Forecasting European equity earnings with macro factors

A strong relationship exists between equity earnings, inflation, and unemployment.January 2024, From the Field

Key Insights

- Changes in European unemployment and inflation explain a large proportion of variation in European equity earnings.

- On average, a decline in inflation is associated with lower earnings growth.

- While a soft economic landing may benefit European equities through the valuation channel, it will likely hurt earnings.

Written by

Cesare Buiatti, Ph.D., CFA

Senior Quantitative Investment Analyst, Multi‑Asset Team

Cesare Buiatti, Ph.D., CFA

Senior Quantitative Investment Analyst, Multi‑Asset Team

Within T. Rowe Price’s Multi‑Asset Division, we have recently explored different models designed to predict equity earnings using macroeconomic data. In the U.S., we found that a simple two‑factor model—using inflation and unemployment as inputs—is remarkably accurate in explaining changes in the S&P 500 Index earnings.

In this note, we extend our analysis to European equities, posing the question: Do inflation and unemployment similarly provide an accurate indication of earnings in the eurozone? Our goal is to establish the significance of the following mathematical relation:

EURO STOXX 50 Index Earnings = ƒ (Inflation, Unemployment)

Our findings confirm that there is indeed a strong co‑movement between equity earnings, inflation, and unemployment in Europe. With a 65% adjusted R‑square, the following model displays an excellent fit versus realized forward earnings.1

The model in detail

Modeling European equity earnings

(Fig. 1) Macro‑implied YoY changes in forward earnings—model vs. realized, March 2007 to October 2023

As of October 31, 2023.

Source: Bloomberg Finance L.P. Analysis by T. Rowe Price.

Drilling down into the model, the coefficient on unemployment is negative, which is intuitive. During economic crises, unemployment rises and earnings fall. An increase in unemployment of one percentage point was associated with a €26.8 loss in earnings.

Year‑over‑Year (YoY) Change in 12‑Month Forward EPS =

‑3.3 + 10.9 x YoY Change in Inflation Rate –

26.8x YoY Change in Unemployment Rate

The positive coefficient on inflation is perhaps less intuitive. We tend to forget that earnings are a nominal quantity that get an extra push from rising inflation. Symmetrically, when inflation declines, the earnings growth decelerates. A one‑percentage‑point decrease in the inflation rate was associated with a €10.9 reduction in earnings.

Obviously, no model is perfect, and ours is no exception. During the 12 months to the end of October 2023, we experienced a major decline in European inflation (falling from 10.6% to 2.9%) and a small reduction in unemployment. According to our model, this should have translated into an €84.3 decrease in earnings—a huge loss, comparable with what was experienced during the global financial crisis. Fortunately, this did not occur. In fact, European equities added €26 to their overall earnings instead. The real growth in earnings was more than enough to compensate for the negative nominal impulse due to the fall in inflation.

Econometrics identifies relations that are deemed to be valid on average. It is hard to argue that the last four years have been “average” for economies and financial markets. The global economy is still entangled in a myriad of distortions, and we should remain humble when building models estimated with pre‑pandemic data. In this case, we have been lucky, as the reality outperformed the model.

Where to from here?

