May 2022 / U.S. EQUITIES

Active Large‑Cap Managers Could Be Poised to Outperform

A narrow U.S. market potentially sets stage for excess returns.

Key Insights

- Recent market conditions have posed formidable challenges for active U.S. large‑cap equity managers seeking excess returns relative to their benchmarks.

- By early 2022, the S&P 500 Index reached concentration and valuation levels not seen since the technology bubble of the late 1990s.

- Historically, returns for active U.S. large‑cap managers typically were stronger after S&P 500 concentration and valuation extremes as those conditions unwound.

Here at T. Rowe Price, we believe strongly that skilled active management can enhance investment returns over the long run. However, we also know that some shorter‑term market environments historically have offered greater potential for active outperformance. In our view, recent conditions in the U.S. large‑cap equity space appear to create just such an opportunity.

Our research has identified several broad equity market environments in which active managers, as a group, historically have been more likely to generate positive excess returns relative to their benchmarks. These include:

- Volatile markets: Active U.S. equity managers typically have had a higher chance of outperforming when market returns have been erratic and/or negative.1

- High dispersion: When return correlations within a benchmark are low, active managers may find greater opportunities to add value through security selection or sector rotation.

- Broad market breadth: As a group, active managers generally seek to limit portfolio concentration. This can hurt relative performance when a handful of large stocks are leading the market, but generate positive excess returns if the largest stocks lag behind.

- Top‑heavy valuations: Just as index returns can be driven by a small group of very large stocks, so can index valuations. If these valuations correct, active managers may benefit from not being concentrated in the most expensive names.

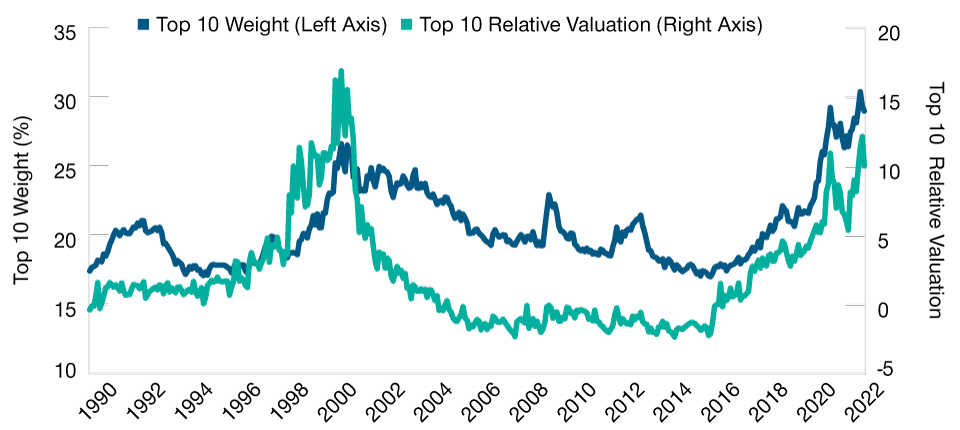

S&P 500 Index Has Become Concentrated in Expensive Stocks

(Fig. 1) Capitalization weight and relative valuation of top 10 names*

September 30, 1989, through April 30, 2022.

*Relative valuation = forward 12‑month P/E for 10 largest stocks in the S&P 500 minus index aggregate P/E using consensus earnings estimates.

Sources: Refinitiv, Standard and Poor’s, and ICE BofA (see Additional Disclosures). Data analysis by T. Rowe Price.

In recent years, prevailing market conditions tended to work against active equity managers as a group. Powerful gains for major U.S. large‑cap benchmarks, such as the S&P 500 Index, were disproportionately driven by a small number of mega‑cap growth stocks. Excluding the pandemic‑related sell‑off in 2020 (which was followed by an exceptionally rapid recovery), market volatility generally remained low, as did return dispersion within large‑cap indexes.

As a result, the S&P 500 Index reached concentration and valuation levels not seen since the technology bubble of the late 1990s (Figure 1). As of April 30, 2022, the 10 largest stocks in the index accounted for almost 28% of total market capitalization, a 10 percentage point increase from the end of 2015. The valuation premium for those same top 10 stocks (as measured by their average forward 12‑month price/earnings (P/E) ratio relative to the index as a whole) reached 10 times earnings, nearly double its level at the end of 2019.

In this environment, a number of active large‑cap stock pickers—those who sought to identify attractive opportunities across the broader market—underperformed their benchmarks.

