Is it smart to keep money invested in equities during market volatility?

March 2025, Make Your Plan

- Key Insights

-

- It is nearly impossible to accurately predict short-term movement in the market.

- Jumping into and out of equity investments could jeopardize a long-term retirement savings plan.

- For those who have shifted out of stock market investing, easing back into the market gradually can help get their strategy on track.

Economic uncertainty is leading even experienced investors to take a second look at their investment portfolios. “People may have anxiety about their finances—both income and investments,” says Roger Young, CFP®, a thought leadership director with T. Rowe Price. “It can be hard to sit back and stay the course; there’s a real temptation to do something.”

An investor may feel compelled to reduce their equity investments in favor of something less volatile—in fact, some may have already moved assets out of stocks and into a money market investment or cash. There might be good reasons for changing an investment strategy, but acting on emotion or trying to anticipate the market’s direction can compromise a portfolio’s long-term return potential. In general, having an asset allocation aligned with the time horizon of an investor’s goals is the most prudent path.

A case for equity investments during market volatility

Staying the course takes patience and discipline and can be especially difficult during times of uncertainty. Investors with a healthy dose of equities in their portfolio are likely to benefit from the long-term growth potential of stocks because, over time, the magnitude of market gains has been significantly greater than that of losses. (See “Look at the stock market through a 15-year lens.”) Of course, past performance cannot guarantee future results.

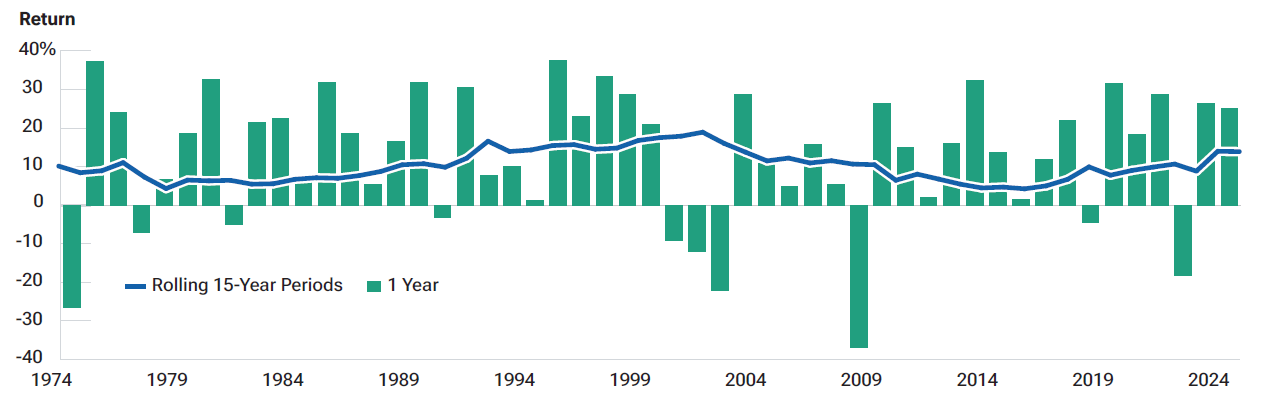

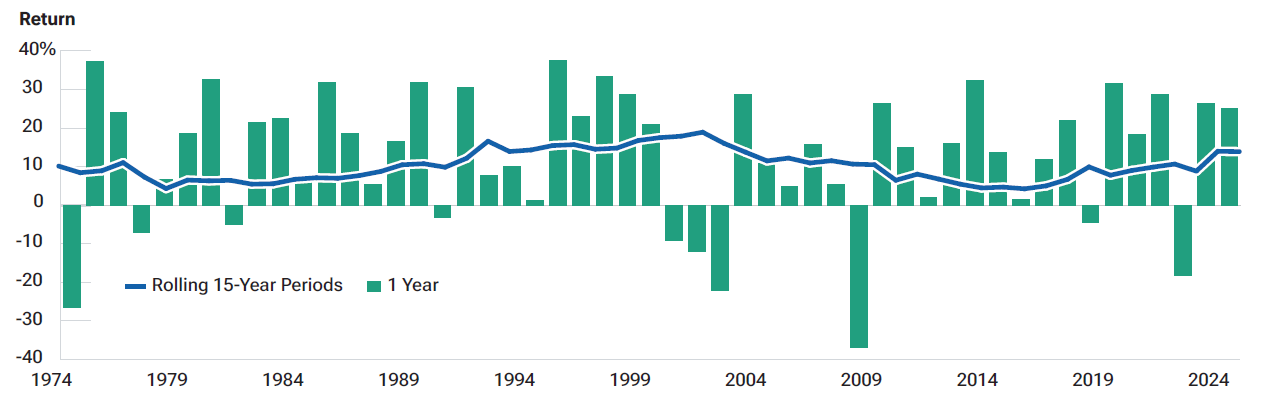

Look at the stock market through a 15-year lens

(Fig. 1) Remaining invested through downturns and corrections may allow investors to take advantage of long-term growth potential.

