June 2022 / OUTLOOK

Capital Market Assumptions

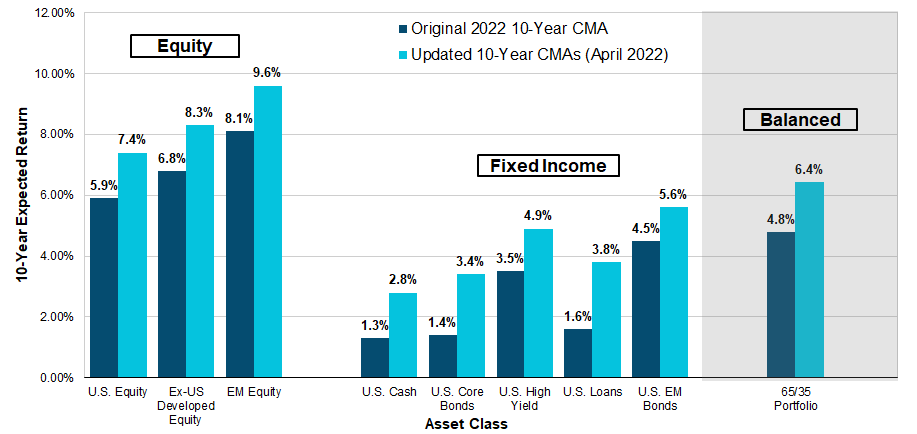

The T. Rowe Price 5-Year Capital Market Assumptions were calculated based on data as of December 31, 2021.

CMAs are best understood as forecasts for the central tendency of forward returns. They do not seek to predict actual or realized returns, as there is bound to be material variation around this central tendency for any given historical or future period. For this reason, T. Rowe Price's approach to portfolio construction relies on the use of multiple methods of optimization and robustness checks.

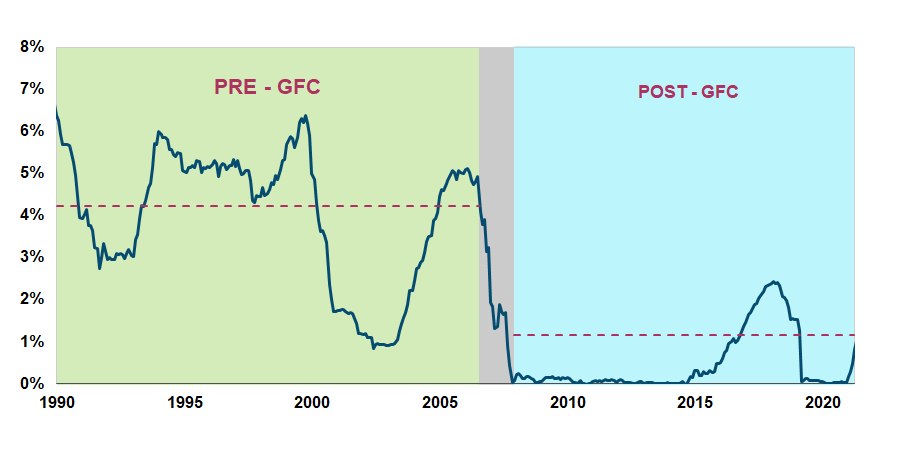

Two Distinct Policy Regimes: What’s Next?

U.S. Generic 3-Month Bill Index, December 31, 1990- to May 31, 2022

Past Performance is not a reliable indicator of future results.

Source: Bloomberg Finance, L.P.

Current tactical positioning in our Multi-Asset strategies is available in our Global Asset Allocation Viewpoints monthly publication.

The information presented is shown for illustrative, informational purposes only. Forecasts are based on subjective estimates about market environments that may never occur. This material does not reflect the actual returns of any portfolio/strategy and is not indicative of future results. Management fees, transaction costs, taxes, and potential expenses are not considered and would reduce returns. Expected returns for each asset class can be conditional on economic scenarios; in the event a particular scenario comes to pass, actual returns could be significantly higher or lower than forecast. See the Methodology and Appendix for detailed methodology and a representative list of indexes.

