June 2022 / MULTI-ASSET SOLUTIONS

Winning by Not Losing: Building Portfolios for a More Challenging World

Generating positive returns in tougher conditions requires new thinking.

Key Insights

- Challenging market conditions and deeper structural shifts are demanding fresh thinking from investors.

- Such thinking may include new ways to help mitigate the impact of volatility on equity portfolios, adapt the role of government bonds, and use active management to potentially benefit from market volatility.

- We believe that ideas such as these will help investors to manage losses while potentially generating inflation‑beating returns.

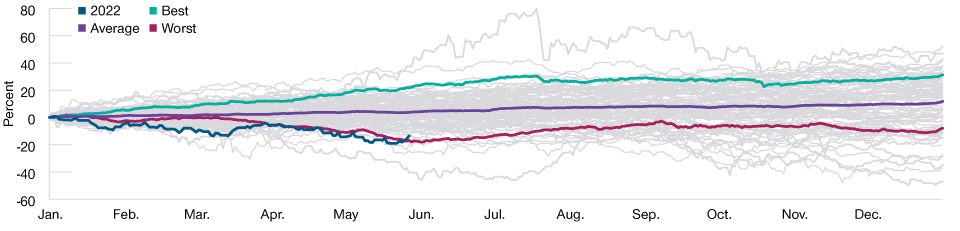

The first five months of 2022 have not been easy for investors. A powerful cocktail of difficult economic conditions and rising geopolitical concerns have made their mark: The S&P 500 Index was down by more than 12% from January 1 to May 31—its worst record over that period since 1970 (Figure 1).1

The S&P 500’s Start to 2022 Was Its Worst in 50 Years

(Fig. 1) It was down by 14% from January to May 31, 2022

As of May 31, 2022.

Past performance is not a reliable indicator of future performance.

Sources: S&P 500 Index (see Additional Disclosures). Analysis by T. Rowe Price. Based on daily total returns measured in U.S. dollars. January 1928 through May 31, 2022. Average is average return of all years. Best is average return of 10 years with highest returns. Worst is average return of 10 years with lowest returns.

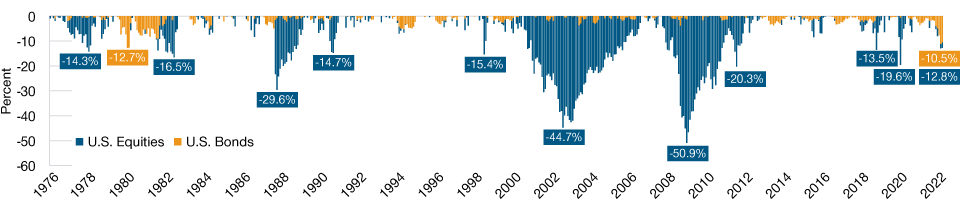

In recent years, multi‑asset investors have generally been able to rely on their fixed income holdings to cushion the blow if equity markets fell. However, these diversification benefits were notable for their absence over the first four months of this year. As equities plummeted, U.S. fixed income was hit by its worst drawdown since 19802—in fact, it was the first time since at least the mid‑1970s that the U.S. equity and fixed income markets both experienced a drawdown more severe than 10% at the same time (Figure 2). These losses were especially painful in inflation‑adjusted terms, as rapid price increases across many major economies led to the purchasing power of investments falling even more.

Equities and Bonds Fell in Tandem Over the First Four Months of the Year

(Fig. 2) It was their worst parallel drop since the mid‑1970s

As of May 31, 2022.

Past performance is not a reliable indicator of future performance.

Sources: S&P 500 Index, Bloomberg U.S. Aggregate Index (see Additional Disclosures). Analysis by T. Rowe Price. Based on monthly total returns measured in U.S. dollars. February 1976 through May 2022.

There seem to be five main reasons for the continued declines of global equity and fixed income markets so far this year: (1) the accelerated pace of monetary tightening by central banks such as the U.S. Federal Reserve, (2) persistently high inflation, (3) concerns over slowing economic growth, (4) disruptions caused by China’s strict zero‑COVID policy, and (5) Russia’s invasion of Ukraine.

Another factor behind the uncertainty is that markets are simultaneously undergoing several structural shifts: from pandemic lockdowns to reopening, from low and stable to high and volatile inflation, from super‑accommodative monetary policy to tightening, from globalization to a focus on local supply chains, and from U.S. hegemony to a realignment of powers. Still recovering from the shock of COVID, the world must now contemplate a slew of new challenges. During structural shifts, investors and markets need to adapt—and adaptation typically involves uncertainty and volatility.

