June 2022 / GLOBAL EQUITIES

Finding Opportunity in Private Investments

T. Rowe Price’s place in the ecosystem of innovative growth companies.

Key Insights

- T. Rowe Price is a global leader in active investing in smaller companies and has become a “crossover” investor in private companies on an IPO track.

- Our recently formed Centralized Private Equity Team is designed to allow us to better identify and invest in innovative companies that we believe have high potential for the benefit of our clients.

- We manage the position size of private company investments within appropriate commingled products in aiming to mitigate risks.

Our firm has long been recognized as a global leader in small‑ and mid‑cap (SMID) active investing. T. Rowe Price’s USD 216 billion in assets under active management of SMID strategies (as of December 31, 2021) is more than twice the level of our nearest competitor.1 Over several decades, we have developed a robust research platform that supports our portfolio managers and analysts in seeking out the smaller companies with the best growth prospects and perhaps the potential to become large‑ or mega‑cap firms.

Our extensive relationships with and research into smaller public companies has positioned us favorably in the broader ecosystem of innovative growth companies, many of which do not trade on public markets. These private companies are developing solutions or products that might one day unlock medical treatments for chronic illness or lead to formative technology solutions for businesses and consumers.

Our research has not only led to select investments in innovative private companies, but has also informed our broader investments in public companies in which we primarily invest. Indeed, we believe that as a “crossover” investor, our managers are able to create portfolios in which private and public companies fulfill their mandates to seek favorable outcomes on behalf of clients.

A Growing Footprint in the Private Market

We’ve Expanded the Breadth and Scale of Our Investments

Some of our products may invest in nonpublic offerings, known as private placements, which are exempt from registration under the federal securities laws and are only sold to certain investors meeting predefined criteria. These offerings can be a key source of capital for businesses, especially small or start‑up companies. The offering document for a private placement specifies the terms of the offering, including the amount of money to be raised and the type of investor that can be solicited to participate in the offering, but contains more limited information on the company when compared with a public offering.

Why We Do Not Include Private Investments in Separate Accounts

Because of their lack of liquidity, T. Rowe Price does not typically include private investments in separate accounts. When owners of separate accounts redeem all or a portion of their assets, securities held in the portfolio must be sold in the open market to a third party, a transaction that is not always possible on a timely basis for private holdings. Commingled products, on the other hand, do allow for small and careful allocations to private companies, as they typically hold cash that is available for redemptions. Our rigorous valuation process for private companies is designed to ensure that all investors in commingled portfolios are treated equitably, as they are in the case of the sales and purchases of public securities.

| 9/30/2017 | 3/31/2022 | |

|---|---|---|

| Private Company Investments | 40 | USD 3 billion |

| Assets Under Management in Privates | 111 | USD 12 billion |

As of date indicated (not cumulative). Subject to change. AUM figures are rounded.

The Boom in Private Markets

Several factors contributed to the rapidly growing private investment market over the past decade. The abundance of capital in the global financial system played an important role, as low interest rates drew investors away from fixed income markets and toward risk assets, including private equity and venture capital. Paradoxically to many, the coronavirus pandemic accelerated risk taking by pushing real yields further into negative territory. The Federal Reserve’s aggressive shift this year toward monetary tightening has heightened risk aversion and led to a steep pullback in both public and private markets (as evidenced by markdowns). But the private market seems unlikely to surrender its growing role in the financial system amid the volatility—indeed, many firms are likely to choose to delay their IPOs as long as public company valuations remain well below recent levels.

With coffers overflowing, traditional investors in private companies, such as hedge and venture capital funds, have been aggressively approaching private companies to put capital to work. According to financial data firm Prequin, venture capital firms ended 2021 with roughly USD 400 billion in “dry powder,” while growth‑focused private‑equity funds were sitting on another roughly USD 310 billion.2

Many innovative growth companies have welcomed the chance to stay private longer. Several factors have been at work here, as well, including the extensive and costly regulatory burden of becoming a public company, the abundance of capital available in the private markets, and the demand on management time from public investors. The number of public U.S. companies has declined steadily since 1997, from more than 7,000 to fewer than 4,500 at the end of 2019.3,4

