November 2021 / MARKET OUTLOOK

Growth Delayed but Not Derailed

Opportunities still lie ahead for firms and investors

Key Insights

- The outlook for the global economy is favorable despite emerging headwinds.

- As the delta variant recedes and the world adapts to living with COVID‑19, pent‑up demand in areas like travel and entertainment should help sustain economic growth.

- Extreme monetary and fiscal stimulus has distorted markets. While the withdrawal of stimulus heightens risks, it should also drive markets to refocus on fundamentals.

The past few months have brought several negative surprises, including the rapid spread of the delta variant of the coronavirus and more political uncertainty around the globe, notably a regulatory crackdown in China. Nevertheless, the outlook appears to be favorable, on balance, for most of the world’s major economies over the coming months. Indeed, the delta variant seems likely to have only delayed rather than derailed the global recovery—perhaps making growth over the coming quarters modestly more robust than it might otherwise have been.

There are challenges on the horizon, however. Chief among them is the withdrawal of extraordinary monetary accommodation in the U.S. and other developed markets. The level of monetary stimulus in the global financial system as measured by central bank balance sheets and growth in the money supply peaked earlier this year. The decline in accommodation will likely accelerate when the Federal Reserve begins tapering its asset purchases, probably in November. Additionally, the European Central Bank (ECB) recently announced it would move to a “moderately lower pace” of emergency bond purchases.

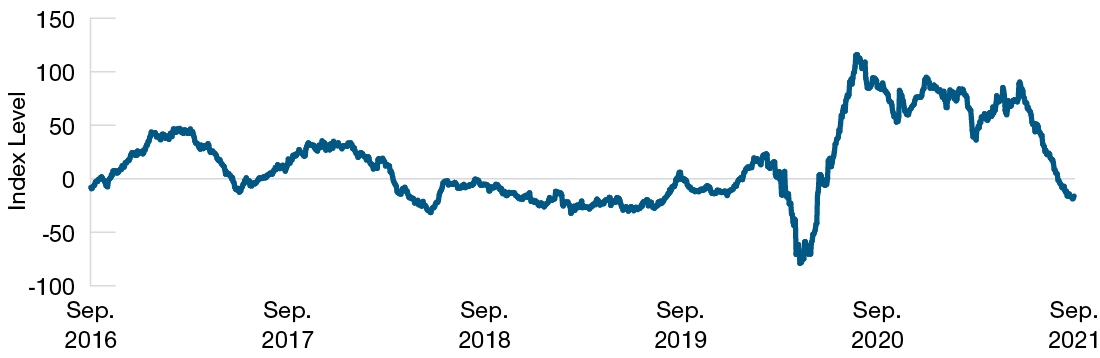

Economic Surprises Have Turned Negative

(Fig. 1) Citi Global Economic Surprise Index

September 21, 2016, through September 21, 2021.

Source: Bloomberg Finance L.P.

How today’s elevated bond and equity valuations will respond to the normalization of monetary policy is an open question. Past tapering episodes have often, but not always, sparked market corrections. In this instance, central banks are walking a tightrope. In order for the bull market to survive, the Fed’s actions will have to be carefully communicated, result in a measured rise in interest rates, and be accompanied by continued growth and moderating inflation.

The Pandemic Response Has Accelerated Some Inflationary Forces in the Short Term but May Reinforce Disinflationary Trends in the Long Run

Inflation is another challenge for investors but likely a transitory one. Supply constraints are more persistent than many expected, and worker shortages remain in many industries. While this cyclical burst of inflation still looks to have room to run, the first signs that inflation is peaking may have already emerged. Used car prices have stabilized, for example, and lumber prices, if up somewhat in recent weeks, are still at a fraction of their spring peak.

Over time, I expect the powerful disinflationary trends of the past few decades—including aging demographics, globalization, and automation—to reassert themselves. The massive shift to online shopping during the pandemic has accelerated the ease in comparing prices across sellers, a major factor in keeping prices down, while “teledoc” visits and internet video conferencing are also disinflationary.

