March 2022 / FIXED INCOME

Five Reasons to Consider Stable Value in a Plan Lineup

Asset class has performed well in multiple rate environments.

Plan sponsors and investment professionals have asked us about the virtues of including stable value in retirement plans. Here, we discuss five important reasons to consider their inclusion—especially considering recent market volatility and looking ahead to the rate‑hiking cycle from the Federal Reserve.

1. Higher Crediting Rates

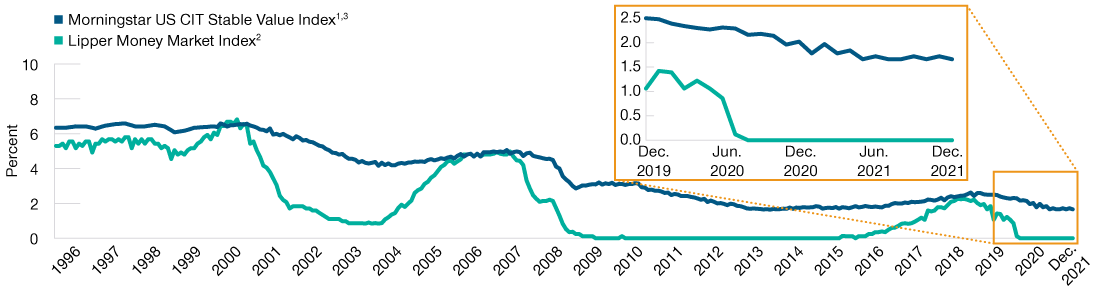

Perhaps the most compelling reason for including stable value is that the asset class has historically generated a higher yield and superior performance to money market funds in various interest rate environments, while also offering similar benefits for investors seeking principal preservation and daily liquidity. In the chart above, we compare stable value crediting rates to money market fund yields and highlight the yield advantage stable value crediting rates have held over money market fund yields for the indicated period.

Stable Value Has Maintained Competitive Yields

(Fig. 1) Annualized yields: Money markets vs. stable value

As of December 31, 2021.

Past performance is not a reliable indicator of future performance.

Money market and stable value funds have different risks. It is important that you carefully review the legal documents for each type of vehicle prior to investment to determine if it is appropriate for you.

1 Universe rates of return are reported gross of management fees.

2 Source for Lipper Index Data: Lipper Inc. Portions of the information contained in

this display was supplied by Lipper, a Refinitiv Company, subject to the

following: Copyright 2022 © Refinitiv. All rights reserved. Any copying,

republication or redistribution of Lipper content is expressly prohibited

without the prior written consent of Lipper. Lipper shall not be liable for any

errors or delays in the content, or for any actions taken in reliance thereon.

3 Source for Morningstar index data: Please see Additional Disclosures for details about this Morningstar information.

Data provided on this page include the historical information of the Hueler Pooled Fund Index through December 31, 2020, and the Morningstar US CIT Stable Value Index from January 3, 2021, to the current period ending date.

The Morningstar US CIT Stable Value GR USD (Morningstar SV CIT Universe) , formerly The Hueler Analytics Stable Value Pooled Fund Index is provided by Morningstar, Inc., a financial services firm, provides an array of investment research and investment management services. The Morningstar SV CIT Universe is an equal-weighted total return average across all participating funds in the Universe and represents approximately 75% of the stable value pooled funds available to the marketplace.

While there are brief periods of time, usually at the tail end of rate‑hiking cycles, when money market funds eclipsed yields generated by stable value, historically, stable value yields have held up well relative to money markets through various rate cycles. Over time, this yield advantage can be beneficial for stable value investors and can help drive better participant investment outcomes, in our view.

Since the start of the pandemic in early 2020 through December 31, 2021, stable value crediting rates were at the higher end of that historical range and offered a more‑than 150‑basis‑point yield advantage over money market funds.

