December 2021 / MARKETS & ECONOMY

The Great Inflation Debate

Have we entered a new era?

Key Insights

- Inflation is elevated, but there is disagreement on its likely path and how it will impact markets.

- Central banks face a difficult choice of when to hike—too early, and they risk strangling the recovery; too late, and inflation may get out of control.

- Investors face the possibility of an investment environment marked by greater inflation, higher yields, and more market volatility.

Inflation is surging across the world, but there is no agreement on how high it will go, how long it will last, and what—if anything—needs to be done about it. While some economists believe that a “new normal” of elevated prices has arrived, others argue that inflation will likely fall back to previous levels once COVID‑era supply chain issues are resolved. Central banks have responded in different ways, with some signaling imminent interest rate rises and others likely to remain on hold for the foreseeable future. Meanwhile, investors face the daunting task of making sense of all this in order to position their portfolios for the period ahead.

Will Elevated Inflation Persist?

Six views from T. Rowe Price senior investment professionals

In a recent call, I asked six T. Rowe Price senior investment professionals to share their views on the current bout of inflation and how it might impact markets over the next few years. Their answers point to an uncertain period ahead as the global economy recovers from the coronavirus pandemic while facing the possibility that the era of low inflation, declining yields, and rising stock markets that followed the global financial crisis (GFC) may finally be over.

How Long Will Elevated Inflation Last?

The first question I asked our panel was: How long will the current high inflation last? Opinion was divided between those who believe it will be largely transitory and those who think it is more structural in nature and therefore likely to stick around. Dave Eiswert, portfolio manager in T. Rowe Price’s U.S. Equity Division, was in the former camp. “There are still lots of distortions in the global economy post‑COVID—there are shortages in goods and labor, interest rates are very low, and fiscal policies are loose,” he said. “Those distortions are going to roll off over the next few years—supply shortages will be resolved, inflationary pressures will peak and begin coming down, and interest rates will rise as inflation falls. This is a key twist in this cycle—fading pandemic inflation may lead to a normalization of interest rates, albeit at low levels.”

Rick de los Reyes, portfolio manager for T. Rowe Price’s Macro and Absolute Return Strategies, agreed that inflation will probably fall in the medium term. He said that an unexpected outcome of the coronavirus crisis has been that the “riddle” of how to generate developed world inflation has finally been solved. “For a long time, quantitative easing was taking place all over the world, and it wasn’t creating inflation,” he said. “But now we’ve found that compensating people who are not working results in higher demand, and if supply is low, this creates inflation.”

If this is true, the key question now is whether labor force participation will rise to pre‑COVID levels, de los Reyes said. “I believe it will because people will have no choice but to return to work—indeed, there is anecdotal evidence that this is already happening. And when people return to work and those supply issues begin to ease, inflation will likely fall back by the middle of next year.”

In addition to the return of labor supply, de los Reyes said he believed the absence of one‑off COVID factors will also help to bring inflation down. “Will car prices jump 27% again? Will Amazon workers get another 25% pay rise?” he asked. “Mathematically, it’s going to be very difficult for inflation not to come down next year.”

A Historical Perspective

However, Arif Husain, head of International Fixed Income, took a different view. He argued that the basic ingredients for structural inflation are in evidence more now than at any point over the past few decades. “If there is ever going to be inflation, now is the time,” he said. “Central banks are unlikely to hike aggressively because they don’t want to cause market disruption. Governments aren’t exercising fiscal discipline because there are no consequences for fiscal indiscipline. But most of all, there is simply a truckload of money held in financial assets—if there is a rotation and some of that money flows out of financial assets into the real economy in the form of capital expenditure and consumer spending, it will put significant upward pressure on prices.”

