retirement planning | october 30, 2023

Three Themes Shaping the U.S. Retirement Landscape

A focus on retirement income, personalization, and diversification.

Key Insights

Growing demand, increasingly supportive legislation, and a continued evolution of products and services could drive the adoption of retirement income solutions.

Data show that targeted and personalized experiences can drive behavioral change and help to improve retirement outcomes.

Given persistent inflation and interest rate uncertainty, it is important to ensure that current allocation policies align with the market environment.

Looking into 2024, retirement income, personalization, and diversification will be the key themes for defined contribution (DC) plan sponsors and their consultants and advisors. Our 2024 U.S. Retirement Market Outlook explores why we expect these topics to shape the retirement landscape in the coming years and outlines the underlying factors that are creating both challenges and opportunities for the retirement industry. We also provide action items or next steps for plan sponsors, consultants, and advisors.

Retirement Income

Retirement income cannot be solved by a single investment solution. Many DC plan sponsors are exploring options to reposition their plans not only as savings‑oriented vehicles but also as decumulation platforms that support retired participants. We encourage plan sponsors, consultants, and advisors to take the broadest view of retirement income possible—from participant tools and retiree‑friendly plan design to considering both investment and insurance solutions and access to personalized advice.

Personalization

Consumers increasingly expect personalization in all aspects of their lives. The retirement experience is no different. Data from our recordkeeping platform show that tailored and targeted experiences can drive behavioral change and help improve retirement outcomes. Some participants are also seeking personalized investment solutions. As employees continue to express a need for comprehensive financial wellness programs through the workplace, personalized solutions can help workers navigate and balance both their short‑term and long‑term financial goals.

Diversification

Diversification is fundamental to helping participants achieve successful retirement outcomes over the long term.1 In an environment where inflation risk persists and interest rates are expected to stay higher for longer, diversification should not just be about basic asset allocation. Plan sponsors and their advisors and consultants should ensure that current allocation policies align with the current market environment. This is especially true for fixed income allocations within target date strategies, which remain the most prevalent default vehicle for retirement investors.

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

Infographic: 2024 U.S. Retirement Market Outlook

A surge in retirees and a complex market environment are creating new challenges for retirement savers. We see three themes impacting the U.S. retirement industry.

Retirement Income: Growing demand could drive innovation and adoption of retirement income solutions.

Participants approaching retirement have many questions. Do I have enough savings to retire? How can I replace my paycheck with my savings? Where can I find help?

They are not alone in this quest to solve the retirement income puzzle. Historically, the marketplace for retirement income services has been dominated by the retail rollover IRA, given its prevalence in the marketplace and the personalized guidance provided by the advisor community. Recently, more and more employers say that they have a responsibility toward their retiring participants, and these employers are actively looking for different retirement income solutions to support retirees in plan. These changes are good for the industry, given the success of DC plans in driving retirement savings.

With an emerging change in mindset from employers, growing demand from retirees, increasingly supportive legislation, and a continued evolution of products and services, we think that now is the time for broader innovation and adoption of retirement income solutions in the DC marketplace. In fact, we are already seeing the beginnings of this trend.

A Tipping Point for Adoption

The need for retirement income solutions isn’t entirely new, yet savers have been slow to adopt existing solutions. However, the growing demand for retirement income and the confluence of various factors are encouraging signs. The Pew Research Center estimates that 10,000 baby boomers are expected to turn age 65 each day until 2030. Plan sponsors are increasingly aware of this aging workforce, and the income needs of millions of baby boomers entering retirement could be transformative.

Among the respondents to our 2023 T. Rowe Price Retirement Savings and Spending Survey, which surveys a nationally representative group of 401(k) participants, 64% of baby boomers reported moderate to high levels of stress about their retirement savings. Education tools and services crafted to support the retirement income experience could ease their worries about planning for retirement.