2. Daily Liquidity

In addition to potentially higher yields over money market yields, stable value also can, in our view, provide participants with similar features that money funds offer, including a stable net asset value (NAV) and daily liquidity. As with money market funds, stable value investment options permit participants to deposit and withdraw, or transfer funds on a daily basis, typically at a stable $1.00 per share. In periods of market stress, notably during the 2008 global financial crisis and the coronavirus pandemic, daily liquidity and principal preservation can be especially important for plan sponsors and participants.

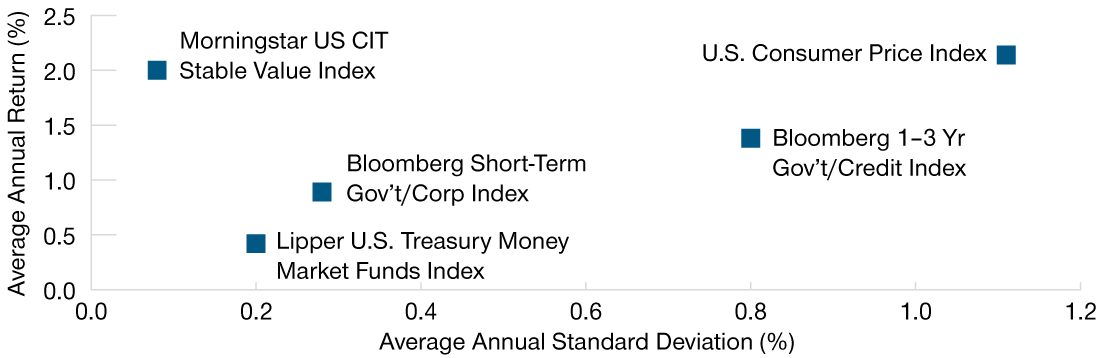

3. Attractive Risk/Return Profile

Not only has stable value outperformed money market funds and comparable low‑duration strategies over the past 10 years ending December 31, 2021, but it has also outperformed these strategies and inflation with a lower volatility and a better risk/return profile (Fig. 2).

Stable Value Has Looked Favorable Over the Last 10 Years

(Fig. 2) Risk/return characteristics

As of December 31, 2021.

Past performance is not a reliable indicator of future performance.

Source for Lipper Index Data: Lipper Inc. Portions of the information contained in this display was supplied by Lipper, a Refinitiv Company, subject to the following: Copyright 2022 © Refinitiv. All rights reserved. Any copying, republication, or redistribution of Lipper content is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

Source for Bloomberg index data: Bloomberg Index Services Limited. Please see

Additional Disclosures for information about this Bloomberg information.

Source for Morningstar index data: Please see Additional Disclosures for details about this Morningstar information.

Data provided on this page include the historical information of the Hueler Pooled Fund Index through December 31, 2020, and the Morningstar US CIT Stable Value Index from January 3, 2021, to the current period ending date.

