A New Era of Active Management Looms

Key insights

- The strong returns of passive strategies since the financial crisis have been driven by central bank quantitative easing (QE), but we believe this period is coming to an end.

- As the impact of QE recedes, returns are likely to fall and cross‑sectional volatility is likely to return.

- In order to gain from rotation within and between asset classes, investors may benefit from putting active strategies at the core of their portfolios.

The surge in popularity of passive investment strategies has been one of the most notable developments in markets since the financial crisis. This has led to frequent—and often intense—debate over the merits of active investing versus tracking an index. However, these discussions frequently ignore the context in which passive investment strategies have grown and the specific risks associated with them. As the global economy moves into the next phase, investors may be forced to reevaluate how they use passive investments—and what returns they can expect from them.

It is not difficult to understand why passive investments have become so popular. For one thing, they are relatively easy to manage—investing in a passive strategy does not require the same effort as researching, selecting, and monitoring good managers (and firing bad ones). In addition, the fees of passive investments are typically cheaper than those of active funds, although some large investors may negotiate fees on active mandates that are comparable to passive strategies. As passive strategies typically follow an index, underperformance risk is also lower than with active strategies. And perhaps most importantly, passive strategies have delivered strong performance over the past decade as asset prices have rallied since the financial crisis.

Central Bank Stimulus Has Created a Perfect Environment for Passive Mandates

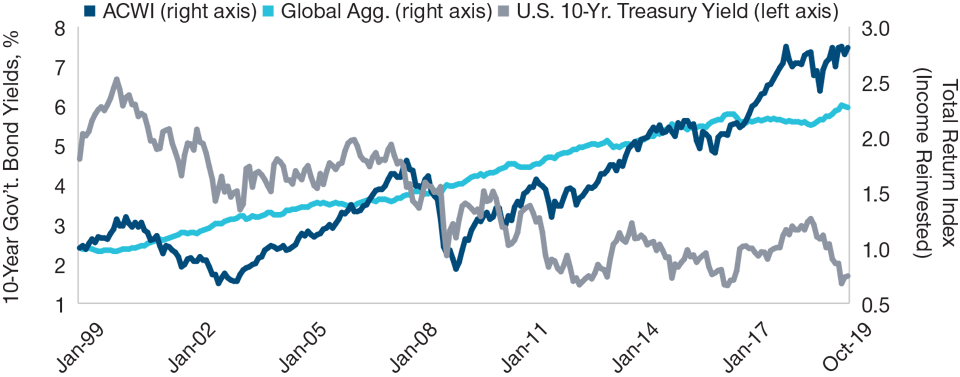

The strong returns of passive strategies since the financial crisis have been driven by central banks: Ultralow and falling interest rates, combined with trillions of dollars of quantitative easing (QE), have caused valuations to balloon since 2008 (see Figure 1). Market returns (beta), upon which passive strategies are built, have been much higher than excess returns (alpha) during this period. This era is almost certainly over, however. There is a limit to how much more QE central banks can administer, its impact is questionable, and given current valuations, expected returns of equities and bonds are diminishing—or at least they are much lower than market returns since 2009.

(Fig. 1) How QE Has Kept Markets Afloat

The performance of stocks and bonds over 20 years

January 1999 to October 2019

Past performance is not a reliable indicator of future performance.

ACWI = MSCI AC World Index, Global Agg. = Bloomberg Barclays Global Aggregate Index Hedged USD, and U.S. 10-Yr. Treasury Yield = Generic U.S. 10-year Treasury yield. Performance of ACWI is cumulative and measured in U.S. dollars. Performance of Global Agg is cumulative and hedged in U.S. dollars.

Sources: MSCI and Bloomberg Index Services Limited (see Additional Disclosures). Analysis by T. Rowe Price.

Even if more rounds of QE are announced, it is unlikely that interest rates on 10‑year bonds will fall by anything like the same degree that they have fallen since the financial crisis. When beta return is 10%, an alpha of 2% is nice to have, but not essential. When beta return is 5%, an additional 2% from alpha could be critical. In this environment, investors will face the choice of either accepting lower returns or adopting a different strategy in pursuit of similar returns.

