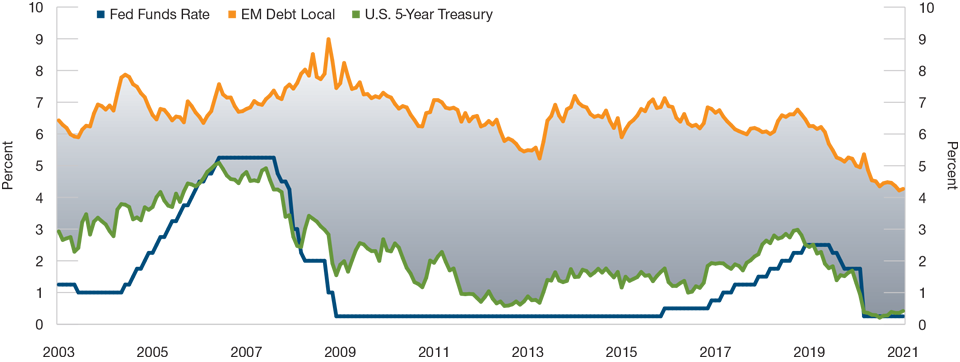

1. Income: High Yield in a Low‑Yield World

The fall of interest rates in developed markets has been a key secular trend of the past four decades. Slowing economic growth, aging populations, and declining inflation have contributed to this, as has central banks having to lower policy rates as they battled four major crises—the early 1990s recession, the 2000 tech bubble burst, the 2008–2009 global financial crisis, and the 2020 coronavirus pandemic. Three decades and four crises have left short‑term interest rates and longer‑term bond yields hovering around zero (Figure 1).

EM local debt offers much higher yields than developed market government bonds. At the end of January 2021, the J.P. Morgan GBI‑EM Global Diversified Composite yielded 4.3% compared with yields of 0.42%, ‑0.74%, and ‑0.03% for five‑year U.S. Treasuries, German bunds, and UK gilts, respectively. In other words, the spread between EM local bonds and Treasuries was 3.9%. While this is not a particularly large spread historically speaking, in a low‑yield world, an extra 3.9%—nearly 10 times the five‑year U.S. Treasury yield—is an attractive uptick for income‑seeking investors.

Interest Rates and Bond Yields Are Hovering Above Zero

(Fig. 1) Yields of EM local bonds, five-year U.S. Treasuries, and U.S. fed funds rate

As of January 31, 2021.

Past performance is not a reliable indicator of future performance.

Sources: T. Rowe Price, U.S. Federal Reserve (Fed), U.S. Treasury, and J.P. Morgan GBI-EM Global Diversified Composite (see Additional Disclosures). January 2003 through January 2021.

Y-axis is yield in percent. The grey area is the spread between EM local debt yields and U.S. 5-year Treasury yield.

2. Emerging Market Economic Advantages: Growth, Demographics, and Yield

Emerging markets are strategically attractive for three main reasons. First, their estimated medium‑term economic growth rate is higher than those of developed market countries; second, their populations are younger; and third, their higher yields today may decline over the next decade as they continue to mature. Combined, these factors may provide a tailwind for EM financial assets.

Although EM U.S. dollar‑denominated bonds may benefit from receding risk premiums as the credit quality of emerging markets should improve, their exposure to the U.S. yield curve means they will not benefit as much from falling EM rates as EM local bonds would. EM local debt, on the other hand, is priced off the yield curves of EM countries, meaning that investors in the asset class may benefit not only from coupon income—or high yields—but also from potential capital gains because of falling rates in EM countries.

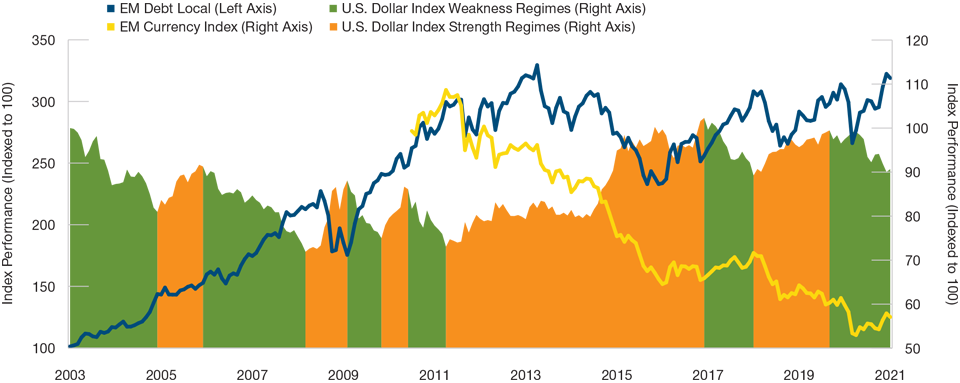

3. Total Returns: Valuations of EM Currencies

The strong rebound in the prices of financial assets since April 2020 have left many with valuations looking rich relative to their history. The prices of some equity markets are near record highs, the yields of some government bonds are near record lows, and credit spreads are tight—including those of EM local debt. When valuations are steep today, future long‑term returns are likely to be shallow.

