February 2023 / INVESTMENT INSIGHTS

How ESG and Value Investing Can Go Hand in Hand

ESG integration can be an essential component to unlocking value

Key Insights

- An increasing number of investors now acknowledge that ESG and value investing are not mutually exclusive.

- If ESG integration is implemented properly, it can be a crucial component to unlocking value.

- Value strategies have lagged growth for the past decade, but the playing field is leveling out.

On the face of it, value investing and environmental, social, and governance (ESG) investing are unlikely bedfellows. The very concept of value investing could be seen as contradicting some of the fundamentals associated with strong ESG credentials. Yet an increasing number of investors now acknowledge that ESG and value investing are not mutually exclusive. In fact, if ESG integration is implemented properly, it can be a crucial component to unlocking value—depending on where investors look.

Identifying “Winners” Amid the Disruption

Value investing focuses on selecting stocks that appear undervalued or overlooked by the market and are trading for less than their intrinsic value. This means that stock pickers often come across distressed opportunities. These opportunities—or the adoption of a “deep” value investing approach—take investors closer to corners of the market where ESG controversies are rife and in sectors that do not always cover themselves in ESG glory.

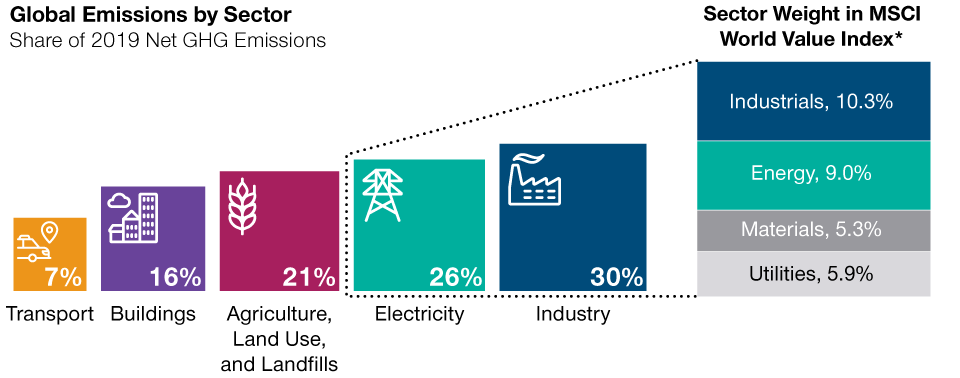

Many of the stocks that value investors consider mispriced are found across so‑called “old economy” industries, such as energy and utilities. Companies within these industries tend not only to be high carbon emitters but are also experiencing significant disruption due to digitalization, the global energy transition, and other challenges. Almost a third of the MSCI World Value Index comes from the materials, energy, utilities, and industrials sectors—sectors that themselves account for approximately 56% of total greenhouse emissions worldwide.1

ESG and Value: A Contradiction in Terms?

(Fig. 1) A number of sectors that feature heavily in value indices screen negatively on GHG emissions

As of September 2022.

*Breakdown within electricity and industry sectors.

Numbers may not total due to rounding.

Sources: Emissions data by sector is from Rhodium Group, Preliminary 2020 Global Greenhouse Gas (GHG) Emissions Estimates. Sector weight in MSCI World Value Index is from MSCI and based on T. Rowe Price analysis. (see Additional Disclosures).

It is no surprise that the market has bought into the misplaced yet convenient and simplistic association of ESG with certain investment styles. It is easy to link “green,” or ESG‑friendly, stocks with growth‑oriented strategies, while many investors have long associated value with “brown,” or ESG‑unfriendly, stocks.