Given the challenges that a relatively top‑heavy and expensive U.S. large‑cap market has posed for active managers, we thought it would be interesting to look at their subsequent relative performance following such episodes in the past. Our analysis suggests that highly concentrated and/or richly valued markets may create environments in which skilled active management potentially can benefit as those conditions unwind.

Historical Performance Analysis

Figures 2 and 3 break down relative performance results for active U.S. large‑cap equity managers in the eVestment universe that were benchmarked to the S&P 500 Index. The results shown cover a more than 33‑year period ended January 31, 2022.2 Excess returns within the group were ranked by percentile, with the 95th percentile denoting the best‑performing managers in the large‑cap category and the 5th percentile indicating the worst performers.

Active Performance Historically Was Stronger After High S&P 500 Concentration

(Fig. 2) Average forward 12‑month excess returns for active U.S. large-cap managers based on weight of top 10 stocks

| Weight of Top 10 Stocks in S&P 500 Index* | |||||

|---|---|---|---|---|---|

| Manager Performance Percentile | All Periods | > 17.5% | >20% | >22.5% | >25% |

| 95 | 14.0% | 14.4% | 18.4% | 23.9% | 28.4% |

| 90 | 9.0 | 9.4 | 11.8 | 16.3 | 17.7 |

| 75 | 3.8 | 4.0 | 5.2 | 7.9 | 6.7 |

| 50 | 0.1 | 0.3 | 0.8 | 1.7 | 0.4 |

| 25 | ‑3.2 | ‑3.1 | ‑2.9 | ‑2.4 | ‑3.9 |

| 10 | ‑7.4 | ‑7.3 | ‑7.5 | ‑7.0 | ‑8.9 |

| 5 | ‑10.9 | ‑10.9 | ‑11.5 | ‑10.8 | ‑13.8 |

September 30, 1989, through December 31, 2021. Returns through December 31, 2021, and calculated monthly. Top 10 weights through December 31, 2020.

Past performance is not a reliable indicator of future performance.

*Top 10 stocks = 10 largest stocks in the S&P 500 Index as measured by market capitalization. Top 10 weights calculated monthly.

For illustrative purposes only. Results shown are gross of fees. Actual performance would be lower as a result of the deduction of applicable fees.

Sources: eVestment, Refinitiv, Standard and Poor’s, and ICE BofA (see Additional Disclosures). Data analysis by T. Rowe Price.

In Figure 2, excess returns relative to the S&P 500 Index are shown for all 12-month rolling periods covered by the study and for 12-month forward periods after the S&P 500 reached various levels of concentration in its 10 largest stocks. Our study found that the relationship was strong and generally consistent, especially for top‑performing managers.

- Forward 12‑month excess returns were significantly stronger for managers in the top quartile (75th percentile and above) following higher levels of index concentration.

- For managers in the top two cohorts (90th and 95th percentiles), forward excess returns were particularly strong after index concentration was very high (>22.5% in the top 10 stocks).

- Forward excess returns for the managers in the lowest quartile (25th percentile and below) were largely unchanged after moderate levels of concentration, but worsened after concentration hit extreme levels (>25% in the top 10 stocks).

High Valuation Levels Also Were Followed by Strong Active Performance

(Fig. 3) Average forward 12‑month excess returns for U.S. large-cap managers based on valuation of top 10 stocks

| Relative P/E for Top 10 Stocks in the S&P 500 Index (Top 10 Minus Index)* | |||||||

|---|---|---|---|---|---|---|---|

| Manager Performance Percentile | All Periods | >0 | >2 | >4 | >6 | >8 | >10 |

| 95 | 14.0% | 16.7% | 19.1% | 26.7% | 32.7% | 35.0% | 41.6% |

| 90 | 9.0 | 10.6 | 12.1 | 17.2 | 21.4 | 23.4 | 29.5 |

| 75 | 3.8 | 4.3 | 4.6 | 7.0 | 8.8 | 9.9 | 14.7 |

| 50 | 0.1 | 0.0 | ‑0.1 | 0.6 | 1.0 | 1.5 | 4.4 |

| 25 | ‑3.2 | ‑3.8 | ‑4.3 | ‑4.8 | ‑4.4 | ‑3.8 | ‑2.7 |

| 10 | ‑7.4 | ‑8.6 | ‑9.8 | ‑11.2 | ‑10.8 | ‑9.9 | ‑9.9 |

| 5 | ‑10.9 | ‑12.5 | ‑14.1 | ‑15.9 | ‑16.0 | ‑15.3 | ‑15.6 |

September 30, 1989, through December 31, 2021. Returns through December 31, 2021, and calculated monthly. Relative P/Es through December 31, 2020.

