June 2022 / INTERNATIONAL EQUITIES

China Is an Outlier in a COVID-Accepting World

Beijing remains cautious about a near-term policy shift

Key Insights

- China may shift from a zero-COVID policy only when the costs of containing the coronavirus exceed the benefits. A prolonged outbreak could crimp growth acceleration.

- The main growth stimulus efforts are likely to come from fiscal sources as policy shifts from deleveraging to pro-growth.

- Beijing could incentivize a capital shift from property to new growth areas, such as high-end manufacturing, electric vehicle supply chain, and IT hardware.

While governments across the world embrace living with COVID-19, China stands out in its steadfast adherence to a zero-COVID policy. Beijing is determined to check the spread of the coronavirus with partial lockdowns, tight border controls, quarantines, mass testing, and aggressive contact tracing.

While these measures have largely created resiliency in China’s supply chains and exports have held up reasonably well, sustained controls will exact a tax on the economy, although this would be followed by a period of strong growth when restrictions ease. The estimated hit to economic expansion varies from 0.5% to 3% on a full year basis depending on the intensity of control that needs to be maintained. In a scenario of full removal of COVID controls, we could see a sharp hit to growth followed by a stronger rebound in the second half of 2022. Still, any recurrence of an outbreak or a failure to rein in its spread could cap growth acceleration from here.

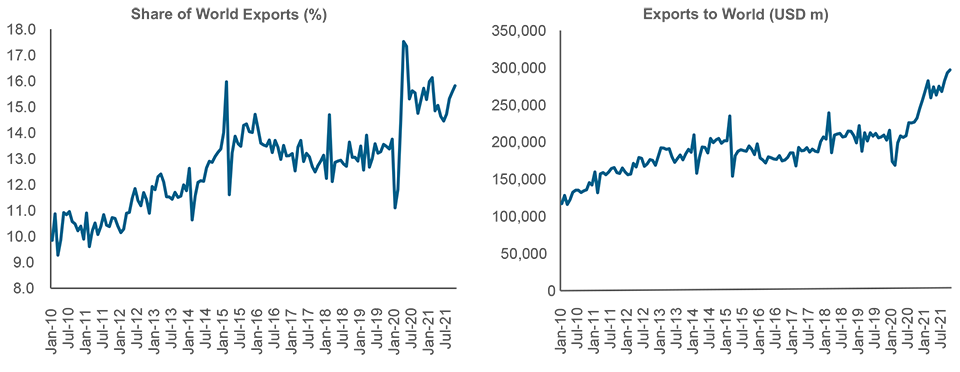

China’s exports beat expectations with trade surplus hitting USD 676.43 billion in 2021—the highest since records started in 1950—up from USD 523.99 billion in 2020. Exports rose 29.9% in 2021, increasing China’s share in the world export market. After a strong start to 2022, exports dipped sequentially for two months in a row following the latest round of restrictions. However, the net effect was a 9% growth in the first quarter, thanks to a strong January.

Supportive Policies

Even as questions swirl around the sustainability of China’s recovery, we think policy will shift from deleveraging to pro-growth this year given the 5.5% growth target. We expect the main stimulus effort to come from fiscal sources, especially spend-down of carry-over cash from previous years.

