June 2022 / MARKET OUTLOOK

In a More Uncertain Environment, Focus on Fundamentals

Maintaining perspective on long-term opportunities

Key insights

- The global rotation into more value‑oriented equity market sectors over the past 18 months has been particularly pronounced in Japan.

- The value rotation has worked against our focus on bottom‑up fundamentals of those companies demonstrating secular growth and transformation.

- The broad market outlook in Japan remains positive, in our view, with various long‑term, secular investment themes expected to continue to underpin returns.

The global trend of rapid, post‑pandemic growth, inflation, and rising interest rates over the past 18 months has had a tangible impact on equity markets, specifically driving a sharp rotation into more value‑oriented sectors. This has been particularly apparent in Japan, where the shift away from growth and into value has been among the most pronounced of any major global equity market. This trend has worked against our focus on bottom‑up fundamentals of those companies demonstrating secular growth and transformation.

However, we have full conviction that our active, research‑driven process can continue to add value in Japan over a longer‑term investment horizon. Moreover, we expect the Japanese market to be supported by policy stimulus, relatively subdued inflation, ongoing digital transformation/increasing productivity, and improving return on equity (ROE) trends.

Focus on Fundamentals

Our investment philosophy is underpinned by the belief that long‑term growth in company earnings and cash flow creates shareholder value. Accordingly, we seek to deliver long‑term performance for investors, typically over a three‑ to five‑year time horizon, within the under‑researched Japanese equity market. We do this by identifying and investing in companies that we believe exhibit sustainable growth and business improvement and a positive environmental, social, and governance (ESG) profile and by actively investing across the full capitalization range.

Importantly, we have not made any changes to our philosophy over the past year, despite the recent period of relative underperformance. We continue to do what we have always done: actively invest in individual companies with positive fundamentals that we believe offer appealing, long‑term growth potential.

Five Factors Underpinning Japanese Equities

Recent volatility does not alter Japan’s long‑term outlook

1. Stable Politics With Stimulus Support

At a broad market level, we continue to believe that the outlook for Japanese equities remains favorable. The post‑pandemic recovery in the global economy is supportive of Japan’s cyclical, export‑oriented industries, while the reopening of the domestic economy should also receive a further boost from the government’s record JPY 56 trillion (USD 490 billion) fiscal stimulus package, the first major policy announcement from new Prime Minister (PM) Fumio Kishida.1

After the recent leadership change and the general election, Japan now faces an expected period of political calm. Signs point to policy continuity under new PM Kishida, while the prospect of further economic stimulus has also been welcomed by investors.

2. Long‑term, Secular Themes

While it is difficult to speculate on how long the current rotation into more value‑oriented sectors in Japan might last, we believe that the long‑term, secular investment themes that we have identified will continue to play out, which should underpin the performance of many of the quality companies in which we are invested. What’s more, valuations of many of these companies have fallen over the past 18 months to levels that now look particularly appealing, in our view.

In the near term, recession risks in the U.S. have increased, which has knock‑on implications for Japan, so it is prudent to reduce some cyclical risk exposure. To this end, we are reducing some of our industrial holdings in favor of more defensively oriented pharmaceutical and telecom holdings.

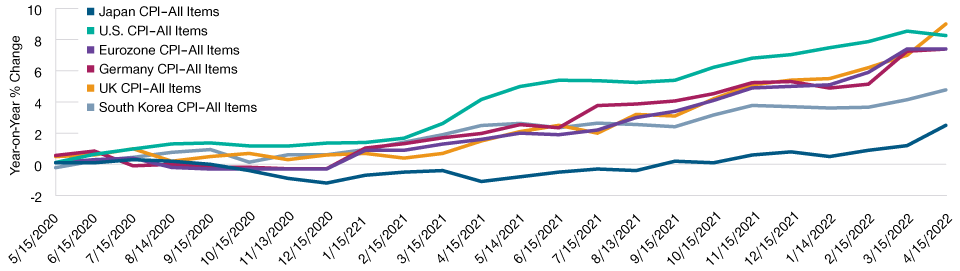

Japanese Inflation Likely to Be More Subdued

(Fig. 1) Comparative major market annual inflation rates

As of April 15, 2022.

CPI = consumer price index.

Source: Refinitiv Datastream © 2022 Refinitiv. All rights reserved. Analysis by T. Rowe Price.

