September 2021 / INVESTMENT INSIGHTS

Why There’s More to China than Just Big Tech

Mainstream indices are a poor reference point for investors in China

Why there’s more to China than just big tech

The growth and sheer dynamism of the Chinese economy and its stock market continue to offer the potential for attractive returns for active investors in Chinese equities. The question, therefore, becomes one of how to approach investing in China. There are a handful of huge companies which have come to dominate China and emerging market equity indices. As a result, most investors holdings in Chinese equities – be it via China, Asia or emerging market funds – tend to be concentrated in a small number of well-known companies that have already achieved ‘mega-cap’ status.

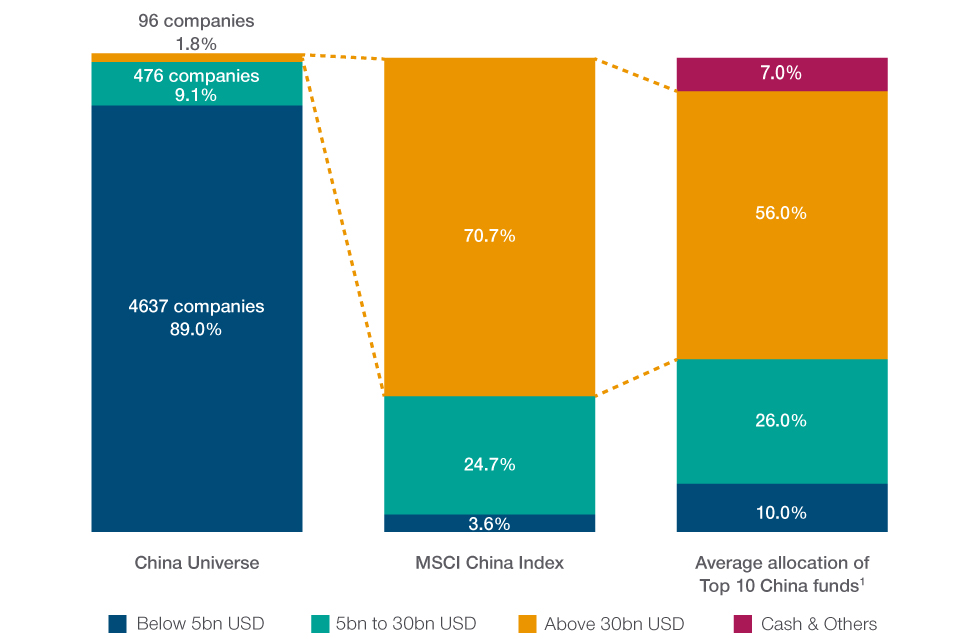

Allocation skewed towards mega-caps

Currently there are 730 Chinese companies listed in the MSCI China Index (as at 31 July 2021) – yet the investable universe comprises more than 5,500 listed stocks. In short, the index is not an accurate representation of the opportunity set. With such a large investment universe it is perhaps surprising then to note that the largest 100 stocks, by market cap, account for a staggering 71% of the MSCI China Index.

Fig. 1: Market cap breakdown by stock count

As at 31 December 2020

Sources: MSCI, HKex, FactSet, Wind, Morningstar. Financial data and analytics provider FactSet. Copyright 2021 FactSet. All Rights Reserved.

Please see Additional Disclosures page for information about this MSCI and Morningstar information.

1 The Top 10 China funds refer to the funds in the Morningstar China Equity universe, measured by AUM.

Even within dedicated China equity funds, data reveals that they tend to gravitate towards this small subset of the market. Taking an average across the largest funds in the Morningstar China funds sector, almost 60% of their assets is invested in these mega-cap names. The remaining 5,400+ companies – an incredible 98% of the investable market – are being largely ignored. While many of these mega-caps will have rewarded investors and remain sound companies, it is this overlooked section of the market where we believe many of the investable success stories of tomorrow lie.

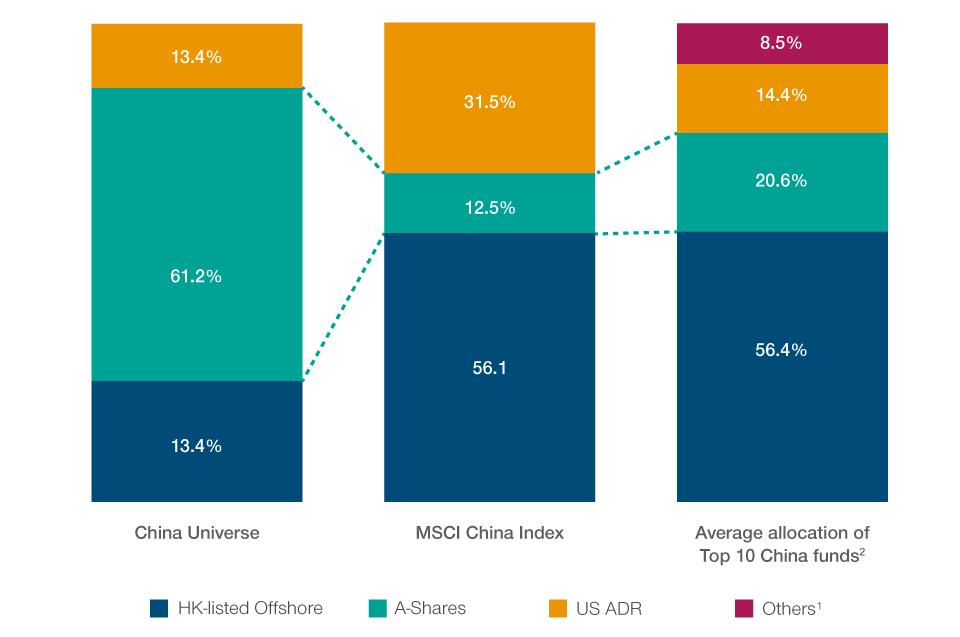

A-shares still under-represented

Chinese equities can be broadly categorised as being onshore, A-shares, or offshore, primarily H-shares (Hong Kong listed) and ADRs (American Depositary Receipts). The opportunity for active investors lies not only in the different companies listed in each of the markets but also in the different investor bases that operate in each market.

