March 2023 / INVESTMENT INSIGHTS

How Climate and Biodiversity Considerations Are Driving Credit Risk

Role for investment industry in creating innovative financing solutions

KEY INSIGHTS

- Management of climate change issues is an important consideration for sovereign and credit risk.

- Green bonds are directing capital toward climate change prevention and adaptation.

- Supranational organizations can play an important role in creating innovative financing solutions

Over recent months, extreme weather events around the world have increasingly dominated the news flow, and the United Nations Secretary‑General at COP27 was unequivocal that the goal of limiting global warming to 1.5°C is now on “life support—and the machines are rattling.” While mitigation—the fight to limit global warming—remains essential, adaptation to the impacts of climate change that are increasingly being felt is now also necessary. A number of countries are engaging in some form of adaptation planning and directing capital toward these efforts. But levels of investments remain small and are not generally keeping up with the pace of climate change. Currently, only 7% of climate‑related investments get spent on adaptation, according to the Climate Policy Initiative.1

This is also where the opportunity lies for governments. They have tools to direct funds toward both emission reduction and climate change adaptation strategies, and markets can play a role by influencing the cost of capital. The Global Commission on Adaptation’s 2019 report2 estimated that USD 1.8 trillion of investment in five areas of climate adaptation could generate USD 7.1 trillion in net benefits: early warning systems, resilient infrastructure, dryland agriculture crop production, mangroves protection, and resilient water resource management.

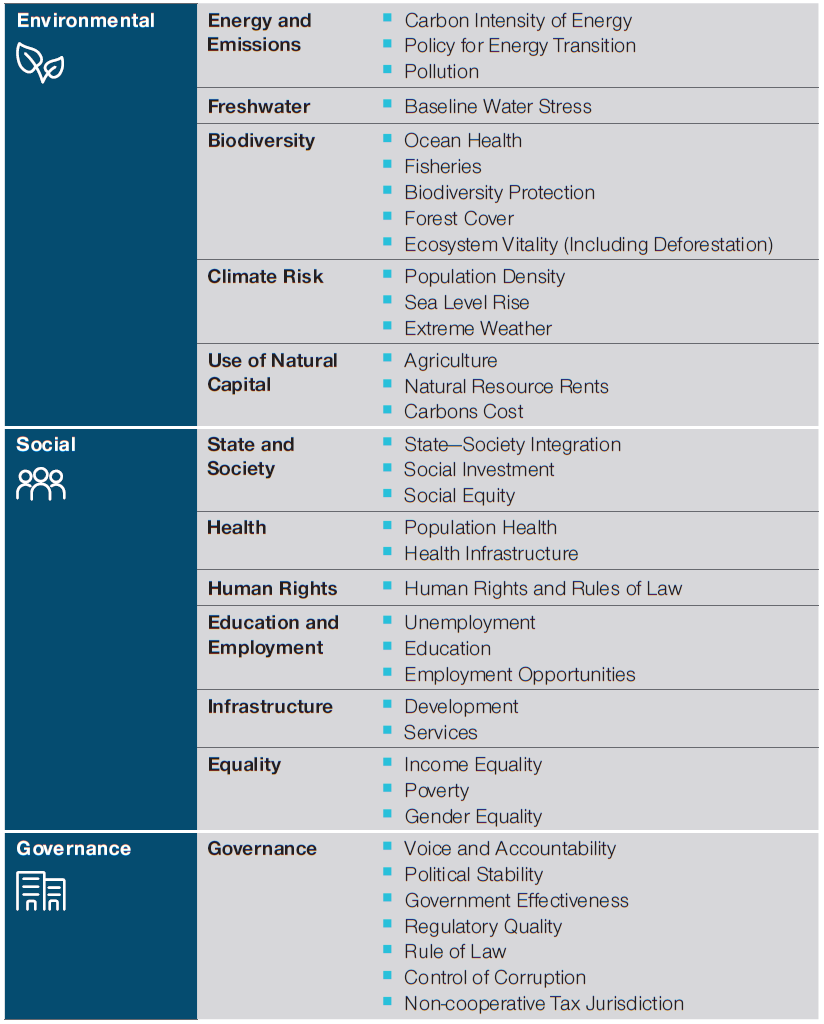

Climate Change Issues Are Key Considerations for Sovereign and Credit Risk

As bond investors, we are focused on an issuer’s ability and willingness to pay coupons and repay the principal. We would argue that certainly for longer‑dated maturities, sovereign‑level emissions trajectories; biodiversity net positive ambitions; and broader environmental, social, and governance (ESG) considerations could become even more important drivers of sovereign credit risk.

Sample of ESG Considerations for Sovereign Bonds

(Fig. 1) Categories for analysis as per T. Rowe Price’s responsible

investing indicator model*

Categories for analysis as per T. Rowe Price’s responsible investing indicator model*

Categories for analysis as per T. Rowe Price’s responsible investing indicator model*

As of February 28, 2023. For illustrative purposes only.

*Our proprietary Responsible Investing Indicator Model (RIIM) framework designed specifically to help portfolio managers and analysts integrate ESG factors into their investment process, as appropriate to their strategy.

Source: T. Rowe Price.

This is particularly important in instances where there are likely to be bigger implications for a nation’s gross domestic product prospects. For example, countries that are heavily dependent on arable agriculture will likely find that production is particularly vulnerable to changing weather patterns. In some cases, rising sea levels could threaten a sovereign issuer’s very existence. This may seem extreme, but Pacific Island countries such as Tuvalu are already having to prepare for this devastatingly probable, worst‑case scenario.

