Estimated Factor Exposures: Signal or Noise?

Executive Summary

- Many investors now use factor analysis to identify the drivers of active performance. However, the investment industry has yet to agree on a single, definitive approach.

- Active factor contributions are not static. Exposures can shift both as portfolio positioning evolves and as correlations among risk factors change over time.

- Unexplained risk and the instability of factor relationships mean that the excess returns on active strategies may not be easily replicated using backward-looking factor exposures.

- We believe factor analysis should be applied within a robust framework that takes its potential imprecision into account and also includes other quantitative and qualitative methods.

Factor analysis has become a popular tool for portfolio managers, investors, and financial advisors seeking a deeper understanding of the performance of actively managed strategies. However, significant differences in factor methodology, and the growing complexity of many factor models, have raised questions about the objectivity and reliability of such analyses.

Historically, the primary focus for most active equity managers has been individual security selection. Over time, academic research also has identified a number of common equity market factors—such as size, valuation, quality, and momentum—that are not fully correlated with each other or with market beta and that are now used by investors when decomposing active risk and excess return.

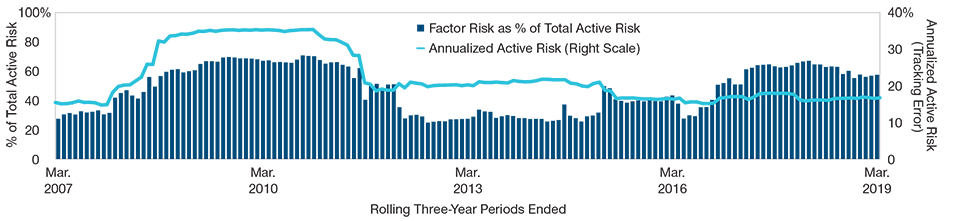

(Fig. 1) Relative Factor Importance Can Change Significantly Over Time

Factor Contributions to Total Active Risk

T. Rowe Price Global Focused Growth Equity

March 31, 2004, Through March 31, 2019

Sources: T. Rowe Price; MSCI (see Additional Disclosures); FTSE London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2019. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor, or endorse the content of this communication.; Thomson Reuters (see Additional Disclosures); I/B/E/S (see Additional Disclosures); S&P Global Market Intelligence; Compustat (see Additional Disclosures); ICE Data Indices, LLC (see Additional Disclosures). All data analysis by T. Rowe Price.

Our hypothetical example illustrates the weak relationship between the active portfolio’s excess returns and those of the replication strategy.

Our hypothetical example illustrates the weak relationship between the active portfolio’s excess returns and those of the replication strategy.

By identifying and tracking factor exposures within active portfolios, investors may be able to gain deeper insights into how their managers have generated returns and how their investment processes have evolved over time. However, the investment industry has yet to agree on a single, definitive factor methodology. Researchers continue to debate different risk factors—which in turn can be defined or measured using a variety of financial metrics. Investors need to understand that these choices may produce very different models and lead to very different analytical conclusions.

The growth of factor‑based analysis also has led some investors to consider the possibility of reproducing the returns on existing active portfolios by tracking the factor exposures within them. In our view, the imprecision associated with factor modeling highlights the potential risks in such an approach. Our analysis also suggests that factor risks may not be as closely linked to active returns as many investors seem to assume. For these reasons, we believe that replication strategies based on backward‑looking factor positions are likely to result in subpar investment performance.

The Roles of Factor Analysis

While there are many potential considerations in factor‑based analysis, we focus on two common applications:

- Decomposition of active risk, including the variability of factor contributions over time and the impact of modifying the time periods used;

- Excess return attribution, or the ability of the various risk factors to explain excess returns.

In addition, we constructed a simple hypothetical model for seeking to replicate future excess returns for an active equity portfolio by tracking its historical factor exposures. Our hypothetical example illustrates the weak relationship between the active portfolio’s excess returns and those of the replication strategy.

The methodology used in this paper employs the T. Rowe Price Equity Style Factor Model, which primarily is based on corporate balance sheet and income statement items and other equity fundamentals.1 The specific portfolio used in our analysis is the T. Rowe Price Global Focused Growth Equity (GFGE) composite; however, we believe our findings provide insights that also can be applied to the analysis of other active strategies.

