April 2023 / INVESTMENT INSIGHTS

China's Reopening: Implications and Impact

Brisk reopening brings quicker consumption response

Key insights

- We attach a 60% probability to a strong reopening for China in 2023, with gross domestic product growth of 5–6% likely achievable.

- China’s sharp reversal of zero-COVID should have the biggest impact on domestic demand. Stimulus policies will be an important element in economic recovery this year.

- We think that the positive impact of China’s reopening on the global economy will likely be moderate. It is unlikely to change the global trajectory on its own.

China’s earlier-than-expected economic reopening following the abrupt end of the zero-COVID policy is seen by global strategists and investors as one of the defining events for 2023. In this note we consider two alternative economic reopening scenarios and their implications for (i) China’s domestic economy and (ii) the rest of the world following China’s dramatic pivot away from zero-COVID on December 7, 2022.

The three scenarios can be summarized as follows:

Scenario 1: Downside case (40% probability) Full/brisk pace of reopening with a cautious consumption response; economic rebound starts in the first quarter of 2023, but momentum takes time to build up as the economy faces headwinds from exports and a continuing drag from housing; likely 4%–5% gross domestic product (GDP) growth. This is lower than the consensus of around 5%.

Scenario 2: Upside case (60% probability) Full/brisk pace of reopening brings about a stronger and quicker consumption response; strong stimulus support from the government helps offset other drags and reignites confidence/optimism; full-year growth still constrained by the weak global outlook, but 5%–6% GDP growth is likely achievable.

Our downside case, Scenario 1, is for the current brisk pace of reopening since December to continue and for this relaxation to be met with a cautious response more broadly, resulting in more notable consumption increase (and rebound in growth) only from the third quarter of 2023 onward. This path takes into consideration the continued weak consumer and business sentiment more broadly and the fact that pockets of the economy have suffered (and continue to suffer) under zero-COVID and that unemployment has become a greater concern. Scenario 1 also attributes a decent amount of growth weakness to negative structural trends versus just COVID effects.

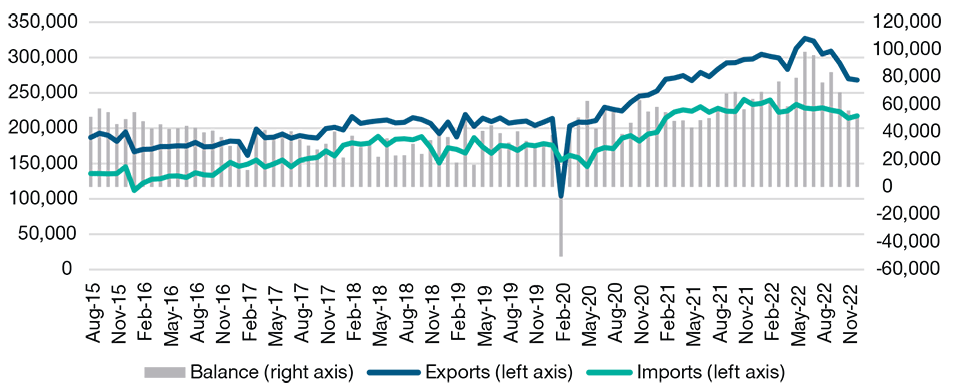

China’s Trade Balance May Shrink Rapidly on Reopening

(Fig. 1) Total exports, imports, and trade balance in USD billions

As of December 2022.

Source: Haver/China General Administration of Customs.

Our upside case, Scenario 2, assumes greater optimism by the Chinese population, resulting in a faster spending response to greater mobility. This view takes comfort from the fact that household excess savings have risen notably over the past few years. The next question is where those savings are likely to be deployed. A soft landing in the global economy would also provide some support to net exports. In our view, the difference between 5% and 6% would likely come from an upside surprise to fixed investment on top of consumption, with notable policy support.

