September 2021 / INVESTMENT INSIGHTS

China – Too Big to Ignore?

China’s development is recognised as one of the most important shifts in the global economy

Over the past decade, China has undergone unprecedented change, including an evolving economic model, increased affluence, innovative entrepreneurialism, industrial upgrades, and a shifting geopolitical outlook from an export-driven manufacturing country to a more domestic, consumer-led economy that is innovating. China’s development is recognised as one of the most important shifts in the global economy. Yet, with China’s economic power meaningfully underrepresented in global indices, many investors appear to underappreciate the full opportunity China offers.

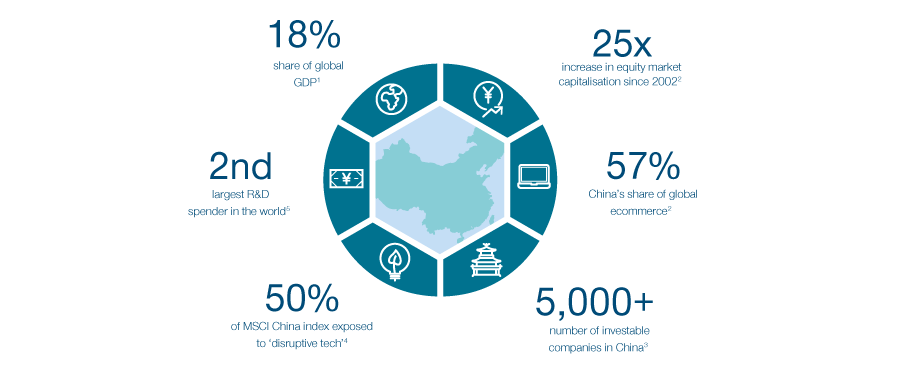

Fig 1: China offers a compelling opportunity set

Sources: 1 CEBR, December 2020. 2 UBS, IMF, March 2021. 3 Goldman Sachs, March 31, 2021. 4 FactSet; T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved. ‘Disruptive Tech’ is defined as the Information Technology sector, the Internet & Direct Marketing Retail industry within the Consumer Discretionary sector, and the Media & Entertainment industry group within the Communication Services sector. 5 OECD,2020.

Global indices are underweight China

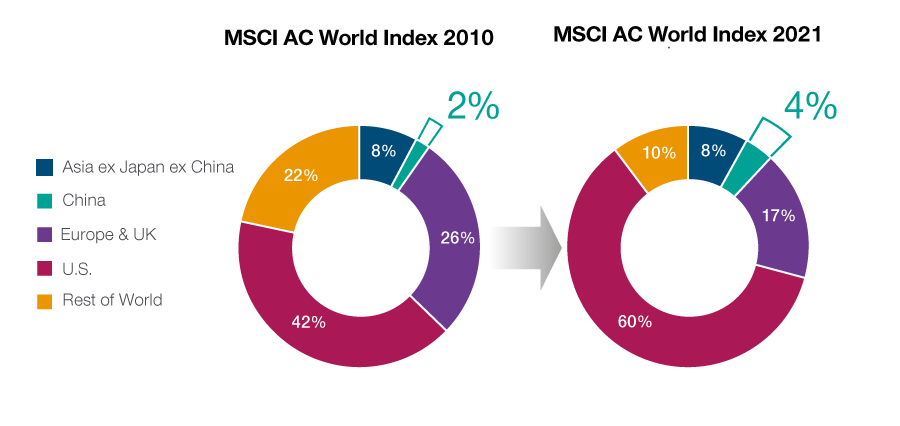

Whilst China’s share of global gross domestic product (GDP) has almost doubled over the past decade from 9% in 2010 to 17.8% in 2020, its expansion has not been matched in global equity indices. China exposure in the MSCI AC World Index expanded from 2% to just over 4% during the same period.

Fig 2: China remains underrepresented in global benchmarks

Past performance is not a reliable indicator of future performance.

Sources: Financial data and analytics provider FactSet. Copyright 2021 FactSet. All Rights Reserved. MSCI, as at 30 July 2021. Please see Additional Disclosure for information on this MSCI data.

China’s rapid market expansion

China’s underrepresentation in global indices belies the fact that it has arguably become the most dynamic equity market in the world, offering more than 5,000 investable companies listed onshore and offshore. Indeed, China’s equity market capitalisation has increased by 25 times since 2002 and it is now the second largest stock market globally, by market cap.

