retirement planning | march 26, 2024

“Unretiring”: Why Recent Retirees Want to Go Back to Work

Millions of retirees have returned to work in search of financial and emotional benefits.

Key Insights

Many people who retired during the coronavirus pandemic have chosen to return to work.

Retirees may choose to go back to work either for financial reasons or for social and emotional benefits.

Before making any decisions about whether to unretire, bear in mind that working in retirement may impact your Social Security benefits.

Judith Ward, CFP®

Thought Leadership Director

When COVID-19 sent the economy into a tailspin in 2020, it resulted in 2.4 million excess retirements, according to research from the Federal Reserve of St. Louis.1 But many of the people behind these “COVID-19 retirements,” as the Fed’s paper describes the trend, have since headed back to work, choosing to “unretire.” Approximately 1.5 million retirees had reentered the workforce by March 2022.2

The pandemic may have created an unusually large wave of retirees leaving and returning to the workforce, but the trend of working in retirement is going strong. According to T. Rowe Price’s recent Retirement Saving & Spending Study,3 around 20% of retirees are working either full time or part time, while 7% of respondents report looking for employment. The study looked at how and why retirees choose to work and found that there are a variety of benefits and motivations.

Many retirees either choose to work or need to have work be part of their retirement lifestyle. This decision can have many powerful positive effects, not least of which is financial well-being.

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

Why retirees choose to work

The reasons many retirees return to work come down to their retirement lifestyles and financial lives. In fact, roughly half (48%) of those working in retirement felt they needed to work for financial reasons, while a similar portion (45%) chose to work for social and emotional benefits.

It stands to reason that many retirees see part-time work as a good transition strategy into retirement. According to our research, overall, 57% of retirees want to continue working in some form, while 43% would stop working all at once. This varies by wealth. Meanwhile, the survey data indicated that retirees who are working full time are most often motivated by the desire for mental stimulation and professional fulfillment that they find in their work. They may especially appreciate the opportunity to work on their own terms, rather than out of sheer necessity.

Motivations also vary along gender and marital lines. Women and single retirees are more likely than men or married couples to cite income as the primary motivator for working in retirement. Many single people also found work to be a good use of time in retirement. Men, in particular, were more likely to cite social connections as motivation to work. (See “The Many Motivations to Work in Retirement.”)

The Many Motivations to Work in Retirement

Motivations differ across groups of retirees.

Gender, Work Status, and Marital Status illustrations reflect two answer options out of nine. Respondents could choose all that apply therefore the results will not total 100%.

Finding new ways to work

Returning to work doesn’t always mean returning to a previous career or work arrangement. Many people choose new vocations or part-time work in retirement. They may explore causes or fields that align with their passions and build on their professional experience, perhaps via consulting arrangements. Others take advantage of remote work, part-time work, or flexible arrangements to achieve a work-life balance that suits their new lifestage.

Working longer is a powerful way to strengthen your retirement plan

Whether people unretire or simply stay in the workforce longer, some of the largest financial benefits of additional years of work are delaying retirement account withdrawals and delaying claiming Social Security benefits. These actions essentially shorten the amount of time your assets will need to support you in retirement. Even a few additional years of income have a positive effect on the probability that you won’t outlive your funds.