Macro Implications of China Reopening

The reopening to date has proceeded relatively rapidly, with an extraordinarily high share of the population being infected with the virus in the first wave of the pandemic and within a short four- to six-week period. This likely changes the dynamics of recovery versus that seen previously in other countries. During the infection period, activity, notably services, dipped sharply. However, by mid-January, with the wave passing, people have been relatively quick to reemerge and reengage with economic activity. Surveys do strike some notes of caution, with a significant percentage of the population remaining concerned about long COVID and possible reinfection. While people have been relatively quick to resume travel and going out, they have been more cautious initially on purchases of consumer goods and buying property.

Domestic Demand—Greatest Beneficiary of China Reopening

Overall, China’s sharp reversal of zero-COVID should have the biggest impact on domestic demand, once the initial shock fades. There was also concern about the impact on supply chains as some disruption appears likely during the initial phase of reopening and wave of infections. But given the authorities’ track record of relatively quickly restoring supply chain functioning in the wake of shocks, we might expect supply chains to return to relatively normal operational status. Indicators such as the Purchasing Managers’ Index (PMI) for supplier delivery times, and freight shipping costs are normalizing relatively quickly, bearing this out.

China’s Economic Growth to Improve in 2023

We believe that growth will likely be positive in the range of 4%–6%, shaped by:

- Expectations for net exports (which have been contributing half to one percentage point to recent growth) to swing to negative as exports fall and imports rise.

- A weak starting base of 3% GDP growth in 2022.

- Still tepid investment growth (circa 1%–3% for total capex) as infrastructure stimulus from last year fades while the drag from housing also eases.

- Manufacturing capex will face headwinds from lower profits but will receive support from monetary policy, industrial policy guidance, and service sector rebounding.

- Stronger fiscal support, possibly via Pledged Supplementary Lending policy. While policy to date has been relatively cautious in signaling more fiscal support, fiscal policy could be upsized over the course of the year as needed to achieve more ambitious growth goals.

Consumption will have to be the main driver of China’s growth to get to 5% plus in 2023 in light of the factors cited above. Consumption is around 55% of GDP on average in recent years. By our calculations, it will need to grow by 9% or more in total (including public consumption) for growth overall to get to 5% plus. Overall, domestic demand will likely need to increase from 2% growth in 2022 to 6% plus in 2023.

China’s supporting stimulus policies will be an important element in economic recovery this year. Beijing policymakers have taken action to stabilize the housing market, but so far there has been little visible turn in housing sales or sentiment. Various surveys suggest that zero-COVID, the weak macro economy, and restrictive government policies toward housing and the challenge of uncompleted projects have all played a role in depressing sentiment toward residential property. Government policy is addressing two of these negative factors with the hope that by restoring overall confidence there will be a positive feedback loop from property to jobs and incomes. Policy is signaling increased support to boost consumption/consumer confidence in 2023, but so far, the details are limited.

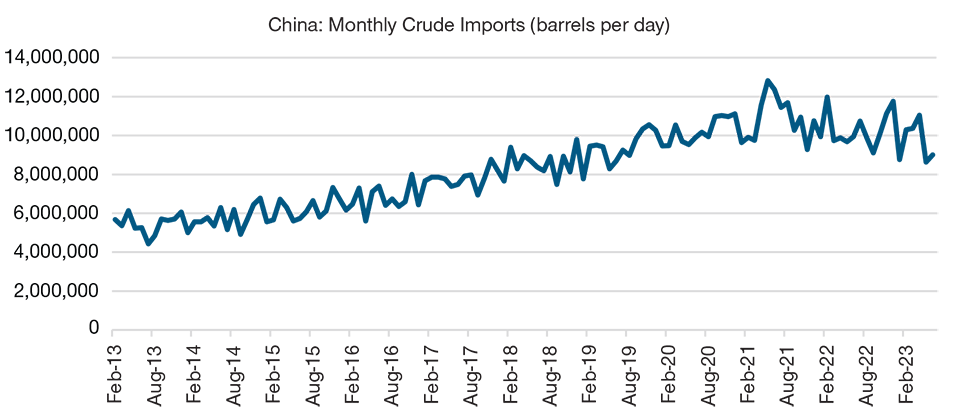

China’s Oil Imports Flat Since 2021

(Fig. 2) A sign of zero-COVID’s impact on domestic demand.

