Why I Am Still Confident in Emerging Markets

Investors face a range of challenges as well as opportunities in 2020. Markets are near all‑time highs, and while bull markets tend to die of extremes or crisis, there are concerns about the age of this particular bull market, especially given the global economy slowed in 2019. Throw in geopolitical concerns over the U.S. presidential election, trade wars, and Middle East tensions, and it would be easy to lurch toward safe havens.

However, we continue to live in a world with low or negative interest rates and central banks that are proactively stimulating or preparing for stimulus. Economic data is troughing with an outlook of stability to gentle improvement in 2020, and with valuations showing few signs of broad‑based extremes, equities remain a good option, in my opinion.

...we continue to live in a world with low or negative interest rates.... with valuations showing few signs of broad‑based extremes, equities remain a good option, in my opinion.

...we continue to live in a world with low or negative interest rates.... with valuations showing few signs of broad‑based extremes, equities remain a good option, in my opinion.

Economic Data Needs to Catch Up With Markets

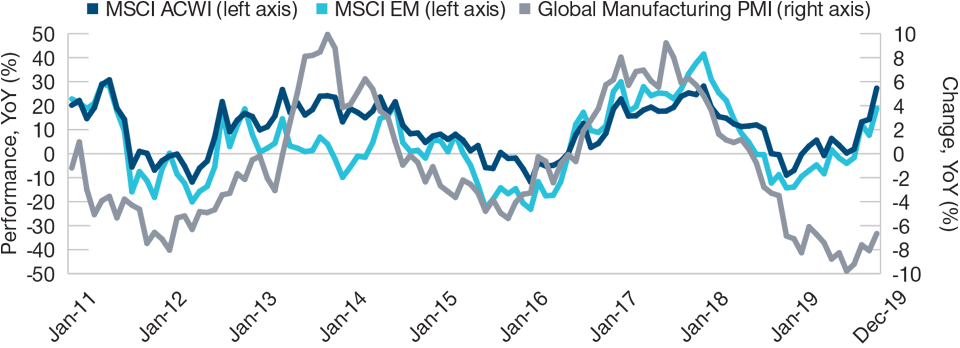

Equity investors generally enjoyed strong gains in 2019.1 The Nasdaq broke through 9,000 for the first time, and the S&P 500 recently hit an all‑time high. With equity markets having performed well in the back end of 2019, we now need to see growth and economic activity improve to back up recent market gains. Figure 1 illustrates the gap that has emerged between equity and economic performance.

Of course, equity markets are predictive creatures and tend to look ahead. That said, there’s not a lot of room for disappointment, and 2020 is going to require some nimble movement in portfolios to tackle the upcoming risks. These include potential earnings disappointments and the sector rotation that may come from unexpected cyclical acceleration or disappointment. I have certainly been reducing a degree of risk within the portfolio and playing for the middle part of the fairway, given the need to maintain a balanced portfolio and account for the mosaic of risk and return opportunities ahead.

Emerging markets haven’t seen anything like the gains that U.S. equities have enjoyed in recent years.

Emerging markets haven’t seen anything like the gains that U.S. equities have enjoyed in recent years.

(Fig. 1) Markets Have Raced Ahead, While Economic Data Have Been Disappointing

Economic data need to catch up with equity markets for there not to be a fallout

As of December 31, 2019

Past performance is not a reliable indicator of future performance.

MSCI ACWI = MSCI All Country World Index, MSCI EM = MSCI Emerging Markets Index, and Global Manufacturing PMI = Global Manufacturing Purchasing Manager Index.

Sources: FactSet and MSCI (see Additional Disclosures).

Value to Be Found in Emerging Markets

One area where there remains a closer correlation with equity markets and economic data is the emerging world. Emerging markets (EMs) haven’t seen anything like the gains that U.S. equities have enjoyed in recent years. Many individual countries have seen positive returns, but upside has been somewhat limited by a slowing global economy and a U.S. dollar that has maintained real strength in good and bad times.

Key to the case for emerging markets over the medium term is a stable economic backdrop and corporate profits lifting returns after a difficult 2019. With valuations across the developed world unlikely to expand further, profit growth is likely to be the main driver of returns this year, and here we are especially encouraged by prospects in the emerging world.

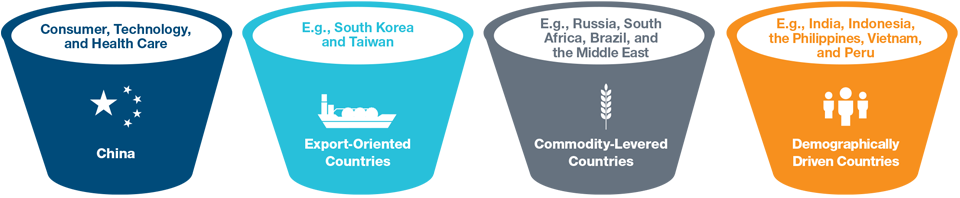

As I have stated before, however, EMs are heterogeneous, and to lump them all together in one bucket is not consistent with fundamental reality today. Instead, I tend to use four different classifications when discussing this dynamic part of the world.