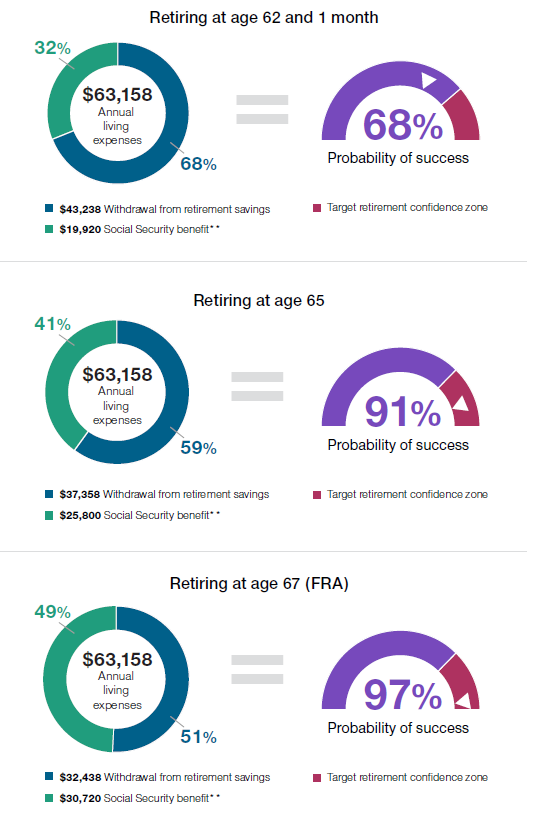

Consider the hypothetical example of a 62-year-old who earns $100,000 per year, has $900,000 set aside for retirement, and expects to spend about $63,000 per year in retirement. If she retires this year, there is a 68% chance that she will not outlive her funds in retirement, based on projections generated by the T. Rowe Price Retirement Income Calculator.* The likelihood of not outliving one’s retirement funds is what we refer to as the “probability of success.”

If she delays retirement by just a few years (until age 65), however, her probability of success rises to 91%. Waiting until full retirement age (FRA) at age 67 increases that probability to 97%. Both of these delayed scenarios are well within T. Rowe Price’s target confidence zone of 80% or higher. The improvement in this hypothetical scenario illustrates how higher Social Security payments result in better portfolio sustainability over a retirement horizon that could last decades. Delaying retirement is that powerful. (See “The Power of Waiting.”)

These scenarios also assume no additional contributions to a workplace plan. While this approach may sound counterproductive, it allows her to shore up her financial footing prior to retiring. For example, she can pay down debt or make big-ticket purchases while still receiving a salary and benefits. Of course, if a company match is available in the plan, it makes sense to contribute enough to get the full match.

Alternatively, having additional years of earned income can also give workers more time to contribute to their savings, especially since many workers are likely eligible to make catch-up contributions at this stage of life. In 2024, those age 50 or older can contribute an additional $8,000 to their 401(k) plan each year, as well as an extra $1,000 across Traditional and Roth IRAs combined. A period of supplemental work may also allow you to increase your cash reserves ahead of full retirement.

The Power of Waiting

Delaying retirement just for a few years increases the possibility of retirement success sustainability.

* *This is an approximation of SSA benefits based on the Benefits of Delaying Social Security chart below.

The advantage of delaying claiming Social Security

Before making any decisions about whether to unretire, bear in mind that working in retirement may impact your Social Security benefits. The choices you make can affect whether your benefits increase or decrease.

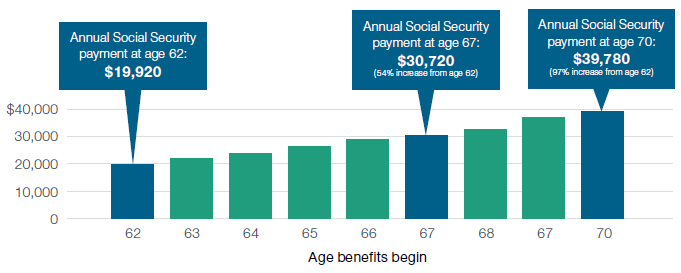

For example, if you hadn’t claimed your benefits when you retired initially, unretiring allows you to delay claiming even further. The longer you delay claiming your benefits (up until age 70), the higher your monthly benefits, which increase by 8% for every year past your FRA that you delay receiving them, until you reach age 70. The converse is true, too: Filing early—at age 62—can lead to an almost 30% reduction in benefits. (See “The Benefits of Delaying Social Security.”)

If you stopped working before your FRA and claimed benefits but then decided to go back to work, you have 12 months to apply for a withdrawal of benefits. In doing so, you would need to repay what you have received, and Social Security will act as if you never took benefits in the first place. If you have reached your FRA but are not yet 70, you can suspend payments and earn delayed retirement credits, increasing your monthly benefit.

The Benefits of Delaying Social Security

Each year you delay claiming your benefits may translate into a permanent increase in your benefit amount.

Social Security payments calculated using the Quick Calculator on the ssa.gov website. Assumes an individual who is age 62 in 2023 (with a full retirement age of 67 years) and is continuing to work and earn $100,000 each year until claiming benefits. All figures reflect current dollars. Actual benefits would be higher to reflect future adjustments for inflation.