(Fig. 2) Correlation Shifts Can Raise or Lower the Importance of Factor Risk

Factor Risk as % of Total Active Risk in a Hypothetical Single-Stock PortfolioMarch 31, 2004 Through March 31, 2019

Sources: FactSet (see Additional Disclosures); MSCI; FTSE (see Fig. 1); Thomson Reuters (see Fig. 1); I/B/E/S (see Fig. 1); Compustat (see Fig. 1); IDC (see Fig. 1). All data analysis by T. Rowe Price.

Factor Contributions Are Dynamic

A central point to understand in any factor analysis is that active factor contributions are not static. Exposures can change dynamically both as portfolio positioning changes and as correlations among risk factors shift over time. Figure 1, for example, shows historical factor contributions to active risk within the GFGE portfolio over three‑year rolling periods ended March 31, 2019. At varying points in time, quality and growth each have been the single most significant factor contributing to portfolio active risk and at other times have been the least significant.

This instability in factor exposures across time highlights the importance of using rolling performance periods when decomposing a strategy’s active risk in order to capture factor relationships across a variety of market environments.

Our analysis implicitly suggests that the level of unexplained risk in an actively managed portfolio also may vary widely depending on the particular period studied. Three primary reasons for these fluctuations are:

- The impact of security selection decisions;

- adjustments in factor exposures implemented by the manager;

- changes in factor relationships (such as cross‑factor correlations).

That last cause—shifts in cross‑factor correlations—often is overlooked in factor analysis, yet it can have a significant impact on a portfolio’s assessed factor profile and on the expected risk and return characteristics associated with that profile.

To illustrate this point, we created a hypothetical portfolio holding a single security, the common stock of a large, diversified financial services company. We then regressed the historical returns of that security over three‑year rolling periods ended March 31, 2019, based on the same factors we used to analyze the GFGE portfolio.

As the ultimate “high conviction” strategy, a portfolio holding only one stock normally would be expected to have an extremely large unexplained risk factor—reflecting the historical predominance of security‑specific risk within unexplained active risk. However, Figure 2 indicates that even for a single‑stock portfolio, the contribution of unexplained risk can shift significantly over time—in this case, from as high as 75% to as low as 29% over the period shown.

In part, the variation in unexplained risk in our hypothetical single‑stock portfolio was driven by the specific factor set in the T. Rowe Price Equity Style Factor Model. If the model had included a financial factor, for example, the unexplained contribution probably would have been significantly lower. However, the variability over time seen in Figure 2 also was driven by changing relationships among the risk factors themselves.

...the results of any factor decomposition

analysis are highly time‑dependent.

...the results of any factor decomposition

analysis are highly time‑dependent.

These results appear to have significant implications for investors using factor analysis to assess the “activeness” of an investment strategy. As shown, the unexplained component of active risk can be highly unstable and may depend on changing relationships among the factors themselves. In our view, this variability should be a key consideration when applying any backward‑looking factor analysis.

We believe it is important for investors to recognize these analytical nuances to avoid the temptation of applying overly simplified rules when evaluating their own active strategies. In our view, factor attribution should be applied within a robust framework that takes into account its potential imprecision and that complements the analysis using other traditional quantitative and qualitative methods—for example, by supplementing a returns‑based factor analysis with a holdings‑based analysis.

(Fig. 3) The Importance of Unexplained Risk May Rise Over Longer Periods

Unexplained Risk as a % of Total Active Risk

T. Rowe Price Global Focused Growth Equity

Backward-Expanding Windows, March 31, 2004, Through March 31, 2019

Sources: MSCI; FTSE (see Fig. 1); Thomson Reuters (see Fig. 1); I/B/E/S (see Fig. 1); Compustat (see Fig. 1); IDC (see Fig. 1). All data analysis by T. Rowe Price.

Factor Importance Is Time‑Dependent

Because factor exposures within an active portfolio can be expected to change dynamically over time, the results of any factor decomposition analysis are highly time‑dependent—thus the importance of evaluating performance across multiple rolling windows to capture the instability of factor exposures. However, modifying the time frames for those rolling windows (e.g., using 10‑year instead of one‑year rolling periods) may significantly change the outcome of the analysis.

Figure 3, for example, shows the contribution of unexplained risk to total active risk for the GFGE portfolio over the period March 31, 2004, through March 31, 2019. The data points in the chart are all backward‑expanding windows—in other words, each data point adds an additional month to the regression compared with the one before it.

Interestingly, the unexplained share of active risk in the portfolio increased quickly until the regression covered a three‑year rolling period. From that point on, the influence of unexplained risk leveled off somewhat but still rose gradually, peaking at a 15‑year window, the end point in our analysis.