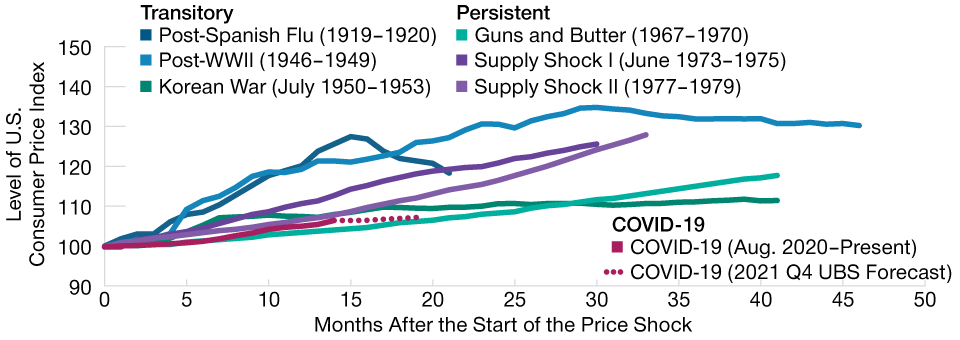

A key question is whether the post‑COVID global economy will resemble the one that preceded the pandemic or be fundamentally different. Chris Faulkner‑MacDonagh, a portfolio manager in the Multi‑Asset Division, urged a historical perspective. He said that while transitory inflation shocks usually have a single cause, persistent inflation tends to arise from a confluence of factors. “People often think the great inflation of the 1970s was caused mainly by the 1973 oil crisis,” he said. “In reality, however, used car and food prices were already rising rapidly before that. In other words, inflation gathered steam because there were a series of supply shocks, not just one (Figure 1).

Transitory Shocks Fade; Persistent Shocks Build

(Fig. 1) A brief history of U.S. inflation

As of September 1, 2021.

Actual future outcomes may differ materially from any estimates or forward-looking statements made.

Source: Haver Analytics.

The current surge in inflation is similar to that of the 1970s because it has multiple causes, Faulkner‑MacDonagh said. “Just like the 1970s, we’ve had a series of supply shocks, including used cars and energy,” he said. “By the time, these sequential supply shocks have worked their way through the system, we’ll have had 24 consecutive months of rapid price increases—and that doesn’t sound very transitory to me.”

Faulkner‑MacDonagh argued that a “huge supply mismatch” between downstream consumer inventories and upstream producer inventories will result in retailers having to undergo major inventory restocking next year. “There is going to be the mother of all scrambles for resources in 2022 as retailers will be restocking, consumers will be borrowing, the federal government will be borrowing via the fiscal deficit, and firms will be investing again as these supply chain issues are resolved,” he said. “I do think inflation will come down from current levels, but only very modestly and not very rapidly.”

Chief International Economist Nikolaj Schmidt suggested that the true path of inflation in coming years may ultimately fall between the transitory and structural views. “It’s been pretty easy for central banks to just repeat the mantra that the inflation spike is transitory,” he said. “But once the service sector recovers and the global economy begins to heat up, that argument is going to become more difficult to sustain. We’re already seeing that policymakers are uncomfortable with having ultra‑loose monetary policy while economies are recovering.”

Schmidt said he believes the world has likely entered a new era of greater inflationary pressures because the great period of deleveraging that followed the global financial crisis is over. However, he cautioned against assuming that stronger inflationary pressures would necessarily equate to structurally higher inflation. “Central banks can bring down inflation easily—they just need to hike rates and kill final demand,” he said. “To make the argument that we’re going to live with much higher structural inflation, you have to assume that the public’s tolerance for higher inflation has fundamentally changed—and I’m just not convinced that that’s the case.”

Changing the Narrative

However, even if society at large has not changed its views on inflation, central banks are well aware that they are now operating in a different environment. This, at least, was the view of Steve Bartolini, a portfolio manager in the Fixed Income Division. Bartolini said he believes that the U.S. Federal Reserve will try to “change the narrative” on inflation over the next six months. “In the post‑GFC world, we had too much supply and a deficiency of demand,” he said. “Then COVID came along and flipped that—now we have lots of demand and a deficiency of supply. This has meant that the Fed achieved its average inflation targeting goal much sooner than it expected—so the Fed’s relationship with inflation has changed.”

Bartolini said that the fact that inflation is already at target means the Fed is free to concentrate on bringing unemployment down. “The stubbornly high inflation we’re seeing now is just a complicating factor for the Fed—what they really want to do is drive down the unemployment rate to where it was pre‑COVID, and they’re going to remain dovish in order to achieve that,” he said.

