October 2021 / FIXED INCOME

Serbia and the mystery of the 747s

Adventures in sovereign research

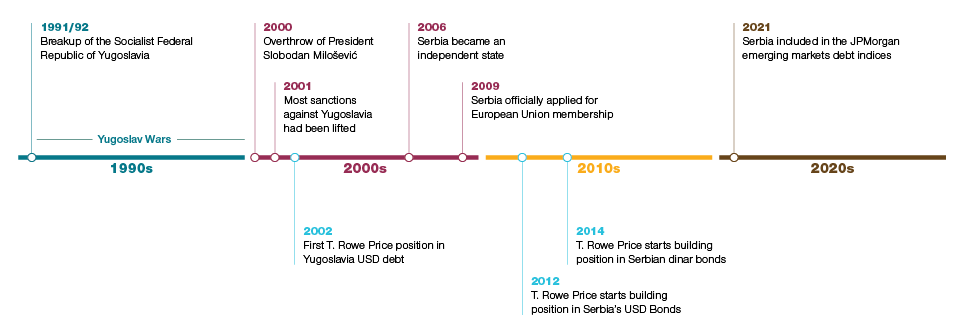

In 50 years of fixed income investing, we have had the benefit of watching new markets grow from infancy, exploiting deep-value early-stage growth opportunities and letting our best investment ideas run – sometimes for years at a time. Our early coverage of Serbia, which entered the JPMorgan emerging markets debt indices this year, is a good example.

In October 2012, sovereign analyst Peter Botoucharov took his customary route to Belgrade, embarking in London and changing in Vienna. As the Antonov propeller plane bounced through the cloud cover and clunked onto the runway, Peter noticed two gleaming 747s – not something you saw every day at Nicola Tesla Airport. Recognizing the livery of the Turkish and Abu Dhabi governments, he made a mental note to find out more from his contacts at the Ministry of Finance.

This was not the start of T. Rowe Price’s relationship with Serbia (more on that later) but it marked the point at which we started becoming one of the largest holders of its US dollar debt. At the time, with the 2021-maturity dollar bonds yielding close to 9%, Serbia was showing signs of being an attractive early-stage recovery story. The purpose of this field trip was to confirm the investment case.

Although Serbia was still poor, it had made significant progress in the decade since the end of the Yugoslav wars and the lifting of sanctions. It was the most industrialized of the former Yugoslav countries and had productive agricultural land. Unlike peers such as Slovenia and Belarus – which had been quick to affiliate closely with the European Union and Russia respectively – Serbia was largely unaligned. So, for foreign powers, the race was now on to form trade relationships.

Finance ministry contacts confirmed that there were two high-level delegations in town. President Erdogan’s team were exploring investments including real estate and productive capacity. The Abu Dhabi delegation were looking at two opportunities. One was a roughly US$2 billion long-term investment in agricultural land, notably to produce camel feed. The second related to Belgrade’s attractive location between the Danube and Sava rivers, which had made it a hub for heavy industry. The Abu Dhabi government saw past the grimy socialist-era factories and goods train depots to the potential of a Belgrade Waterfront.

Two 747s may not have been the only data point in the recommendation that Peter took back to London, but they were certainly a sign of things to come. Foreign direct investment in Serbia would go on to double between 2014 and 2020.

In it for the long haul

We had been covering Serbia for a decade before Peter’s trip: in 2002 we had initiated a US dollar denominated position in the then Yugoslavia. (These were London Club loans issued as part of a workout of the country’s foreign debt to commercial creditors.) We held the position until the debt was redeemed in 2018. Today, T. Rowe Price remains one of the largest investors in Serbia, and we have diversified. As the market evolved, in 2014 we started building up our position in the local currency bonds.

Looking ahead

Today, we remain confident in Serbia’s macroeconomic stability and long-term structural transformation of the economy. Over the years we’ve watched its credit rating climb from a highly speculative single B, to BB+, on the edge of investment grade. If it continues on its current trajectory, it should be on track for European Union membership in 5 to 7 years. It’s also worth noting that Serbia is the third of the central and Eastern European countries (after the much larger Poland and Hungary) to develop a well-structured green bond framework, issuing its first green bonds this year.

The downside of Serbia’s success story is that sovereign yields have become less attractive: dinar-denominated 10-year bond yields fell from around 12% to 2%-3% between 2014 and 2021. But while that early-stage growth opportunity has been harvested, there will be further opportunities, for example in equities and corporate bonds. The most recent joint visit of the Fixed Income and Equity teams led to increased investments in regional banking groups (notably OTP and NLB) with increasing exposure to Serbia’s economy.

Risks - The following risks are materially relevant to the portfolio:

- Contingent convertible bond risk - contingent convertible bonds have similar characteristics to convertible bonds with the main exception that their conversion is subject to predetermined conditions referred to as trigger events usually set to capital ratio and which vary from one issue to the other.

- Country risk (Russia and Ukraine) - in these countries, risks associated with custody, counterparties and market volatility are higher than in developed countries.

- Credit risk - a bond or money market security could lose value if the issuer’s financial health deteriorates.

- Currency risk - changes in currency exchange rates could reduce investment gains or increase investment losses.

- Default risk - the issuers of certain bonds could become unable to make payments on their bonds.

- Derivatives risk - derivatives may result in losses that are significantly greater than the cost of the derivative.

- Emerging markets risk - emerging markets are less established than developed markets and therefore involve higher risks.

- Frontier markets risk - small market nations that are at an earlier stage of economic and political development relative to more mature emerging markets typically have limited investability and liquidity.

- High yield bond risk - a bond or debt security rated below BBB- by Standard & Poor’s or an equivalent rating, also termed ‘below investment grade’, is generally subject to higher yields but to greater risks too.

- Interest rate risk - when interest rates rise, bond values generally fall. This risk is generally greater the longer the maturity of a bond investment and the higher its credit quality.

- Liquidity risk - any security could become hard to value or to sell at a desired time and price.

- Sector concentration risk - the performance of a portfolio that invests a large portion of its assets in a particular economic sector (or, for bond portfolios, a particular market segment), will be more strongly affected by events affecting that sector or segment of the fixed income market.

General Portfolio Risks

- Capital risk - the value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

- Counterparty risk - an entity with which the portfolio transacts may not meet its obligations to the portfolio.

- ESG and sustainability risk - ESG and sustainability risk may result in a material negative impact on the value of an investment and the performance of the portfolio.

- Geographic concentration risk - to the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

- Hedging risk - a portfolio's attempts to reduce or eliminate certain risks through hedging may not work as intended.

- Investment portfolio risk - investing in portfolios involves certain risks an investor would not face if investing in markets directly.

- Management risk - the investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although in such cases, all portfolios will be dealt with equitably).

- Operational risk - operational failures could lead to disruptions of portfolio operations or financial losses.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

October 2021 / INVESTMENT INSIGHTS