Bespoke Tools Can Support Robust Analysis

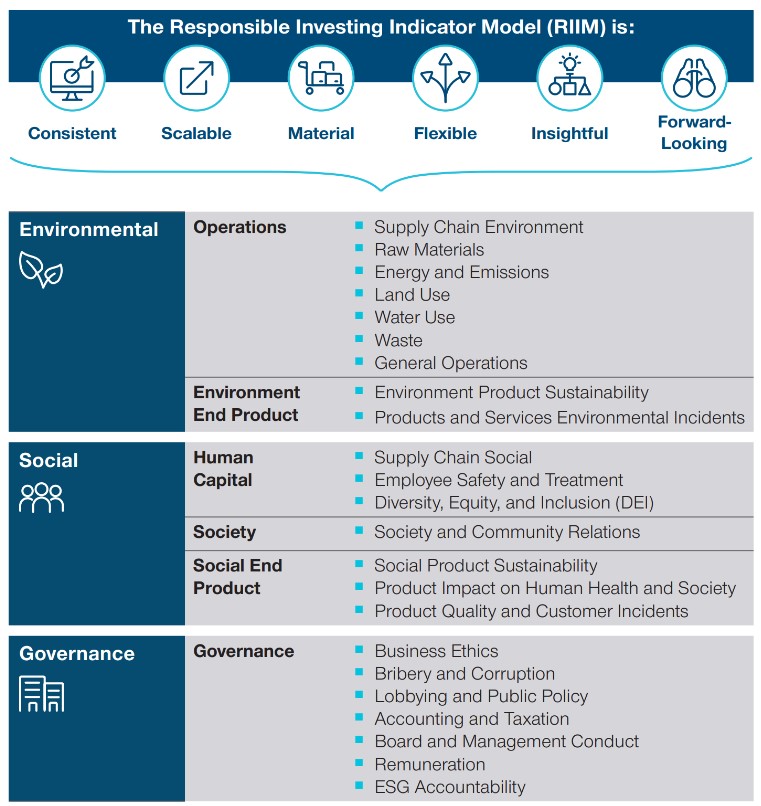

(Fig. 2) T. Rowe Price’s Responsible Investing Indicator Model for equities and corporate bonds

As of October 2022.

For illustrative purposes only.

Source: T. Rowe Price.

This way of thinking was all well and good when growth stocks were in vogue, but attitudes began to change when value first started to show signs of outperformance in Q4 2020—when COVID‑19 vaccine progress was announced—and even more so when the rally proved more durable than some investors had initially assumed. Interestingly, we are now increasingly seeing the emergence of a new and long‑overdue narrative: the notion that ESG and value are not mutually exclusive and that ESG does not restrict itself to growth stocks.

With this in mind, it is important to remember that ESG integration is about incorporating ESG factors into fundamental analysis for the purpose of maximizing investment performance. This works across all styles, sectors, and geographies. In other words, it does not discriminate. Crucially, ESG integration is very different from exclusionary screening, yet the two approaches are still regularly conflated. Moreover, both ESG integration and exclusionary screening should not be confused with sustainable and impact investing—where investors seek to promote sustainable outcomes as well as delivering financial returns. This can include investing in companies that look to reduce inequalities or promote affordable and clean energy, for example.

Effective ESG integration requires significant resources and expertise, involving analysts who specialize in conducting robust ESG industry reviews. For ESG integration to be successful, consistency is key, and it’s important to develop a common language for measuring and comparing ESG factors across companies and sectors.

At T. Rowe Price, our proprietary Responsible Investing Indicator Model (RIIM) framework has been specifically designed to help portfolio managers and analysts integrate ESG factors into their investment process, as appropriate to their strategy. Our RIIM framework for equities and corporate bonds involves collecting data across the three main environmental, social, and governance pillars, as well as six sub‑pillars and 23 categories—collecting a total of 200 data inputs for around 15,000 securities.

How a Materiality Lens Creates a Level Playing Field

In addition to consistency and scalability, materiality is key. We have incorporated a materiality lens into our proprietary model, where we fine‑tune the weight of ESG factors at 159 subindustry levels. Why do we do this? Because, depending on the subindustry that a company operates within, certain ESG factors will be more financially material or relevant from an investment perspective than others.

For example, an energy company might have a higher weight within our RIIM environmental pillar than that of a software business, but social factors may be more material at that software company—with human capital, recruitment, and retention of key software engineers appearing much more financially relevant.

ESG integration involves scoring how management mitigates ESG‑related risks and makes the most of ESG‑related opportunities. It should not mean giving companies a low score simply because they belong to a sector where ESG risks are inherently high. Investors must bear in mind that ESG integration should, in principle, be “style agnostic.” Companies that score green in our proprietary model, for instance, represent a similar weight in the MSCI World, MSCI Growth, and MSCI Value indices (see Figure 3).

ESG Integration Levels Out Value and Growth

(Fig. 3) Percentage of companies with a green rating in the RIIM

As of September 2022.

For illustrative purposes only.

Source: T. Rowe Price, RIIM ratings. A green rating indicates no/few flags.

ESG integration provides an additional lens to decision‑making. Many ESG factors are often tail risks and long term in nature, such as climate change, and it’s important to be able to factor these externalities into Discounted Cash Flow (DCF) models.

