June 2022 / INVESTMENT INSIGHTS

ESG Integration in Action—Circular Economies

How a circular model could support economic and population growth

Key Insights

- Investors can play a role in helping to close the food gap, but we also must ensure that our investment is being deployed sustainably.

- Plastics have come to epitomize the problems of the end-to-end (or linear) economy.

- The circular economy underpins a transition to renewable energy and materials.

The vast majority of economic activities are built on a linear model, where raw materials are taken from the earth, used to make products, and eventually discarded. This source of environmental degradation is worsening as the global population grows, signaling that this linear model is not sustainable. If global economies are to prosper and support the world’s burgeoning population, a shift to a circular economy is needed.

The circular economy is based on three principles— eliminating waste and pollution, circulating products and materials, and regenerating nature. It underpins a transition to renewable energy and materials, helping to decouple economic activity from the consumption of finite resources. This white paper is divided into three sections, exploring the following key themes: Sustainable Agriculture, Plastics, and the Energy Transition.

SUSTAINABLE AGRICULTURE

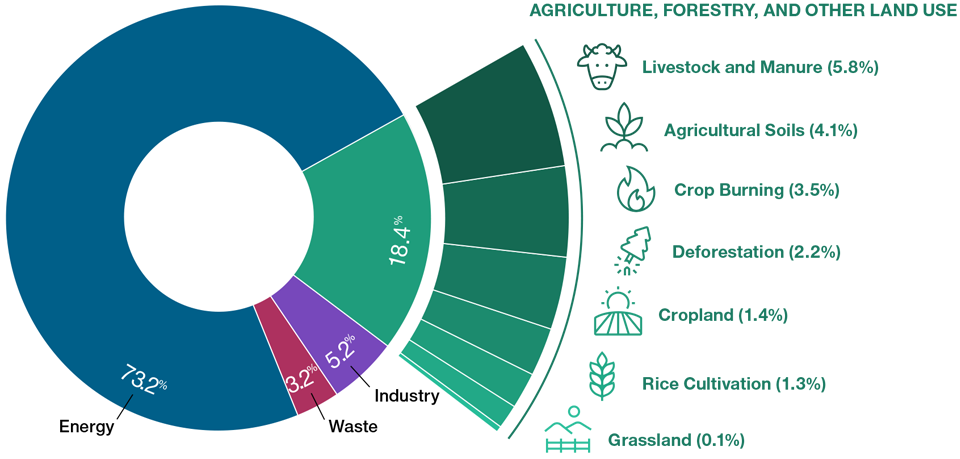

Sustainability in the agricultural sector is a challenging web of considerations. On the one hand, agriculture accounted for 18.4% of global greenhouse gas (GHG) emissions (in 2016),1 alongside ecosystem loss and land degradation. It also accounts for 70% of all freshwater withdrawals2 and is the largest contributor to nutrient runoff (a process that creates toxic algal blooms as well as “dead zones” in aquatic ecosystems). On the other hand, agriculture is a powerful force for good. It provides the food we all need to survive and has an outsized role in reducing poverty. The United Nations forecasts food demand to increase more than 50% by 2050, if the global population grows to an expected 9.8 billion (from 7.7 billion in 2021) and incomes increase across emerging markets. As investors, we can play a role in directing capital toward agricultural projects that can help close that food gap, but we also must ensure that our investment is being deployed sustainably. Investing in the same agricultural practices of the past 50 years will only serve to exacerbate the sector’s negative impacts—eventually leaving both society and investors to suffer the consequences.

Increasing food production by more than 50% without a radical change in traditional farming practices would require an enormous amount of land conversion and a sizable increase in GHG emissions. Neither is compatible with limiting global warming to a maximum target rise of 1.5°C. Indeed, most scenarios imply that agricultural emissions need to contract by half from 2016 levels, alongside reforesting 585 million hectares of land. There are a range of sustainability issues that we believe will impact companies, and each can vary substantially in how they impact the business (such as a binary event or compounding pressures). For example, a food company may face earnings volatility driven by a commodity shock resulting from physical climate risk, or it may face a steady, gradual shift in consumer preferences.

Greenhouse Gas Emissions by Source (2016)

Agriculture is a big contributor to GHG emissions

As of September 2020.

Source: Our World in Data (September 2020). Data as of 2016—most recent data available.

At T. Rowe Price, our equity and credit analysts consider sustainability issues related to agriculture, forestry, and other land use (AFOLU) as part of their fundamental investment research. Often, they receive support from our environmental, social, and governance (ESG) specialists when considering how AFOLU issues may impact specific industries or securities.

Click here to view the full report

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.