November 2022 / ASSET ALLOCATION VIEWPOINT

Adapting to a New Investment World

Investors face new opportunities and challenges as we head into 2023

Key Insights

- While 2022 was challenging, with both global equity and fixed income markets falling in tandem, the future may bring higher expected returns but also higher volatility.

- We believe that investors should consider five ways to adapt to the new investment world. We explain each of these in detail in the following article.

- We believe that a well‑managed, well‑diversified multi‑asset strategy could be an efficient one‑stop solution to potentially benefit from all five suggested approaches.

Introduction: 2022—A Difficult Year for Investors

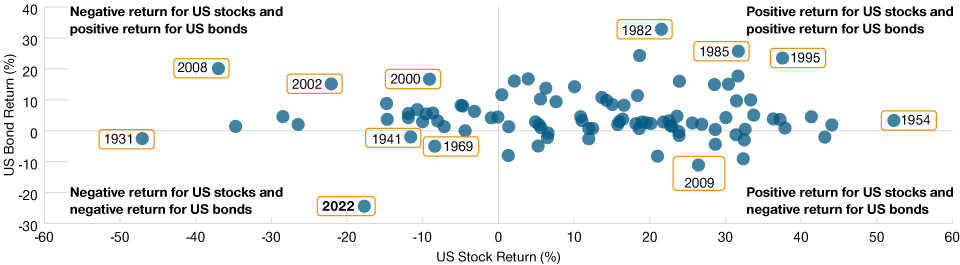

This year has been disappointing for investors in public markets. Equity and fixed income investments across the globe have fallen sharply after strong returns, particular to equity markets, leading up to and after the coronavirus pandemic. What made 2022 especially challenging was that both equity and fixed income markets fell in tandem, making it very difficult to diversify portfolios. Figure 1 illustrates this, using returns of US equities and US Treasuries for calendar years since 1928. This year is a clear outlier in a historical context.

Calendar Year Total Returns of the S&P 500 and US 10‑Year Treasury

(Fig. 1) For the period 1928 through 2022 (to 30 September)

As of 30 September 2022.

Past performance is not a reliable indicator of future performance.

Based on annual total returns measured in US dollars (USD).

Sources: S&P 500 Index and US 10‑year Treasury (see Additional Disclosures). Analysis by T. Rowe Price.

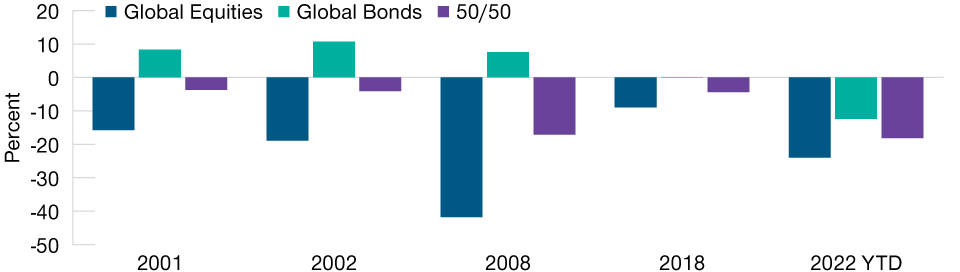

Figure 2 highlights the five worst years since 1992 for a portfolio of 50% global equities and 50% global bonds. We consider portfolios made up solely of global equities and global bonds, represented by the MSCI All Country World Index (ACWI) measured in sterling (GBP) and the Bloomberg Global Aggregate Index hedged to GBP, respectively, throughout this paper. While many other investment types are possible within a multi‑asset portfolio, we believe the overall findings would be generally similar.

Returns of Global Equities, Global Bonds and a 50/50 Mix

(Fig. 2) For selected years 1992–2022

As of 31 October 2022.

Past performance is not a reliable indicator of future performance.

Global equities—MSCI ACWI in GBP, global bonds—Bloomberg Global Aggregate Index hedged to GBP.A 50/50 mix portfolio is assumed to rebalance annually.

Sources: Index data sourced from Bloomberg and MSCI (see Additional Disclosures). Analysis byT. Rowe Price.