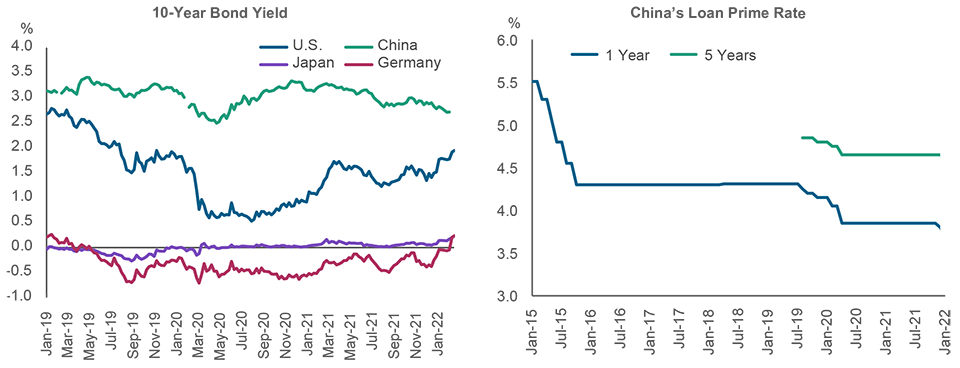

The credit impulse has started to pick up—while the People’s Bank of China’s (PBOC) target for credit growth is unchanged, for the GDP target to be met, the total social funding to gross domestic product (GDP) ratio needs to be cranked up. Although local expectations for monetary easing have increased with multiple open market operations and a required reserve ratio (RRR) cut, albeit smaller than expected, since the growth target was unveiled at the National People’s Congress (NPC) in March. We think expectations of monetary easing may be getting too aggressive, particularly if the aim is to add stimulus through regulatory and fiscal tools.

We think investing in China is no longer about chasing headline GDP numbers in the fast-evolving economy whose growth drivers are changing with a greater emphasis on self-reliance, technology upgrading, and “dual circulation” strategy.

The qualitative transformation from a labor-intensive to an engineering-intensive economy with the education dividend taking over from the demographic dividend is the key driver. This has opened up opportunities in a myriad of sectors. The change has also, manifested itself in the composition of the MSCI China Index sector breakdown—for example, financials now account for only 18% versus 35% a decade ago, while technology dominates with a 43% weight, a significant rise from 6% 10 years ago.1

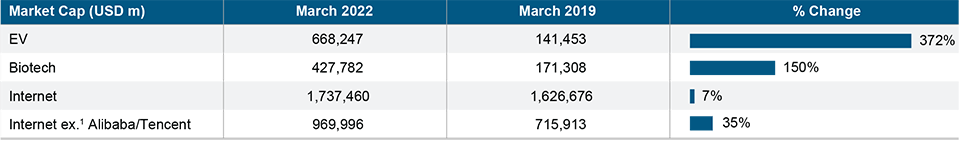

There are reasons for this surge. China’s R&D spend, at 2% of its GDP, is higher than European standards, and three sectors—electric vehicles (EVs), biotech, and internet—alone account for USD 2.8 trillion market capitalization (as of March 31, 2022). Innovation has become the major source of opportunity for wealth creation.

China Exports, Trade Surplus Surge

(Fig. 1) Gains larger share of global export market

As of October 2021.

Source: The International Monetary Fund, data analysis by T. Rowe Price.

Innovations: A Critical Driving Force for the Economy and Wealth Creation

Investment prospects are opening up in the “more productive” new areas of growth for China—such as more advanced manufacturing, environmental protection, health care, software, and some new internet models—under the recent government regulations. New secular growers in areas such as high-end manufacturing, the EV supply chain, and IT hardware are on the right side of government regulations and present good opportunities, in our view. We also believe that in the post-pandemic era, the world will need traditional industries to transition to a greener economy and meet climate goals, and that China will play an important role in that supply chain.

Innovations: A Critical Driving Force for the Economy and Wealth Creation

(Fig. 2) Investments flow into innovation-led sectors

1 The specific securities identified and described are for informational purposes only and do not represent recommendations.

For illustrative purposes only. This is not intended to be investment advice or a recommendation to take any particular investment action.

Sources: FactSet, Bloomberg Finance L.P.

Financial data and analytics provider, FactSet. Copyright 2021 FactSet. All Rights Reserved.

Property Shakeup, Dovish PBOC

We think the government will find a way to shift capital to these new growth areas from property by potentially offering direct or indirect stimulus. While the property sector has been pressured by tougher funding conditions both offshore and onshore, we feel the measures reflect Beijing’s ongoing efforts to deleverage and “fix the roof on sunny days.” The recent standardization of use of funds in escrow accounts is a relaxation of the earlier move when some cities went too far in restricting the use of funds for cash-strapped developers previously. We think the government has the right tools to avoid serious systemic risk and a “hard landing,” although a slowdown in the overall economy is inevitable as property and its related sectors account for almost one‑third of China’s GDP.

