June 2022 / INVESTMENT INSIGHTS

Winning by Not Losing: Building Portfolios for a More Challenging World

Generating positive returns in tougher conditions requires new thinking

Key Insights

- Challenging market conditions and deeper structural shifts are demanding fresh thinking from investors.

- Such thinking may include new ways to help mitigate the impact of volatility on equity portfolios, adapt the role of government bonds, and use active management to potentially benefit from market volatility.

- We believe that ideas such as these will help investors to manage losses while potentially generating inflation‑beating returns.

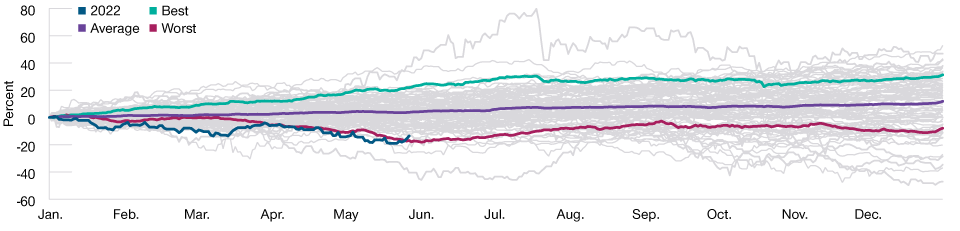

The first five months of 2022 have not been easy for investors. A powerful cocktail of difficult economic conditions and rising geopolitical concerns have made their mark: The S&P 500 Index was down by more than 12% from January 1 to May 31—its worst record over that period since 1970 (Figure 1).1

The S&P 500’s Start to 2022 Was Its Worst in 50 Years

(Fig. 1) It was down by 14% from January to May 31, 2022

As of May 31, 2022.

Past performance is not a reliable indicator of future performance

Sources: S&P 500 Index (see Additional Disclosures). Analysis by T. Rowe Price. Based on daily total returns measured in U.S. dollars. January 1928 through May 31, 2022. Average is average return of all years. Best is average return of 10 years with highest returns. Worst is average return of 10 years with lowest returns.

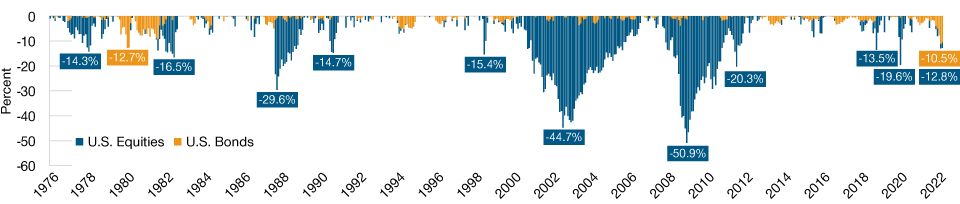

In recent years, multi‑asset investors have generally been able to rely on their fixed income holdings to cushion the blow if equity markets fell. However, these diversification benefits were notable for their absence over the first four months of this year. As equities plummeted, U.S. fixed income was hit by its worst drawdown since 19802—in fact, it was the first time since at least the mid‑1970s that the U.S. equity and fixed income markets both experienced a drawdown more severe than 10% at the same time (Figure 2). These losses were especially painful in inflation‑adjusted terms, as rapid price increases across many major economies led to the purchasing power of investments falling even more.

Equities and Bonds Fell in Tandem Over the First Four Months of the Year

(Fig. 2) It was their worst parallel drop since the mid‑1970s

As of May 31, 2022.

Past performance is not a reliable indicator of future performance.

Sources: S&P 500 Index, Bloomberg U.S. Aggregate Index (see Additional Disclosures). Analysis by T. Rowe Price. Based on monthly total returns measured in U.S. dollars. February 1976 through May 2022.

There seem to be five main reasons for the continued declines of global equity and fixed income markets so far this year: (1) the accelerated pace of monetary tightening by central banks such as the U.S. Federal Reserve, (2) persistently high inflation, (3) concerns over slowing economic growth, (4) disruptions caused by China’s strict zero‑COVID policy, and (5) Russia’s invasion of Ukraine.

Another factor behind the uncertainty is that markets are simultaneously undergoing several structural shifts: from pandemic lockdowns to reopening, from low and stable to high and volatile inflation, from super‑accommodative monetary policy to tightening, from globalization to a focus on local supply chains, and from U.S. hegemony to a realignment of powers. Still recovering from the shock of COVID, the world must now contemplate a slew of new challenges. During structural shifts, investors and markets need to adapt—and adaptation typically involves uncertainty and volatility.

What can investors do to generate positive inflation‑adjusted returns in this market environment? Or, to put it another way, where can they lose the least money? To help achieve these objectives, we have identified three investment ideas, each of which is shaped around one of the possible regimes that lie ahead.

View full insights here

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.