February 2023 / ASSET ALLOCATION STRATEGY

Asset Allocation Beyond Diversification

Insights from the Multi-Asset engine room

Key Insights

- In response to a major structural shift to higher inflation, investors may wish to re-think portfolio construction from a strategic or long-term perspective.

- Even investors who do not formulate expected returns as a precise number must still make implicit forecasts when they allocate assets.

- Future long-term returns may be less than in the past. In response, we extend the 60/40 model portfolio, improving diversification by adding more asset classes.

Our Global Multi-Asset team has received a growing number of requests from clients to talk about our views on strategic asset allocation (SAA), as opposed to the usual market outlook discussions popular at this time of year. A growing number of clients are rethinking portfolio construction given the paradigm shift from an environment of low interest rates and inflation to one of rising rates and higher inflation.

At a recent online event for Asian institutional clients, I spoke on this important topic. How does T. Rowe Price’s Global Multi-Asset team allocate portfolios across its USD 400 billion franchise1 when the world is experiencing an abrupt paradigm shift from three decades of declining interest rates to a prolonged period of higher rates? In response to such a major structural shift, we believe that investors need to rethink portfolio construction from a strategic or long-term perspective.2

In today’s tough markets, the initial response of investors might be to increase the time and resources spent on developing their short-term market views and projections. This is understandable. However, the long-term asset allocation implications of the shift to higher rates arguably matters more. There is considerable empirical evidence to suggest that strategic asset allocations can drive long-term returns and risks more than any other investment decision.

Long-Term Returns and Valuations

Strategic asset allocation usually begins with assumptions for the long-term returns to stocks and bonds. While forecasting asset returns is always difficult, it is possible to arrive at some working assumptions that have proved to be useful in practice.

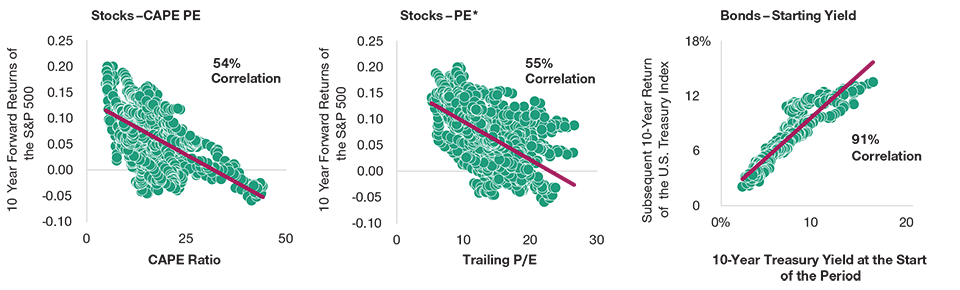

Turning to Figure 1, the chart on the left shows the relationship between the Shiller cyclically adjusted price earnings (or CAPE) ratio and subsequent 10-year equity returns. The CAPE is simply the ratio of the S&P 500 Index’s price to trailing 10-year earnings, adjusted for inflation, which smooths the earnings cycle. The correlation is 54%, which is not bad for this type of relationship. It tells us that what you pay for stocks, in terms of multiple of earnings, matters a lot for subsequent long-term returns. When markets are expensive, subsequent returns tend to be lower, as evidenced by the downward slope of the regression line. And vice versa when markets are cheap.

The middle panel of Figure 1 shows an alternative comparison between equity returns and valuations using the current trailing 12-month earnings yield (the inverse of the PE ratio), sometimes referred to as the “Siegel” model. The fit is different, but also quite good. Interestingly, the correlation is about the same, which suggests that there is nothing particularly magical about the CAPE approach. The first two panels of Figure 1 simply tell us that if you have a long investment horizon, then you should pay attention to starting valuation levels. Buy low; sell high!

Turning to bonds, the right-hand panel of Figure 1 plots the starting or opening yield of a 10-year U.S. Treasury against the long-term return from holding the bond to maturity. In this case, the fit is remarkable, with a correlation of 91%. The starting yield of a long-term government bond is a good predictor of the subsequent return for a bond held to maturity. Besides return predictability, there is an important takeaway if you are a long-term investor, such as in a pension or insurance fund. Rising rates are good news for long-term bond investors, because when yields rise, the long-term expected return on their bonds held to maturity increases.

Valuations and Future Stock and Bond Returns

(Fig. 1) Starting valuations and subsequent 10-year returns

Past performance is not a reliable indicator of future performance.

*Trailing earnings replaced with 12-month forward earnings in January 1990.

Equities (left and middle panels) are for the period of January 1881 through March 2021. Figures calculated in U.S. dollars.

Source: Robert Shiller data set, eon.yale.edu/~shiller/data.html. Bonds (right panel) are for the period of January 31, 1973, through December 31, 2010. Figures calculated in U.S. dollars. Source: Bloomberg Finance L.P.

Download full report (PDF).

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

February 2023 / MARKETS & ECONOMY

February 2023 / INVESTMENT INSIGHTS