The flip side for investors is that global growth seems to be peaking, particularly in China, where the delta strain of the coronavirus and the government’s tighter financial controls on property and infrastructure weighed on domestic demand, pushing gauges of the service sector into contraction territory. The delta variant has also taken a toll on U.S. growth expectations, with economists surveyed by Reuters recently cutting their median annualized growth forecasts for the third quarter from 7.0% to 4.4%. Recent vaccination progress may have made Europe an outlier. The ECB recently raised its growth forecasts for both this year (from 4.0% in March 2020 to 4.6%) and next year (from 4.1% to 4.7%).

The fiscal situation remains as clouded as ever. As of this writing, the U.S. infrastructure bill remains on hold, while jitters are likely to grow again once an end looms to the temporary increase in the federal debt limit, which will probably run out in December. Conversely, the passage of both substantial physical infrastructure and social spending bills would add to the recovery, but likely at the cost of even further elevated debt levels and a higher tax burden. The grimmest—if unlikely—outcome over the longer term would be a loss of confidence in the U.S. dollar. I am mindful that our ability to short‑circuit a deep recession after the outbreak of the pandemic relied on the Fed’s ability to monetize the nation’s debt without sparking inflation.

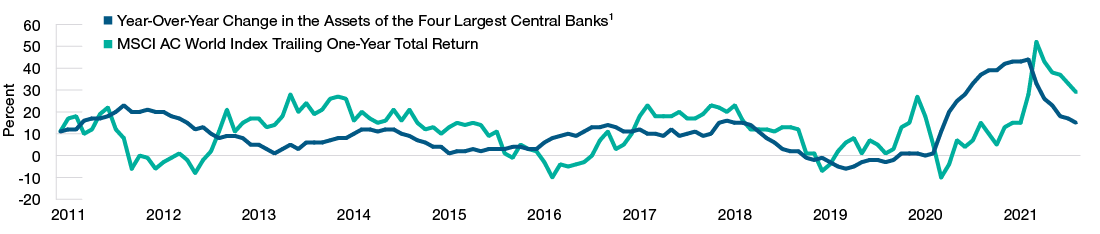

Fading Stimulus

(Fig. 2) Change in central bank assets vs. equity performance

December 31, 2010, through August 31, 2021.

Past performance is not a reliable indicator of future performance.

Sources: Bloomberg Finance L.P. and MSCI. T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. See Additional Disclosures.

1 The four largest central banks are the U.S. Federal Reserve, European Central Bank, Bank of Japan, and Central Bank of China.

While fading stimulus might pose some challenges for investors, it also presents opportunity by making markets more efficient. Extreme monetary stimulus from the Fed and other central banks has interfered with price discovery by introducing a major buyer that is completely price insensitive. In particular, the Fed’s commitment to buy USD 80 billion in Treasuries and another USD 40 billion in mortgage‑backed securities (MBS) every month, no matter what, has made the real “price” of both unknowable. This has been a boon for homeowners in the case of MBS, perhaps, but a problem for investors, given that Treasuries form the reference price for assets globally.

Unprecedented Stimulus Has Fed Speculation in Some Areas

The flood of liquidity has clearly led to speculation in some parts of the market, but it is difficult to generalize about where these pockets of excess lie and how to avoid them. For example, I do not have a strong view on the relative appeal of growth stocks relative to value shares. While growth stocks’ valuations are very high relative to history, so are the earnings growth rates of some innovative companies. Similarly, it is difficult to make blanket statements about the relative appeal of developed versus emerging markets or U.S. versus non‑U.S. investments. In my view, the strong recent performance in some asset classes is another argument for maintaining a highly diversified portfolio.

Indeed, the return of price sensitivity in global markets bodes well for selective investors focused on fundamentals. While I do not expect robust overall equity returns given the market’s elevated valuations, I am also mindful that investors have not yet enjoyed all the potential fruits of the recovery. Many companies have yet to see business return to pre‑pandemic levels, and identifying which ones are either regaining their footing or disrupting markets through innovation will be key. I’m confident our global research organization will serve our investors in this environment.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

November 2021 / INVESTMENT INSIGHTS