August 2023 / INVESTMENT INSIGHTS

2023 Aggregate Proxy Voting Summary

Key trends in T. Rowe Price’s proxy voting activity over the past year.

Executive Summary

In this report, we summarise the T. Rowe Price Associates (TRPA) proxy voting record for the 12-month reporting period ended June 30, 2023. Our goal is to highlight some of the critical issues in corporate governance during the period and offer insights into how we approach voting decisions in these important areas. This report is not an all‑inclusive list of each proxy voted during the year but, instead, a summary of the year’s most important themes.

Thoughtful Decisions Leading to Value Creation

At T. Rowe Price Associates, proxy voting is an integral part of our investment process and a critical component of the stewardship activities we carry out on behalf of our clients. When considering our votes, we support actions we believe will enhance the value of the companies in which we invest, and we oppose actions or policies that we see as contrary to shareholders’ interests. We analyse proxy voting issues using a company‑specific approach based on our investment process. Therefore, we do not shift responsibility for our voting decisions to outside parties, and our voting guidelines allow ample flexibility to account for regional differences in practice and company‑specific circumstances.

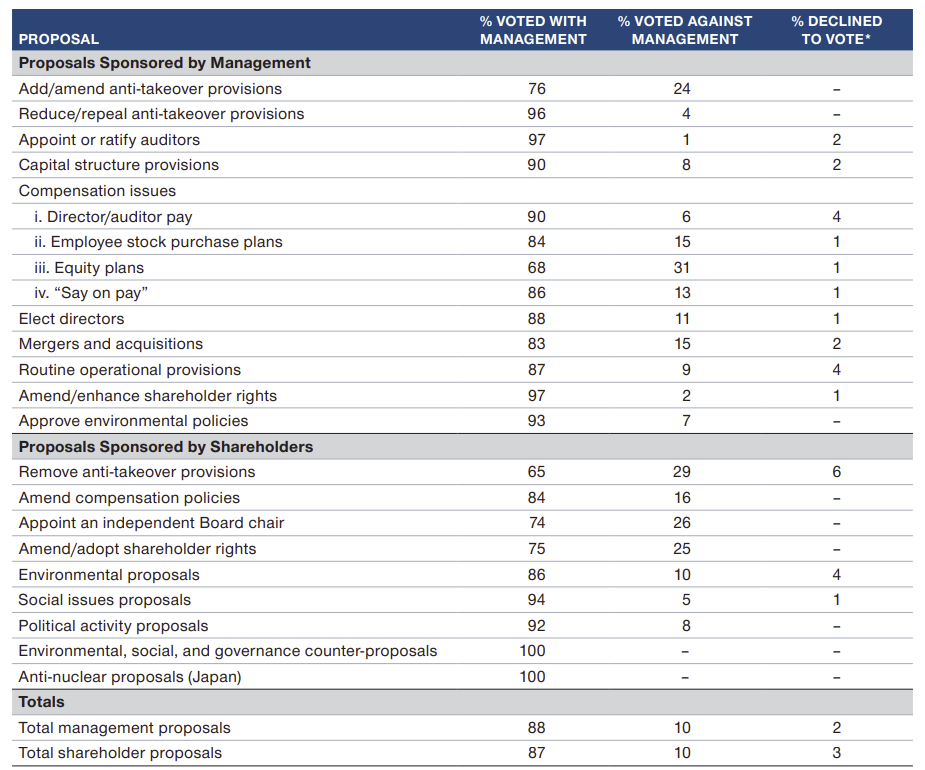

The following table is a broad summary of some of our proxy voting patterns and results for the reporting period covering July 1, 2022, through June 30, 2023, across our global equity-focused portfolios.

Summary of Major Proposal Items

*TRPA endeavors to vote every ballot we are eligible to cast. On rare occasions, we submit ballots with instructions not to vote, for technical reasons. Primarily,

these are situations where (1) there is a contested election with multiple ballots and we can only vote on one, or (2) countries where investors must give up their

ability to trade their shares in order to vote.

Themes From Vote Results

The categories above represent a subset of our total voting activity during the reporting period, but these are the most prevalent and significant voting issues. In the following section, we discuss some of these categories in detail.

In this voting period, we have identified two distinct but related trends that stand out. The first is a continuing decline in our overall support levels for shareholder proposals of an environmental or social nature. The second is a broadening out of our voting guidelines to reflect the different needs of our investing clients who choose investment mandates emphasising not only financial returns but also environmental or social impact.

Social, Environmental, and Political Proposals

While shareholder resolutions can be an effective means of instigating change under certain circumstances, in most cases we find that direct engagement and the election of directors are more targeted ways for investors to express reservations over a Board’s oversight of strategic, financial, human capital, environmental, or other issues related to the company’s performance.

Over the past two years, issues such as racial justice, income inequality, worker safety, and climate change had been on prominent display within the corporate sector due to a confluence of events, including the coronavirus pandemic. Shareholder resolutions addressing such issues received notably higher‑than‑average support in 2021 from certain investors and higher visibility when compared with previous years, although these support levels began to subside in 2022.

In this most recent proxy voting season, investor support for such resolutions was relatively low. There are multiple reasons for this outcome. It began when the U.S. Securities and Exchange Commission (SEC) decided to allow more proposals across a wider range of environmental and social topics to move forward. Since that time, the number of environmental and social resolutions voted on at companies within the S&P 1500 Index rose 74%, from 170 in the 2021 season to 296 this year.

The traction that so many of these resolutions gained in 2021 seemed to not only attract a new set of proponents in the subsequent two years but also inspired experienced proponents to expand their topics of advocacy. Our observation is that the increase in the volume of proposals resulted in a decrease in their overall quality. We observed more inaccuracies in proposals, more poorly targeted resolutions, and more proposals addressing non‑core issues. In addition, we observed a marked increase in the level of prescriptive requests. Proponents moved swiftly from disclosure‑based requests seeking additional reporting on environmental, social, and governance (ESG) matters to action‑based requests seeking specific commitments, capital investments, or structural changes from the targeted companies.

Our view on these prescriptive proposals is that they usurp management’s responsibility to make operational decisions and the Board’s responsibility to guide and oversee such decisions. Our overarching framework for determining how to vote on these proposals uses an economically centered, returns-focused lens. We do not believe it is consistent with our fiduciary duties to support proposals that, intentionally or not, are designed to impose burdensome requirements on the corporation that have no clear path to long-term value creation.

Amid this activity by shareholders, changes in the geopolitical landscape prompted investors and issuers to widen the scope of previous discussions around the shape an energy transition may take and the importance of energy security.

Another important development over the past three years is the pace at which issuers have collected and disclosed decision-relevant data on environmental and social considerations. When a company’s ESG disclosures are comprehensive and quantitative enough to meet our needs as investors, we are less inclined to support shareholder resolutions seeking additional reporting.

Finally, there was a marked increase this year in activity by advocacy groups known to be critical of using ESG considerations in corporate decision-making. Previously, these ESG counter-resolutions were rare, but so far in 2023 we have voted on dozens of them across our portfolios.

Read the full summary here:(PDF)

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.