March 2023 / ASSET ALLOCATION VIEWPOINT

A Recession May Be Delayed, Not Avoided

Near-term tailwinds could favor international markets

Key Insights

- Equity markets started the year on a positive note, boosted by economic surprises in the U.S. and improved outlooks in China and Europe.

- In our view, favorable economic news in the near term could mean a more hawkish Federal Reserve, which would be a headwind for the economy and equity markets.

Equity markets rallied from the beginning of the year into early February, driven by encouraging data regarding the health of the U.S. economy and improved economic outlooks in China and Europe that were supported by the reopening of the Chinese economy and falling energy prices in Europe.

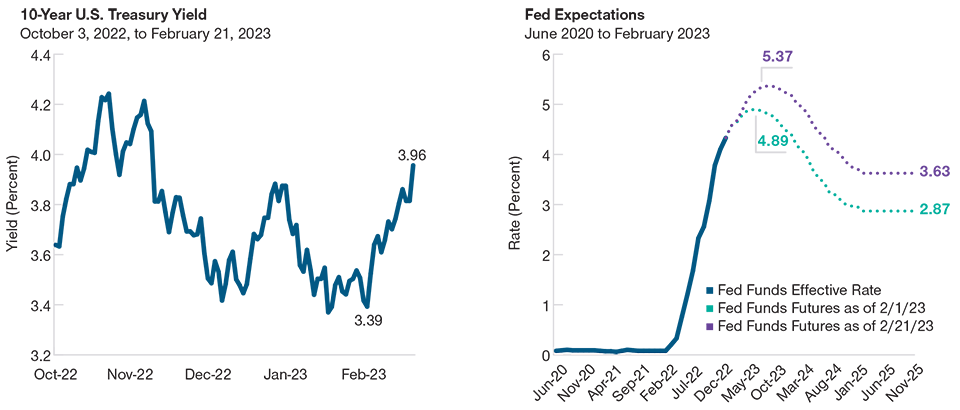

Positive Economic Data Could Mean Rates Stay Higher for Longer

(Fig. 1) 10-year U.S. Treasury yield and Fed rate hike expectations rose in February

Past performance is not a reliable indicator of future performance. Actual outcomes may differ materially from estimates. Estimates are subject to change.

Source: Bloomberg Finance L.P.

In the U.S., positive economic surprises—including an unexpectedly strong jobs report in January, an uptick in consumer spending, and a slowing trend in inflation—boosted optimism that a U.S. and global recession could be avoided. However, investor sentiment shifted by mid-February amid concerns that these positive developments could lead the Federal Reserve (Fed) to take a more hawkish policy stance. From February 2 through February 21, the 10-year U.S. Treasury yield rose, and futures markets shifted their predictions for both the federal funds rate and the 10-year Treasury yield meaningfully higher (Figure 1).

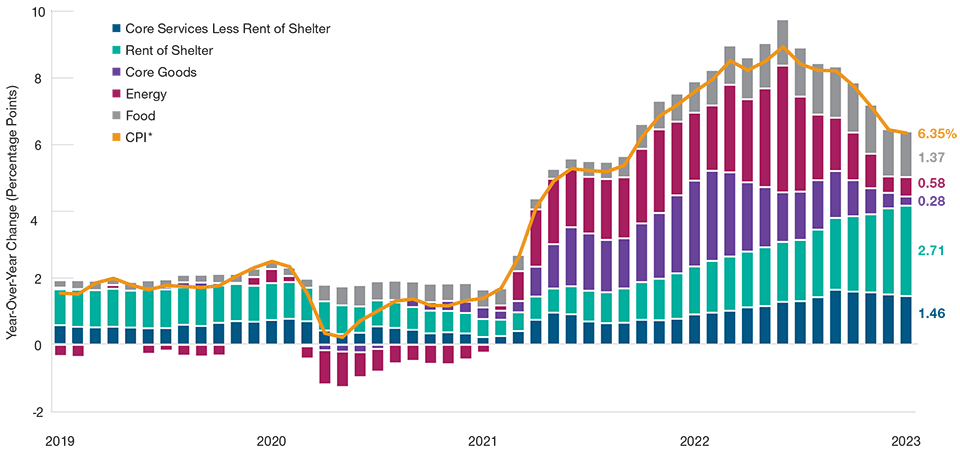

Notably, the Fed has signaled that it remains committed to fighting inflation. Although aggregated data show that inflation is slowing overall, the “services excluding shelter” category—which is very sensitive to wages—is still problematic (Figure 2). Typically, strong economic indicators suggest a healthy economy, but to the Fed, they also indicate that labor costs are likely to remain stubbornly high and that additional rate hikes may be needed to moderate elevated wage inflation.

In our view, positive economic news may be short-lived as the Fed could be forced to keep raising rates—a headwind for the economy and equity markets. This could mean that, for now, a recession may be delayed, but not avoided. Therefore, we remain cautious, and the T. Rowe Price Asset Allocation Committee is maintaining an underweight position in stocks relative to bonds.

Inflation Is Not Falling Fast Enough

(Fig. 2) Contribution to the consumer price index (CPI) in percentage points

January 2019 to January 2023.

Source: Bloomberg Finance L.P.

*CPI = year-over-year percent change. CPI measures the monthly change in prices paid by consumers and is a widely used measure of inflation.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

March 2023 / ASSET ALLOCATION STRATEGY