As Japan Looks to the Future, Productivity Is the Key

Key insights

- Challenging demographics represent one of the biggest risks to Japan’s long‑term growth outlook.

- Crucially, however, Japan is taking action to counteract this challenge, and the focus of these efforts—from both the public and private sectors—is on boosting productivity.

- The imperative to act means that Japan is pioneering new and innovative productivity‑enhancing solutions, pushing the boundaries of what is possible today.

When you strip economic growth back to its basic parts, it is essentially powered by population growth, particularly a growing labor force, and improving productivity. In applying this equation to Japan, the country’s challenging demographic trends are well documented—an aging and shrinking population represents perhaps the biggest risk to Japan’s long‑term growth outlook. Crucially, however, Japan is taking action to counteract this challenge. And the magic word is “productivity.”

Japan is not the only country facing the modern reality of challenging demographics. However, among the world’s advanced economies, it is the country where the problem is most pronounced and, thus, where the imperative to act is most urgent. Accordingly, Japan is leading the way in pioneering new and innovative solutions aimed at boosting productivity.

Efforts to boost productivity are being driven by both the public and private sectors in Japan. On the public side, a focus on broad structural reform is creating a more flexible and dynamic working environment, with increased workplace participation a key objective. Meanwhile, the private sector also understands the need to boost productivity in order to stay globally competitive. Companies are investing in new technology and systems with the aim of encouraging smarter, more efficient work practices.

Structural Workplace Reform Has Laid the Groundwork

One of the principal “arrows” of Abenomics has been the overhaul of Japan’s corporate environment, in order to improve efficiency and encourage greater investment inflows. Significant progress has already been made here, most notably in the form of improved standards of governance and a new framework of tighter regulatory control. At the same time, a range of government initiatives, from new laws and policies to investment in infrastructure to financial incentives for companies, have all been specifically aimed at encouraging a more inclusive, and dynamic, Japanese workforce.

The historically inflexible nature of Japan’s labor market goes some way toward explaining why Japanese productivity has slipped behind global peers over recent decades. Tradition and culture meant that jobs were generally considered to be for life, creating limited competition and few opportunities for advancement, and so little incentive to move. This kind of inflexibility has a negative impact on productivity, in three key ways.

- It tends to lead to overstaffed, inefficient workforces where necessary downsizing in leaner times is difficult.

- With limited movement of employees between companies, the important function of regular sharing of best practices is lost.

- With little incentive to move jobs, employees are less likely to continue developing new skills throughout their career.

However, the legal confines that once enabled, even encouraged, companies to provide lifetime employment have today been largely removed. While it will take time for the ingrained one‑company “salaryman” mentality to unwind, the benefits of free and open movement are already apparent, with evidence of shared best practices between companies as well as increased employee upskilling, as competition for jobs intensifies. Businesses are also employing more staff on temporary or contract bases, which makes for a more flexible and efficient pool of labor than was possible in the past.

“Womenomics” Is Central to Japan’s Economic Growth Agenda

Meanwhile, Prime Minister Shinzo Abe has emphasized Womenomics—dedicated to making it easier for women to rejoin the workforce—as a central component of his economic growth agenda. A large percentage of Japanese women leave the workforce after their first child, and many never return to full‑time employment. In response to this problem, the government has announced several initiatives, including:

- Extending paid parental leave.

- Expanding child care services, including building more dedicated facilities.

- Increasing the number of women in company management roles to 15% by 2020.

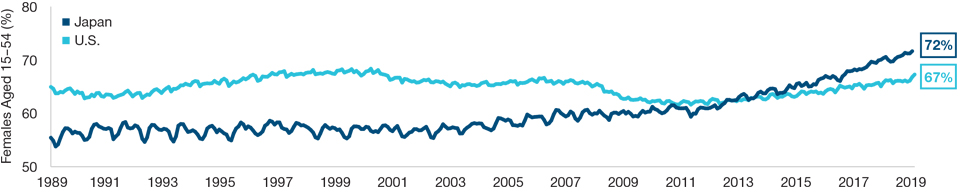

Figure 1 highlights the success that these policies are having in encouraging more women back into the Japanese workforce. The percentage of working‑age women in employment reached a record‑high 72% in September 2019. This compares with a 67% female employment rate in the U.S., with the gap widening noticeably over the past five years.

