June 2023 / INVESTMENT INSIGHTS

ESG Integral to Emerging Markets Corporate Bond Investing

ESG-labeled bonds gain momentum, but monitoring credentials is vital

Key Insights

- We integrate environmental, social, and governance (ESG) factors throughout our investment process—from our research right through to our investment decisions and ongoing monitoring.

- ESG factors have become critically important in the emerging markets credit space, with companies much more aware of the potential negative consequences from acting badly in terms of ESG.

- We expect the shift away from fossil fuels toward renewables to gather pace, with some countries and regions better placed than others to transition.

For this Q&A, we sit down with Siby Thomas, co‑portfolio manager for the Emerging Markets Corporate Bond Strategy, to discuss the importance of environmental, social, and governance (ESG); his approach; and the key trends to watch out for in this space in the future.

Q1: How do you think of ESG factors within your investment process?

ESG considerations are an important part of our investment process and framework that we incorporate in aiming to enhance investment outcomes.

Our philosophy consists of three core tenets: integration, collaboration, and materiality. First, integration is key as we embed ESG analysis throughout the investment process—from our research right through to our investment decisions and ongoing monitoring. Second, collaboration means that we work closely together with our dedicated in‑house responsible investing and governance teams. The third tenet is materiality as we focus on ESG factors that we consider the most likely to have a material impact on investment performance, either positively or negatively.

In emerging markets (EMs), we believe that it’s important to look at potential investments through a range of lenses. We emphasize the need for cognitive diversity in our approach and believe that ESG offers us another angle to do this. During our research process, our dedicated emerging market credit analysts assess a variety of fundamental factors, including traditional balance sheet metrics alongside corporate governance and other ESG factors. This helps us to gain a holistic credit assessment of the company, which is essential, given the potential higher risks inherent in emerging markets lending. The incorporation of ESG analysis is supported by inputs from our in‑house responsible investing and governance teams and our proprietary responsible investing evaluation tool. This approach can help uncover considerations that more traditional financial analysis may overlook, which we believe gives us a potential competitive edge.

Our ESG Integration Philosophy

Three core tenets fundamental to our approach

As of March 31, 2023.

ESG considerations form part of our overall investment decision making process alongside other factors to identify investment opportunities and manage investment risk. At T. Rowe Price this is known as ESG integration.

For certain types of investments, including, but not limited to, cash, currency positions, and particular types of derivatives, an ESG analysis may not be relevant or possible due to a lack of data. Where ESG considerations are integrated into the investment research process, we may conclude that other attributes of an investment outweigh ESG considerations when making investment decisions. As part of our wide range of investment products we also offer products with specific ESG objectives and/or characteristics.

Source: T. Rowe Price.

Q2: How important are ESG factors in the EM credit space?

ESG factors have become critically important in the EM credit space. Companies are now much more mindful of the risks of being a so-called bad actor in terms of ESG and how that could potentially be detrimental to their ability to access funding in the future. A few years ago, such a penalty might not have been so high, but with the rise in importance of ESG, companies are much more aware of the potential negative consequences from behaving badly.

Generally, ESG trends among EM companies have been improving, although there is still a long way to go. We believe it’s important to focus on where EM companies are going to be in five or 10 years from now, but ESG data are often backward‑looking. That is why company engagements are so vital to help us gain a better understanding of the company’s ESG goals. Engagement is also an opportunity to influence corporate behavior and potentially drive positive change in terms of ESG. For example, last year, a Brazilian media company approached us for guidance around sustainability. This led to us helping the company develop a sustainability framework, and it then went on to issue its first sustainability‑linked bond.

Q3: What are the ESG trends to watch for within EM credit?

First is the shift away from fossil fuels toward renewables, which we expect to gather pace. It is likely to hit EMs differently, with some places—such as Latin America—potentially better positioned to transition because they have hydropower and other sources of energy available. It may be harder for companies located in South Africa and India as there are fewer sources of natural transition, so they will need to be more strategic in their transition approach.