Emerging Markets—Four Areas of Focus

The multifaceted and heterogeneous nature of emerging markets means that I focus on four distinct areas

The most interesting area of emerging markets are the demographically driven areas, such as India, Indonesia, the Philippines, Vietnam, and Peru.

The most interesting area of emerging markets are the demographically driven areas, such as India, Indonesia, the Philippines, Vietnam, and Peru.

The first one is China. China is so large and important that it deserves its own category. Although the Chinese economy has slowed substantially, it is still growing much faster than the developed world. But it faces challenges in its financial system and in transitioning from an investment‑driven to a consumer‑driven economy, bringing frictions along the way. Our exposure is focused in areas such as the consumer, technology with highly specialized intellectual property, and growth segments of health care. These are the areas of China that we believe can continue to do well over the long term, whether the economy slows or not.

The next are export‑oriented countries, particularly in North Asia (South Korea, Taiwan). These are, for all intense purposes, developed economies supplying the segments of the technology chain but, due to idiosyncratic reasons, have ended up being classified as emerging. While we see an improvement in the IT capex and semiconductor industry in 2020, we find more opportunity in developed world peers and alternatives, especially given better corporate governance standards for those in developed market.

The third bucket is commodity‑levered economies—countries including Russia, South Africa, Brazil, and those in the Middle East whose economies are primarily driven by the commodity cycle and energy prices. Here, we are underweight given our view of a low‑growth world and our negative outlook for commodities. Within very selective pockets of these economies, we are focused on companies with growth leveraged to positive consumer trends and emerging technologies, including electronic payments. High‑quality balance sheets, low‑cost production, and better growth profiles remain our compass in tougher neighborhoods. Moving down the quality spectrum is not part of our strategy given the tougher growth backdrop.

Finally, the fourth (and most interesting, in my opinion) are the demographically driven areas of EMs—consumption‑driven economies that tend to have growing populations and where citizens are working very hard to make a better life for themselves. Given the favorable growth backdrop this creates, pricing power is more evident, along with positive real interest rates and stable inflation. This creates a fertile environment for traditional banks as well as consumer companies. The five countries that typify this best for me are India, Indonesia, the Philippines, Vietnam, and Peru. This is where I continue to find some of our best ideas for long‑term investments.

Why Emerging Markets Are a Good Hunting Ground

If we take the example of global consumption (which is fading late in the cycle), one of the remaining growth segments centers on Southeast Asia, India, and China. Outside of sectors like luxury goods, where western companies tend to have the edge, we believe the best way to benefit from structural consumption growth is via domestically focused companies supplying products for local tastes and preferences.

Another example of a positive emerging market growth trend amid a tough global sector backdrop is banking. In Europe and Japan, near-zero or negative interest rates persist. That makes it very difficult for banks to generate returns. In contrast, banks in India and Indonesia operate in economies with high‑single‑digit interest rates and 10%+ nominal GDP growth, all with expanding consumer debt usage profiles. They also have increased room to grow due to low customer penetration levels. This enables banks in these areas to potentially deliver much stronger returns.

With equity markets having performed well...we now need to see growth and economic activity improve to back up recent market gains.

With equity markets having performed well...we now need to see growth and economic activity improve to back up recent market gains.

More generally, as a global investor I like to address the full opportunity set available to me as an active investor. And what I really love is finding stock ideas where there is inefficiency, where the mosaic of fundamentals is complex, and where we have a real fundamental research edge or advantage.

At T. Rowe Price, the fact that we have such experience and so many people in these markets is a huge advantage in our opinion. Within EMs, there is also much more information asymmetry, emotion, and fear and greed at play. This means that, as a long‑term active manager, I can create greater potential alpha for my clients as I can adopt a long‑term strategy.

What Happens Next?

At times like these—with above‑average valuations, a mature economic cycle, and geopolitical uncertainties—investors tend to become increasingly nervous, and market behavior can become increasingly short term in nature. This is where experience and an ability to see through short‑term market movements can become advantageous. With investors’ disenchantment with emerging markets having become abnormally high in recent years, I see this as a clear opportunity, and that is why I remain overweight to what I believe are the most compelling segments of the EM world.

1 MSCI All Country World Index performance: +27.3% for calendar year 2019.

Source: MSCI (see Additional Disclosures).

Additional Disclosures

Financial data and analytics provider FactSet. Copyright 2020 FactSet. All Rights Reserved.

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

202001-1055893