Large Private Companies: A Growing Opportunity Set

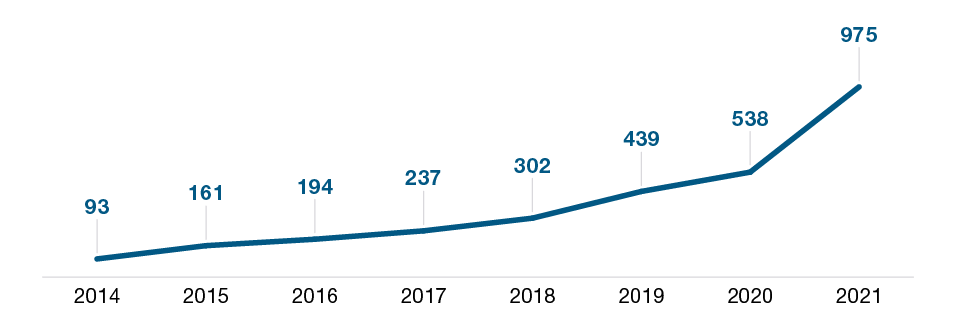

(Fig. 1) Global active unicorn count, 2014–2021

As of December 31, 2021.

Source: PitchBook.

With extensive financing available in the private market, company founders and their early employees have been able to realize personal liquidity as part of private funding rounds rather than wait for an IPO. Businesses not requiring heavy capital investment, such as software firms, are more likely to remain private for longer, as are firms that can forgo the branding value of an IPO. The result has been a virtuous cycle, in which the growing number of private firms—and the shrinking number of public ones—has attracted more capital to private markets.

The boom in private investing is most visible in the number of unicorns, or private firms with a valuation over USD 1 billion. As of the end of 2021, there were 975 such companies around the globe, compared with 93 just seven years earlier (see Figure 1). Until recently, most unicorns were based in the U.S., and predominantly in Silicon Valley. More recently, however, China and India, with their enormous population bases and rapidly growing economies, are closing the gap. While unicorns were typically found in the technology sector—particularly the software industry—firms in other sectors are increasingly using technology to innovate. The result has been disruption in a range of industries and sectors, from autos and retail to health care and financial services.

Why Companies are Likely to Choose Us as Investors

To date, our private investments have largely been the result of our relationships with company management teams or venture capital investors. These first contacts began almost two decades ago, when celebrated portfolio manager Jack Laporte managed small‑cap growth portfolios for us. The deep industry and sector expertise of our seasoned team of analysts and portfolio managers is embedded in our seasoned research platform and helps us continuously look for opportunities. As our team has grown, our efforts have increased considerably.

Executives at growing companies understand that an investment from T. Rowe Price can provide more than just needed capital for expansion. Our analysts are experts in their industries, with important contacts that they can leverage to help new firms.

Our experience in navigating a wide range of governance issues is also highly prized. We believe that a private investment from T. Rowe Price can signal to other investors that this is a responsibly managed enterprise on its way to becoming a successful public company. In situations where we play a large role in a financing round, we typically ask for a board observer seat to enhance our understanding of the company and its competitive environment.

Using our industry knowledge, we can also provide companies with insights on where we think the best opportunities—and biggest pitfalls—may lie. We can make strategic introductions to prospective customers, partners, and investors. This has been particularly helpful in the biotechnology sector, for example, where the scientific and medical expertise of our health care team has helped us make connections—including at neighboring research leader Johns Hopkins—and led us to promising new tests and treatments. Building trust is a key part of our process.