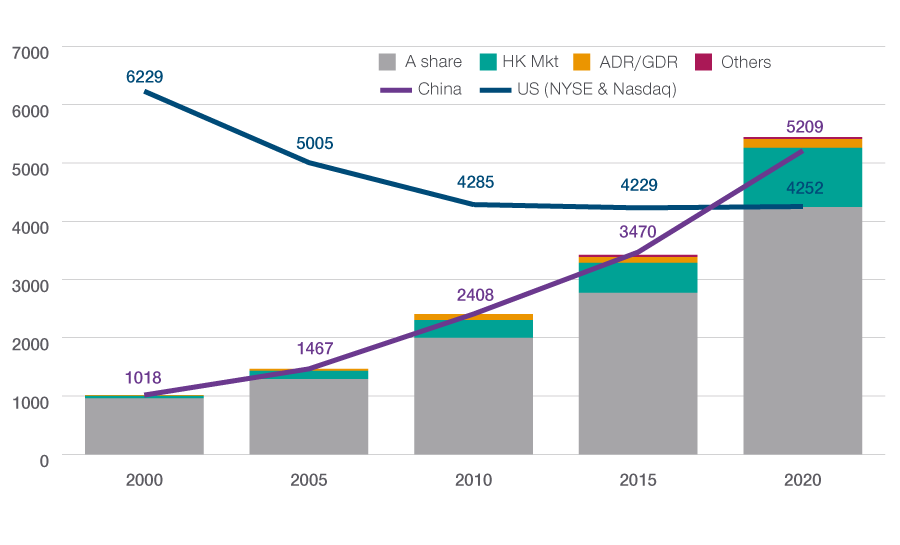

Fig 3: Number of common stocks, 2000-2020

Source: Financial data and analytics provider FactSet. Copyright 2021 FactSet. All Rights Reserved.

China total represents all listed stock. Dual listed ADR/GDR excluded to avoid double counting.

A closer look at the China growth story reveals an even more striking representation of the expanding market. According to data from Bloomberg, initial public offerings (IPOs) in the Asia ex Japan region far exceeded those in other emerging market regions by a factor of almost 10 to one from 2015 to 2020. IPOs in China specifically made up almost one‑third of newly listed equities in the region as a whole, with a total of 1,442.

Furthermore, the number of IPOs in China now exceeds those seen in the US. In the last 10 years the number of investable stocks in Chinese companies has risen by 46%, while for the US it has remained largely unchanged.

A market characterised by innovation and disruption

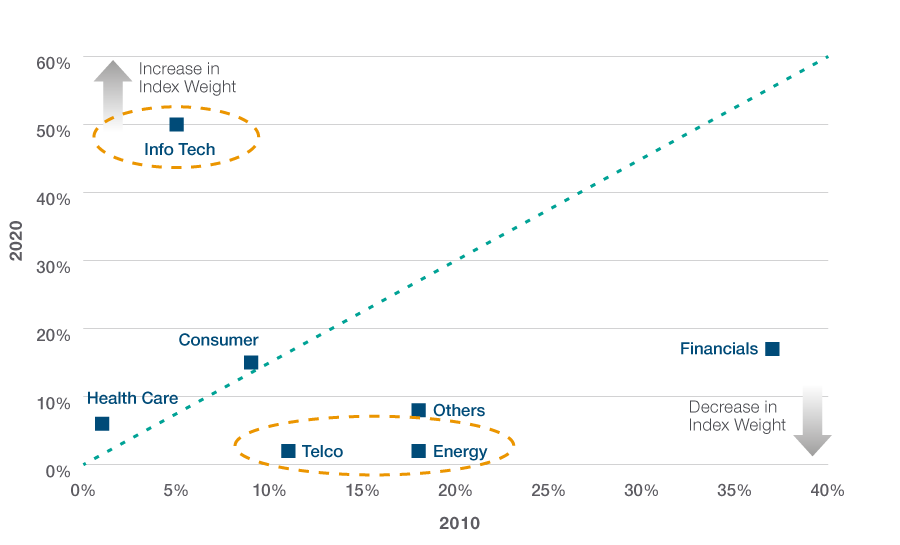

Crucially, this growth in listed Chinese equities has occurred across a range of innovative sectors. Sectors which used to dominate Chinese equities 10 years ago, such as energy and telcos, have today shrunk to relatively small weights, with market breadth being increasingly driven by growth industries such as technology, industrial automation, healthcare and other consumer-led sectors. Innovation and disruption are not just the preserve of the US, providing an abundant source of opportunity for investors seeking exposure to these trends.