As the impact of QE recedes, cross‑sectional volatility (the spread of performance between different sectors and securities) is also likely to return. When markets are flooded with central bank money, most assets are lifted, and selectivity becomes less important as investors can effectively “buy” the market and enjoy the ride upward. When markets return to more normal conditions, dispersion between sectors and securities is likely to reappear, bringing opportunities for a good asset manager to select outperforming investments and underweight lagging investments. At the extreme, when all securities move in the same direction, active management cannot add value; on the other hand, when returns of securities diverge active management can add value. We are likely to be heading into an environment where active management is not only important, but also has more opportunities to add value.

Passive Strategies Are Not Well Positioned to Benefit From Disruption

The perception that passive strategies are lower risk may also need to be reassessed. Many investors believe that passive strategies are a risk‑free way to invest, but I believe this is a mistake. Most equity indexes, for example, are weighted by market capitalization—in other words, the index overweights large companies and underweights small ones, and so does a passive strategy tracking the index. This means that investing in the index is effectively a bet that the most recently successful companies will continue to be successful. History shows us that this is not always the case, though. IBM, Philip Morris, Coca‑Cola, and General Electric have all been among the largest 10 firms in the S&P 500 Index in the past, yet over the 10 years to August 31, 2019, the cumulative returns of these stocks lagged the index by 189%, 112%, 63%, and 270%, respectively.

Passive investment strategies can make it more difficult to be on the right side of disruptive change. Kodak, Nokia, Xerox, Blockbuster, and Yahoo were all giants in their respective fields that failed to identify disruptive forces and lost. Today, the biggest firms are digital companies such as Apple and Amazon. These names may, of course, continue to perform well over the next decade and beyond, but relying on them to do so is an active bet, not a passive one—and it is important that investors are aware of this. A good active manager, with a keen sensitivity to change and disruption, could actively tilt the portfolio not only to avoid disrupted firms, but also to benefit from the disruptors.

Passive bond strategies are arguably even more vulnerable. The Bloomberg Barclays Global Aggregate Bond Index weights issuers by the amount of debt they issue, meaning that any passive strategy tracking the index will be overweighting the most indebted issuers. And while it may not be a problem to have an approximately 40% allocation to U.S. government debt, holding around a 16% weighting in Japan is likely to carry more risk, as is an overweight allocation to Italian government bonds.

Volatility and Dispersion Likely to Return to Markets

The global economy is likely to be hit by considerable volatility over the next few years as the diminishing impact of central bank stimulus removes artificial support from markets, leaving assets to return to their “true” values from currently elevated valuations. At the same time, the U.S.‑China trade dispute, Brexit, and the rise of populism in various parts of the world are likely to bring added turbulence. Considerable rotation within sectors and asset classes can be expected. In this environment, passive strategies are likely to perform less well than they have during the long period of relative stability and growth since the financial crisis.

This is neither to suggest that it is “wrong” to invest in passive strategies nor to suggest that passive investments will not have a role to play in the future. Passive strategies will very likely continue to perform an important function in investor portfolios, albeit in a different way than in the recent past. It is often suggested, for example, that passive strategies should form the core of a portfolio, with active investments used as “satellite” investments. In the future, the opposite may be the case: Active strategies may be used to make the core of the portfolio work as hard as possible, while passive strategies could be used primarily for thematic satellite investments. The active core is unlikely to be changed too frequently—allowing managers to benefit from a long investment horizon and minimize disruption due to cash flows—while the thematic satellite allocations may be swapped on a more regular basis.

These developments will become clearer over the next few years. In the meantime, investors seeking to position themselves for the period ahead may benefit from at least reexamining the role that passive strategies have in their portfolios as the impact of central bank stimulus fades—and consider how active strategies may be deployed more effectively to help them continue to generate strong returns in the future.

What we’re watching next

We will be closely monitoring central banks for indications of any plans to

extend or wind down stimulus. As the impact of QE is gradually withdrawn

from the system, we expect overall returns in many sectors to fall and

volatility and dispersion of returns to increase, potentially marking the

end of the long era of strong performance from index-based strategies.

There are signs that some investors are already tilting back towards active

strategies, and we will be watching to see whether this continues.

The specific securities identified and described are for informational purposes only and do not represent recommendations.

Additional Disclosures

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

201911-1003111