Past performance is no guarantee of future results.

Sources: T. Rowe Price, created with Zephyr StyleADVISOR, and S&P. See Additional Disclosure on last page.

The stock market is represented by returns of the S&P 500 Index. Annual returns began in calendar year 1974. Rolling 15-year data began in 1960. Price return calculations include dividends and capital gains. It is not possible to invest directly in an index. For illustrative purposes only.

close

close

The risk of trying to time the market

Another reason to stay invested is the difficulty of anticipating short-term market movements. “Very few of us can predict a decline coming,” says Roger Young, CFP®, a thought leadership director with T. Rowe Price. “Similarly, it’s impossible to anticipate the timing of the rebounds that follow, even with a good understanding of economic indicators.”

The decision to reduce stock exposure—moving these assets into money market investments or cash—not only means anticipating when to exit the market, but also choosing when to reenter the market—thus requiring two acts of successful market timing. “Unfortunately, investors typically wait until the market drops to get out, then wait until the market shows improvement to get back in,” says Young.

While it may be challenging to stick with a long-term strategy, doing so means an investor could be well positioned to reap potential gains as the market recovers. (See “The high cost of cashing out stocks.”)

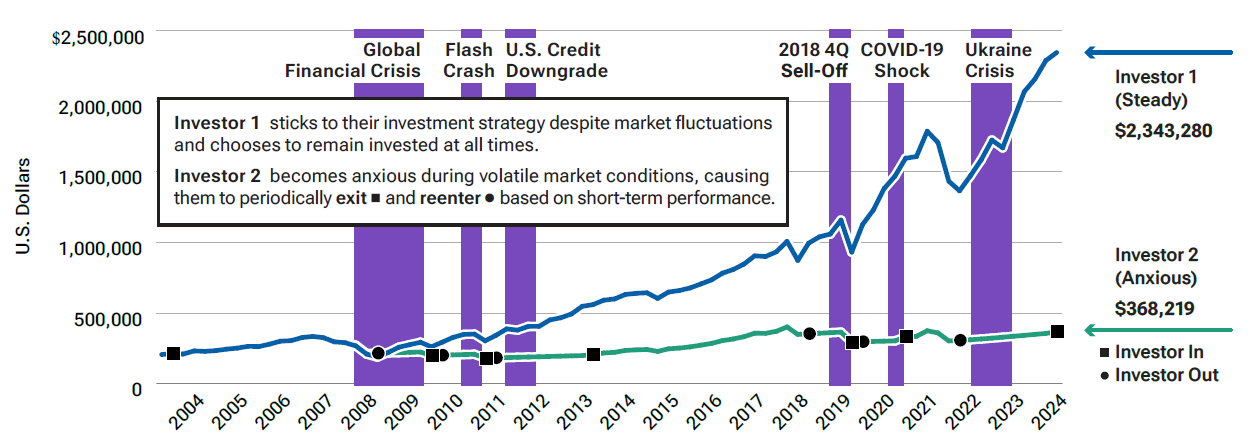

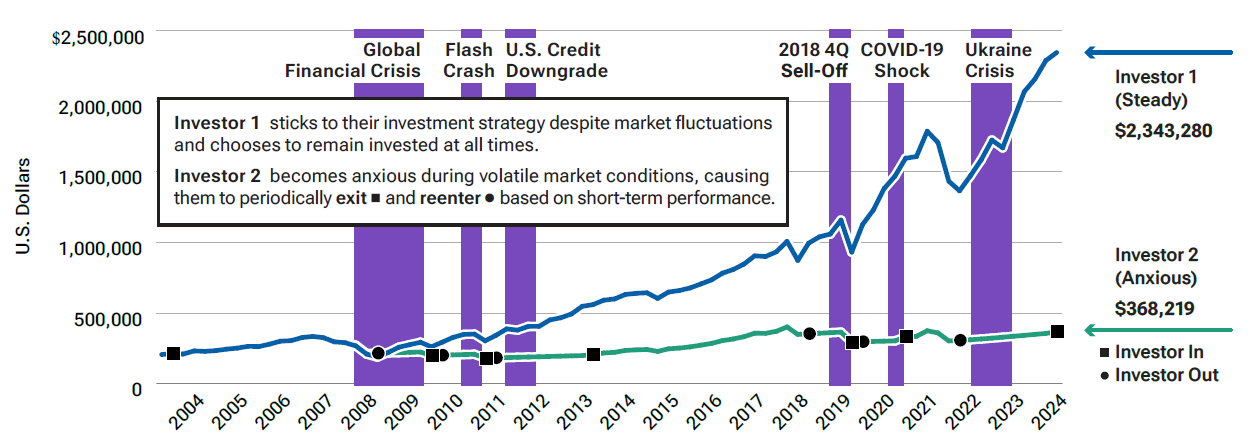

The high cost of cashing out stocks

(Fig. 2) Over time, a hypothetical steady investor who stays invested is likely to outperform a hypothetical anxious investor who jumps into and out of the market.

Past performance is no guarantee of future results.

Sources: T. Rowe Price and Standard & Poor’s.

The “anxious” investor style is assumed to be invested in 3-month Treasury bills as a cash equivalent. The $2,000 contributed each quarter in this example assumes minimal interest earned. The anxious investor style also assumes that cash is invested in Treasury bills during those periods when not invested in the stock market. The performance of stocks shown is that of the S&P 500 Stock Index, which measures the performance of large‑capitalization companies that represent a broad spectrum of the U.S. economy. Charts are for illustrative purposes only. Investors cannot invest directly in an index.

close

close

The benefit of staying invested

To illustrate the benefit of maintaining equity exposure through all types of markets, let’s consider two hypothetical investors—the first adheres to a steady investment strategy despite market fluctuations, and the second becomes anxious during volatile markets and jumps in and out.