A-shares market are by far the biggest investment universe by both number of companies and market cap, yet this dynamic, fast evolving part of the market is greatly underrepresented in both the index and many China funds; H-shares continue to dominate even though they now make up just 25% of listed Chinese equities by market cap. On the other hand, A-shares make up over 60% of Chinese equity markets but represent just 12.5% of the MSCI China Index, and only 20.6% of the average top 10 holdings in dedicated China funds (see Fig. 2).

Fig. 2: China universe share type breakdown (US$11.4 trillion)

As at 31 December 2020

Sources: MSCI, Goldman Sachs, Morningstar. Please see Additional Disclosures page for information about this MSCI and Morningstar information.

1 Top 10 AUM fund holdings outside of China Universe, non-China stocks, derivatives and cash.

2 The Top 10 China funds refer to the funds in the Morningstar China Equity universe, measured by AUM.

This underrepresentation is important, not only because of the broad range of investable opportunities A-shares have to offer, but also because the A-share market remains highly inefficient given its retail-driven investor base. It is a high liquid, high velocity market, with local retail investors accounting for over 80% of market turnover and an average holding period of just 17 days (source: Goldman Sachs Global Investment Research).

Furthermore, a lack of sell-side coverage outside of a handful of A-share companies serves only to exacerbate these inefficiencies and creates mispricing opportunities. Coverage of A-share companies with a sizeable market capitalisation of between US$5-US$30 billion are covered, on average, by five analysts. For companies with a market cap below US$5 billion, the average falls to just one. As such, we believe the A-share market presents an attractive opportunity set for skilled fundamental, active investors to invest in potentially mispriced assets (source: Financial data and analytics provider FactSet. Copyright 2021 FactSet. All Rights Reserved.).

That said, it’s not just about A-shares either. We encourage investors to take a truly holistic approach to the China universe to be able to identify the best opportunities across the entire on-shore/off-shore universe thereby maximising both diversification and alpha generation.

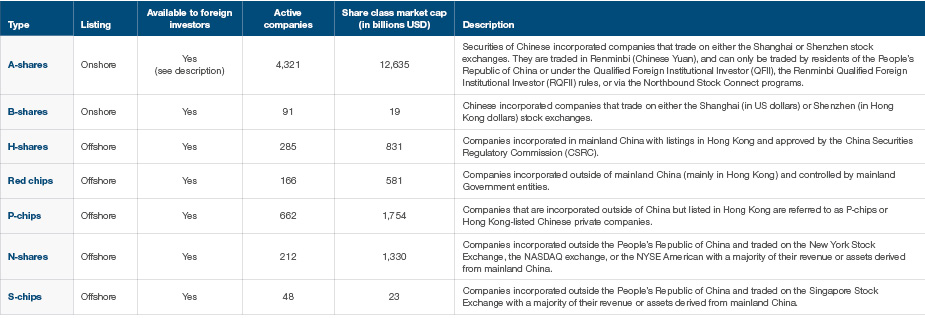

Capital market reforms have expanded the investable universe

A decade ago, the ability to invest in local markets for foreign investors was still highly restrictive, with access via a largely complex and limited quota system, referred to as QF-II. In recent years, however, reforms led by the Chinese government aimed at opening up their markets to overseas capital, resulted in the launch of the Stock Connect program in 2014. This facility connects the onshore (Shanghai) and offshore (Hong Kong) stock markets, enabling foreign investors to access local shares and local Chinese investors access to offshore markets. This instantly expanded the investable universe for foreign investors and the correlation of the China A-shares market with global indices has increased markedly since 2015 as a result. This rise in correlation means it has become more important for investors seeking diversification to explore less crowded opportunities outside of the well-owned mega-caps.

The scale of the opportunity and the ability today to invest across both onshore and offshore markets provides global investors with the potential to invest in future winners today before they reach mega-cap status. And yet, investors who are led by mainstream indices in the size and make-up of their China equity allocation could be missing out. Chinese equities are both under-represented and under-explored in most investors’ portfolios, with many exposed merely to a handful of the largest and most owned companies. Indeed, for the majority, they will likely already have exposure to these names through existing global emerging or Asia portfolios. While many of these mega-caps will have rewarded investors and remain sound companies, it is the overlooked and highly inefficient part of the market outside of that narrow subset that, in our view, warrants a deeper look and presents attractive potential for outsized alpha generation. As such, we believe it presents an abundant opportunity for the curious investor willing to go beyond the obvious.

Fig. 3: A summary of the main China share types available

Sources: Financial data and analytics provider FactSet. Copyright 2021 FactSet. All Rights Reserved.; Wind; Bloomberg; Goldman Sachs Investment Research.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

September 2021 / U.S. FIXED INCOME