However, there is still more to do. Japan’s gender pay gap, for example, remains one of the widest in the world, and closing this will be crucial for encouraging more women to stay in, or return to, the workforce. Also, the sharp increase in female employment over the past 10 years has been driven by a rise in the number of women working in part‑time or non‑regular jobs. This is encouraged by a tax framework that penalizes higher‑income‑earning households. Policy reform in this area, therefore, could see more women return to full‑time employment.

Encouraging older workers to remain in the workforce for longer is another government priority to help boost productivity. In 2013, a rise in the mandatory retirement age started to be phased in, from 60, rising to 65 by 2025. The government has also introduced subsidies for companies that employ or retain staff beyond retirement age. Meanwhile, companies are also realizing that valuable skills and experience can be retained for longer.

(Fig. 1) Efforts to Boost Japan’s Female Workplace Participation Are Working

Percentage of Japanese women in employment notably exceeds the U.S.

As of September 30, 2019

Source: T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved.

Private Sector Investment Is Also Driving Productivity Gains

Crucially, after decades of underinvestment, the private sector is also beginning to act, with more Japanese companies investing in human and physical capital and pioneering new and innovative productivity‑enhancing solutions. Born of necessity, these companies are pushing the boundaries of what is possible today and, in the process, setting new standards.

Japanese companies, for example, are investing heavily in automation and artificial intelligence technologies with the aim of improving or optimizing processes. In turn, this could potentially alleviate many of Japan’s social challenges, such as resolving labor shortages, releasing people from overwork, and improving productivity across a range of industries. While we are still in the relatively early stages of these disruptive trends, Japanese companies, both large and small, are increasingly utilizing intelligent machines and automation technologies. As this trend continues and broadens across industries, the impact on Japanese productivity could be significant. The most significant impact could potentially be felt in Japan’s service sector, where productivity lags that of the U.S. by some margin.

Leading the Way in Robotic Process Automation

One of the hottest developing areas in technology currently is in service‑industry software, like robotic process automation (RPA). This is technology that can speak, hear, read, conduct transactions, and automate process‑oriented work. While it is increasingly being used in all industries, more process‑driven businesses, such as banks, insurers, utilities, and telecom companies, are the biggest adopters so far. The software is helping these companies to automate procedural and repetitive tasks that would otherwise be done by human workers. If you consider that these industries currently employ thousands of people to do this kind of process‑driven work, it is not hard to see the efficiency‑creation potential offered by RPA software, enabling vast amounts of work to be automated. This is potentially transformational for Japan in terms of the productivity‑enhancing outcomes.

RPA Technology Is Potentially Game‑Changing for Productivity

As an early mover, Japan is leading the way in productivity‑enhancing solutions

Pioneering Investment in Potentially Disruptive Technologies

One company that believes in the disruptive, productivity‑boosting potential of RPA technology is SoftBank. In late 2018, the Japanese multinational conglomerate invested USD 300 million in U.S. startup business Automation Anywhere, which specializes in the field of automated technology. Investing via its Vision Fund, SoftBank is at the forefront of identifying and investing in disruptive technology businesses that it believes have the potential to lead the next age of innovation.

Abenomics has laid the crucial groundwork, delivering necessary structural reform, creating jobs, and encouraging investment. However, if Japan is to counteract its long‑term demographic challenges, then improving productivity is the key. To this end, efforts to boost workforce participation are bearing fruit, and this is an ongoing positive trend. Meanwhile, closing the productivity gap between the manufacturing and service sectors in Japan is also a priority. We can already see a positive dynamic starting to develop here, with the private sector investing in new technologies and systems, which is driving a “smart” upturn in service‑sector productivity. Importantly, the combination of public and private sector efforts could deliver a meaningful boost to Japanese productivity, counteracting demographic challenges and paving the way for potentially sustainable long‑term growth.

1 Source: Financial data and analytics provider FactSet. Copyright 2019 FactSet. All Rights Reserved. As of September 30, 2019.

The specific securities identified and described are for informational purposes only and do not represent recommendations.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

201911‑1019112