Both investors contributed $2,000 each quarter to their investment accounts. The steady investor kept their money and ongoing contributions invested, riding out the stock market’s ups and downs. The anxious investor moved their account balance and contributions to cash when stocks dropped 10% or more in a quarter and only jumped back into equities after a fourth consecutive quarter of positive returns. This behavior was repeated throughout several market cycles.

While both investors saw their portfolio balances decline during downturns, the steady investor took advantage of lower stock prices through ongoing contributions and was rewarded as the market recovered. Ultimately, the anxious investor’s account value was less than half of the steady investor’s account at the end of the period.

Investors who are considering making changes or have already made changes to their equity investments

Some investors may have felt the need to act over the last couple of years—whether for tactical or emotionally driven reasons. Investors who have made changes could consider their motivation and what they can do now.

Motivation: Selling stocks to increase your cash reserve

For those nearing retirement or already retired, keeping a cash reserve that could cover one to two years’ worth of spending needs in retirement is a good rule of thumb. It is ideal to build up this reserve in the years leading up to retirement.

What an investor can do now:

An investor concerned about increasing cash on hand could direct any new contributions to a money market account rather than exchanging investments out of stocks all at once. This would allow the investor to revisit their allocation strategy once the market and their emotions are in a better position.

Motivation: Concern about losing money in the stock market and what may happen if market volatility continues

Suppose an investor’s emotions got the best of them and they panicked and moved their equity investments to a money market investment. Perhaps it was unsettling to see an account balance slide, or they are remembering what happened to their investments during previous crises. Such an emotional response is understandable, but at some point, investors will need to get their strategies back on track. The people who were most impacted by the 2020 downturn were the investors who got out of stocks and didn’t get back in.

What an investor can do now:

“The best advice we can give is to not wait too long,” says Young. “There will be no all-clear signal to let investors know that markets have bottomed.” Consider investing a little at a time by gradually purchasing stocks. Investors don’t have to time it perfectly.

For those who have not made any adjustments to their investments but are still afraid of volatility, maintaining or modestly boosting an allocation to fixed income can help buffer against short-term declines.

If an investor feels their equity exposure is currently too high, they should avoid acting out of fear. Since an asset mix can be a moving target during periods of volatility, an investor could set a schedule to periodically reevaluate an asset allocation based on their time horizon and risk tolerance.