How working in retirement affects Social Security

Keep in mind, working prior to FRA while receiving benefits can reduce the size of your benefits because of income limitations: If you exceed the 2024 earned income limit of $22,320 per year, your benefits will be reduced by $1 for every $2 you earn above the limit. (Benefits are recalculated once you reach FRA to give you credit for the months in which your benefit was reduced or withheld due to excess earnings.)

Once you reach your FRA, working does not affect the amount of benefit you receive, with one exception: Additional years in which you earn a high income could potentially increase your benefit. Your benefit is based on your best-paid years. It’s possible that a current wage could replace a lower or zero earning year for purposes of determining your Social Security benefit. Ultimately, it may be better to delay claiming benefits until FRA or later while you are working.

Your Full Retirement Age

FRA varies depending on your birth year.

| Year of Birth | Full Retirement Age |

|---|---|

| 1943–1954 | 66 |

| 1955 | 66 and 2 months |

| 1956 | 66 and 4 months |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 | 67 |

Source: ssa.gov.

Meeting emotional and financial needs

If you’re considering unretirement, examine how doing so could affect your Social Security benefits and look for opportunities to improve your financial situation over time. In addition to increasing your financial stability, rejoining the workforce can be a powerful way to make social connections and find purpose—worthy goals no matter your circumstances.

1Economic Synopsis, No. 25. Federal Reserve of St. Louis, October 2021.

2Calculations by Nick Bunker, director of North American Economic Research at Indeed Hiring Lab, using IPUMS extract of CPS microdata.

3The 8th annual T. Rowe Price Retirement Saving & Spending Survey was conducted by NMG Consulting on behalf of T. Rowe Price and included a sample of 2,895 401(k) retirement plan participants and 1,136 retirees with a Rollover IRA or left-in-plan balance. The survey was fielded online from June 24 to July 22, 2022.

*The projections in this article were calculated using the Retirement Income Calculator. The calculator uses Monte Carlo analysis to generate 1,000 hypothetical scenarios based on inputs such as, but not limited to, performance of various asset classes, saving and spending assumptions, a client’s time horizon, life expectancy, income and expenses, and other variables. The Monte Carlo analysis provides ranges of potential future outcomes based on a probability model. The Monte Carlo simulation runs the user’s scenario 1,000 times, so, for example, if 600 of those runs are successful (i.e., all goals are funded and you have at least $1 of assets remaining at the end), then the probability of success would be 60%, and the probability of failure would be 40%. For purposes of this illustration, a moderate allocation (60% stocks, 40% bonds) was used, and these allocations are assumed to be rebalanced annually to remain consistent. Additionally, the investor is assumed female, single, and residing in Colorado with a date of birth of March 1, 1961. Ninety percent of the assets are in qualified retirement accounts. For details on this and other assumptions, please read our Methodology and Assumptions (PDF).

The information provided in this tool is for general and educational purposes only and is not intended to provide legal, tax, or investment advice. The assumptions and methodology are not tailored to the needs of any specific investor. Results are intended as an aid, are not guaranteed, and should not be your only source of information when making financial decisions. Other T. Rowe Price educational tools or advice services use different assumptions and methods and may yield different results.

IMPORTANT: The projections or other information generated by the Retirement Income Calculator regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. The simulations are based on assumptions. There can be no assurance that the projected or simulated results will be achieved or sustained. Actual results will vary with each use and over time, and such results may be better or worse than the simulated scenarios. Clients should be aware that the potential for loss (or gain) may be greater than demonstrated in the simulations.

Important Information

This material has been prepared by T. Rowe Price for general and educational purposes only. This material does not provide recommendations concerning investments, investment strategies, or account types. It is not individualized to the needs of any specific investor and is not intended to suggest that any particular investment action is appropriate for you, nor is it intended to serve as the primary basis for investment decision-making. T. Rowe Price, its affiliates, and its associates do not provide legal or tax advice. Any tax-related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

View investment professional background on FINRA's BrokerCheck.

202403-3466143

Next Steps

Find out if you’re on track for retirement with the T. Rowe Price Retirement Income Calculator.

Contact a Financial Consultant at 1-800-401-1819.