It is noticeable that the losses on such a supposedly ‘balanced’ portfolio in 2022 would have been close to those seen in 2008 during the depths of the global financial crisis. Unlike other difficult years, the decline in 2022 hit both global equities and global bonds.

A Changing Investment Environment

Falling markets have brought one silver lining, however. Valuations in equity and fixed income markets, which stood at multiyear highs for many markets as we entered 2022, have fallen back sharply.

The yields on US 10‑year Treasuries had only been lower 13% of the time over the 15 years to the end of 2021, but this has now changed drastically. Government bond yields, credit spreads and equity valuation multiples now generally look close to, or below, average levels seen over the period.

Lower valuations today translate to higher expected returns in the future. For fixed income, there is a strong link between yields and expected total returns. Higher government bond yields and increases in credit spreads for both investment‑grade and high yield bonds have moved longer‑term expected returns to investors higher.

Our equity return expectations combine three key elements: (1) dividend yields, (2) expectations for inflation and real profit growth and (3) repricing or changes in valuations over a five‑year forecast period. The key driver of changes to these elements over 2022 relates to expected future valuation multiples.

Lower multiples imply more space for positive increases in the future, boosting equity returns. For equity markets outside the US, many valuation measures are now as low as they have been for the last decade or more.

This combination of rising bond yields and falling equity valuations means that expected returns have increased sharply for multi‑asset portfolios. This change in potential returns is more than just a reset of the positive investor sentiment seen since the pandemic. Rising policy rates are driving higher returns on cash and increasing yields on high‑quality government bonds. Uncertainty over future monetary policy, economic growth and geopolitical events has risen sharply, driving investors to demand higher risk premiums for lending by buying bonds and buying shares.

Investors looking to generate a particular nominal level of return over the long term may now need to allocate less to risky assets. If we consider our mixed portfolio of global equities and global bonds at the end of 2021, targeting an expected return of 4% per annum over the next five years would have required an allocation of 65% to global equities. The same expected return would have a required allocation of 47% to global equities by the fourth quarter of 2022.

On the downside, market risk has increased; given the removal of monetary policy support in most major economies, we believe this is likely to be a structural change. Since the global financial crisis, central banks have flooded the system with liquidity, soothing investor worries and mitigating volatility. They are now focused on fighting inflation and withdrawing liquidity from markets, often leading to more nervous investors and violent price moves. We believe that recent levels of volatility are the new normal and that the period from 2012 to 2019 is likely to have been an outlier, as suggested by Figure 7. It is unlikely that investors are prepared for this. As a result, their portfolios may display a wider variance of returns than they expect.

When investors forecast volatility based on this historical period as the basis to construct portfolios, it creates an issue. Outcomes for portfolios which have been built with one volatility regime in mind may be riskier than is desirable in a new, more turbulent, environment.

Figure 8 shows the allocation to global equities in a portfolio of global equities and global fixed income which would have delivered volatility of 7% per annum and 10% over two time periods: 2010 through 2019 and 2020 through 2022 to date.

Figure 8 shows the impact that increased volatility of asset classes would have even at the multi‑asset portfolio level. A portfolio with around three‑quarters in global equities would have delivered a volatility of returns of about 10% per annum over the 2010s. Since the end of 2019, the volatility of such a portfolio would have been over 15% per annum—a jump of more than 50%. If this persists, investors are likely to need to either accept higher risk or reduce exposure to return‑seeking assets.

This year may also force a rethink of what diversification and risk management mean in a more uncertain environment—quite simply, there has been almost nowhere for investors to hide. As Figure 9 shows, the benefits of some historical safe havens such as high‑quality government bonds, gold and the Japanese yen were minimal compared to the experience during the early days of the coronavirus pandemic, for example. The US dollar was a rare exception.

By contrast, areas such as UK equities, select emerging markets and China government bonds held up well in terms of performance. But, even for investors in these countries, the benefits of home bias were limited. UK government bonds were amongst the worst‑performing major bond markets so far in 2022, while Chinese equities have also considerably underperformed their global peers during the year to date.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

November 2022 / INVESTMENT INSIGHTS

November 2022 / INVESTMENT INSIGHTS