(Fig. 4) Longer-Term Factor Contributions Are Distributed More Evenly

Factor Contributions to Total Active Risk

T. Rowe Price Global Focused Growth Equity

Trailing Periods Ended March 31, 2019

Sources: T. Rowe Price; MSCI; FTSE (see Fig. 1); Thomson Reuters (see Fig. 1); I/B/E/S (see Fig. 1); Compustat (see Fig. 1); IDC (see Fig. 1). All data analysis by T. Rowe Price.

The implication is that, over the long run, unexplained risk accounted for the majority of the strategy’s active risk, while the combined contribution of the six risk factors (including market beta) specified in the T. Rowe Price Equity Style Factor Model diminished steadily.

In other words, while specific risk factors appeared to contribute a sizable portion of total active risk over shorter rolling periods, they explained less over time as relationships between the factors and the portfolio and among the factors themselves continued to evolve. We believe this is a result of the strategy’s long‑term, bottom‑up, active approach to investing.

When analyzing factor exposures and their contributions to active risk, we think it is critical for investors to consider the portfolio manager’s investment process. For strategies with a long‑term focus—such as the GFGE Strategy—a returns‑based analysis that considered only the most recent years of performance could falsely highlight exposures that might have been only fleeting and that likely stemmed from the manager’s security‑selection decisions based on forward‑looking company fundamentals.

In addition, while the proportion of active risk explainable by the factors in our model declined as regression windows were extended, the composition of those factor contributions also changed over time. Figure 4 illustrates the variability of the magnitude of individual factor contributions within the GFGE portfolio.

As we focused on increasingly longer‑term periods, we found that the contributions by any one factor tended to grow weaker. For example, our growth factor contributed slightly more than one‑third of the GFGE portfolio’s total active risk over the trailing 12‑month window (March 31, 2018, through March 31, 2019). However, as we moved to the longer‑term 15‑year window ended March 31, 2019, the growth factor contributed less than 20% of total active risk. Factor contributions also were relatively diversified over the 15‑year window, spanning value, growth, and quality.

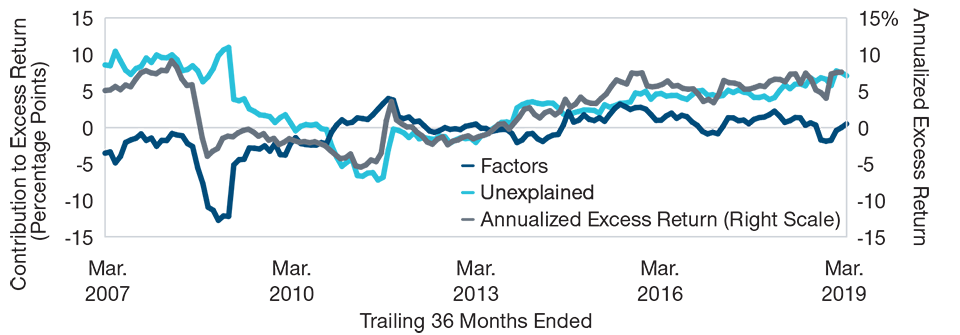

(Fig. 5) Factor Risks May Be Only Weakly Related to Excess Returns

Contributions to Annualized Excess Returns1

T. Rowe Price Global Focused Growth Equity (Gross of Fees)

Rolling 36-Month

Periods, March 31, 2004, Through March 31, 2019

Past performance is not a reliable indicator of future performance.

Sources: T. Rowe Price; MSCI; FTSE (see Fig. 1); Thomson Reuters (see Fig. 1); I/B/E/S (see Fig. 1); Compustat (see Fig. 1); IDC (see Fig. 1). All data analysis by T. Rowe Price.

1Excess returns relative to the Morgan Stanley Capital International All Country World Index (MSCI ACWI). Returns would be lower as a result of the deduction of applicable fees.

...while factors may explain a sizable portion of total active risk, they may not explain a

comparably large portion of total excess return.

...while factors may explain a sizable portion of total active risk, they may not explain a

comparably large portion of total excess return.

Factors May Explain Risk but Not Return

Factor decomposition analysis most typically is used to explain active risk, and the “activeness” of portfolio managers often is judged based on the percentage of total active risk that cannot be explained by a factor model. However, identifying and measuring active risk factors is not the same as quantifying the contributions that those factors have made to excess return. In other words, while factors may explain a sizable portion of total active risk, they may not explain a comparably large portion of total excess return.

