April 2022 / INVESTMENT INSIGHTS

Active Stock Choices Are Key in Volatile Times

Steering through complex dynamics within global equities

Key Insights

- We are using our experience and learning to separate the long‑term prospects of stocks from the short‑term narratives that are causing volatility in equity markets.

- Inflation and rising interest rates have seen marked underperformance for growth stocks. However, the power of companies that can deliver superior long‑term earnings and cash flows should not be underestimated.

- Geopolitical and macroeconomic uncertainty will remain part of the near‑term environment, but long‑term stock prices are ultimately driven by changes in earnings power and cash flow generation.

Markets have endured a tumultuous period over the last two years with an extraordinary period encompassing a pandemic, economic recovery, and now, military conflict in Europe. Stocks remain especially volatile given the shocking events occurring in Ukraine, adding uncertainty to an already complex backdrop of rising inflation and monetary tightening.

While the geopolitical and economic backdrop is dominating market movements, we have managed client assets through periods of uncertainty before. We are using our experience and learning to focus on separating the long‑term economic prospects of stocks from the short‑term narratives surrounding equities in a highly unusual period. We have always believed, and continue to believe, that fundamental analysis and maintaining our time horizon will deliver the best outcome for our clients.

Regime Shifts and the Growth Versus Value Debate

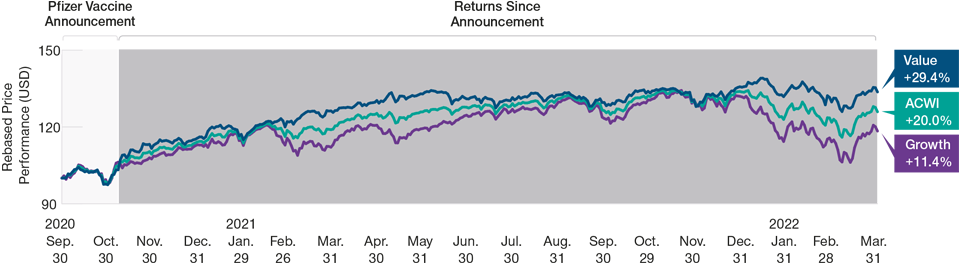

At a headline level, we believe 2022 marks a point of regime change for investors. A marked uptick in inflation and rising interest rates have contributed to equity market weakness and a very material rotation into value stocks. Indeed, the first quarter of 2022 has been one of the worst starts for growth versus value stocks for many years (Figure 1).

Growth Stocks Struggle as Inflation Rises and Monetary Policy Tightens

(Fig. 1) Headwinds for growth stocks as inflation and rising rates negatively impact sentiment

As of March 31, 2022.

Past performance is not a reliable indicator of future performance.

MSCI ACWI price returns September 30, 2020, through March 31, 2022.

Source: T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved.

The emergence of inflation catalysts in a recovery phase for the global economy is to be expected, but inflation has accelerated faster than expected and is presenting a significant challenge for monetary policymakers. While the sources of rising inflation are embedded in a complex mosaic of temporary and structural forces, the investor reaction has been clear. We have seen a significant repositioning into areas of the market that might benefit from monetary tightening, accelerated further by the consequences of the Russia‑Ukraine conflict, most notably the rise in commodity prices and further supply chain disruption. The shift in focus comes at the expense of long duration growth stocks that have experienced exceptional levels of volatility.

While we experience adverse market conditions from time to time, the sheer size and speed of the market’s rotation to value and deep cyclicals are perhaps less common. The moves have resulted in a magnitude of underperformance for growth stocks that we would not expect, especially in such a short period.

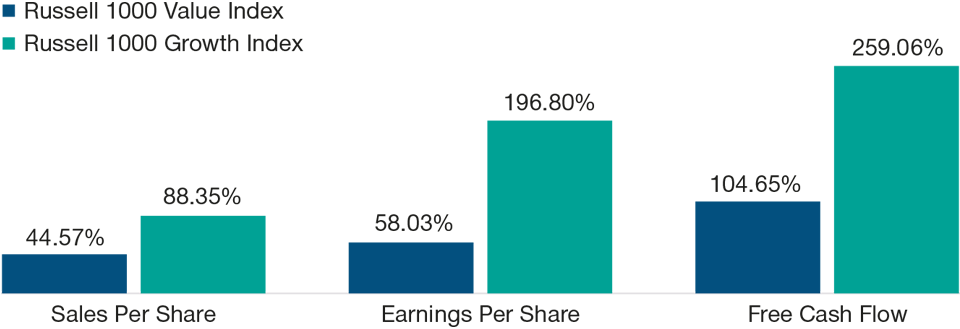

Since the global financial crisis (GFC), outperformance of growth stocks has been the dominant feature of equity markets, one accelerated by the coronavirus pandemic. While it is important to recognize that extended valuations and shifting inflation have played a part in the recent correction, it is also crucial to note that the outperformance of growth stocks has been built on a prolonged and persistent fundamental advantage—that of superior sales, earnings, and cash flow growth (Figure 2). We expect markets to recognize that as the best‑quality growth stocks deliver superior earnings over the next few years.