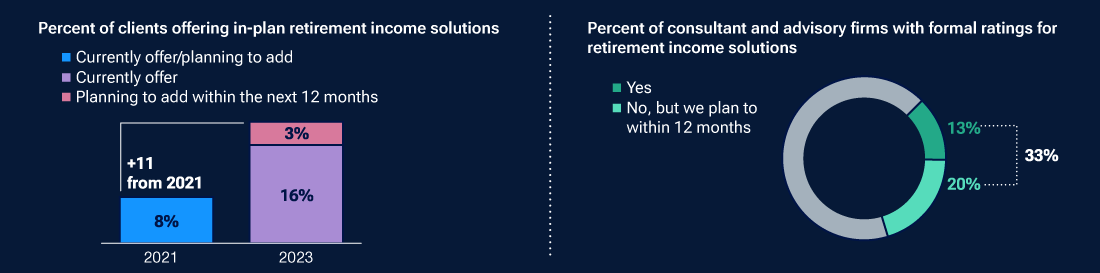

The legislative and regulatory environment has also been supportive.2 While implementation of in‑plan retirement income solutions is likely to be gradual, we are already observing more plan sponsors moving from an information‑gathering stage to a decision‑making stage relative to retirement income. To support this emerging trend, one‑third of advisors and consultants who responded to our 2023 DC Consultant Study said that they are already including or intend to include formal ratings systems for retirement income strategies within the next 12 months (Figure 1).

64%

baby boomers who reported moderate to high levels of stress about their retirement savings.

Evolving from Exploration to Decisions

(Fig. 1) Data suggest that more plans, consultants, and advisors are taking a position on retirement income.

Sources: T. Rowe Price, 2023 Defined Contribution Consultant Study; 2021 Defined Contribution Consultant Study.

Please see T. Rowe Price Sources for additional detail on T. Rowe Price studies referenced throughout this material.

T. Rowe Price Sources

2023 Defined Contribution Consultant Study: This study included 45 questions and was conducted from February 14, 2023, through March 31, 2023. Responses are from 32 consulting and advisory firms with more than $6.7T in assets under administration.

2021 Defined Contribution Consultant Study: This study included 51 questions and was conducted from September 20, 2021, through November. Responses are from 32 consulting and advisory firms with more than $7.2T in assets under administration.

2023 Retirement Savings and Spending Study: The Retirement Savings and Spending Study is a nationally representative online survey of 401(k) plan participants and retirees. The survey has been fielded annually since 2014. The 2023 survey was conducted between July 24, 2023, and August 13, 2023. It included 3,041 401(k) participants, full‑time or part‑time workers who never retired, currently age 18 or older, and either contributing to a 401(k) plan or eligible to contribute with a balance of $1,000 or more. The survey also included 1,176 retirees who have retired with a Rollover IRA or left‑in‑plan 401(k) balance.

2022 Retirement Savings and Spending Study: The Retirement Savings and Spending Study is a nationally representative online survey of 401(k) plan participants and retirees. The survey has been fielded annually since 2014. The 2022 survey was conducted between June 24, 2022, and July 22, 2022. It included 3,895 401(k) participants, full‑time or part‑time workers who never retired, currently age 18 or older, and either contributing to a 401(k) plan or eligible to contribute with balance of $1,000 or more. The survey also included 1,136 retirees who have retired with a Rollover IRA or left‑in‑plan 401(k) balance.

1Diversification cannot assure a profit or protect against loss in a declining market.

2The original SECURE Act of 2019 served to accelerate product creation and encourage the launch of innovative solutions to support retired participants who choose to stay in plan. More recently, the SECURE 2.0 Act of 2022 includes provisions that support lifetime income.

Important Information

This material is provided for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide recommendations concerning investments, investment strategies, or account types; it is not individualized to the needs of any specific investor and not intended to suggest any particular investment action is appropriate for you, nor is it intended to serve as the primary basis for investment decision‑making.

Any tax‑related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material.

The views contained herein are as of November 2023 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor, and T. Rowe Price Associates, Inc., investment adviser.

202311-3209165

Next Steps

Gain valuable insights on retirement guidance and financial planning.

Contact a Financial Consultant at 1-800-401-1819.