What can investors do to generate positive inflation‑adjusted returns in this market environment? Or, to put it another way, where can they lose the least money? To help achieve these objectives, we have identified three investment ideas, each of which is shaped around one of the possible regimes that lie ahead.

Three Investment Ideas for a Changing World

(Fig. 3) Striving to generate positive returns in a period of structural change

| Investment Idea | New Thinking |

|---|---|

| Managing equities in a time of volatility | Downside risk mitigation, global diversification, and dynamic management. |

| Rethinking the role of government bonds | Sharp rises in yields means safe‑haven bonds are again ready to play their traditional role of equity diversifier as well as a source of stable income. |

| Balancing market and active risk | Allowing portfolios to adjust as the market environment adapts—volatility is the friend of the skillful active manager. |

Source: T. Rowe Price.

1. Managing Equities in a Time of Volatility

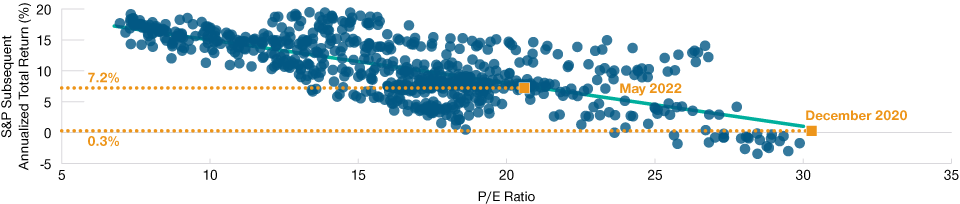

Major equity market indices have fallen by between 13% and 23% from their peaks in 2022,3 bringing previously elevated valuations into “reasonably priced” territory. Over the long term, valuations—measured by price to earnings (P/E) ratio—are a significant driver of equity market performance (Figure 4).

Valuations Are a Key Driver of Equity Market Performance

(Fig. 4) Low P/E ratios typically lead to stronger subsequent returns

As of May 31, 2022.

Sources: S&P 500 Index (see Additional Disclosures). Analysis T. Rowe Price. Based on monthly total returns measured in U.S. dollars. The orange dots represent values of P/E ratio as of December 2020 and May 2022. For the period January 1954 through May 2022.

At the end of December 2020, the S&P 500’s valuation implied a potential near zero total return for the index over the next decade based on historical experience. Following the sell‑off in equity markets seen so far in 2022, the relative valuation now implies about a 7% total return per annum over the next decade. In other words, the equity risk premium may have staged a comeback.

Equity exposure is the strategic cornerstone of most multi‑asset portfolios, and we are currently modestly underweight equities. However, gradually building exposure using dollar cost averaging to avoid betting on a single buying price, with a focus on more beaten‑down areas, could generate long‑term inflation‑beating returns. The market is already pricing in a much higher probability of negative events playing out than it did at the beginning of the year. This will soften the blow if such events materialize. Conversely, some cyclical areas may rerate higher if worst‑case scenarios can be averted.

For truly long‑term investors, investing in equities has been, and remains, one of the best ways to help generate attractive returns. However, to get to the long term, investors need to survive the short term. Until some of the imbalances affecting markets recede, volatility is likely to persist. To help smooth the ride, investors should consider the following ideas:

- Mitigating downside risk. Consider techniques and listed derivative overlays to help mitigate volatility and downside risks, focused on minimizing the drag on performance. Our diversified tail‑risk mitigation program is an example of this.

- Using diversified diversifiers. Consider diversifying across global equity markets. This may include more esoteric areas such as frontier markets and involve different equity style blends, thereby ensuring exposure to areas such as growth, value, and small‑caps.

- Dynamically managing portfolios. Consider making portfolios more dynamic; for example, by actively controlling the volatility of the overall equity portfolio within a desired range.

2. Rethinking the Role of Government Bonds

One of the challenges so far in 2022 has been that both equity and bond markets have fallen at the same time, making diversification difficult. In recent years, many investors have moved away from high‑quality government bonds as long‑term yields around zero meant little prospect of positive returns from such holdings. However, after the recent rise in yields, there may be more scope for government bonds to resume their traditional role of safe havens in the event of a very negative economic or geopolitical outcome. In addition, inflation‑linked bonds are one of the few assets offering cash flows that increase in line with inflation.