As of December 2022. All subsequent data represents estimates. Actual outcomes may differ materially from estimates. Source: Haver/China General Administration of Customs/T. Rowe Price calculations.

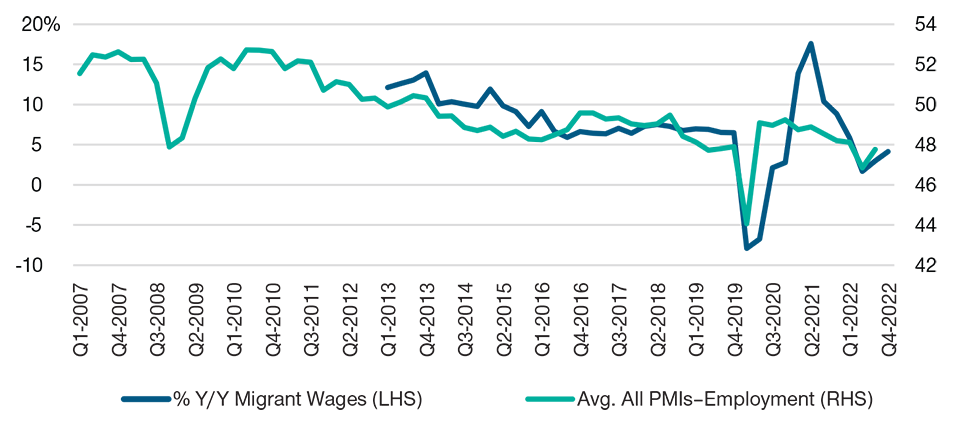

China Has No Wage Growth Pressures

(Fig. 3) Reopening is unlikely to trigger domestic wage inflation.

As of Q3 2022 (average PMI) and Q4 2022 (migrant wages).

Source: Haver/China NBS.

China’s Economic Reopening: Differences Versus Experience of Other Countries

One uncertainty related to China’s post-pandemic recovery will be how much scarring there is in the economy. While scarring fears on the demand side stemming from bankruptcies/lost income proved overrated in most other countries, China’s experience with zero-COVID has meant a prolonged period of sub-trend activity that has been different than elsewhere. China’s policy mix has also been geared mainly toward supply-side support and additional infrastructure investment while generally avoiding direct consumption support. Finally, China’s crackdown on the property sector post-2020 has added further downward pressure on the economy. This interacted with zero-COVID policies and likely amplified their negative effects.

In short, China’s zero-COVID economy had the following characteristics:

- A focus on maintaining industrial operations—exports remained strong throughout, with limited disruption only during the one to two months of Shanghai lockdowns.

- Heavy pressure on domestic consumption and “going out” activities, which disproportionately hit service-oriented SMEs (small and mid-size enterprises).

- Weak job creation—particularly in the youth segment—creating an overall rise in job insecurity and weak consumer confidence leading to a rise in precautionary savings. Household deposits rose by 7% of GDP in 2022 compared with a typical rise of 1% of GDP pre-pandemic.

- Low demand for credit—despite policies that have sought to lower interest rates on borrowing and targeted on-lending facilities.

- Below-trend demand for commodities, particularly oil but also industrial metals.

- Low/below-trend inflation. Core inflation trended down from 1% to 0.5% over the course of 2022. Headline inflation was higher at 2.5% due to higher energy and food prices, but has since fallen back. The policy target for inflation has remained unchanged at 3%.

Global Economy—Only Moderate Spillovers From China Reopening in 2023

We think that the positive impact on the global macro economy of ending zero-COVID will likely be moderate given that its negative effects should also have had limited spillovers. We expect to see:

- Some increase in commodity import demand, particularly oil and gas (estimated at 500k–1m barrels per day (bpd) for crude). A key debate is around where the natural trend in demand lies and how much of the recent increase is strategic buying for reserves. Consensus estimates coverage around 800k bpd; our estimates lean to the lower side.

- An increase in Chinese demand for other imports—mainly from Asia, but also more capital goods. The biggest negative changes in imports in 2022 versus prior-trend growth have been from Hong Kong, Singapore, Australia, Vietnam, Thailand, Japan, and the eurozone. The least affected have been Indonesia, Malaysia, the U.S., and Africa.