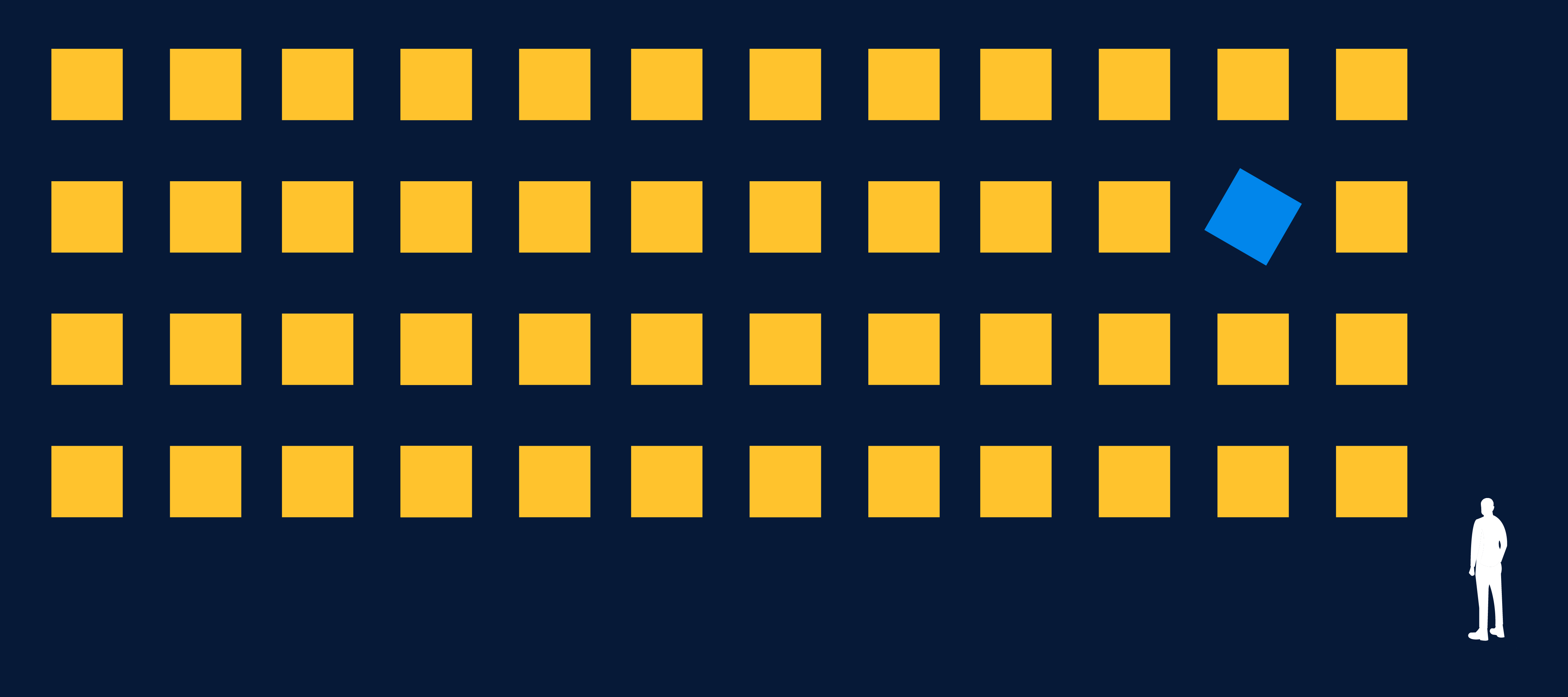

In the following table, we consider four potential scenarios for Europe, defined in terms of inflation and unemployment projections for October 2024. For each scenario, we show the change in earnings implied by our model.

- Scenario 1

The first, sticky inflation, scenario corresponds to the latest European Central Bank (ECB) staff projections. During 2024, they anticipate inflation of 2.7%, stubbornly above the ECB target, and unemployment at 6.6%, slightly above the October 2023 level. - Scenario 2

Here we envision an economic soft landing outcome, characterized by inflation finally moving slightly below the ECB’s target of 2%, without any increase in unemployment. - Scenario 3

Under this scenario, we anticipate a potential economic hard landing, where we see a larger decline in inflation at the expense of a significant increase in unemployment. - Scenario 4

We also consider a potential no landing scenario, in which inflation reaccelerates and unemployment remains largely unchanged.

2024 Europe macro scenarios

(Fig. 2) Model‑forecasted impact on earnings

For illustrative purposes only. Actual outcomes may differ materially from the scenarios and results shown.

The “sticky inflation” scenario corresponds to the ECB staff macroeconomic projections for the euroarea in 2024. The other scenarios are hypothetical and defined by the authors of this paper.

Sources: European Central Bank. Analysis by T. Rowe Price.

The final no landing scenario is the only outcome that ultimately leads to an increase in European earnings, according to our model. In all the other scenarios, the model predicts a decline in earnings. While this might not be surprising in the event of a hard landing or sticky inflation environment, it is worth noting that a more positive, economic soft landing outcome also results in a 4% decrease in earnings, according to our model.

Soft landing enthusiasm should be tempered

We think this forecasted result should serve as a small brake to the markets’ overt enthusiasm for a soft landing. Certainly, a soft landing may benefit equities through different channels (for instance, it may create the conditions for easier monetary policy, which would likely boost equity valuations), but our research shows that, on average, a soft landing is bad for earnings. European equities managed to do much better than expected in 2023, but pulling it off again in 2024 could be difficult.

Macro-implied earnings

A simple model can explain how earnings will respond to changes in the health of the economy.

1Data sources: Bloomberg Finance L.P. Analysis by T. Rowe Price. Monthly data from March 2006 to October 2023. 12‑month forward earnings per share (EPS): EURO STOXX 50 Best EPS, Inflation Rate: Euro Area Harmonised Index of Consumer Prices, Unemployment Rate: Euro Area Unemployment Rate.

Past performance is not a reliable indicator of future performance. There is no guarantee that any forecasts made will come to pass. Certain assumptions have been made for modeling purposes, and this material is not intended to predict future events.

Additional Disclosure

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

Australia—Issued by T. Rowe Price Australia Limited (ABN: 13 620 668 895 and AFSL: 503741), Level 28, Governor Phillip Tower, 1 Farrer Place, Sydney NSW 2000, Australia. For Wholesale Clients only.

Canada—Issued in Canada by T. Rowe Price (Canada), Inc. T. Rowe Price (Canada), Inc.’s investment management services are only available to Accredited Investors as defined under National Instrument 45‑106. T. Rowe Price (Canada), Inc. enters into written delegation agreements with affiliates to provide investment management services.

EEA—Unless indicated otherwise this material is issued and approved by T. Rowe Price (Luxembourg) Management S.à r.l. 35 Boulevard du Prince Henri L‑1724 Luxembourg which is authorised and regulated by the Luxembourg Commission de Surveillance du Secteur Financier. For Professional Clients only.

New Zealand—Issued by T. Rowe Price Australia Limited (ABN: 13 620 668 895 and AFSL: 503741), Level 28, Governor Phillip Tower, 1 Farrer Place, Sydney NSW 2000, Australia. No Interests are offered to the public. Accordingly, the Interests may not, directly or indirectly, be offered, sold or delivered in New Zealand, nor may any offering document or advertisement in relation to any offer of the Interests be distributed in New Zealand, other than in circumstances where there is no contravention of the Financial Markets Conduct Act 2013.

Switzerland—Issued in Switzerland by T. Rowe Price (Switzerland) GmbH, Talstrasse 65, 6th Floor, 8001 Zurich, Switzerland. For Qualified Investors only.

UK—This material is issued and approved by T. Rowe Price International Ltd, Warwick Court, 5 Paternoster Square, London EC4M 7DX which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

ID0006631 (01/2024)

202401‑3310064