January 2022 / U.S. FIXED INCOME

Digging Deep in Securitized Credit as Supply Booms

Our analysts are finding value in data centers, aircraft ABS.

Key Insights

- A 2021 boom in securitized credit issuance helped create value relative to other fixed income sectors as fundamental credit quality generally remained strong.

- Our analysts have recently been finding opportunities in two segments of asset-backed securities (ABS) in particular—data center securitizations and aircraft ABS.

- We think most of the risk of a major sell-off in securitized credit related to lockdowns has dissipated as society increasingly learns to live with COVID-19.

Securitized products have a reputation for complexity, leading some investors to avoid the sector. While some segments of securitized credit—which includes asset-backed securities (ABS), non-agency residential mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMBS), and collateralized loan obligations (CLOs)—have complex and varying cash flow structures that affect their credit quality, we believe that our securitized credit analysts can accurately analyze and value these bonds. This can potentially allow us to uncover areas of value in securitized credit that other investors may overlook.

As one of the sectors that is most directly impacted by consumer financial health, securitized credit experienced severe selling pressure at the onset of the pandemic in March 2020. In those early months, investors extrapolated extremes in unemployment and consumer credit default rates into their forecasts. The sector then staged a rapid recovery later in 2020 and into 2021 as the economy rebounded from the pandemic-related shutdowns and investors realized that consumer fundamentals—and the fundamentals of most areas of securitized credit—were still solid. We believe that the majority of the risk of another major sell-off in securitized credit related to economic lockdowns has dissipated as society increasingly learns to live with COVID-19.

Booming New Issuance

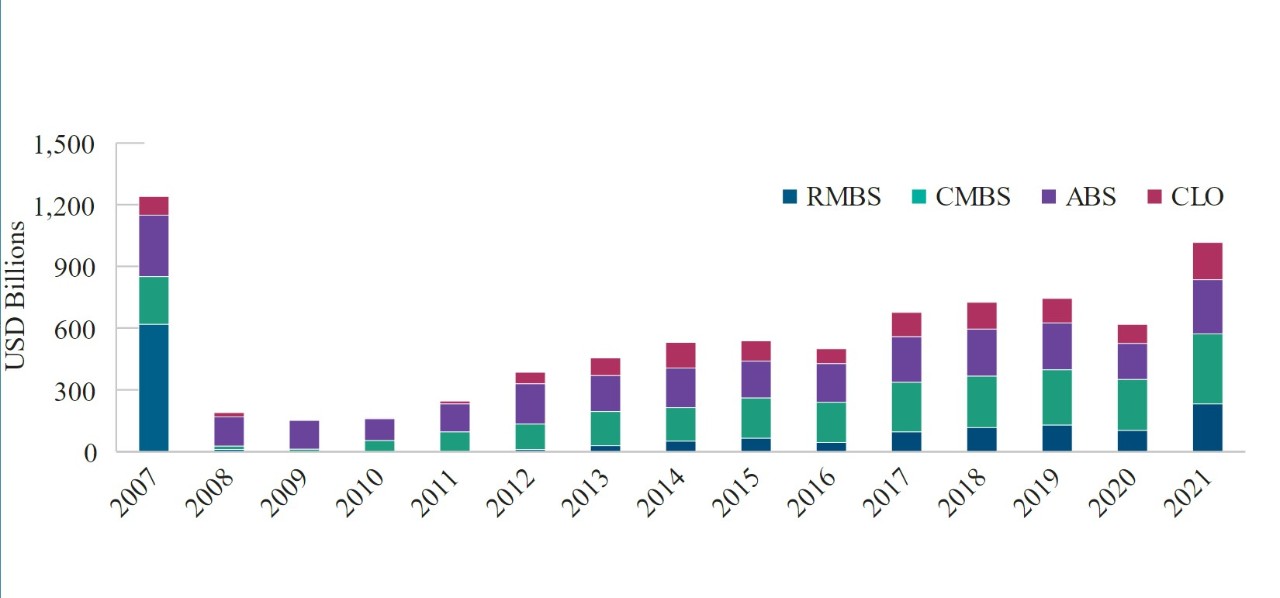

Issuance of securitized credit boomed in 2021 as consumers borrowed heavily to buy houses, vehicles, and other durable goods and to refinance mortgages on their existing homes at meaningfully lower rates, providing new credit for securitization. Issuers raced to securitize the new collateral to take advantage of low interest rates and strong investor demand. Total securitized credit issuance jumped to USD 1.02 trillion in 2021 from only USD 618 billion in 2020.1 The new supply helped keep security prices low even as fundamental credit quality generally remained strong, creating relative value versus other fixed income sectors.

Securitized Credit Supply Jumped in 2021

(Fig. 1) Issuance volume in USD billions by segment

As of December 31, 2021.

Source: J.P. Morgan. Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The index may not be copied, used, or distributed without J.P. Morgan’s prior written approval.