Past performance is not a reliable indicator of future performance.

*Relative P/E is the forward P/E for the top 10 stocks minus the index P/E. Relative P/Es measured monthly.

For illustrative purposes only. Results shown are gross of fees. Actual performance would be lower as a result of the deduction of applicable fees.

Sources: eVestment, Refinitiv, Standard and Poor’s, and ICE BofA (see Additional Disclosures). Data analysis by T. Rowe Price.

The same trends are visible in Figure 3, which sorts excess returns for U.S. large‑cap active managers based on the valuation premium awarded to the 10 largest stocks in the S&P 500. Here, forward 12‑month excess returns for most percentile groups were significantly higher after top 10 valuations were elevated, but weaker for the lowest manager percentiles.

We believe these results make intuitive sense. Other things being equal, the tendency for many active managers to underweight the largest and most expensive stocks in their benchmarks can be expected to detract from relative performance when markets are rewarding those factors, but boost excess returns if the largest and most highly valued stocks eventually fall out of favor.

Similarly, the greater the skill that active managers show in recognizing and avoiding the pitfalls of excessive concentration and overvaluation, the more likely they are to benefit when underlying investment fundamentals reassert themselves, in our view.

However, the potential for active management to outperform when markets have become extremely concentrated doesn’t necessarily require being underweight the largest and most expensive stocks across the board.

Since highly concentrated markets can remain that way for extended periods—or grow even more concentrated—we believe it’s important to have an active view on the largest securities in order to position a portfolio for how markets might evolve.

Changes in market concentration also may not affect all securities equally, so an active manager potentially may be able to benefit from relative positioning among the largest securities, particularly in markets where security correlations are low and there is higher return dispersion.

T. Rowe Price’s Active Performance

An examination of a group of T. Rowe Price’s U.S. large‑cap equity composites shows that, on average, they typically performed well following periods of extreme market concentration and overvaluation.

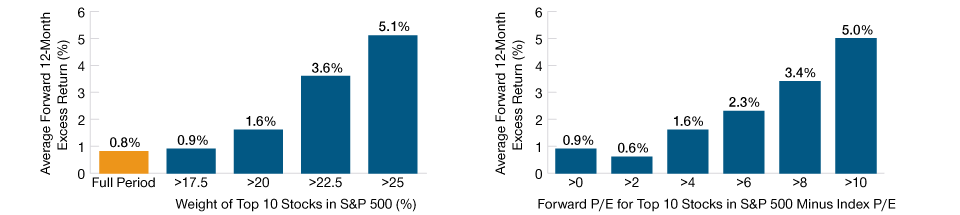

The left panel in Figure 4 shows average forward 12‑month excess returns for a group of our U.S. large‑cap equity composites over a 26‑year period ended December 31, 2021.3 Here again, the relationship was linear, with higher levels of S&P 500 concentration associated with higher rates of excess return.

The performance pattern was similar for index valuations (right panel in Figure 4). The richer the valuation premium for the 10 largest stocks in the S&P 500, the higher the forward 12‑month excess return average for the group of T. Rowe Price U.S. large‑cap equity composites. In our view, this speaks well of our large‑cap investment process’s ability to add value over the long run, in part by avoiding excessive exposure to concentration and valuation risks.

On Average, T. Rowe Price U.S. Large-Cap Equity Composites* Historically Performed Well After S&P 500 Concentration and Valuation Levels Were High

(Fig. 4) Average forward 12‑month excess returns

January 1, 1996, through December 31, 2021. Returns through December 31, 2021, and calculated monthly. Relative P/Es and top 10 weights are calculated monthly though December 31, 2020. Full period represents average excess returns for all 12-month rolling periods. Average forward 12-month excess returns are calculated following different levels of concentration in, and relative P/Es for, the Top 10 stocks in the S&P 500.

Past performance is not a reliable indicator of future performance.

*Performance is shown from January 1, 1996, or from composite inception date if later. Based on equal-weighted average returns for a group of T. Rowe Price U.S. large‑cap equity composites relative to their size- and style-specific benchmarks. Results are net of fees. See Composite Performance page for additional important information.

