personal finance | august 4, 2025

Six smart ways to help boost your financial wellness

Make saving easier and help reduce financial stress by considering these steps.

Key Insights

Taking fundamental steps toward financial fitness can help reduce stress.

Budgeting to save and pay off debt and putting money toward retirement can help stabilize your finances.

Building an emergency fund and boosting your income can help you reach your goals.

Make it easier to get on track and stay there using apps, software, automation, and education.

Judith Ward, CFP®

Thought Leadership Director

When you’re juggling competing financial priorities, figuring out how to manage your spending, saving, and investing can feel overwhelming. Fortunately, taking a few basic, but important, steps can help you get a handle on your money today and put you on the path to financial fitness in the future. The most fundamental steps toward financial wellness include establishing a budget, managing cash flow and debt, building your emergency fund, and putting some automation in place with your savings.

What is financial wellness?

Financial wellness is the process of developing healthy financial habits and being at peace with your finances, both present and future. It could include budgeting, eliminating debt, and investing.

Taking the following six steps can help reduce your stress and get you started.

1. Start with a budget

The first step toward achieving your financial goals is knowing where your money is going. A budget gives you the opportunity to make sure your saving and spending match your priorities. There are plenty of ways to prepare a budget. You can use a spreadsheet or pen and paper, and there are also apps and programs available to help make the job easier. Whichever way you choose to build your budget, you will want to list your monthly expenses, including fixed expenses such as your mortgage or rent, student loan payments, phone, and internet; variable expenses, such as groceries, entertainment, and travel; and irregular expenses like some health care expenses or home repairs.

When you make your budget, be sure to include your savings goals. It makes sense to pay yourself first—that means prioritizing savings goals as part of your essential monthly expenses.

A budget should also include a plan to reduce any debt. T. Rowe Price research shows that debt is a key driver of financial stress and often derails long-term savings goals.1 First, make the minimum monthly payments on all your debt. Then target high-interest debt, like credit card balances. You may need to make short-term adjustments to your savings and spending plans while you take care of existing balances.

Once you have a clear picture of your expenses, compare your spending with your income, and consider any changes you may want or need to make. After you set your budget, you should monitor your spending regularly to ensure that you’re staying on track to realize your goals.

2. Put away money for an emergency

When it comes to financial fitness, one of the most important steps you can take is creating an emergency fund. Set aside cash in an emergency fund so that you can deal with life’s unexpected events without derailing your budget or long-term savings strategy. T. Rowe Price’s 2024 Retirement Savings & Spending survey found that half (50%) of surveyed 401(k) savers stated that saving for emergencies was a major objective.

How much do you need? While you are working, T. Rowe Price recommends that you set aside at least $1,000 for emergencies to start. Then build up to an amount that can cover three to six months of expenses. If your income is less predictable—such as with freelance or commission-based work—you may want to set aside enough to cover at least six months or more.

While investing can be a powerful way to potentially grow your savings, you will want to consider keeping your emergency fund in a savings, checking, or money market account. These accounts can offer you lower-risk investing and easy access to these funds when needed. If you need to use your emergency savings, make sure you work on replenishing your fund afterward.

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

3. Make your saving automatic

One of the best ways to help stay on track with your saving and investing plans is to make your contributions automatic. Automation saves time and doesn’t require ongoing work, so once you set it up, you can make progress toward your contribution goals without any extra effort. It also helps remove the emotions from investing, helping you stick to your plan despite market ups and downs. (See “How automated investments can grow over time.”)

How automated investments can grow over time

Consistently investing $300 a month could hypothetically add up to $368,426 over 30 years.

Chart assumes a starting balance of $300 and monthly contributions of $300 made at the end of each period, with annual returns of 7% compounded monthly. Figures do not account for investment fees or taxes, and no withdrawals were taken; had these been included, actual results would be lower. Results are for illustration only, do not represent specific investments, and do not project or predict investment results. Investing a constant dollar amount, also known as dollar cost averaging, cannot assure a profit or protect against loss in a declining market. Since such a plan involves continuous investment in securities regardless of fluctuating price levels, investors should consider their financial ability to continue purchases through periods of low and high price levels.

All investments involve risk, including the loss of principal.