Our initial analysis of the GFGE portfolio, shown in Figure 1, indicated that the factors in our proprietary equity style factor model described a substantial portion of active risk in the portfolio over the period March 31, 2004, through March 31, 2019. However, Figure 5 shows that those same factors explained only a modest share of the GFGE portfolio’s total excess return. The majority of the excess return was unexplained across most of the time periods studied. In our view, the high proportions of unexplained active risk and excess return demonstrated in our analysis appear to offer compelling evidence of the GFGE Strategy’s “activeness.”

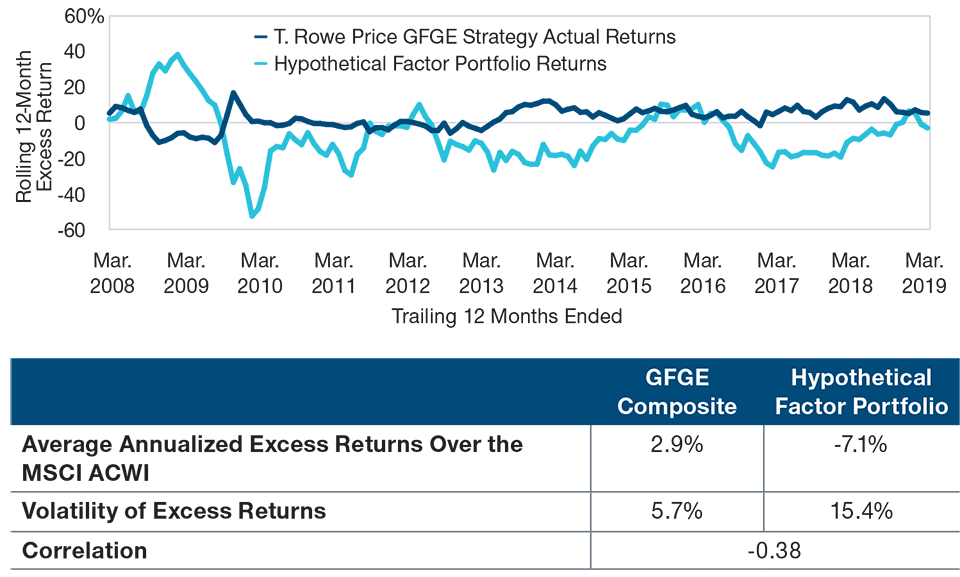

The Trouble With Replication

The development of increasingly sophisticated factor models has led some investors to explore whether actively managed strategies could be replicated simply by tracking the factor exposures in those portfolios, thus achieving substantially the same performance while avoiding the costs associated with individual security selection based on fundamental research. However, our analysis suggests that this approach could yield extremely poor results.

To illustrate this point, we constructed a hypothetical portfolio based entirely on the estimated factor exposures within the GFGE portfolio. We then compared the excess returns that potentially could have been generated by this portfolio with the historical returns actually experienced by the GFGE portfolio. Our analysis covered rolling 12‑month excess returns over the period March 31, 2007, through March 31, 2019.2 Our hypothetical factor portfolio was rebalanced monthly based on the trailing 36‑month factor exposures in the GFGE portfolio as estimated by the T. Rowe Price Equity Style Factor Model.

(Fig. 6) Active Performance May Not Be Replicable With Factor Exposures

Potential Excess Returns for a Hypothetical Factor-Based Strategy Versus the T. Rowe Price Global Focused Growth Equity Composite (Gross of Fees)1

Rolling 12-Month Periods, March 31, 2007, Through March 31, 2019

Past performance is not a reliable indicator of future performance.

Sources: T. Rowe Price; MSCI; FTSE (see Fig. 1); Thomson Reuters (see Fig. 1); I/B/E/S (see Fig. 1); Compustat (see Fig. 1); IDC (see Fig. 1). All data analysis by T. Rowe Price.

1Excess returns relative to the MSCI ACWI. Returns would be lower as a result of the deduction of applicable fees.

This chart contains hypothetical data. See Appendix for important disclosures.

We found that while our factor set did a relatively poor job of explaining the GFGE Strategy’s long‑term historical excess returns, trailing factor exposures did an even worse job of predicting (or tracking) the strategy’s future excess returns.

As can be seen in Figure 6, the hypothetical factor strategy not only could have underperformed the GFGE portfolio, but could have done so with considerably more portfolio volatility. Over the 133 rolling 12‑month periods covered by our study, the hypothetical factor portfolio could have:

- underperformed the MSCI ACWI by an average 7%,

- experienced average active risk (tracking error) in excess of 15%,

- posted lower annualized excess returns than the GFGE portfolio in almost 80% of rolling‑12 month periods.