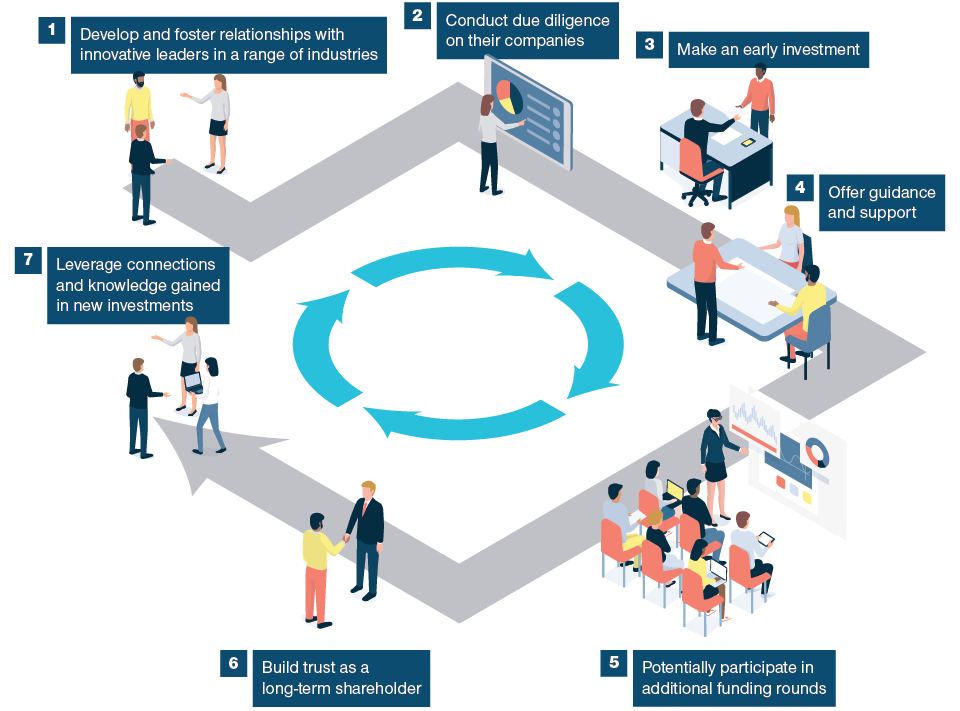

Our Place in the Private Company Ecosystem

(Fig. 2) A virtuous cycle based on our solid reputation

For illustrative purposes only and intended to show our goal when working with private companies. This is not representative of all private security investments, and individual company relationships might vary.

Seeing Early Potential in Electric Vehicle Maker Rivian

Our largest private investment in recent years has been Rivian, a pioneer in bringing electric vehicle (EV) technology to the sport utility and light truck markets. The company provides a good example of how we pursue promising companies and invest with them as they grow.

Our analysts have been closely following the EV market for over a decade, guided in part by our early investments in Tesla and our interest in similar opportunities presented by the shift to green energy. While Tesla’s successes have been phenomenal, it has also suffered its share of growing pains and missteps. These are inevitable in any new company, especially in the first stage of an industry’s growth.

We believe that Rivian may be positioned to lead the industry’s next stage, which we refer to as “EV 2.0.” Instead of “reinventing the wheel,” Rivian is hiring industry veterans and selectively leveraging the efficient scale production methods that carmakers have honed over decades. The company has also brought on board top talent from the technology sector. As a result, Rivian has excelled at melding the auto and tech worlds, in our view.

Following an initial introduction to Rivian from a trusted relationship at Amazon and thorough due diligence, we soon joined Amazon as a major investor in Rivian, leading the final three rounds of private financing.

Rivian delivered it first vehicles to customers in August 2021 and became a public company three months later. The stock was volatile following its IPO, rising and then falling sharply (as of May 2022)—demonstrating the extra risk in investing in early‑stage companies. While it is too early to judge the success of our investment, we are optimistic that Rivian’s growth prospects could be substantial, as it is the first entrant into the EV market for SUVs, trucks, and crossover vehicles, which together represent roughly three‑quarters of consumer auto demand.

Expanding Our Search

Reflecting our large and growing focus on finding promising, early‑stage companies, we have recently created a Centralized Private Equity Team (CPET). The CPET is now the central point of contact for the firm’s private investing operations, responsible for coordinating communications with private companies and ensuring proper due diligence by our investment staff. For example, the team will ensure that new investment ideas are sent to the appropriate analysts on the global research platform and that the appropriate person attends board meetings once we have invested in the company. CPET will also work with the firm’s recently established and separate U.S.‑registered investment adviser, T. Rowe Price Investment Management.

The CPET also works closely with our valuation team (see “Valuing Private Companies”) and legal staff. As a shared service, the CPET began functioning on March 7, 2022, on behalf of both T. Rowe Price advisers, while assuring that final investment decisions are made separately by the two entities’ investment staffs.