One asset class that is attractively priced—cheap, even—is EM currencies. The value of a basket of EM currencies fell by around 43% from July 2010 through January 2021; the U.S. dollar index appreciated by approximately 11% against a basket of currencies over the same period (Figure 2).

Emerging Market Currencies Appear to Be Cheap

(Fig. 2) EM local debt, U.S. dollar, and EM currency indices

As of January 31, 2021.

Past performance is not a reliable indicator of future performance.

Sources: T. Rowe Price, J.P. Morgan Emerging Market Currency Index, U.S. Dollar Index, and J.P. Morgan GBI-EM Global Diversified Composite (see Additional Disclosures). January 2003 through January 2021. EM currency index July 2010 through January 2021.

Unsurprisingly, the performance of EM local debt has been positively correlated with EM currencies and negatively correlated with the U.S. dollar. EM currencies are likely to appreciate over time, partly because of their very low current valuations and partly because of the economic advantages as described above (high yields today, rather than expected falling yields, should support EM currencies).

The U.S. dollar may weaken because it has lost the interest rate advantage it had before the pandemic and because fiscal and monetary stimulus have led to an abundant supply of it. EM local debt effectively involves investing in two asset classes—EM sovereign bonds and EM currencies—and it is the cheap valuation of EM currencies, not necessarily the valuations of EM bonds as reflected in their spreads, that may boost the total return of EM local bonds over the next decade.

4. Diversification Benefits: Mind the Risks

EM local debt is a risk asset. During times of stress, the spreads of EM local bonds tend to widen as investors demand higher compensation for holding riskier bonds issued by EM sovereigns rather than safer bonds issued by developed market (DM) governments. In addition, the value of EM currencies tends to fall when investors de‑risk their portfolios and rush to safe‑haven currencies such as the U.S. dollar. EM local debt is therefore a volatile asset class, with exposure to EM currencies as well as narrowing and widening spreads on underlying bonds.

For these reasons, investors should consider holding EM local debt only as part of a well‑diversified portfolio. Because the correlation of EM local bonds with other traditional asset classes has been imperfect, adding a modest allocation to EM local debt to a portfolio may actually—and perhaps counterintuitively—reduce risk within portfolios focused on growth assets in particular. The correlation between EM local bonds and global equities has been 0.7, while the correlation between EM local debt and global investment‑grade DM bonds has been 0.3.1

5. Active Edge: Opportunity to Add Value

When allocating to EM local bonds, an active investment approach may be advantageous. There are two reasons for this. The first relates to performance. EM local debt returns comprise three elements: coupon income, capital gains or losses due to changes in yields (duration risk), and currency movement (currency risk). Over the short term, most performance tends to come from the most volatile component of currency movement. Over the long term, however, the bulk of performance has tended to come from the least volatile component of coupon income. An active approach that emphasizes harvesting coupons, carefully managing currency risk, and avoiding taking large bets on duration risk has the potential to consistently add value.

The second reason we believe actively managing EM local debt is advantageous is the wide investment opportunity that set the asset class offers. EM bonds cover a diverse range of issuers, including China, Mexico, Brazil, South Africa, Russia, and Poland, as well as opportunities to diversify across differing interest rate cycles. Because the asset class is not as heavily researched as some other asset classes—such as investment‑grade DM fixed income—and because its volatility often leads to divergence between prices and intrinsic value, skilled asset managers can add value through security selection, country allocation, and prudent duration and currency management. In a low‑yield environment where spreads are tight, the potential value add from active management is even more important.

The ESG Advantage

Beyond the investment merits of EM local debt, EM sovereign issuers that are able to tap capital markets via bonds denominated in their own currencies are statistically more reliable than issuers who are denied this opportunity. Countries with local markets accessible for international investors will usually have undertaken the necessary regulatory improvements and will have developed an institutional framework to establish themselves. This goes hand‑in‑hand with higher credit quality of the asset class, on average, and a potentially better ESG score.

We believe EM local bonds offer both strategic and tactical investment opportunities for investors, as well as higher ESG ratings on average compared with other EM assets. In markets where many assets have stretched valuations, tight spreads, and low yields, investors should consider EM local debt as a potential source of income and growth in their portfolios.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

March 2021 / PODCAST