Source: Relevant indices, analysis provided by T. Rowe Price.

65/35 Portfolio Allocation: 40% US Equity, 20% DM Equity, 5% EM Equity, 25% Core Bonds, 5% each to High Yield, Loans, EM Bonds.

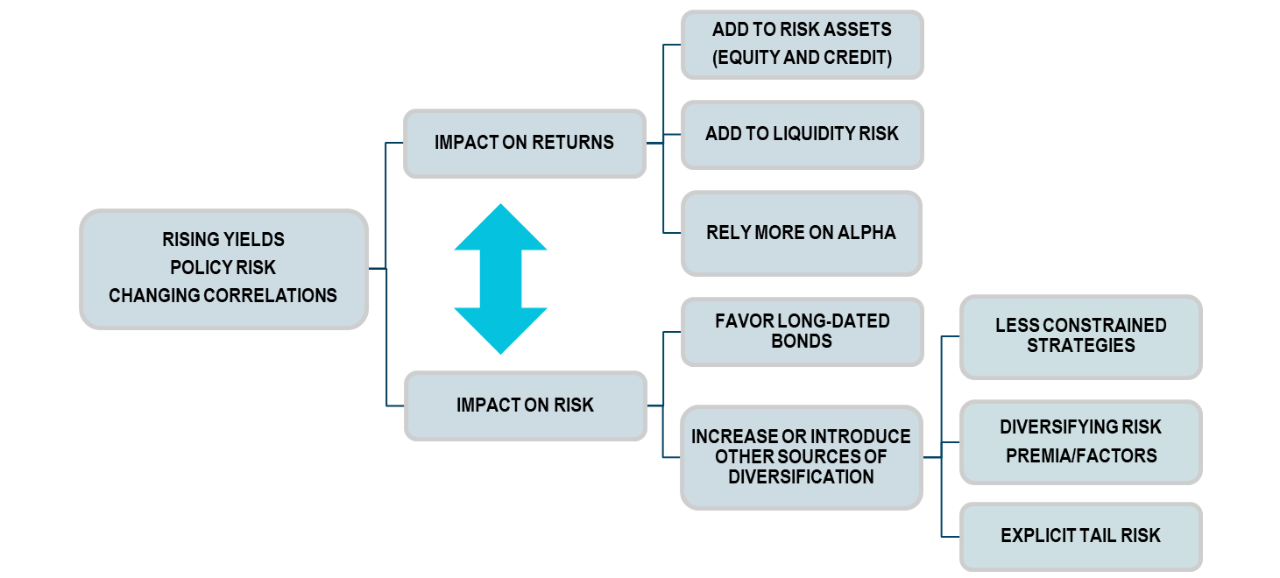

Strategic Asset Allocation Playbook

Does not change the playbook, but maybe the play

IMPORTANT INFORMATION

T. Rowe Price Capital Market Assumptions: The information presented herein is shown for illustrative, informational purposes only. Forecasts are based on subjective estimates about market environments that may never occur. This material does not reflect the actual returns of any portfolio/strategy and dis not indicative of future results. The historical returns used as a basis for this analysis are based on information gathered by T. Rowe Price and from third-party sources and have not been independently verified. The asset classes referenced in our capital market assumptions are represented by broad-based indices, which have been selected because they are well known and are easily recognizable by investors. Indices have limitations due to materially different characteristics from an actual investment portfolio in terms of security holdings, sector weightings, volatility, and asset allocation. Therefore, returns and volatility of a portfolio may differ from those of the index. Management fees, transaction costs, taxes, and potential expenses are not considered and would reduce returns. Expected returns for each asset class can be conditional on economic scenarios; in the event a particular scenario comes to pass, actual returns could be significantly higher or lower than forecast.

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass.

USA – Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2022 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.