June 2022 / INVESTMENT INSIGHTS

Analyzing the Case for Asia Credit Bonds

An attractive combination of risk and return

Key Insights

- We view Asia credit bonds as a relatively new asset class with sound long-term prospects predicated on strong regional economic growth.

- Asian corporate bonds generally have held up well relative to their developed market peers in periods of global market volatility and widening investment-grade credit spreads.

- Many of our Asian credit exposures are from countries that have investment-grade credit ratings and stable or positive ratings trajectories in recent years.

Here we consider some of the key features of Asia credit bonds, defining the asset class as the universe of U.S. dollar or other hard currency denominated bonds of Asian issuers, both corporate and sovereign, but excluding Japan. We view Asia credit bonds as an exciting, relatively new asset class with sound long-term prospects predicated on strong regional economic growth. An allocation to Asian credit can act as a diversifier within global fixed income portfolios. When compared with regional equities, the corporate segment can also be thought of as providing a more defensive way for investors to access Asia’s high economic growth potential.

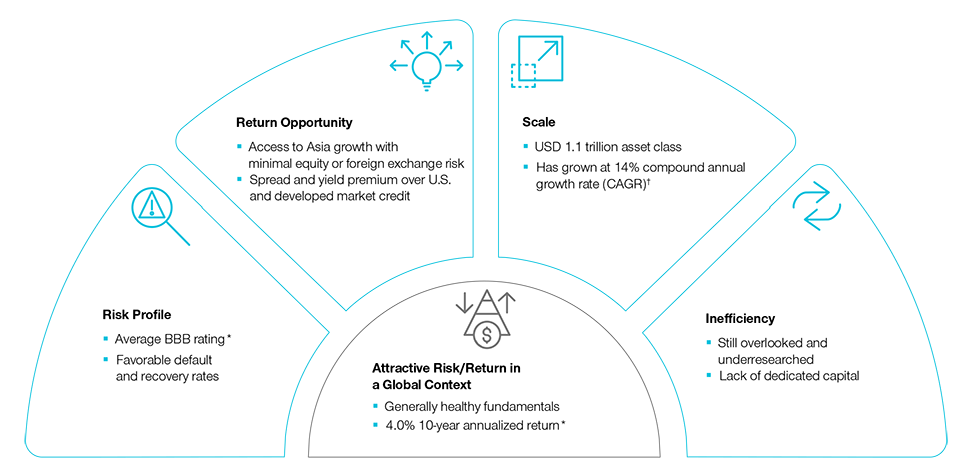

Advantages of Asia Credit Bonds

Scale: The first advantage of Asia credit bonds is that they possess significant scale, having grown into a universe that is too big for global bond investors to ignore. Today, the Asia credit bond market consists of around USD 1.1 trillion of outstanding bonds.1 In terms of size, this is roughly comparable to some of the more mainstream global fixed income sectors. For example, the U.S. high yield market—a segment often thought of as mainstream—is only a little larger, with some USD 1.5 trillion of bonds outstanding.1

The Asia credit opportunity today is broadly comparable in terms of magnitude to that offered by U.S. high yield. Importantly, we have reached today’s scale via healthy growth in the volumes of Asia credit over the past decade, where annual growth has averaged 14%.2 So this is a fixed income market that has experienced significant growth over time. This has led to a corresponding increase in the breadth and depth of the opportunities available to investors in Asia credit bonds.

Return Potential: The second key advantage of Asia credit bonds concerns prospective returns. Currently, global investors receive a yield pickup that looks quite attractive versus U.S. and devoped credit markets, and also versus global aggregate benchmarks. The average yield to maturity for Asia credit bonds ( J.P. Morgan Asia Credit Index Diversified) is 4.8%, offering a spread of around 265 basis points over the corresponding yield on global bonds.3 At the same time, we view investors as gaining access to a region where there is still good long-run growth potential that over time can translate into improving credit profiles and lower spreads.

Making the Case for Asia Credit Bonds

(Fig. 1) Key drivers of Asia credit investing

Past performance is not a reliable indicator of future performance.

As of March 31, 2022.

*Average credit rating and 10-year return are for the J.P. Morgan Asia Credit Index Diversified, as of March 31, 2022.

† Refers to the market capitalization of the J.P. Morgan Asia Credit Index Diversified, 10-years as of March 31, 2022.

Source: J.P. Morgan. Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2022, J.P. Morgan Chase & Co. All rights reserved.

Risk: The third factor supporting Asia credit bonds concerns the risk profile. Out of the emerging market fixed income universe, our analysts characterize Asia credit as belonging to the higher-quality segment. The ratings profile is one feature that shows this higher-quality bias. Asia credit bonds have an average investment-grade (IG) rating, and almost 80% of the bonds in the universe are rated investment grade.4

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.