January 2021 / MARKET OUTLOOK

Global Market Outlook

Four factors for 2021

After facing one of the most testing environments in history following the Covid-19 outbreak, investors are increasingly optimistic of a strong recovery in 2021 due to recent positive vaccine news and additional fiscal and monetary stimulus announcements. However, as the unprecedented health crisis continues to lock down many parts of the world, risks to the recovery remain.

In the following update, T. Rowe Price investment leaders – David Giroux, CIO Equity and Multi Asset, Justin Thomson, CIO Equity, and Mark Vaselkiv, CIO Fixed Income – highlight the four factors investors need to focus on for 2021.

The first factor discusses the current threats and opportunities for investors, particularly as the recovery is somewhat already being priced into asset markets. The second factor examines the backdrop for hard-hit value stocks, with expectations rising of a rotation in market leadership toward cyclical sectors in 2021 – in light of the vaccine news. The third factor centres on the current low interest rate environment and the need for fixed income investors to think creatively in order to extract yield in 2021. Finally, factor four looks at how the global pandemic has accelerated economic inequality and appears to have worsened political divisions in some countries, and what this means for investors.

As many uncertainties remain, the T. Rowe Price investment leaders all agree on one crucial element in the year ahead – the need for active management. With the uneven impact of the pandemic and the recovery likely to lead to bouts of heightened volatility, strong fundamental analysis and skilled active security selection is likely to be a key driver of investment success in 2021 and beyond.

Factor 1: recovery threats and opportunities

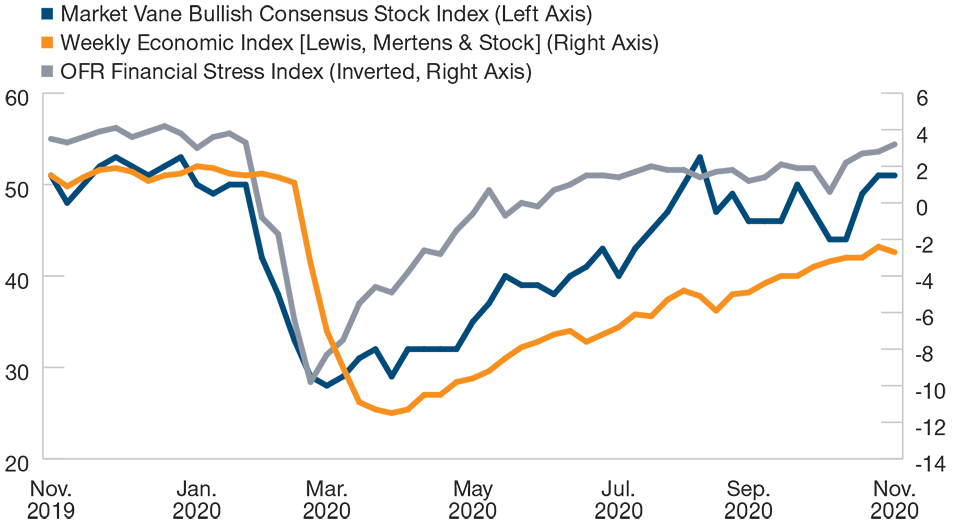

Although most global economies saw a relatively rapid economic rebound from the initial onset of the pandemic (figure 1), the world still has not returned to normal.

As 2020 ended, a major spike in COVID‑19 cases in the US and Europe posed a renewed threat to the recovery. While the new vaccines and improved treatment therapies are encouraging signs for 2021, the economic effects of the pandemic are likely to echo for some time and uneven progress could produce periods of market volatility.

The first quarter of 2021 could see a trough in economic activity, but assuming the new vaccines can be distributed on an accelerated scale – especially to higher‑risk populations – economic conditions could improve rapidly in the second quarter. People are going to want to travel, to get back to work, to have deferred elective medical procedures. If so, the second half of 2021 could look more like 2019 than like the first half of 2020.

A ‘swoosh’ shaped recovery so far

(Fig. 1) Investor sentiment, economic and financialstress indicators

As of November 27, 2020.

Past performance is not a reliable indicator of future performance.

Source: Bloomberg Finance LP. Haver Analytica/Barron’s, Federal Reserve

bank of New York, Office of Financial Research and Standard & Poor’s (see

additional disclosure)

Encouraging signs globally

A key economic variable will be whether governments in the US and Europe will provide additional fiscal support to supplement the monetary stimulus provided by the US Federal Reserve and the European Central Bank.