The analysis indicates that, historically, the performance of the GFGE portfolio could not have been effectively replicated using this method of tracking the portfolio’s factor exposures on a backward‑looking basis.

Conclusions

Factor‑based analysis can be an efficient and effective method for decomposing active risk into its primary drivers over time. The insights from such an analysis may flag potential areas of concern for investors—such as unexpected changes in a manager’s investment process—or identify potential opportunities to improve future excess returns.

However, as highlighted in this paper, we believe it is important for investors to consider the subjectivity inherent in any factor‑based analysis. The results of an analysis can change dramatically depending on the parameters used. Therefore, we recommend that investors:

- incorporate multiple model calibrations (e.g., look‑back windows, rolling time periods) to seek to minimize biases stemming from any one approach;

- combine returns‑based factor regression with complementary approaches, such as holdings‑based and historical analysis using different factor models and statistical methods;

- include a qualitative analysis of the investment philosophy and process of each active strategy under review.

While factor models can provide a helpful guide to historical drivers of active risk, it is important to understand that the performance of a strategy over a sample of historical periods can be very different from the actual results going forward. Likewise, excess returns for a strategy that is based on tracking the historical factor exposures in an active equity portfolio may be only weakly related to the actual returns for that active portfolio.

We believe these recommendations can help investors and analysts develop a more robust framework for factor analysis, thereby reducing the risks of reaching faulty analytical conclusions or making poor investment decisions.

1 The 5 risk factors (in addition to market beta) specified in the T. Rowe Price Equity Style Factor Model, and the metrics used to quantify those risk factors, can be found in the appendix.

2 Excess returns for the GFGE Strategy and potential excess returns for the hypothetical factor portfolio both were measured relative to the MSCI ACWI.

See the Appendix for important disclosures regarding hypothetical portfolios.

Key Risks—The following risks are materially relevant to the strategy highlighted in this material: Transactions in securities of foreign currencies may be subject to fluctuations of exchange rates which may affect the value of an investment. The portfolio is subject to the volatility inherent in equity investing, and its value may fluctuate more than a portfolio investing in income‑oriented securities. The portfolio may include investments in the securities of companies listed on the stock exchanges of developing countries.

Hypothetical Results: The results shown are hypothetical, do not reflect actual investment results, and are not a guarantee of future results. Hypothetical results were developed with the benefit of hindsight and have inherent limitations. Hypothetical results do not reflect actual trading or the effect of material economic and market factors on the decision-making process. These results are derived from the actual returns of The T. Rowe Price Global Focused Growth Equity Strategy; MSCI ACWI Index, FTSE. Results do not include management fees, advisory fees, trading costs, and other related fees. Actual returns may differ significantly from the results shown above.

Additional Disclosures

I/B/E/S & Thomson Reuters—© 2018 Thomson Reuters. All rights reserved.

IDC—© Copyright 2018 Intercontinental Exchange, Inc.

Compustat—© 2018 S&P Global Inc.

For recipient’s internal use only. All Information provided by S&P Global Market Intelligence, in any form, is proprietary to S&P Global Market Intelligence and is protected by U.S. and international laws governing intellectual property.

ICE Data Indices, LLC (“ICE DATA”), is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES AND REPRESENTATIONS, EXPRESS AND/OR IMPLIED, INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND T. ROWE PRICE OR ANY OF ITS PRODUCTS OR SERVICES.

MSCI and its affiliates and third-party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2019. FTSE Russell is a trading name of certain of the LSE Group companies. Russell® is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

Appendix: Study Methodology

The active risk and return analyses in this study all were computed relative to the Morgan Stanley Capital International All Country World Index (MSCI ACWI). The active risk and return decomposition analyses were performed using rolling and backward-extending window multivariate linear regressions on the five long/short fundamental equity style factors defined in the T. Rowe Price Equity Style Factor Model, plus a global equity market factor.

The five style factors in the T. Rowe Price model, and the metrics used to define them, are shown in Figure A1. Market beta was measured based on the return on the MSCI ACWI in excess of the risk-free rate, defined as the return on the FTSE 3-Month Treasury Bill Index.

(Fig. A1) Style Factors in the T. Rowe Price Equity Style Factor Model

Source: T. Rowe Price.

Source: T. Rowe Price.