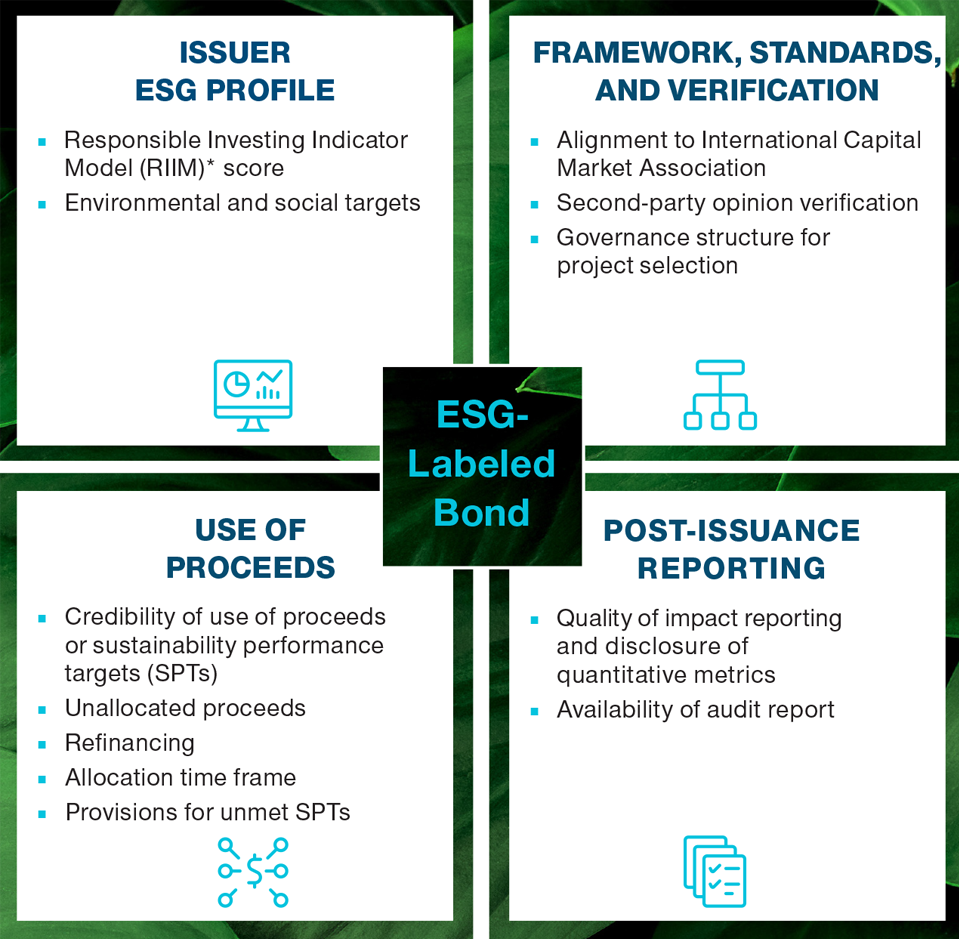

ESG‑Labeled Bonds—Evaluation Framework

Four pillars are key to T. Rowe Price’s assessment

As of March 31, 2023.

*T. Rowe Price’s proprietary RIIM framework designed specifically to help portfolio managers and analysts integrate ESG factors into their investment process, as appropriate to their strategy.

Source: T. Rowe Price.

Second is demand for customization. Clients and prospects have their own ESG values to which they want us to be aligned. This might take the form of more stringency around corporate governance or a particular focus on the environment or social factors. As a result, we are partnering with clients on customized solutions that aim to serve their specific ESG values and needs.

Third is the market for ESG‑labeled bonds. We expect that the market share of ESG‑labeled bonds in EM credit will keep on growing, but caution is warranted as this fast‑growing, yet still nascent, category has proven vulnerable to greenwashing—where some issuers provide misleading information about the environmental credentials of an organization’s products, services, and investments. For example, there are signs of companies selling ESG‑labeled bonds for environmental/social projects that lack credibility, or, in the case of sustainability‑linked bonds, they set targets that are either easy or have already been achieved. Therefore, fundamental research is critical. We utilize our firm’s proprietary ESG bond framework when considering an ESG‑labeled bond, which helps to evaluate the quality and credentials of a labeled bond as well as helps to ascertain whether we should pay the “greenium”often associated with these types of bonds.1

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.