June 2022 / INVESTMENT INSIGHTS

Evaluating ESG Bonds—What’s Behind the Label?

Greenwashing risks underpin importance of assessing an ESG bond’s credentials

Key Insights

- The market for environmental, social, and governance (ESG)‑labeled debt has grown rapidly, a trend we expect to continue as governments and companies step up their efforts to meet climate and social goals.

- A lack of global compulsory standards and criteria for issuing debt with an ESG‑related tag leaves investors vulnerable to greenwashing, however.

- To help mitigate this risk, we have built a proprietary framework to evaluate the quality and credentials of an ESG‑labeled bond.

The market for debt issued with an environmental, social, and governance (ESG) focus has grown rapidly in recent years to become a significant feature of today’s fixed income investing landscape. While we are encouraged to see companies and governments undertaking green and social projects eligible for ESG‑labeled bond financing, caution is warranted. This fast‑growing, yet still nascent, category has proven vulnerable to greenwashing—where some securities convey a false impression or provide misleading information about the environmental credentials of an organization’s products, services, and investments. Furthermore, not all green, social, sustainability, and sustainability‑linked bonds are created equal or have adequate safeguards in place to ensure that their proceeds will indeed target sustainable activities. For these reasons, we do not feel that it is appropriate to just accept a bond as “sustainable” based solely on its label. A robust ESG bond framework is vital, therefore, to help evaluate the credentials of an ESG‑labeled bond.

Rapid Growth in ESG‑Labeled Issuance Set to Continue

Since the issuance of the first green bond in 2007, the market for sustainable finance has grown considerably and broadened to include social, sustainability, and sustainability‑linked bonds. In 2021, for the first time ever, more than USD 1 trillion worth of bonds were sold for the purpose of either financing specific environmental/social projects (green, social, and sustainability bonds) or for general purposes (sustainability‑linked bonds) where the structure is linked to the issuer’s achievement of a predefined ESG target.

Behind the rapid growth is insatiable demand from investors who are keen to gain exposure to more ESG‑conscious investments. This has led to a so‑called greenium where investors are willing to pay more for an ESG‑labeled bond than the plain-vanilla equivalent, despite both carrying the same level of credit risk. According to T. Rowe Price analysis, investment‑grade ESG bonds denominated in euros typically trade at a premium of around three basis points over vanilla bonds, while U.S. dollar‑denominated ESG‑labeled debt trades, on average, around six basis points more expensive than non‑ESG equivalents.1

What’s Behind the Label

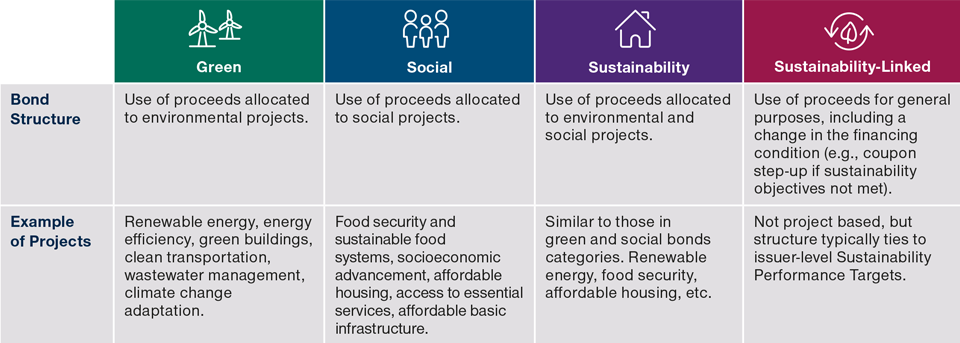

Understanding ESG‑labeled bonds

Source: T. Rowe Price.

Surging investor demand makes ESG‑labeled bonds an increasingly cheaper form of financing and should continue to entice issuers to bring new deals to this market. Furthermore, companies and governments are under growing investor, community, and regulatory pressure to transition toward a low‑carbon economy and improve on issues, such as social inequality. For these reasons, we expect the market for ESG‑labeled bonds will continue to grow.

Wariness About Greenwashing Risks and Materiality

With ESG‑labeled bonds expected to continue growing in both size and complexity, it is critical to understand the various nuances of this market. While ESG‑labeled bonds offer potential new opportunities for investors to diversify and gain exposure to more ESG‑conscious investments, there are several unique challenges in this market.

First, strong investor demand for ESG investments and flexible standards have created an environment that issuers can potentially exploit. For example, there are signs of companies selling ESG‑labeled bonds for environmental/social projects that lack credibility or, in the case of sustainability‑linked bonds, companies set targets that are either easy or have already been achieved.

Second, there is a lack of detail in the principles that companies use as a guide for issuing labeled debt. Although not compulsory, the large majority of companies follow the International Capital Market Association (ICMA) guidelines for issuing each category of ESG debt—the Green Bond Principles, the Social Bond Principles, the Sustainability Bond Guidelines, and the Sustainability‑Linked Bond Principles. These are both vague and lack specific environmental and social project category details. This leaves a lot of room for different interpretations by companies, which raises the risk of potential greenwashing.

Third, there’s concern about ESG‑labeled bonds potentially lacking “additionality” or positive ESG impact. For example, issuing a green bond for operational expenditures on renewable energy procurement that was already taking place does not constitute a new green investment nor does it achieve additionality. Another worry is sustainability‑linked bond structures that allow an issuer to recall the bond before its sustainability target measurement date or where the coupon step‑up for missing the target is immaterial.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.