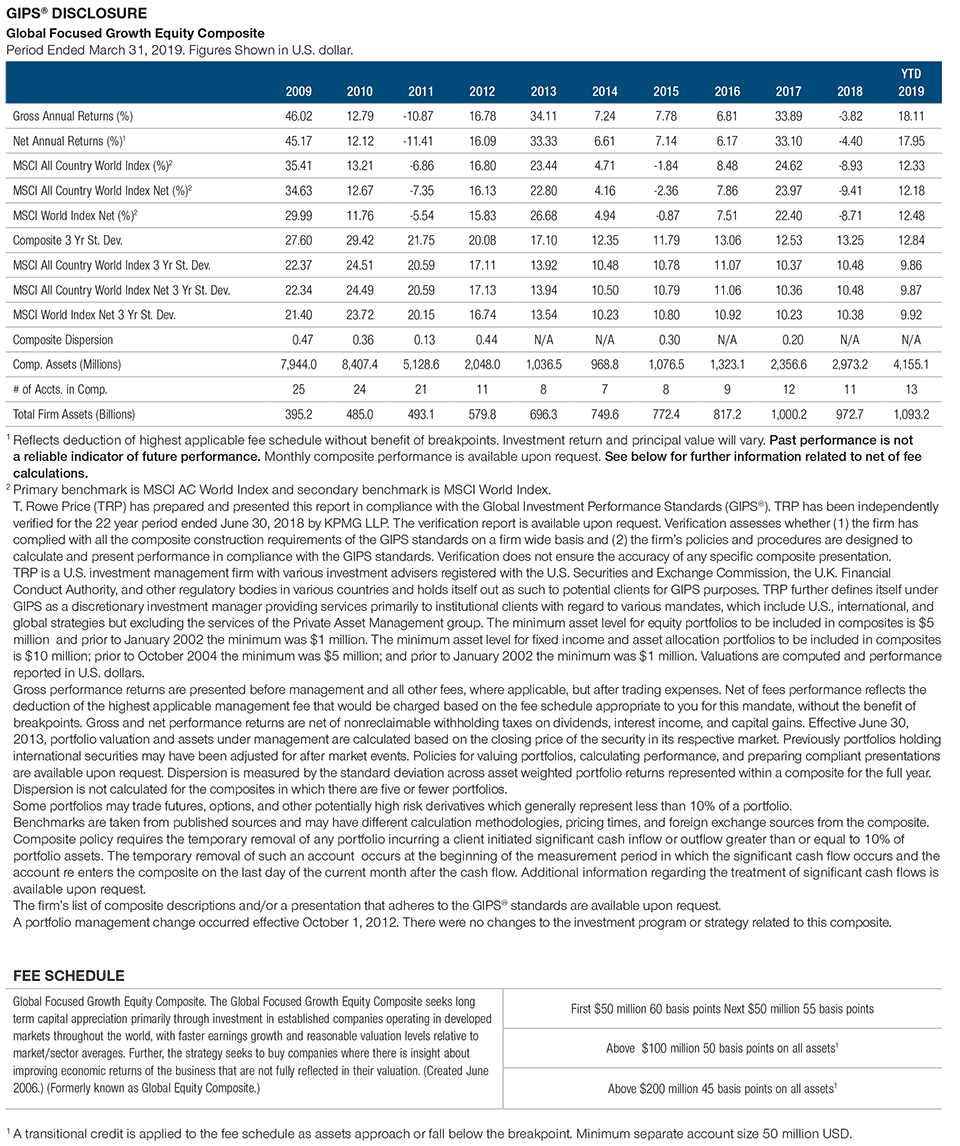

(Fig. A2) Composite Performance

As of March 31, 2019. Figures are calculated in U.S. Dollar. Domicile: United States

Past performance is not a reliable indicator of future performance.

Gross performance returns are presented before management and all other fees, where applicable, but after trading expenses. Net of fees performance reflects the deduction of the highest applicable management fee that would be charged based on the fee schedule contained within this material, without the benefit of breakpoints. Gross and net performance returns reflect the reinvestment of dividends and are net of all non-reclaimable withholding taxes on dividends, interest income, and capital gains.

Source for MSCI data: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI.

1 Returns shown with gross dividends reinvested.

2 The Value Added is shown as Global Focused Growth Equity Composite (Gross of Fees) minus the benchmark in the previous row.

3 Returns shown with reinvestment of dividends after the deduction of withholding taxes.

4 September 30, 2012 represents the date the Portfolio Manager took over lead management responsibility for the strategy.

201906-869368

Important Information

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.