Copyright © 2022, J.P. Morgan Chase & Co. All rights reserved

Our analysts have recently been finding opportunities in two ABS segments in particular—data center securitizations and aircraft ABS. In a securitization, bondholders receive cash flows from the collateral backing the deal. The structure of the securitization dictates which tranches, or slices, of the deal have priority on receiving cash flows, with the higher priority, senior tranches typically having higher credit ratings. In the case of data center securitizations, the cash flows are primarily from business services contracts and lease payments on data centers; for aircraft ABS, the cash flows are from airline lease payments on the aircraft they operate.

Opportunities in Data Center Securitizations

Data center securitizations allow private equity firms to finance data center acquisitions through the ABS market. The private equity firms then lease space in the data centers to end users that can range from large-cap technology companies to smaller businesses that similarly rely upon off-site data center space for their essential technology needs.

The structural protections within these data center securitizations allow for generally lower borrowing costs than alternatives like issuing bonds in the high yield market, making the securitizations attractive for potential issuers while providing lender a hedge against risk. Typically, the securitization involves lease cash flows and associated customer contracts from multiple data centers. Related assets and ancillary cash flows can also be part of the securitization, further diversifying the sources of cash flow.

Data centers have been one of the most in-demand areas of commercial real estate since the beginning of the pandemic. For many data center securitizations, the cash flows ultimately come from major technology companies like Amazon that often have very high levels of cash on hand. In terms of risk, data center securitizations are still new and so do not have a track record in the market, and the credit rating agencies have been slow to assign ratings to them. However, we are confident in the ability of our credit analysts to accurately value these deals to find opportunities.

Aircraft ABS

The other securitized credit segment where we have been finding value is aircraft ABS, which are backed by aircraft lease payments from a diversified pool of airlines, traditionally with a large concentration of emerging markets exposure. These contrast with enhanced equipment trust certificates (EETCs), which are a form of corporate debt and a common way for major carriers in developed markets to finance their planes.

Aircraft ABS include meaningful credit enhancements to the senior tranche that have now been stress-tested through a pandemic that has stretched on for almost two years. For aircraft ABS issued since the start of the pandemic, there have been additional structural and collateral enhancements, including faster amortization (paydown of principal), younger aircraft collateral, and more exposure to major developed market airlines with ample access to liquidity. Through our credit underwriting process, we have focused our attention on the senior-most tranches of aircraft ABS with reliable cash flows in addition to yields that are attractive relative to other bonds with similar credit quality.

Credit Risk More Dependent on Collateral

We think of owning EETCs as taking on the credit risk of a developed market airline and having the benefit of collateral (the aircraft) securing that credit risk. Because aircraft ABS generally have no recourse to the airline lessor, we consider holding aircraft ABS as taking a senior position in the cash flows of a specified pool of aircraft collateral—in other words, the credit risk is more highly dependent on the collateral and the management of the collateral, and our credit underwriting process reflects this dynamic.

In terms of broader risks involved with aircraft ABS, major pandemic-related travel shutdowns could hurt the segment. However, if there are severe travel restrictions, we think that governments would likely step in again with boosts of fiscal aid to support their national flag carriers and economies. There have also been pockets of strength in short-haul domestic air travel, in contrast with weaker transcontinental air travel that is more impacted by travel restrictions. In addition, there are signs of pent-up demand for air travel with the lifting of government restrictions. Finally, there is some country risk involving the legal details of airline default and collateral repossession, but we think that the credit enhancements and structural protections within aircraft ABS more than offset these risks.

Heavy New Supply Likely to Continue

Although the rush of new supply in 2021 has helped create some relative value in securitized credit, it is important to note that we see heavy issuance continuing and that dealer inventories in the sector are likely to remain elevated. This continuing imbalance in favor of supply over demand will probably limit potential gains from credit spread2 compression, so the opportunity is more for carry, or interest income in excess of the risk-free rate, rather than capital appreciation.

Of course, omicron or another coronavirus variant that triggers economy-wide lockdowns and causes another recession could cause selling pressure on all bonds with credit risk, including securitized credit. However, we think that most securitized credit segments could withstand this scenario and emerge relatively unscathed, as they did following the mass shutdowns in 2020.

What we’re watching next

We closely monitor various measures of consumer sentiment, both to gauge the health of the U.S. economy in general and to ascertain the outlook for the many segments of securitized credit that depend on consumer spending. High inflation has recently weighed on consumer sentiment, although consumer balance sheets remain strong.

Key Risks—The following risks are materially relevant to the discussion highlighted in this material:

Debt securities could suffer an adverse change in financial condition due to ratings downgrade or default, which may affect the value of an investment. Fixed income securities are subject to credit risk, liquidity risk, call risk, and interest rate risk. As interest rates rise, bond prices generally fall. Mortgage-backed securities are subject to credit risk, interest rate risk, prepayment risk, and extension risk.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is no guarantee or a reliable indicator of future results.. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.