“The Fed has started tapering, and that will take six to eight months. They won’t raise rates until they’ve finished tapering, so we’re probably not looking at a rate rise until the middle of next year at the earliest,” Bartolini said. However, he warned that this may change if inflation remains at a stubbornly high level. “The markets will start to challenge the Fed if inflation remains elevated—and that will be particularly true if other central banks start to blink,” he said.

The Risk of Policy Error

The delicate balance that central banks are trying to achieve has increased the risk of policy mistakes occurring. According to Arif Husain, there are two types of errors to which central banks are currently vulnerable. “Policy mistake number one would be to not raise rates and let the inflationary genie out of the bottle,” said Husain. “If that happens, the yield curve will steepen, and the currency will weaken. Policy mistake two would be to hike too much too quickly, which would kill the post‑COVID growth rebound.”

Husain said that he believes that the fear of hiking too early currently outweighs the fear of leaving too late—and that policy mistake number one was more likely. He cited the example of the Bank of Canada (BoC), whose October statement on inflation unleashed a burst of volatility in the markets because of its perceived hawkishness. In the statement, the BoC acknowledged that inflation was above target and that growth was likely to remain strong over the next three years—and suggested that it might begin raising rates “in the middle quarters” of next year. “If that was considered a hawkish response to that kind of data, then I think we’re firmly in policy mistake number one territory,” Husain said.

Steve Bartolini agreed that central banks are more likely to err on the side of dovishness than hawkishness. He suggested that the Fed rarely makes the same mistake twice in a row—but will often make new mistakes. “Typically, the Fed will learn from the mistake it made in the previous cycle, but then the economy will change and it will make a new mistake,” Bartolini said. “I think policy mistake number one is more likely because the Fed made policy mistake number two during the last cycle.”

Will Yields Spike?

I concluded our discussion by asking the panel members what they thought the U.S. Treasury 10‑year yield would be in one year’s time. As with my first question about how long inflation would remain elevated, there was a difference of opinion. Chris Faulkner‑MacDonagh, Arif Husain, and Steve Bartolini all agreed that a yield of 3% or more would be possible within a year. “There’s a lot of upward pressure on yields,” said Faulkner‑MacDonagh. “People are sitting on a huge amount of accumulated fiscal stimulus savings. At some point, it will have to be consumed or invested in financial assets—and if it goes into consumption, inflation may stay higher for longer and long‑term rates will go up. I think it can potentially get to 3% to 4% within a year.”

Husain agreed. “My view is 3%, but the direction of travel suggests it could possibly go higher than that,” he said.

“I think the conditions are in place for the 10‑year yield to go higher,” said Steve Bartolini. “If pressed, I’d say 2.5%, but if it gets to 3%, that won’t be too surprising to me.”

However, Dave Eiswert was more cautious, arguing that a yield of 2% was more likely. “Clearly, COVID has changed things, and life is likely to look very different in a year’s time—from where people work to where they go on vacation,” he said. “I think the markets have perhaps been too complacent about just how much things have changed, but I also sense that we might have reached an inflection point for that complacency. So I think a 2% yield in a year’s time is not only feasible, but the most likely outcome. I think it would would have massive implications if it went as high as 4%.”

Rick de los Reyes echoed Eiswert’s view that the yield is unlikely to go as high as 4%. “I think there’s a cap at the long end of the curve,” he said. “Long‑term rates just can’t go higher, in my view. If we got to 4%, the implications for mortgages and the economy would be huge. I think we could go to 2.5%, but I don’t think we can go much higher than that without causing some real damage and eventually inverting the curve.

Is there any chance the yield could fall? “Not in the short term because we have to go through this inflationary period,” de los Reyes said. “But I think in the longer term, we may be back on the lower track, yes.”

Nikolaj Schmidt also supported the idea that longer‑dated yields will likely remain anchored. “I think 2.5% is about right,” he said. “Much higher than that and it could be extremely disruptive and self‑defeating—it would be bad news for everybody,” he said. “Eventually, it may go higher, but I would say 2.5% is realistic for this time next year.”

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.