March 2022 / VIDEO

Growth Likely to Remain Under Pressure

Key Insights

- Equity markets—especially growth stocks—have pulled back meaningfully in 2022, weighed down by looming interest rate hikes and the Russia-Ukraine conflict.

- The Asset Allocation Committee has moderated the overweight to value stocks, given a less promising economic growth outlook and other factors.

Global equity markets have sold off significantly since the beginning of the year, as investors worry about the implications of Russia’s invasion of Ukraine and an increasingly hawkish Federal Reserve intent on combating persistently high inflation.

Notably, the downturn has been much harsher for growth stocks. Historically, value stocks have fared better in a rising interest rate environment; in particular, for companies in the financials sector—a significant portion of the value universe—rate hikes have often expanded profit margins. Meanwhile, since the investment rationale for growth stocks is based on the expectation of higher future earnings, the value of their future cash flows is diminished when discounted at higher rates.

As we enter the early stages of rapidly tightening monetary conditions, investors may be considering whether growth’s underperformance is likely to continue. We believe that a review of the two asset classes’ price to free cash flow—an equity valuation metric that accounts for a company’s ability to sustainably generate additional revenues—could offer guidance.

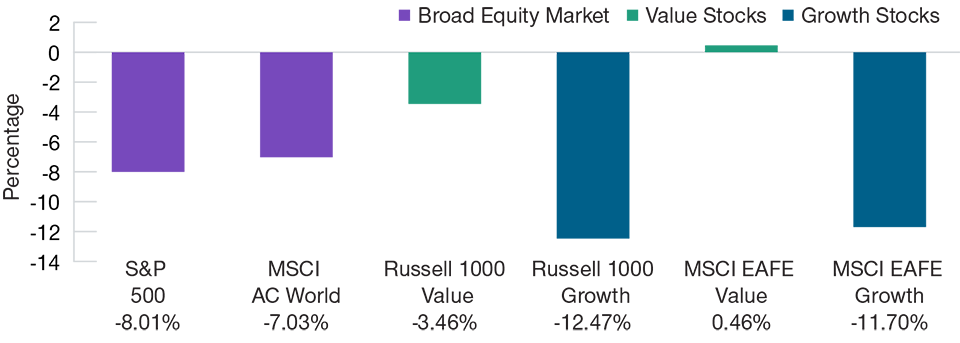

So Far, 2022 Has Been a Difficult Year for Equities

(Fig. 1) Overall, growth-oriented stocks have borne the brunt of the sell-off

Year-to-date performance ended February 28, 2022.

Past performance is not a reliable indicator of future performance.

Sources: Standard & Poor’s, MSCI, and Russell. T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. See Additional Disclosures.

A comparison of stock valuations for the Russell 1000 Growth Index and the Russell 1000 Value Index suggests that the valuation gap between U.S. growth and value stocks remains large relative to history. Although the difference has narrowed after the sharp sell-off in growth stocks this year, the gap could, in our view, tighten further as growth-oriented companies are more susceptible to economic uncertainty.

A Historical Look at U.S. Growth and Value Stock Valuations

(Fig. 2) Despite the recent rout, growth stocks are still more expensive than value

15 years ended February 28, 2022.

Past performance is not a reliable indicator of future performance. Cash flow is represented by 1-year forward estimates. Actual outcomes may differ materially from estimates.

1 January 2020 Gap is shown to provide pre-Covid metrics.

Sources: Russell. T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. See Additional Disclosures.

As a result, our Asset Allocation Committee remains overweight to value stocks. However, the allocation was recently moderated as we believe that a supportive boost from rate hikes is likely priced into value stocks following their rally this year, and further upside may be muted going forward. In addition, the economic growth outlook appears less promising as investors weigh the potential impacts of a prolonged conflict in Ukraine.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is no guarantee or a reliable indicator of future results.. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

March 2022 / INVESTMENT INSIGHTS