Engaging with value companies on ESG issues, such as environmental or social‑related disclosures, is crucial when it comes to gauging which companies are taking certain risks seriously and how they are seeking to mitigate those risks or improve practices. Furthermore, we believe that a periodic review of the ESG profile of value portfolios provides a useful hygiene check that ESG risks are being controlled at portfolio level and can help target engagements to where unmanaged ESG risks have been identified.

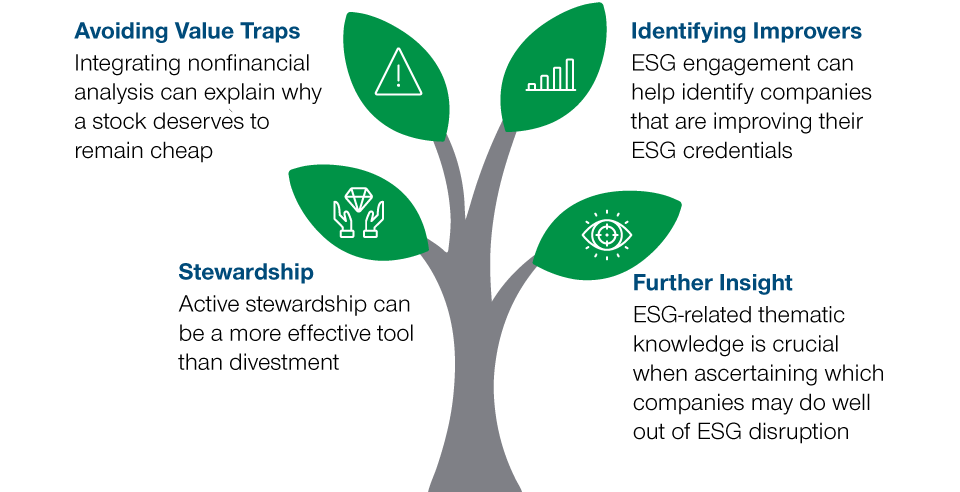

Value Investing: When ESG Integration Comes Into Its Own

In practical terms, ESG integration plays an important role across several areas when it comes to value investing. One of the risks that value managers face is a value trap—where a stock misleadingly appears to trade at very low valuation metrics but then continues to drop further once the investment has been made. Sometimes, integrating nonfinancial analysis can help to explain why a stock deserves to remain cheap. This is where ESG engagement can play a big part in identifying companies that are genuinely improving their ESG credentials—especially those that might have faced severe controversies in the past and are credibly cleaning up their acts.

The Importance of ESG Integration in Value Investing

(Fig. 4) ESG integration plays an important role across four key areas

As of October 2022.

For Illustrative Purposes Only.

Source: T. Rowe Price

ESG‑related thematic knowledge is also invaluable when ascertaining which companies may do well out of ESG disruption. Moreover, active stewardship can be incredibly powerful in terms of unlocking unrealized value. Perennial value territory can be found in Japan, a country where we have amplified our ESG stewardship and proxy voting efforts to shift the agenda with regard to gender board representation and excess capital tied in cross‑shareholdings.

Presenting Opportunities for Value Investors

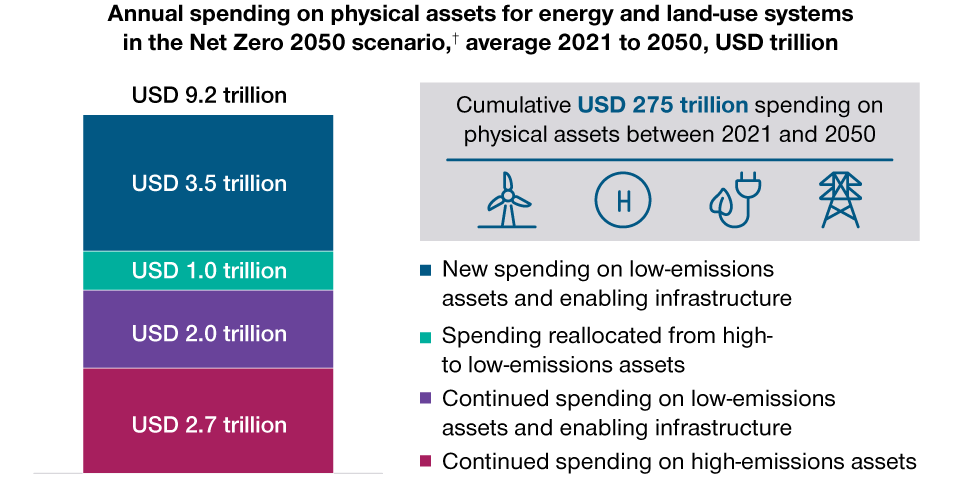

(Fig. 5) Capital spending needs for land‑use and energy systems* to meet net zero goals

As of January 2022.

