March 2021 / INVESTMENT INSIGHTS

U.S. High Yield Bonds Should Benefit From Improving Fundamentals

The asset class offers current high income, lower rate sensitivity

Key Insights

- The U.S. high yield bond market offers an attractive combination of higher income and lower interest rate sensitivity relative to investment-grade bonds.

- We expect defaults in the asset class to decrease to below longer-term averages in 2021 amid the expected economic reopening and improving fundamentals.

- We are broadly focusing on issuers with improving credit quality and are still finding value in select names related to travel and in the energy industry.

With interest rates still historically low but increasing amid worries about inflation, the U.S. high yield bond market offers an attractive combination of higher income and lower duration1 relative to investment‑grade bonds. We expect defaults in the asset class to decrease to below longer‑term averages in 2021 amid the expected economic reopening and broadly improving fundamentals, but rigorous credit analysis is still vital.

Going into the 2020 economic downturn, the U.S. below investment‑grade bond market had benefited from 10 years of economic expansion and improved credit fundamentals. From 2007 through the end of 2020, the amount of outstanding higher‑quality bonds (BB rating) increased by more than 50%, while the combined amount of lower‑rated bonds (B and CCC) decreased by 30%.2 The 2020 crisis brought higher‑quality fallen angels—bonds downgraded from investment grade into the high yield category—into the market, further contributing to a higher overall credit quality in the asset class today than in the past.

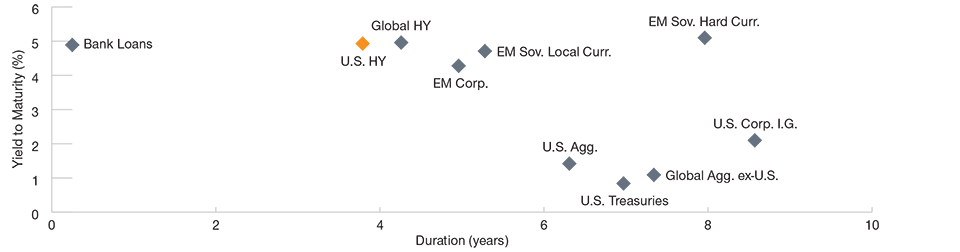

Healthy Income and Lower Duration

Even after the shift toward higher quality, the U.S. high yield bond market currently provides healthy income relative to investment‑grade sectors. As of the end of February, the Bloomberg Barclays U.S. High Yield Index yielded 4.9%. In contrast, the broad investment‑grade Bloomberg Barclays U.S. Aggregate Index yielded only 1.4%, and the Bloomberg Barclays U.S. Corporate Investment Grade Index’s yield was 2.1%.

Higher Income With Lower Duration

Duration and yield across fixed income sectors

As of February 28, 2021.

Past performance is not a reliable indicator of future performance.

Sources: Bloomberg Finance L.P., T. Rowe Price, and J.P. Morgan Chase (see Additional Disclosures).

Indexes used: U.S. Treasuries: Bloomberg Barclays U.S. Treasury Index; U.S. Aggregate: Bloomberg Barclays U.S. Aggregate Index; U.S. Corp. I.G.: Bloomberg Barclays U.S. Corp. I.G. Index; U.S. High Yield: Bloomberg Barclays U.S. High Yield Index; EM Sovereign Hard Currency: J.P. Morgan EMBI Global Diversified; EM Corporates: J.P. Morgan CEMBI Broad Diversified; EM Sovereign Local Currency: J.P. Morgan GBI EM GD Index; Global Aggregate ex-U.S.: Bloomberg Barclays Global Aggregate ex-U.S. Index; Global High Yield: Bloomberg Barclays Global High Yield; Bank Loans: JPM Levered Loan Index.

Yield and duration are subject to change.

Rates could continue to increase meaningfully as global economies more fully reopen later in 2021 after vaccines are more widely distributed. The U.S. below investment‑grade market is much less exposed to interest rate risk than investment‑grade sectors. The duration of the Bloomberg Barclays U.S. Corporate Investment Grade Index was 8.6 years at the end of February, meaning that its price would decline approximately 8.6% if interest rates increased by one percentage point. The duration of the Bloomberg Barclays U.S. High Yield Index was only 3.8 years on February 28.

As investors seek instruments with lower duration profiles to combat rising interest rates, the bank loan market should offer compelling assistance. Because bank loans pay a floating coupon rate that generally resets quarterly, they have minimal interest rate risk. Loans are also higher in an issuer’s capital structure than bonds, so they receive repayment priority in the event of default. Recent credit spreads3 for the same issuer’s loans and bonds have been close to equal, so we believe the market is not fully reflecting the more attractive characteristics of loans. We have maintained a meaningful allocation to bank loans4 partly because of their unique low‑duration characteristics.

Ongoing Improvement in Fundamentals

We expect the fundamentals of most U.S. high yield issuers to improve as the economy continues to reopen and expand. Further fiscal stimulus, which appears likely, should strengthen this process. At the end of 2020, the default rate in the asset class was running near 6%.5 We think that this may decline to below the long‑run average in 2021. After the flood of fallen angels in 2020, we anticipate that there will be opportunities to buy future rising stars—bonds upgraded from high yield to investment grade—this year. We believe that our relatively concentrated portfolio and focus on credit research should allow us to benefit from opportunities in improving credits.

Selectivity Is Key to Source Value

Our process for selecting individual names to include in the strategy relies on the insights of our dedicated team of U.S. high yield credit analysts. Environmental, social, and governance (ESG) analysis is a key component of the credit research process. ESG insight can help us identify issuers that are more optimally positioned for the long term while also helping us assess risks associated with ESG factors.

In terms of credit quality positioning, we broadly favor the single B rating segment, which is where we are finding the most relative value after the compression in credit spreads as the market recovered from the March 2020 sell‑off. We also have positions in issuers that may have lower ratings from external rating agencies—we select these holdings when our forward‑looking proprietary research reveals that they are, in our view, higher quality than their credit ratings convey and may be primed for an upgrade. Within the BB rating segment, which is more exposed to rising rates, we seek to balance the interest rate risk against select improving credit stories that may return to investment grade.

We have been finding select credits in industries related to travel and leisure that still trade at spreads that represent attractive value. In addition, we favor some issuers in the energy sector because we think that oil prices can remain resilient as economic growth accelerates. We believe that our flexible approach to managing a U.S. high yield strategy and experience over many past credit cycles gives us the ability to navigate the volatile environment as the economy emerges from the pandemic.

What we’re watching next

Our outlook for improving fundamentals and a declining default rate in 2021 should mark the beginning of another credit cycle. Since the global financial crisis of 2008–2009, credit cycles have become more compressed, so we will be monitoring issuer fundamentals going into 2022 for signs of broad deterioration.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.