The CPET is also helping us evolve our private investing role by allowing us to become more proactive in seeking out opportunities and investing in promising companies even earlier. We have been strengthening our considerable contacts in the venture capital (VC) community. In many instances, VC investors might participate in the first two or three series of funding rounds, while we might begin investing at later stages, where the risks to the company’s business model have diminished. Ideally, we would make our initial investment in companies that are one to three years from their IPO and are at a later stage (Series C and beyond) in their capital‑raising process. VC funds can work with us to identify firms that are at a stage more appropriate for a large crossover investor.

Valuing Private Companies

Among the many challenges posed by investing in private companies, one of the more significant is determining their appropriate valuations—a task complicated by a lack of readily available market prices, confidentiality obligations that limit disclosures, and occasional irregular information flows from private companies, often due to their resource constraints.

At T. Rowe Price, a rigorous process is based on the guiding principles of fairness and independence, says Christopher Casserly, a member of the firm’s Valuation Committee, which is composed of senior members of the Enterprise Risk, Pricing, Legal and Compliance, Investment Treasury, Equity, Fixed Income, and Global Trading Departments.

“We want to be fair to both buyers and sellers of our products that own private equity while making an independent analysis that considers both the currently available information and the long‑term potential of these investments,” Mr. Casserly says. Dedicated and independent private company valuation analysts in the Enterprise Risk Department focus on the valuation of these investments.

The Private Company Valuation Advisory Group was formed in 2016 to provide an additional investment professional perspective. The group is composed of professionals who work in or with the Investment Division but who do not currently manage or cover private company investments, which helps reduce potential conflicts of interest. Although these investment professionals are consulted, the final valuation determination of a company rests solely with the Valuation Committee.

As a part of the adviser’s oversight, members of the applicable Equity Steering Committee receive a monthly update of any notable activity or valuation changes, and each T. Rowe Price fund Board must annually review and approve the firm’s formal valuation policies and procedures.

Balancing Remarkable Potential and High Valuations

We recognize that private company valuations remain elevated, both on an absolute basis and relative to public markets. It can often take several quarters for private valuations to adjust to lower public market levels. As capital has flooded into the market, selectivity and research are vital. Successful funding rounds by one company in an industry have encouraged imitators to follow suit—sometimes without a solid plan to put the capital to work.

On the other hand, more great companies are being formed than ever before, in our view. The disruption caused by the internet and the broader digitalization of the economy has been taking place across industries and has made room for innovative upstarts. The caliber of these companies is impressive—indeed, we have never seen this number of well‑run firms with promising products in our careers.

For the foreseeable future, at least, T. Rowe Price will remain mostly invested in public companies. Many of our portfolios are regulated in the U.S. under the Investment Company Act of 1940, which limits private investments and other illiquid holdings to 15% of assets, and many of the portfolios we offer in Europe and Asia have even more stringent restrictions. Moreover, we acknowledge the extra risk involved in private investing, and we are committed to seeking to limit risk to acceptable levels for our clients. We are confident that investing in both private and public companies will continue to provide synergies for our research platform.

Another Step in Our Evolution

Our growing role in private markets is just another step in the evolution of our firm in the decades since 1937, when our founder, Thomas Rowe Price, Jr., began offering what today would be described as “separate accounts” for individuals. As markets continue to evolve, we will continue to find ways to provide clients access to some of the best and most promising opportunities.

The specific securities identified and described are for informational purposes only and do not represent recommendations. No assumptions should be made that investments in the securities identified and discussed were or will be profitable.

GENERAL PORTFOLIO RISKS

Capital risk—the value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

ESG and Sustainability risk—May result in a material negative impact on the value of an investment and performance of the portfolio.

Equity risk—in general, equities involve higher risks than bonds or money market instruments.

Geographic concentration risk—to the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

Hedging risk—a portfolio’s attempts to reduce or eliminate certain risks through hedging may not work as intended.

Investment portfolio risk—investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management risk—the investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although in such cases, all portfolios will be dealt with equitably).

Operational risk—operational failures could lead to disruptions of portfolio operations or financial losses.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is no guarantee or a reliable indicator of future results.. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.