Sources: T. Rowe Price, FTSE/Russell, Standard & Poor’s (see Additional Disclosures). Created with Zephyr StyleADVISOR.

Implications for Future Returns

The potential for skilled active management to enhance large‑cap equity performance may be especially important for investors going forward, given the low index returns implied by recent market valuations.

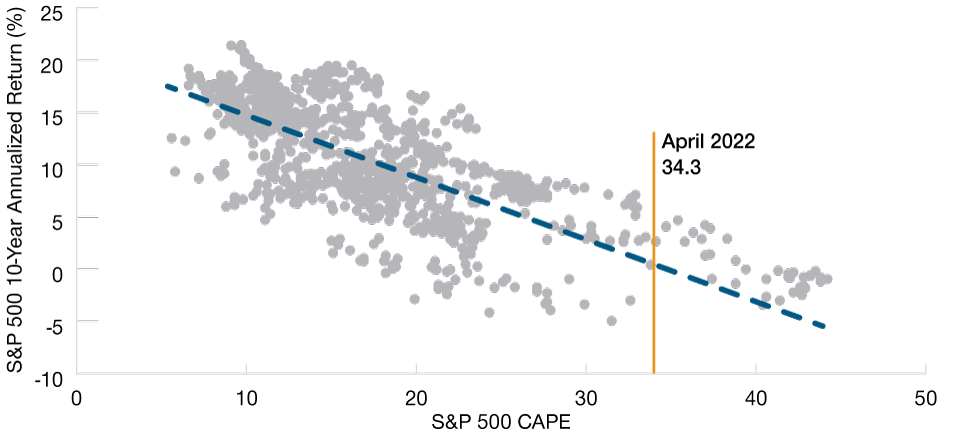

Figure 5 compares forward 10‑year rolling returns (rolled monthly) for the S&P 500 with the cyclically adjusted P/E ratio (CAPE) for the index at the start of those same periods.4 Historically, the correlation has been negative and fairly reliable, with high CAPE associated with significantly lower forward returns.

Recent Market Valuations Imply Lower Returns

(Fig. 5) S&P 500 Index CAPE vs. forward 10‑year S&P 500 annualized return*

Returns from September 30, 1989, through December 31, 2021. S&P CAPE from September 30, 1989, through December 31, 2011, plus most most recent CAPE value as of April 30, 2022.

Past performance is not a reliable indicator of future performance.

*Dashed line depicts where the S&P 500 12-month return falls on the line of best fit. The line of best fit is based on historical data. This is not to be considered a specific estimate of future returns and is for illustrative purposes only. Actual outcomes may differ materially.

Sources: Refinitiv, Standard and Poor’s, ICE BofA (see Additional Disclosures), Dr. Robert J. Shiller, and Department of Economics, Yale University.

As can be seen, the most recent S&P 500 CAPE reading shown in Figure 5 (34.3 as of April 2022) falls far to the right, suggesting the index’s future return prospects could be limited.

If these forecasts are correct, purely passive exposures to large‑cap equity beta—i.e., to S&P 500 Index returns—may fail to generate the results that investors will need to achieve their long‑term investment objectives. This means that even modestly positive excess returns from skilled active management could make an important difference in achieving those goals.

Conclusions

Despite the sharp but relatively short market downturn triggered by the coronavirus pandemic, the S&P 500 Index performed exceptionally well in recent years. However, some of the trends driving that performance—narrow leadership and elevated valuations for the largest stocks in the index—created a difficult environment for active management seeking to add value.

More recent market developments, however, could signal a reversion toward conditions that favor closer attention to valuation and other fundamentals, potentially creating attractive opportunities for bottom‑up stock selection.

If the historical relationship we have identified between valuations and longer-term returns holds, active equity management could play an even greater role in the future in helping investors reach their objectives. By continuing to focus on the factors that we believe support long‑term relative performance, T. Rowe Price’s active U.S. large‑cap equity strategies will seek to contribute to that effort.

Additional Disclosures

© 2022 Refinitiv. All rights reserved.

eVestment Alliance, LLC

Copyright © 2022, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

ICE Data Indices, LLC (“ICE DATA”), is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD‑PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES AND REPRESENTATIONS, EXPRESS AND/OR IMPLIED, INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD‑PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD‑PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND T. Rowe Price OR ANY OF ITS PRODUCTS OR SERVICES.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2022. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is no guarantee or a reliable indicator of future results.. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.