Sticking with your plan through short-term market volatility can help you, through a process called dollar cost averaging—buying more shares when prices are low and fewer shares when prices are high. Dollar cost averaging can reduce the average purchase price for stock shares during times of volatility or down markets. Accumulating more shares when the price is lower means benefiting when the market and the price of the investment rebound. This method, however, cannot assure a profit or protect against loss in a declining market. Investors should consider their financial ability to continue purchases through periods of low and high price levels. (See “Investing on a regular basis.”)

Automation also removes the temptation to spend. The money is routed to your goals before you become distracted by tempting purchases.

You may already take advantage of an automated savings plan through a workplace 401(k), 403(b), or other retirement account. You can also automate contributions to other accounts, such as individual retirement accounts (IRAs) and taxable brokerage accounts. For example, with T. Rowe Price Automatic Buy,2 you can establish regular monthly payments to existing retirement, general investing, or brokerage accounts.

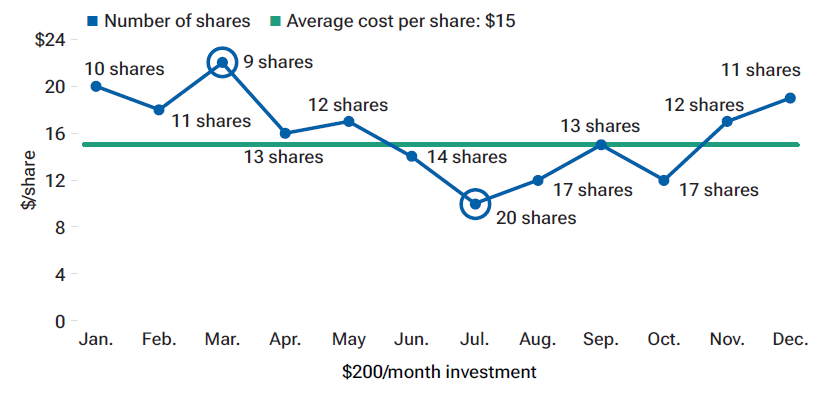

Investing on a regular basis

Consider this hypothetical example of investing a constant dollar amount over the course of a year. At the highest price point, nine shares are purchased with the $200 monthly investment. At the lowest price point, the same $200 buys 20 shares.

Investing a constant dollar amount, also known as dollar cost averaging, cannot assure a profit or protect against loss in a declining market. Since such a plan involves continuous investment in securities regardless of fluctuating price levels, investors should consider their financial ability to continue purchases through periods of low and high price levels. This is a hypothetical example and is for illustrative purposes only. Number of shares is rounded to whole numbers and may not equal total shares due to rounding.

4. Increase retirement contributions each year

When it comes to your retirement goal, saving as much as possible and starting as early as possible can be keys to success. T. Rowe Price analysis suggests investors save about 15% of their income, including any employer match, over the course of their working career, and that they need to have about 11 times their ending salary saved by the time they retire in order to maintain their lifestyle in retirement. According to T. Rowe Price’s 2024 Retirement Savings & Spending1 survey, only 45% of respondents think they are saving enough for retirement. The median contribution amount was just 6% of salary.

If you fall into this category and you cannot get to 15% right away, it’s important that you at least try to contribute enough to get the full employer match and then steadily increase your contributions over time. (See “Saving early can make a difference.”) Many workplace plans offer a service that will automatically increase your retirement contributions by 1% or 2% each year. Because the increases are small and incremental, you might not even notice that you are saving more, but doing so can potentially make a big difference over time.

If auto-increase options aren’t available or you’re investing outside your 401(k) plan (in an IRA, for example), then schedule gradual increases into your savings plan yourself—making sure you stay within any contribution limits.

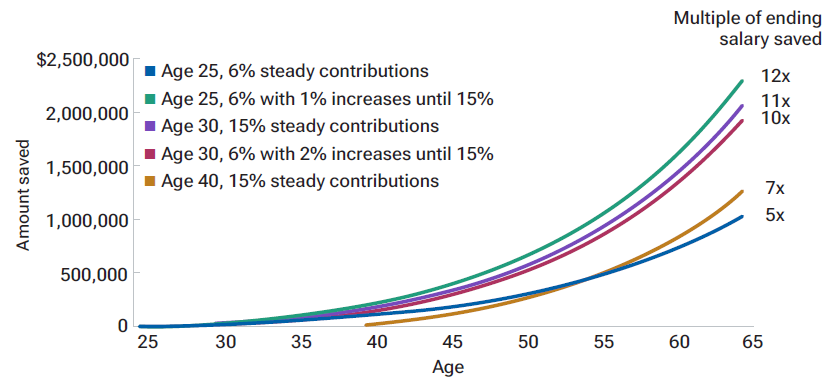

Saving early can make a difference

Starting early and steadily increasing your contributions up to the 15% target can help you reach your retirement savings goal.