Fig 4: MSCI China sector breakdown, 2010-2020

“Disruptive Technology” is defined as the information technology sector, the internet and direct marketing retail industry within the consumer discretionary sector, and the media and entertainment industry group within the communication services sector.Consumer: Consumer Staples and Consumer Discretionary ex Media & Entertainment, and Internet & Direct Marketing Retail.Financials: Financials, Real Estate.Others: Industrials, Utilities, and Communication Services.T. Rowe Price uses the MSCI/S&P Global Industry Classification Standard (GICS) for sector and industry reporting. T. Rowe Price will adhere to all future updates to GICS for prospective reporting.Please see Additional Disclosures for information about this MSCI and Global Industry Classification Standard (GICS) information.

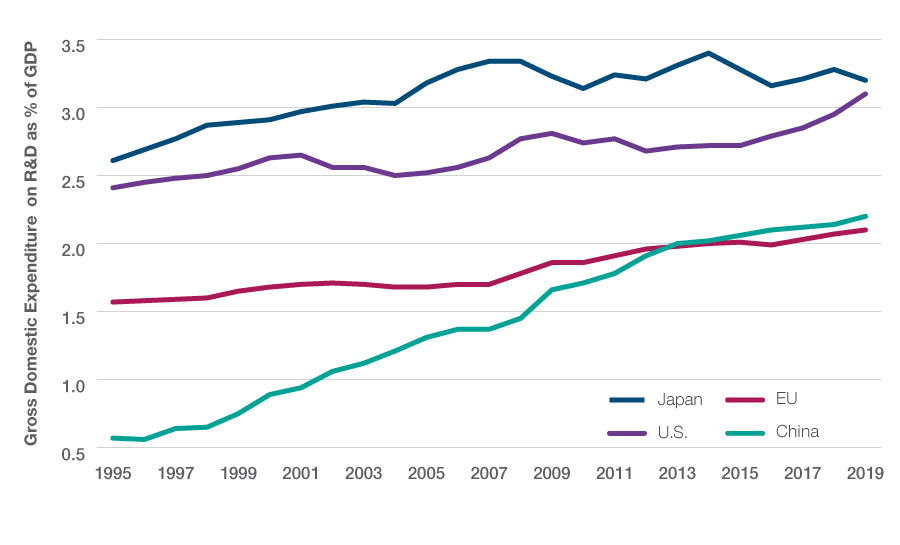

R&D spend driving continued growth

Investment in research and development (R&D) is the lifeblood of many private sector organisations and helps bring new products and services to market. It’s also important to national economies and plays a crucial role in GDP growth. According to data released from China’s National Bureau of Statistics, China’s spend on R&D climbed 10.3% to 2.44 trillion Chinese yuan (US$378 billion) in 2020. This accounted for 2.4% of China’s GDP, a new record, and it is a priority of China’s dual circulation strategy that focuses on higher value-added domestic growth while at the same time preserving China’s global competitiveness.

Fig 5: R&D expenditure as % of national GDP

As at 31 December 2019

Source: OECD, China National Bureau of Statistics. Latest data available.

The world’s largest eCommerce market

Today, China is the world’s largest eCommerce market with a 57% share of global eCommerce transactions (source: UBS, IMF, March 2021). According to a report by Dezan Shira & Associates, it is predicted that China’s eCommerce market will be larger than the US, UK, Japan, Germany and France combined by the end of 2021. Home to more than 710 million digital buyers, in 2019 China’s online retail transactions reached US$1.93 trillion and are forecast to reach US$4.09 trillion by 2023.

These exciting macroeconomic and market dynamics are set to continue. China’s economy has enjoyed a V‑shaped recovery from the coronavirus‑induced shock in the first quarter of 2020. Successful containment of the virus has enabled manufacturing to bounce back strongly, followed by a recovery in the services sector. Meanwhile, Chinese policymakers continue to support innovation and rebalancing toward domestic consumption as core components of the nation’s future economic strategy.

However, gaining exposure to China by simply aligning to global indices means investors risk missing out on much of the potential that this broad engine of global growth represents. While investors might be familiar with some of the big-name Chinese companies that have captured global headlines in sectors such as technology and communications, those willing to go deeper into Chinese markets have the potential to discover the lesser-known stock stories that are poised to be the winners of tomorrow – those with the potential to compound over time and generate real value when held over the long term. Investing in the status quo is simply not an option in this fast-evolving opportunity set.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

September 2021 / MARKETS & ECONOMY