*McKinsey & Company has sized the total spending on physical assets in power, mobility, fossil fuels, biofuels, hydrogen, heat, carbon capture and storage (not including storage), buildings, industry (steel and cement), agriculture, and forestry. Estimation includes spend for physical assets across various forms of energy supply (e.g., power systems, hydrogen, and biofuel supply), energy demand (e.g., for vehicles, alternate methods of steel and cement production), and various forms of land use (e.g., GHG‑efficient farming practices).

† Based on the Network for Greening the Financial System (NGFS) Net Zero 2050 scenario using the global “REMIND‑MAgPIE” model (phase 2). Based on analysis of systems that account for around 85% of overall CO2 emissions today.

Sources: McKinsey & Company: “The net zero transition: What it would cost, what it would bring.” January 2022. Sources for the McKinsey & Company figures featured in this chart include: McKinsey Center for Future Mobility Electrification Model (2020); McKinsey Hydrogen Insights; McKinsey Power Solutions; McKinsey–Mission Possible Partnership collaboration; McKinsey Sustainability Insights; McKinsey Agriculture Practice; McKinsey Nature Analytics; McKinsey Global Institute analysis. The chart is reproduced by T. Rowe Price specifically for inclusion in this article, and its use does not reflect the views of McKinsey & Company, nor does it reflect or imply McKinsey & Company’s endorsement.

Green Transition Opportunities Are Polarized

One of these long‑term emerging themes that could provide significant opportunity for value investors is the green transition. According to a McKinsey Global Institute report, capital spending needs on physical assets for land‑use and energy systems to meet net zero goals would amount to approximately USD 275 trillion between 2021 and 2050, or USD 9.2 trillion per year on average. This would require an additional USD 3.5 trillion per annum on top of what is currently spent today.2

Most of the revaluation of assets has so far concentrated on a narrow pool of renewables and electric vehicles (EVs). However, there is potentially much more compelling value to be found in less “glamorous” sectors—such as utilities, materials, and capital goods, where their price‑to‑book value sits toward the low end of their historical range.

While the world cannot achieve net zero goals without a clear decarbonization of these more traditional and value‑oriented sectors, investors need to be able to separate the wheat from the chaff. A sound understanding of how the transition could play out in terms of timing and investment is critical when assessing the impact on profitability and identifying companies that can adapt their business models to be truly future proof.

Through RIIM, T. Rowe Price collects information on investee companies’ net zero goals. We look not only at the existence of a target, but also what period it covers, which scope(s) of emission it includes, and whether it is on a credible pathway. We then convert this into a net zero status classification: indicating how far down the net zero path a company is, how much they have achieved so far, and where they are not currently aligned. We then prioritize engagements with those who are not aligned.

Emerging markets are generally perceived to have weaker ESG standards, but this is often reflecting poorer ESG disclosures and an area where robust ESG analysis and engagement can help spot the improvers and leaders.

While value strategies have lagged growth for the past decade, the playing field is leveling out—with multiple tailwinds supporting the investing style going forward. These range from the end of very low inflation and the normalization of monetary policy to the green transition and an increased focus on food and energy security. We believe plenty of opportunities lie in emerging markets and higher‑emitting value sectors that are integral to addressing these issues. To fully unlock that value‑investing potential, we see ESG integration as one of the many essential tools—helping investors seek to avoid potential value traps, spot the ESG improvers, and identify unappreciated opportunities amid the disruption.

Providing New Insight: Fuyao Glass Industry Group

Fuyao Glass, a large global automotive safety glass manufacturer, is a good example of a company that is enabling the transition to net zero.

Fuyao Glass is integrating more energy‑efficient product features and sells to the rapidly growing electric vehicle portion of the automobile market. The company plays an important role in lowering fuel consumption and fleet emissions of OEM (original equipment manufacturer) glass through the development of green features, such as “lightweighting.”

However, while its product is becoming “greener,” and while ESG disclosure and programs on the environmental side are strong by Chinese standards, Fuyao Glass still lags international best practices—and we, therefore, continue to monitor the company.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.