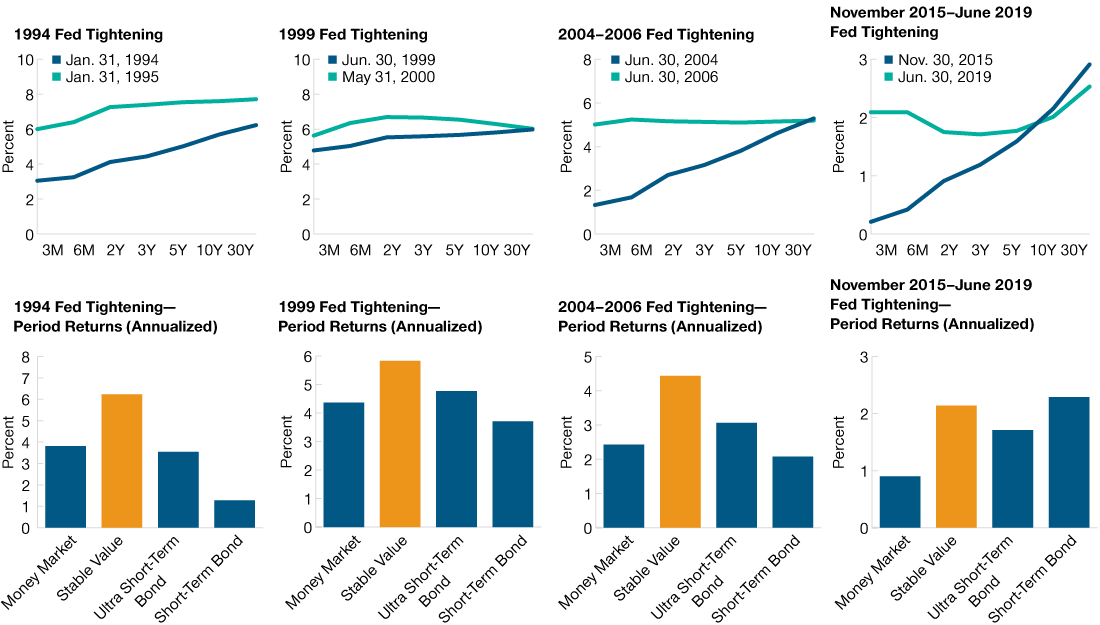

Stable Value Was Attractive Through Multiple Market Types

(Fig. 3) Historical rate tightening cycle yield curve change

Past performance is not a reliable indicator of future performance.

Money market and stable value funds have different risks, in addition to the possible loss of principal. It is important that you carefully review the legal documents for each type of vehicle to determine if it is appropriate for you prior to investment.

Money Market is represented by the Lipper U.S. Treasury Money Market Index; Stable Value is represented by the Morningstar US CIT Stable Value Index; Ultra Short‑Term Bond is represented by the Bloomberg 9–12 Month T‑Bill Index; Short‑Term Bond is represented by the Bloomberg U.S. 1–3 Year Government/Credit Bond Index.

The Fed’s target rate rose 300 bps over the 1994–1995 tightening cycle; 175 bps over the 1999–2000 tightening cycle; 425 bps over the 2004–2006 tightening cycle; and 250 bps over the November 2015–June 2019 tightening cycle.

Sources: Morningstar, Lipper Inc., U.S. Department of the Treasury. Analysis by T. Rowe Price.

Source for Bloomberg index data: Bloomberg Index Services Limited. Please see Additional Disclosures page for more information about this Bloomberg information.

Source for Morningstar data (see Additional Disclosures).

4. Building Block Option

Given stable value’s unique risk/return profile, we believe that stable value portfolios can offer participants a well‑diversified, stable NAV investment option to help round out their retirement portfolios. Plan sponsors and investment professionals may be drawn to the potential benefits of a flexible, well‑diversified, and uncorrelated investment option that can be used in other capacities in an investment lineup. Various implementations for a stable value portfolio can include:

- A building block in custom target date funds,

- Managed accounts,

- Retirement income investment offerings, and

- The default option for a self‑directed brokerage account.

5. A Multi‑Use Investment Strategy

Perhaps the most important reason to consider including stable value in an investment lineup is that it has demonstrated long‑term success in providing liquidity and principal preservation across myriad market conditions. Stable value performed well relative to money market funds and comparable low‑duration strategies in various rate environments.

Conclusion

Stable value has come a long way since its inception in the mid‑1970s. Today, with assets approaching USD 1 trillion,1 stable value is a mainstay in the retirement industry, especially for participants approaching retirement and those in retirement.

With enhanced features and potential advantages over money market funds and low‑duration strategies, we believe stable value should be considered as a standalone investment option in every plan and also as an option in other retirement.

As the Fed begins to taper bond purchases ahead of expected rate hikes, we believe stable value could once again perform well relative to money market funds and could be an attractive alternative to money market funds.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is no guarantee or a reliable indicator of future results.. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

March 2022 / INVESTMENT INSIGHTS