Assumptions: Examples beginning at age 25 assume a beginning salary of $40,000 escalated 5% a year to age 45 then 3% a year to age 65. Examples beginning at age 30 assume a beginning salary of $50,000 escalated 5% a year to age 45 then 3% a year to age 65. Example beginning at age 40 assumes a beginning salary of $80,000 escalated 5% a year to age 45 then 3% a year to age 65. Annual rate of return is 7%. All savings are assumed to be tax-deferred. Multiple of ending salary saved divides final ending portfolio balance by ending salary at age 65. This example is for illustrative purposes only and is not meant to represent the performance of any specific investment option. The assumptions used may not reflect actual market conditions or your specific circumstances and do not account for plan or IRS limits. Please be sure to take all of your assets, income, and investments into consideration in assessing your retirement savings adequacy.

This chart compares savers beginning at ages 25, 30, and 40. A 25-year-old saving 6% of salary and increasing each year by 1% until reaching 15% may have 12 times her final salary saved at age 65. If the 25-year-old never increases the savings rate, she may have only 5 times her final salary saved. A 30-year-old saving 15% over the horizon may have 11 times his final salary saved by age 65. At the same time, a 30-year-old saving 6% of salary and increasing that amount 2% each year to 15% may still have about 10 times her final salary at age 65. And a 40-year-old saving 15% over the horizon may have about 7 times his final salary at age 65.

5. Take advantage of financial education and tools

You don’t need to figure out your financial life on your own—there are lots of ways to get help. For instance, many employers offer financial wellness tools and education programs to help their employees define goals and identify concrete incremental steps to achieve them. Some employers offer important financial support, including matching retirement contributions, student loan repayment, tuition reimbursement for additional education, and other benefits. Your employer is not your only option. Many financial companies, including brokerages and banks, offer free online tools and education. You can also gain perspectives on T. Rowe Price Insights to help inform your financial journey. Financial advisors can help with everything from creating a financial plan to ongoing investment management.

6. Boost your earning power

When it comes to building savings and paying down debt, coming up with the money to achieve your goals can be difficult. How much you earn is a key part of your financial outcome, so it makes sense to consider your income as part of your overall plan.

You may be able to increase your earning potential. Investigate additional education to improve your career prospects. Many employers offer training programs or tuition reimbursement to support your ongoing education. Some people boost earnings with side gigs, second jobs, or small businesses. Finding a way to make more money may not be easy, but doing so may help decrease stress and increase your financial self-determination.

Making financial wellness a lifelong practice

Financial wellness is a process that should last a lifetime. Starting with these six steps and revisiting them periodically could help you on your way to a stronger financial position, less stress, and realizing your financial goals.

1The T. Rowe Price Retirement Savings & Spending Study (RSS) is an annual study that has been conducted online since 2014. The study annually surveys approximately 3,000–4,000 participants who are currently contributing to a 401(k) plan or are eligible to contribute and have a balance of at least $1,000. The 2024 RSS was conducted between July 17, 2024, and August 7, 2024, and included 3,005 plan participants.

2Investing through Automatic Buy cannot assure a profit or protect against loss in a declining market. Since it involves continuous investment regardless of fluctuating price levels, investors should consider their financial ability to continue purchases through periods of both high and low price levels.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types; advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

The views contained herein are those of the author as of August 2025 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates. All investments are subject to market risk, including the possible loss of principal. Diversification cannot assure a profit or protect against loss in a declining market.

Charts are shown for illustrative purposes only. All investments involve risk, including possible loss of principal.

T. Rowe Price Investment Services, Inc., distributor, and T. Rowe Price Associates, Inc., investment adviser.

View investment professional background on FINRA's BrokerCheck.

202507-4689314

Next Steps

Explore all the ways we can help you reach your retirement goals.

Contact a Financial Consultant at 1-800-401-1819.