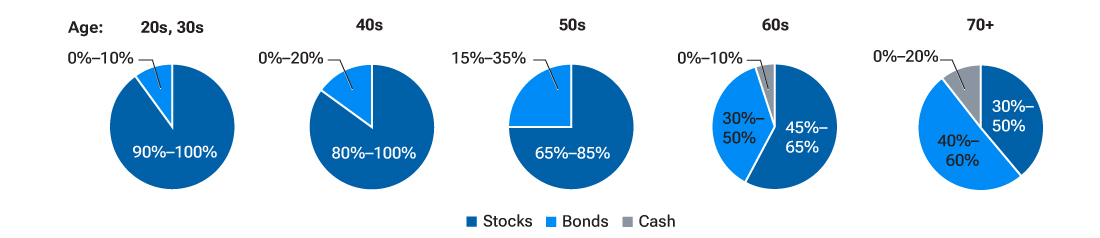

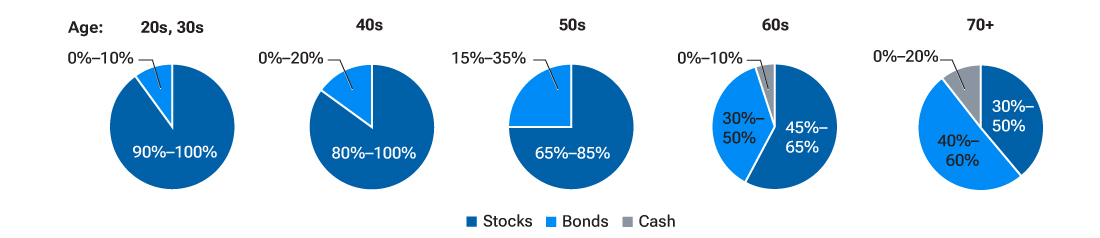

The right target allocation

Whatever an investor’s reasons for changing their strategy, reevaluating their target asset allocation is an important first step to getting back on track. T. Rowe Price’s sample retirement portfolios offer a good starting point. (See “Investing for long‑term growth.”) These portfolios show a range of equity exposures that we consider appropriate for various ages and time horizons. The range on display allows an investor to factor in their own risk tolerance. For example, an investor in their 60s could choose the lower end of the equity range in that model (45%) and still have enough growth potential for a portfolio to last for another two or three decades.

Investing for long-term growth

(Fig. 3) As an investor gets closer to their retirement, their portfolio may move gradually from more aggressive (more stock) to more conservative (less stock). Below are T. Rowe Price age-based asset allocations for retirement.

These allocations are age-based only and do not take risk tolerance into account. Our asset allocation models are designed to meet the needs of a hypothetical investor with an assumed retirement age of 65 and a withdrawal horizon of 30 years. The model asset allocations are based upon analysis that seeks to balance long-term return potential with anticipated short-term volatility. The model reflects our view of appropriate levels of trade-off between potential return and short-term volatility for investors of certain ages or time frames. The longer the time frame for investing, the higher the allocation is to stocks (and the higher the volatility) versus bonds or cash.

Limitations

While the asset allocation models have been designed with reasonable assumptions and methods, the tool provides models based on the needs of hypothetical investors only and has certain limitations: The models do not take into account individual circumstances or preferences, and the model displayed for your investment goal and/or age may not align with your accumulation time frame, withdrawal horizon, or view of the appropriate levels of trade-off between potential return and short-term volatility. Investing consistent with a model allocation does not protect against losses or guarantee future results. Please be sure to take other assets, income, and investments into consideration in reviewing results that do not incorporate that information. Other T. Rowe Price educational tools or advice services use different assumptions and methods and may yield different outcomes.

close

close

Weathering market volatility

In times of market volatility, it’s impossible to know when it may end. Investors who feel that a strategy change is in order could consider gradual adjustments. They could also wait until the volatility subsides to make wholesale shifts to their strategy. “These are challenging times for many people,” says Young. “If investors control the important things, such as how much to save and spend, and position their investments to balance this short-term volatility with longer-term growth, they can give themselves the best chance to achieve a comfortable retirement.”

Roger Young, CFP®

Thought Leadership Director

Roger Young, CFP®

Thought Leadership Director

Confidence runs deeper with a trusted advisor by your side

Get expert advice on investing, retirement, and tax-smart approaches, so you can have greater clarity and confidence in your financial future.

Additional Disclosure

Copyright © 2025, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

The “S&P 500 Index” is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”), and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). T. Rowe Price’s product is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P or their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product nor do they have any liability for any errors, omissions, or interruptions of the “S&P 500 Index.”

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of March 2025 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from any estimates or forward-looking statements provided.

Past performance is not a guarantee or a reliable indicator of future results. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor. T. Rowe Price Associates, Inc., investment adviser. T. Rowe Price Investment Services, Inc., and T. Rowe Price Associates, Inc., are affiliated companies.

© 2025 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (troweprice.com/en/intellectual-property) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners.

- 202503-4308615