With higher yields, the “price” of safety has come down. Indeed, one reason for the weakness in equity markets in 2022 has been that government bonds have become more attractive. Some investors, satisfied with a modest but predictable nominal return, have rotated from riskier equities to bonds.

If inflation persists, economic growth remains solid, and central banks continue to tighten their policies, government bond yields may keep rising and government bonds may deliver negative total returns. Nevertheless, portfolios balancing equities and bonds should perform well because equity gains are likely to outweigh bond losses under these circumstances.4

On the other hand, if inflation recedes, growth slows, and central banks discontinue tightening policy, bonds may generate positive returns and diversify equity risk.

To mitigate the risk of bond losses, the following may help:

- Adopting a global approach. Tapping the global government bond market, instead of the local one, while systematically hedging overseas currency exposure offers diversification and a wider investment opportunity set.

- Adding selective currency exposure. Allocations to safe‑haven currencies, such as the U.S. dollar and Japanese yen, may add to equity diversification at times of stress.

- Allocating to inflation‑linked bonds. A strategic allocation to inflation‑linked bonds is one way to add some protection against inflation.

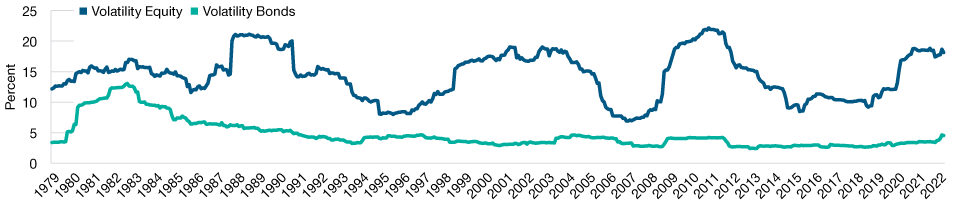

Equity Market Volatility Has Increased Over the Past Two Years

(Fig. 5) It was low between 2013 to 2020

As of May 31, 2022.

Past performance is not a reliable indicator of future performance.

Sources: S&P 500 Index, Bloomberg U.S. Treasury Index (see Additional Disclosures). Analysis T. Rowe Price. Based on monthly total returns measured in U.S. dollars. Volatility (annualized standard deviation) is calculated using rolling 36 months. For the period January 1979 through May 2022.

3. Balancing Market and Active Risk

Equity and fixed income markets have rallied strongly over the past two decades, which has meant that index exposure has often been sufficient to generate the returns required by investors. Beating inflation at the current level of around 8%5 is a much bigger hurdle. Even if current supply issues unwind and geopolitical tensions abate, inflation expectations have moved sharply upward—market expectations for U.S. inflation are about 3% per annum6 over the next five years. An extra boost may be needed to deliver positive after‑inflation returns in this environment.

While equity volatility was low between 2013 to 2020, it has subsequently increased, offering more opportunities for active management to add value.

For skillful active managers, volatility is a friend. It creates opportunities, especially when widening the dispersion of prices across investments and sending prices away from intrinsic values. The following ideas may help investors capitalize on these.

- Actively managing traditional asset classes. An increased level of market volatility and an uncertain macro environment create winners and losers, rewarding skilled equity and fixed income managers.

- Using liquid alternatives. With uncertain returns forecast for equity and fixed income markets, alternatives may prove their worth within a diversified portfolio. Investors need to treat each alternative on a case‑by‑case basis, ensuring clarity on why an alternative strategy is included within their portfolio and what to expect in different market conditions.

- Embracing multi‑asset investing. Large‑scale adjustments to portfolios against a turbulent market backdrop can be challenging. Multi‑asset investing can bring these ideas together, dynamically blending different sources of returns and adjusting portfolios as markets adapt to new regimes and as new strategies or risk management techniques become available.

Adjusting to a Tougher Environment

The investment environment has become more challenging. New market conditions under new regimes require new thinking. We believe investors face a period of lower market returns, less predictable inflation, and higher volatility. We have listed three investment ideas for consideration to help investors manage losses while potentially generating inflation‑beating returns. The old ways of investing may give way to new ones.

Active management does not ensure a favorable outcome, and there is no assurance that any investment objective will be achieved. Diversification does not assure a profit or protect against loss in a declining market.

Additional Disclosures

Bloomberg Finance L.P.

The S&P 500 is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is no guarantee or a reliable indicator of future results.. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

June 2022 / MARKET OUTLOOK