Property has been a major driver for China’s economy over the past two decades, and while policy so far in 2022 has been relatively cautious in providing support, the credit impulse is starting to gain traction, suggesting that the transmission of monetary policy easing is beginning to work. Mortgage lending has stabilized at the margin, although it has yet to pick up significantly, while corporate lending has started to accelerate.

The government is aware of the unintended consequences of last year’s regulatory crackdowns and is putting more emphasis on policy easing. Government support will be front-loaded, but it will take time to filter through the economy. The NPC did not mention more property-easing policies, but many local governments have already taken bolder actions at city levels. There are now 40 cities on mainland China that have lowered local mortgage rates and/or down-payment ratios. The PBOC has also urged Shanghai banks to boost mortgages and developer loans.

Both onshore and offshore defaults have been worse than expected over the last couple of months as the offshore funding market is effectively closed to the majority of issuers. And although onshore financing is still available, it is very much limited to the highest grade SOEs (state owned enterprises), and to the very best private sector issuers. While April’s PBOC meeting left interest rates unchanged on the heels of a smaller-than-expected RRR cut, it has stepped up other means of support to the economy as consumption, real estate, and exports took a hit in March. Authorities will guide financial institutions to expand lending and surrender profits to the real economy, the PBOC said recently.

Interest Rates in China Still Declining as Other Central Bank Turn Hawkish

(Fig. 3) PBOC has cut banks' reserve ratio and urged banks to support the economy

Past performance is not a reliable indicator of future performance.

As of January 2022.

Source: People's Bank of China/Haver Analytics.

Limited Fallout From Ukraine Conflict

The sanctions on Russia, that followed by the invasion of Ukraine, have stoked the prices of oil and many other commodities. While this has triggered inflation fears across the world, we think the effect on China will be contained given that the oil trade deficit adds up to only a small percentage of GDP (gross domestic product) and because it has one of the lowest consumer price index (CPI) inflation rates among major economies. So there is more room to absorb this second-order impact compared with other countries.

Inflation has remained low for some time at the core level (excluding food and energy) and although the fallout from the Russia-Ukraine conflict will be inflationary at the headline level, with an initial impact via first-round fuel prices then food prices, the second-round impact will likely be relatively contained until we see more upward traction on growth later in 2022. The Chinese economy is running with surplus capacity in a range of areas, and a downward bias to home prices remains an important factor for containing core inflation.

On the economic front, we think the Russia-Ukraine conflict will complicate China’s efforts to stabilize its economy this year around an expected 5% growth target, mainly via potential downward pressure on export demand as well as higher commodity input prices.

We expect that this will push Beijing policymakers to extend incremental stimulus. Downstream inflation remains low, which not only gives the PBOC room to continue to ease even in the face of higher upstream prices, but also means that the impact continues to be felt more in corporate margins of intermediate/downstream players. We continue to expect easing to come via fiscal and regulatory easing channels on the credit/housing sides while monetary policy plays a supporting role via a potential rate and a further RRR cut.

The inflation target is set at 3% as per past years; inflation is currently running just over 2% but will rise as food price base effects from high pork prices roll off and higher commodity prices are passed through. That said, underlying core inflation remains very low and gives the PBOC space to ease further.

Sticking With Zero-COVID Policy in 2022

China has been very cautious about relaxing its zero-COVID strategy ahead of key events this year, China was very cautious about relaxing its zero-COVID the Winter Olympics in February and the National People’s Congress in March. Later this year, Beijing will host the BRICs summit as well as the 20th National Congress of the Chinese Communist Party, arguably the most important political event of 2022, when President Xi Jinping will seek a third term in office.

Thus, it is highly likely that Beijing will continue with the current dynamic zero-COVID strategy, which, at least until the recent omicron variant outbreak, has been successful in reining in any widescale spread.