3. Japan’s Digital Transformation Continues Apace

The onset of the pandemic shone a spotlight on Japan as lagging other major markets in terms of its technological advancement and efficiency in some areas of the economy. More positively, however, this has created a sense of urgency around government plans to invest heavily in upgrading and advancing Japan’s lagging information technology (IT) infrastructure and capabilities.

Digital reform is the government’s top policy objective, seen as crucial to the modernization of Japanese business and industry, and to closing the technology gap that exists with other major global market economies. To this end, a dedicated Digital Agency government portfolio was established in September 2021, tasked with, among other things, reforming the culture of over‑administration and improving business efficiency through digitalization. The agency is being resourced from the private sector, rather than being run by government bureaucrats, which is a positive change from the past.

We believe that this initiative will have a halo effect, accelerating the pace of digital transformation and creating ample, multiyear investment opportunities. For example, the government’s ability to effectively manage the coronavirus health crisis was decidedly hampered by outdated and cumbersome IT infrastructure and myriad non‑compatible local government administration systems. As such, many health care industry companies stand to benefit directly from the government’s digital reform agenda.

4. Prioritizing Improved Productivity

The Japanese workforce, at large, was also caught unprepared in terms of its ability to transition to a new home‑based working environment during the pandemic. The sudden necessity to work from home brought on by the coronavirus once again highlighted the inadequate nature of Japan’s technology capabilities.

More broadly, Japan’s workforce is shrinking, meaning economic growth will need to come from greater productivity going forward. This should be significantly enabled by more extensive application of digital technology and by adopting more flexible and efficient work practices. Deeply ingrained, traditional work practices continue to impact corporate performance, so efforts to create a more productive, efficient work environment are likely to be rewarded over the long term. To this end, we have identified several specialist recruitment and short‑term staffing companies as potential beneficiaries of this secular productivity trend.

5. Progressive ESG Credentials

The focus on higher ESG standards in Japan has become a powerful market trend and one that is not subject to any economic environment or cycle. Government efforts, particularly via its mammoth Government Pension Investment Fund (only allowing investments with strong ESG characteristics), have resulted in a greater market awareness about corporate stewardship and responsibility. This positive shift is growing more prominent in Japan, which further underscores our focus on investing in quality companies that are progressive in their approach to sustainability.

Return on Equity Expected to Improve

Importantly, the pandemic has not derailed Japan from its path of improving corporate governance. This is driving a significant improvement in capital allocation, which has the potential to be a powerful driver of stock prices over the next stage of the economic cycle.

Japanese companies are slated to repurchase over USD 32 billion worth of shares this fiscal year—double the amount from last year and the largest buyback in 16 years. We expect Japanese companies to resume their strong focus on buybacks over the coming quarters, which is crucial in attracting greater international investment. ROE in Japan declined during the pandemic, but with Japanese company earnings highly geared to the global economy, we believe that we will again see improvement in this metric over the coming quarters.

A True Active Management Opportunity

The reopening of the Japanese domestic economy is expected to support the stock market, while added stimulus measures under new political leadership could provide a further substantial tailwind. Improved governance standards and a growing focus on sustainability also contribute to our positive long‑term outlook. As we enter the next stage of the equity cycle amid a broadening global economic recovery, we believe that Japan is a compelling active management case, particularly as the market remains under‑researched and under‑owned and continues to display positive change dynamics.

Risks—The following risks are materially relevant to the strategy:

Currency—Currency exchange rate movements could reduce investment gains or increase investment losses.

Liquidity—Liquidity risk may result in securities becoming hard to value or trade within a desired time frame at a fair price.

Small‑ and mid‑cap—Small and mid‑size company stock prices can be more volatile than stock prices of larger companies.

Style—Style risk may impact performance as different investment styles go into and out of favor depending on market conditions and investor sentiment.

General Portfolio Risks

Equity—Equities can lose value rapidly for a variety of reasons and can remain at low prices indefinitely.

ESG and sustainability—ESG and sustainability risk may result in a material negative impact on the value of an investment and performance of the portfolio.

Geographic concentration—Geographic concentration risk may result in performance being more strongly affected by any social, political, economic, environmental, or market conditions affecting those countries or regions in which the portfolio’s assets are concentrated.

Hedging—Hedging measures involve costs and may work imperfectly, may not be feasible at times, or may fail completely.

Investment portfolio—Investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management—Management risk may result in potential conflicts of interest relating to the obligations of the investment manager.

Market—Market risk may subject the portfolio to losses caused by unexpected changes in a wide variety of factors.

Operational—Operational risk may cause losses as a result of incidents caused by people, systems, and/or processes.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.