- Outbound travel/tourism may see a short delay in ramping up after reopening, e.g., three to six months due to constraints around resuming air service and approving passports/visas for travelers. It will likely have the biggest economic impact on Thailand but should also lead to modest positive spillovers for the rest of Asia.

- A resumption of international travel would also lead to some increase in capital outflows from China via the tourism channel, where we are likely to see a rise of around USD150 billion in outflows if we revert to pre-pandemic trends.

- Some upward pressure on global growth and inflation—though this comes at a time when the U.S./global outlook is for slower growth and moderating inflation. China’s economic reopening is unlikely to change the global trajectory on its own.

- An eventual return of inflation pressures onshore as demand recovers amid uncertain longer-term effects on the supply side of the economy, particularly services and smaller enterprises.

The experience of other countries is that post-pandemic reopening in the majority of cases has been broadly reflationary. China—by running against the global cycle—may see some relief from lower commodity price pressures. Only a handful of countries have seen limited rises in core inflation versus the large majority seeing upside surges. The lower inflationary outcomes mainly have been due to subpar performance in domestic demand. We conclude that China may be able to avoid some of the larger overshoots to inflation by having been more moderate in its direct consumer stimulus support and given the limited expectations for a rebound in fixed asset investment.

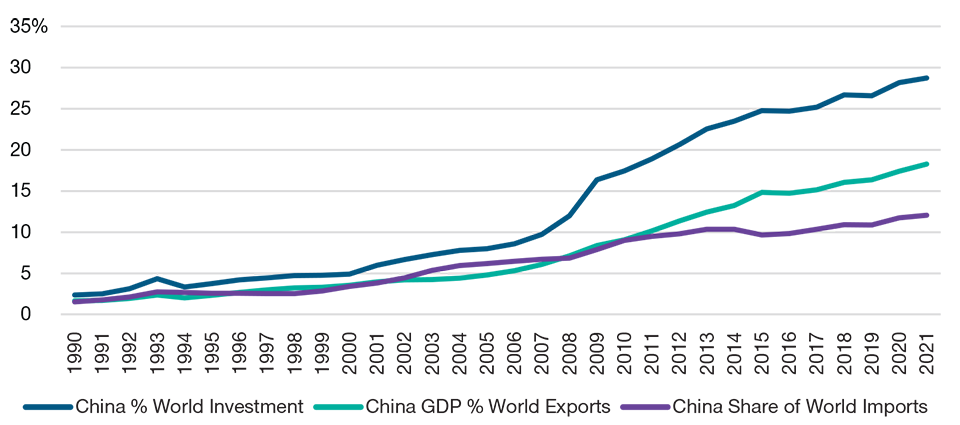

China: Until 2021 Few Signs of Deglobalization

(Fig. 4) China’s share of world imports, GDP, and investment.

Annual data to 2021. Most recent full-year annual data.

Source: Haver/IMF WEO.

Assessing the net impact of China reopening on global growth and inflation is complicated by the baseline outlook for a global slowdown and potential for recession later in the year or in 2024. Based on OECD estimates of trade in value added in recent years, China’s imports of goods are thought to account for about 2.5% of GDP on average in the rest of the world versus a higher 9%–10% share for the G-3 economies (the U.S., the eurozone, and Japan). A four-percentage-point increase in China’s domestic aggregate demand is estimated to only add about 10 basis points (bps) of GDP growth impulse to most developed economies and 30 bps to 50 bps to China’s closer trading partners in Asia.

The main potential spillover effect on global inflation will likely be via the commodity channel. However, if a global slowdown outweighs the 0.5-1% impulse China reopening gives to global demand, then the effect is more one of causing less disinflation at the headline level. We are also seeing the impact on the physical oil market play out in two stages, with the first stage being a softening in oil prices during the initial wave, followed by a recovery starting in the first and second quarters of 2023. The handoff between the improving momentum in China and the slowdown in the rest of the world will be the key determining factor.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

April 2023 / INVESTMENT INSIGHTS