While the zero-COVID policy has been modified to allow for more targeted efforts to manage outbreaks, moving away from this policy completely remains a work in progress. There are signs of plans being lined up with a target date for late 2022 or early 2023 based on a third round of vaccinations, stockpiling therapeutic drugs, creating test zones, and slowly opening to the world. However, these plans remain nascent and have not been officially articulated.

While it is hard to take a call on the timing, a shift in the zero-COVID strategy could be triggered when the costs of containing the virus start to exceed the benefits. For example, if prolonged omicron lockdowns start to seriously hurt the economy by disrupting supply chains and reducing consumer demand. On the positive side, a change may still come about if Beijing is confident that a treatment is available that would allow the health care system to better handle the situation. We expect such a change to be signaled much in advance.

The April lockdowns and temporary closures of factories in Shanghai and Jilin will clearly have a negative impact on consumption and GDP in the second quarter. Although this is the largest outbreak in mainland China since 2Q2020, we have faced similar scenarios before. The last outbreak in 2020 turned out to be a good buying opportunity for investors as the equity market quickly recovered after investors looked past the restrictions.

Policy Support at the National People’s Congress

At the recently concluded NPC, the annual GDP growth target for 2022 was set at “around 5.5% year on year,” which is higher than the last quarter of 2021’s 4%, as well as above market expectations. This suggests there could be stronger stimulus measures in the pipeline. Authorities also indicate tax cuts as the main source of support to the economy.

While there looks to be a strong desire to avoid using housing as a tool to reflate the economy, there is also a recognition that policy has swung too far in the tightening direction and needs to loosen somewhat to get back to neutral. We expect there will be ongoing pressure to incrementally loosen to revive homebuying demand.

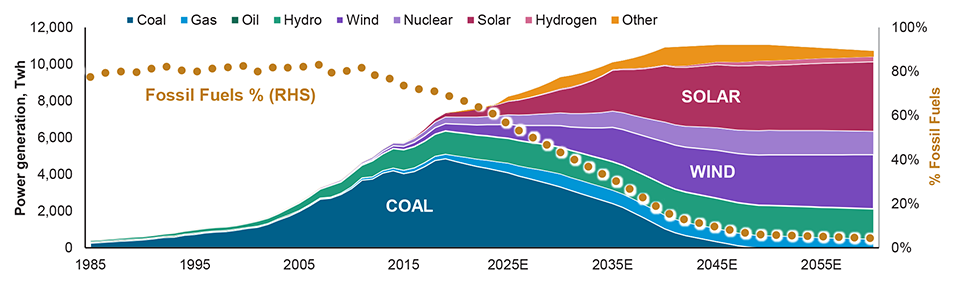

In a departure from earlier practice, no target was set for “energy intensity,” which gives authorities greater flexibility to favor growth over controlling pollution. Decarbonization goals have been flexibilized. For example, specific yearly targets to reduce energy/carbon consumption have been shifted to energy intensity targets with a multiyear time frame given as the metric. The aim appears to be to smooth the impact on GDP and not repeat the mini-energy shortages seen in Q3 last year. There also appears to be a renewed focus on domestic energy security and stockpiling sufficient reserves of key commodities, including coal, although the target remains to get to peak carbon by 2030.

Transformation of China’s Power Generation Profile

(Fig. 4) Growing share of clean energy

As of December 31, 2020. Twh = Terra Watt Hour, a unit of energy equal to an output of one trillion watts for one hour.

Source: Goldman Sachs Global Investment Research.

Unlike the U.S., we think China has the ability to ease monetary policy; so in this sense, China is in better shape relative to other markets as it has more room to maneuver. While we saw a lot of noise around regulatory crackdowns last year as Beijing was “fixing its roof on sunny days,” we think the priority has shifted from addressing structural issues to stabilizing growth in the current year. We believe that the regulatory cycle has peaked, liquidity has improved, and excessive valuations of the past have corrected—all supportive factors for the market.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.