As ESG integration becomes standard practice, investor scrutiny on environmental considerations and their implications for the potential risk and reward profile of any given investment opportunity is increasing. A more thorough analysis and understanding of the risks and how well they are being managed will likely influence investor decisions and could ultimately impact the cost of capital. This is one way that investors can signal what is important to them or where action is deemed insufficient.

Some investors—particularly, larger institutional asset owners and asset managers—may have a greater ability to influence issuers and debt structures through engagement. For instance, liaising with issuers ahead of new bond issuance can provide a chance to impart views, urge best practice and strong disclosure, and support the process of evaluating the investment opportunity.

Green Bonds Are Directing Capital Toward Climate Change Prevention and Adaptation

Green bonds are debt securities that are specifically designed to support climate‑related or environmental projects. According to the Climate Bonds Initiative, more than 40 nations have issued green bonds to date, with proceeds being used to finance projects such as energy efficiency, renewable energy, green buildings, and pollution prevention.

A recent example comes from the Swiss government, which issued its first inaugural green bond last October. Proceeds from the sale are to help fund transport decarbonization and biodiversity projects with the Swiss Green Bond Framework outlining clean transportation; agriculture, forestry, natural landscapes, and biodiversity; green buildings and energy efficiency; and renewable energy as eligible categories, among others. We believe that these eligible categories could meaningfully aid in reducing the nation’s total greenhouse gas (GHG) emissions. In addition, a portion of the Swiss green bond proceeds could be used to support developing and emerging countries in their transition toward more environmentally friendly economies, as this is also an eligible category under the framework. This is an innovative and compelling concept as the Swiss state, with its stable bond rating, can typically access capital markets at terms materially better than many—and certainly significantly better than developing and emerging economies.

Sustainability‑Linked Bonds Can Align Incentives to Climate‑Related Goals

Unlike green bonds, the proceeds of sustainability‑linked bonds (SLBs) are not directed to specific projects. Instead, SLBs link financial and/or structural characteristics to predefined sustainability objectives, as measured through specified key performance indicators (KPIs). We believe it’s critical that SLBs leverage recommendations contained within the International Capital Market Association principles, including the selection of KPIs that are relevant, core, and material to the issuer; are credible and ambitious; and are quantifiable and externally verifiable.

Uruguay recently launched its first SLB, which was also only the second such debt instrument ever issued by a sovereign, the first having been issued by Chile earlier in 2022.

Uruguay set targets based on a reduction in aggregate GHG emissions, rather than on carbon dioxide (CO2) alone, which for most countries can be seen as a good proxy for overall emissions. Given Uruguay’s large beef cattle herd, around 80%3 of the nation’s GHG emissions come from the agriculture sector, and, therefore, methane and nitrous oxide emissions play an outsized role. While CO2 has a longer‑lasting effect in our atmosphere, according to the United Nations Environment Programme (UNEP), methane has more than 80 times the warming potential of CO2 over the first 20 years after it reaches the atmosphere.4 We believe that explicitly incorporating emissions caused by other GHGs brings credibility to Uruguay’s ambitions.

Uruguay’s bond also incorporated a biodiversity‑related KPI. While biodiversity is rising up the sustainability agenda, its close connection to climate change is not always acknowledged. Climate change is one of the main drivers of biodiversity loss, while the destruction of ecosystems undermines nature’s ability to regulate GHG emissions and protect against extreme weather, thus, in our opinion, accelerating climate change. We believe that the protection, restoration, and enhancement of ecosystems can also help us to manage some of the impacts of climate change and adapt to a warming world. Nature‑based solutions (such as the creation of living shorelines to help solve flooding and coastal erosion or the development of tree canopies to help reduce storm water runoff and urban heat effects) can often be more effective than hard engineered approaches while also generating substantial economic benefits.

Supranational Organizations Can Leverage Capital Markets Presence

Supranational organizations can play an important role by leveraging their capital markets presence to create innovative financing solutions. The World Bank was a key player in the development of the labeled sustainable debt market through the world’s first recorded green bond issuance in 2008.5 Since then, green bonds have been issued by corporates, sovereign, supranational and agencies (SSA), the municipal market, and securitized borrowers. And the World Bank, in and of itself, has issued more than 200 green bonds.

With a track record as a high‑quality bond issuer, access to environmental projects needing finance, and the infrastructure in place to support the necessary reporting, a supranational organization like the World Bank was—and remains—well positioned, in our view, to support the stewardship of capital directed toward solutions aimed at tackling the world’s most pressing issues.

A recent example of novel financing came in the form of the World Bank’s (IBRD) Wildlife Conservation Bond, also known as the “Rhino Bond.” This bond is channeling financing toward the conservation of the critically endangered black rhino population in South Africa. Rather than paying coupons to investors, this innovative bond makes payments to finance conservation activities. At the bond’s maturity, in addition to principal redemption, investors may receive a conservation success payment based on the achieved rhino population growth rate.

We believe that asset managers and asset owners can work with organizations such as the World Bank to continue to support innovative financing options, insist on ambitious targets and credible measurement of progress, and provide the essential underlying investments.

Important Role for Investment Industry in Helping Support Emissions Reduction

According to a report by UN Climate Change,6 the country‑level targets that have been set so far remain insufficient to limit a global temperature rise to 1.5°C by the end of the century. Unfortunately, even for those targets that have already been committed, in many cases, policies are not in place to ensure that they will be achieved.

Continued development of sustainable finance and engagement by the investment industry alone will not be sufficient. However, the industry can play a role in helping to move the dial and providing some of the capital needed to fund the economic changes and innovations that will support a reduction in emissions and help the world adapt to rising temperatures.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

March 2023 / INVESTMENT INSIGHTS