Fed Chairman Jerome Powell has emphasised fiscal stimulus needs to take priority over additional monetary stimulus because it has a more significant impact on the real economy. The size and timing of any additional US fiscal stimulus may depend on the partisan balance of power in Washington. A divided government could require lengthy negotiations and limit the scope of any aid package.

In Europe, on the other hand, the fiscal outlook appears encouraging. Unlike in past economic emergencies, such as the 2012 European sovereign debt crisis, the European Union is not imposing austerity but rather has committed to fiscal stimulus. It finally appears Europe is acting in a concerted, cohesive fashion.

China’s recovery appears robust, relative both to the developed world and to other emerging market economies, and the country should see positive economic growth for 2020 as a whole. However, Chinese corporate bond yields have started to rise, which could limit credit growth in 2021.

A bullish 2021 case can be made for Japan, based on historically close correlations between Japanese equities and the global cyclical sectors that could benefit most from a pandemic recovery. Increasing shareholder activism is another potentially positive factor for the country.

Rapid earnings recovery

For US and global equity markets, a rapid economic recovery could bring an accelerated earnings recovery. Following the last three recessions, it took the S&P 500 Index three, four and five years, respectively, to regain its previous earnings per share peak. This time, it potentially could happen in 2021.

However, rapid earnings growth might not translate into strong equity returns in 2021. Despite the sharp earnings decline seen during the pandemic, most global equity markets finished 2020 with strong gains and a lot of the recovery is already priced into the markets.

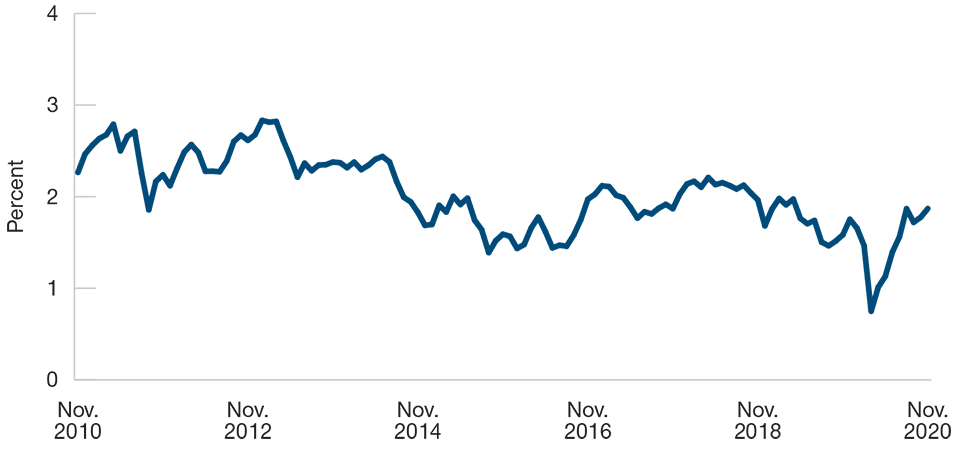

A broader economic recovery could also produce a modest uptick in inflation, which decelerated in early 2020 as the pandemic spread. Forward‑looking measures of inflation expectations, such as spreads between nominal and inflation protected government bonds (figure 2) have rebounded sharply since mid‑2020. There is a risk the US could pierce the 2% inflation ceiling – not quickly, but perhaps in 2022 or 2023.

Upside inflation risks should not be ignored

(Fig. 2) US ten-year government yield minus governmentinflation-linked 7- to 10-year yield

As of November 30, 2020.

Past performance is not a reliable indicator of future performance.

Source: T.Rowe Price analysis using data from Factset Research Systems Inc.All rights reserved.

Actionable investment ideas

When uncertainty is elevated and markets are choppy, investors should balance return‑seeking and defensive assets to navigate volatility and ensure true diversification. Offensive assets such as stocks, corporate bonds and emerging market debt can be balanced by defensive assets like high‑quality long‑dated duration, safe‑haven currencies and other defensive strategies. In addition, procyclical assets tend to outperform during economic recovery. Some of these assets – such as small‑cap stocks and credit markets – have lagged in the 2020 rally in risk assets, so valuations may be attractive. Finally, volatility and change cause prices to diverge from valuations. This is an environment for skilled active managers to add value, in particular when some valuations are rich. Fundamental‑driven security selection and tactical asset allocation can adapt to new conditions rather than relying on past behaviours.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

January 2021 / INVESTMENT INSIGHTS