April 2022 / FIXED INCOME

Why It’s Not Yet Time to Add Credit Risk

Despite cheaper valuations, a rally does not seem imminent.

Earlier this year, we reduced credit risk in our international and global multi‑sector bond portfolios. Credit spreads were very tight by historical standards, growth was shaky, and central banks were about to start tightening monetary policy to tackle inflation. The prospect of spread widening—which would reduce the value of corporate debt relative to high‑quality government bonds—was very real. So we decided to cut our exposure.

Spreads have since widened, and corporate debt is now trading more cheaply than it was in January. In ordinary times, this might be regarded as a signal to add credit back to the portfolio. But we are not living through ordinary times.

Despite the cheap valuations on offer, we do not believe that now is a good time to add credit back to our portfolios. Why? Because, if anything, the outlook for credit has deteriorated since we reduced our exposure to the asset class a few months ago. There are two main reasons for this. First, the global growth outlook has declined since Russia invaded Ukraine and COVID‑19 cases surged in China, and second, central banks seem even more determined to tighten policy to keep inflation under control. This combination of weak growth and tighter monetary policy means there is little reason to believe that a sustained credit rally is possible.

How could this be wrong? The growth outlook could improve if the war in Ukraine ends or there are clear signs of an improvement in China’s growth outlook (through large‑scale fiscal stimulus and successfully controlling COVID), but neither of these appear imminent. Central banks would probably only ease up on monetary tightening if there was a major growth slowdown and/or a significant widening of credit spreads. We would want to add credit risk back after that happened.

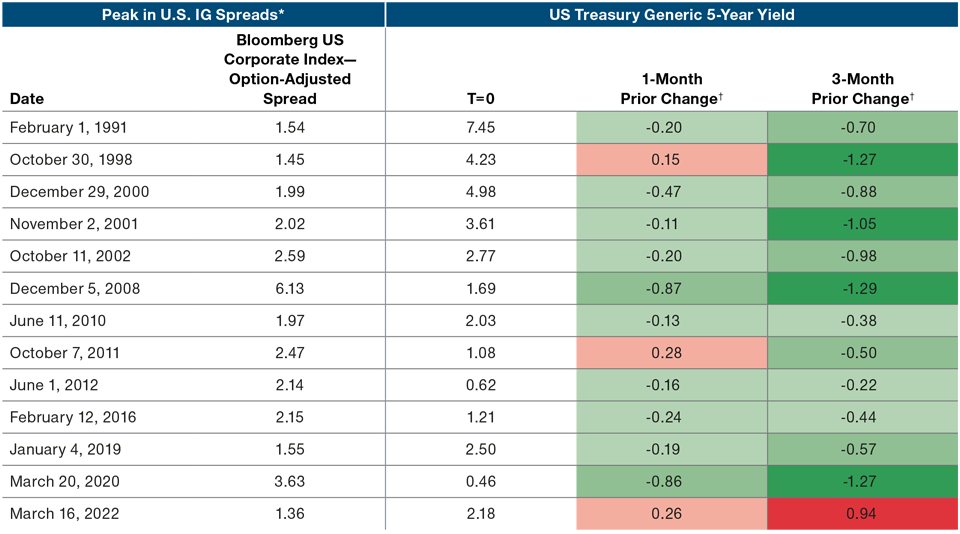

Current Spread Widening Does Not Fit Historic Pattern

(Fig. 1) Peaks in spreads are usually preceded by Treasury rallies

As of March 16, 2022.

Past performance is not a reliable indicator of future performance.

*The peak in US IG spreads was taken as the highest weekly closing spread among weekly closing spreads in the three months prior to, and following, the peak.

† Change in yield in percent.

Source: Bloomberg Finance L.P.

History tells us that sustainable rallies in credit have been preceded by an actual or anticipated easing of monetary policy. Whenever credit spreads have widened over the past 30 years, the peak in spreads (i.e., the point at which they stop widening before narrowing again) has almost always been immediately preceded by a rally in five‑year U.S. Treasury yields (Figure 1). This typically happened because spreads widened due to concerns about economic growth, and the usual response of central banks to growth concerns is to ease monetary policy—which creates the conditions for a credit rally. But this hasn’t been happening this time: Central banks are clearly so concerned about inflation that yields continue to climb.

So, the current period sticks out like a sore thumb compared with previous peaks in credit spreads. And while it is not an absolute rule that Treasury yields must rally before you can add credit risk to a portfolio, there is no reason to believe that credit can rally while central banks remain so determined to tighten financial conditions.

Could anything change this picture? Yes: If a major slowdown during the second quarter causes markets to become jittery and spreads to widen further, we might be able to identify an “investable bottom” in credit spreads. However, if growth doesn’t slow enough to get inflation forecasts down and central banks continue to hike, spreads may continue to be volatile for some time with no clear sign that the peak has been reached.

If that happens, it could be some time before we’re ready to add credit risk back to our portfolios.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is no guarantee or a reliable indicator of future results.. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

April 2022 / MARKETS & ECONOMY