Superior Sales, Earnings, and Cash Flow Growth Have Been Forgotten in the Value Rally

(Fig. 2) Markets should begin to reward growth stocks as better earnings come through

As of March 31, 2022. Past performance is not a reliable indicator of future performance. Sources: MSCI (see Additional Disclosure), and Factset Research Systems Inc. All rights reserved.

Inflation Remains a Risk

While we remain comfortable in our search for stocks with superior earnings prospects and more enthusiastic about valuations after the sell‑off, inflation has clearly emerged as a risk in the near term. Supply chain normalization is crucial to easing pressure points, and while much of the world is learning to “live with COVID,” the outbreak of the omicron variant in China has ramifications for an extension and amplification of supply chain disruptions and inflation.

We believe that inflation is likely to peak in 2022, with interest rates moving slowly and progressively higher, given the need to maintain financial stability. While inflation is indicative of economic recovery, tight labor markets and supply chain malfunctions are likely to dampen economic growth. However, demand destruction, together with a proportion of inflation being less responsive to traditional policy levers, may afford policymakers some leeway to move more slowly on monetary tightening, even with near‑term inflation being figures implying more aggressive action. This could provide a more positive backdrop for equity markets later in the year.

We Continue to Find Attractive Opportunities in Many Areas of the Market

In this new world of higher inflation and rising interest rates, we still fundamentally believe in the outperformance potential of companies capable of compounding long‑term earnings and cash flows at above‑market levels. After recent weakness, we believe we are at a point where risk/reward looks materially better. As a result, we have leaned in to some of the prevailing scepticism surrounding technology names, where many stocks have pulled back from their highs on near‑term disappointment.

Our largest sector overweight position remains in consumer discretionary, specifically leaders within the global online retail and consumer services ecosystem. We also have strong exposure to health care, where we see cyclical, economic reopening, and secular forces influencing prospective earnings growth. With inflation pressures likely to remain prevalent, we have largely retained our exposure to financials and real estate.

Our faith in our ability to find good stock ideas in emerging markets remains steadfast. The prospects of higher U.S. interest rates and the subsequent knock‑on impact of funding costs for emerging markets have seen the asset class underperform materially versus developed markets. Countries with higher levels of debt have been impacted most, as was the case during 2013’s “taper tantrum,” despite the reality that the debt structure of most countries has changed materially over the course of the past two decades.

Improving corporate earnings growth in 2022–2023 should help, but we have increasingly seen more examples of self‑help by individual companies. During a period of crisis, there are a growing number of examples of companies focusing more intensely on cost control, efficient capital expenditure, and improving shareholder returns. We feel that valuations are also attractive and remain at a discount relative to developed markets.

More generally, at this stage of the equity cycle, being able to find profit growth is essential, both in a defensive and offensive portfolio strategy. Irrespective of the near‑term rotation in markets, fundamental growth in earnings and cash flow remains the most powerful driver of stock prices over the long term, in our view.

While it is important to debate risks and to understand the fundamentals underpinning potential periods of change, we remain focused on idiosyncratic fundamental stock drivers recognizing but not being driven by top‑down macro factors.

Complexity Levels Remain High, But Experience Can Guide Us

After an outstanding period for equity investors since the GFC, higher inflation, tightening liquidity conditions, armed conflict, and the unwinding of pandemic era extremes imply higher risks and ongoing market fluctuations going forward. The challenge that many investors have today is not new, separating long‑term expected returns from short‑term narratives and concerns.

There are obvious concerns around the terrible events happening in Ukraine, but outside of these geopolitical concerns, we believe the world will be more like its pre‑pandemic self than not. While some of the forces that have supported economic recovery have shifted, our base case remains that supply chains will normalize as we learn to live with the coronavirus and that inflation will peak and eventually ease to a lower and more manageable level. Interest rates will rise in the meantime. As central banks tackle short-term inflation, interest rates will rise but likely without exerting excessive pain on consumers or the broader economy.

Importantly, volatility has historically proven to present opportunities, and while we live in highly unusual times, we continue to apply our investment process as we have during other crises. Indeed, we are observing a broader opportunity set than we have for some time. Innovative, high‑growth companies are trading in our view at much more reasonable valuations, while idiosyncratic stock ideas not tied to broader market direction are also a focus. Generally, we see a much more balanced outlook for value versus growth stocks after the market’s initial reaction to this period of change.

Geopolitical and macroeconomic uncertainty will remain part of the near‑term environment, but long‑term, stock prices are ultimately driven by changes in earnings power and cash flow generation. We believe that focusing on this is the best way to help navigate through one of the most complex market environments we have seen for some time.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.